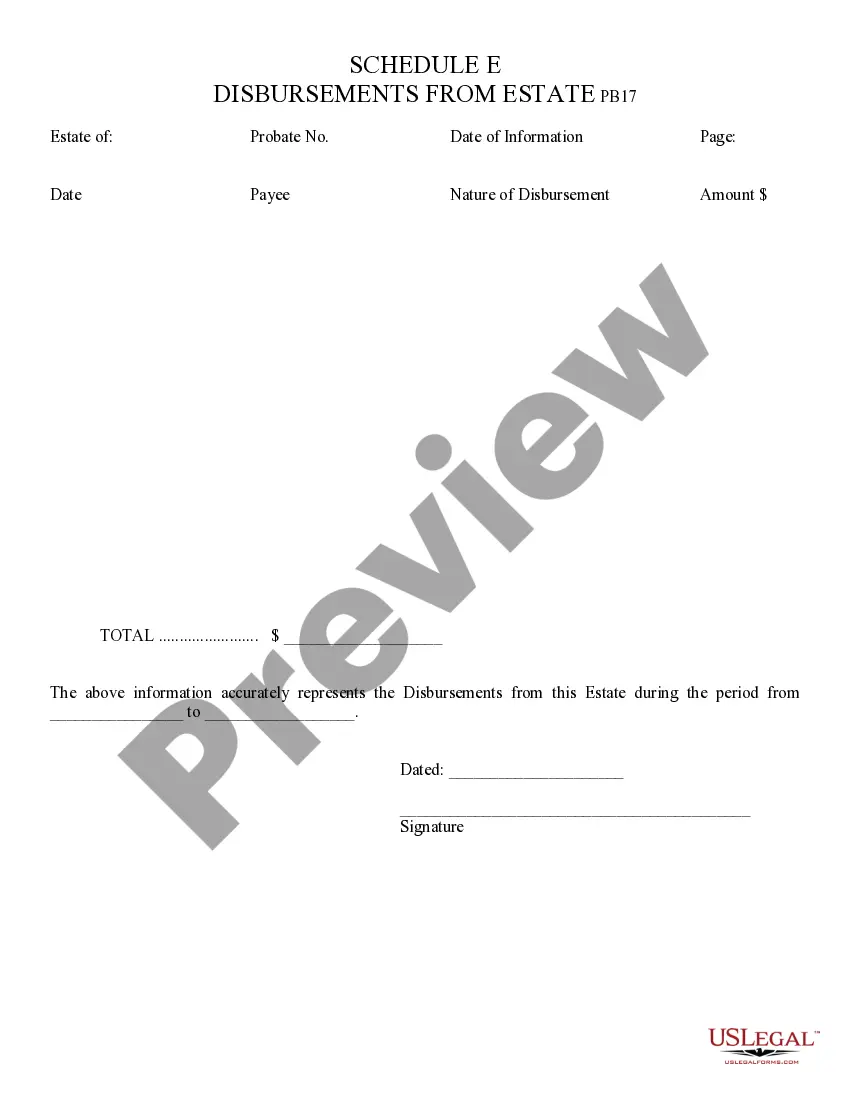

Disbursements from Estate Schedule E - Arizona: This document lists all of the disbursements, or payments, made by the estate during the year. It states the amount paid, as well as to who the payment was made. It is available for download in both Word and Rich Text formats.

Surprise Arizona Disbursements from Estate Schedule E: Everything You Need to Know When it comes to estate planning, understanding Surprise Arizona Disbursements from Estate Schedule E is crucial. This detailed description aims to walk you through the various aspects of Surprise Arizona Disbursements from Estate Schedule E, shedding light on its purpose, types, and relevance. What are Surprise Arizona Disbursements from Estate Schedule E? Surprise Arizona Disbursements from Estate Schedule E refers to the distribution of assets or funds from an estate to its beneficiaries. This process is governed by the Estate Schedule E, which outlines the disbursement procedures and ensures the rightful beneficiaries receive their share. Types of Surprise Arizona Disbursements from Estate Schedule E: 1. Cash Payments: This type of disbursement involves the transfer of liquid assets, such as cash, directly to the beneficiaries. Cash payments are the most common form of disbursements and can be made either as a lump sum or in installments, depending on the estate's provisions or court orders. 2. Transfer of Real Estate: Sometimes, the estate may include properties like houses, land, or commercial buildings. In such cases, Surprise Arizona Disbursements from Estate Schedule E may involve transferring ownership of the real estate to the designated beneficiaries. This transfer can be done through deeds or other legal procedures. 3. Stocks, Bonds, and Investments: If the deceased had investments in stocks, bonds, or other financial instruments, Surprise Arizona Disbursements from Estate Schedule E may involve transferring these assets to the beneficiaries. This requires careful assessment and valuation of these investment holdings to ensure equal distribution among the heirs. 4. Personal Property: Disbursements from Estate Schedule E may also cover the distribution of personal property, such as jewelry, artwork, vehicles, furniture, and other valuable assets. Depending on the estate plan or will, these items may be specifically assigned to individual beneficiaries or distributed among them based on predetermined percentages. 5. Digital Assets: With the prevalence of digital technology, Surprise Arizona Disbursements from Estate Schedule E may also encompass distributing digital assets. This includes online accounts, cryptocurrency wallets, intellectual property rights, and other digital possessions. It is important for the estate plan to address the handling and rightful distribution of these assets to avoid complications. Relevance of Surprise Arizona Disbursements from Estate Schedule E: Surprise Arizona Disbursements from Estate Schedule E is essential for ensuring a fair and efficient distribution of assets among the beneficiaries. By adhering to the estate plan and following legal procedures, the executor or trustee can avoid disputes and ensure that the deceased's wishes are respected. Understanding Surprise Arizona Disbursements from Estate Schedule E allows beneficiaries to have a clear picture of how their inheritance will be received, whether through cash payments, property transfers, investment holdings, personal items, or digital assets. This knowledge helps them plan their finances accordingly and make informed decisions about managing their portion of the estate. In conclusion, Surprise Arizona Disbursements from Estate Schedule E is a crucial component of estate planning and ensures a smooth distribution of assets after someone passes away. Whether it involves cash payments, real estate transfers, investment holdings, personal property, or digital assets, adhering to the estate plan and legal procedures is vital for a fair and efficient distribution process.Surprise Arizona Disbursements from Estate Schedule E: Everything You Need to Know When it comes to estate planning, understanding Surprise Arizona Disbursements from Estate Schedule E is crucial. This detailed description aims to walk you through the various aspects of Surprise Arizona Disbursements from Estate Schedule E, shedding light on its purpose, types, and relevance. What are Surprise Arizona Disbursements from Estate Schedule E? Surprise Arizona Disbursements from Estate Schedule E refers to the distribution of assets or funds from an estate to its beneficiaries. This process is governed by the Estate Schedule E, which outlines the disbursement procedures and ensures the rightful beneficiaries receive their share. Types of Surprise Arizona Disbursements from Estate Schedule E: 1. Cash Payments: This type of disbursement involves the transfer of liquid assets, such as cash, directly to the beneficiaries. Cash payments are the most common form of disbursements and can be made either as a lump sum or in installments, depending on the estate's provisions or court orders. 2. Transfer of Real Estate: Sometimes, the estate may include properties like houses, land, or commercial buildings. In such cases, Surprise Arizona Disbursements from Estate Schedule E may involve transferring ownership of the real estate to the designated beneficiaries. This transfer can be done through deeds or other legal procedures. 3. Stocks, Bonds, and Investments: If the deceased had investments in stocks, bonds, or other financial instruments, Surprise Arizona Disbursements from Estate Schedule E may involve transferring these assets to the beneficiaries. This requires careful assessment and valuation of these investment holdings to ensure equal distribution among the heirs. 4. Personal Property: Disbursements from Estate Schedule E may also cover the distribution of personal property, such as jewelry, artwork, vehicles, furniture, and other valuable assets. Depending on the estate plan or will, these items may be specifically assigned to individual beneficiaries or distributed among them based on predetermined percentages. 5. Digital Assets: With the prevalence of digital technology, Surprise Arizona Disbursements from Estate Schedule E may also encompass distributing digital assets. This includes online accounts, cryptocurrency wallets, intellectual property rights, and other digital possessions. It is important for the estate plan to address the handling and rightful distribution of these assets to avoid complications. Relevance of Surprise Arizona Disbursements from Estate Schedule E: Surprise Arizona Disbursements from Estate Schedule E is essential for ensuring a fair and efficient distribution of assets among the beneficiaries. By adhering to the estate plan and following legal procedures, the executor or trustee can avoid disputes and ensure that the deceased's wishes are respected. Understanding Surprise Arizona Disbursements from Estate Schedule E allows beneficiaries to have a clear picture of how their inheritance will be received, whether through cash payments, property transfers, investment holdings, personal items, or digital assets. This knowledge helps them plan their finances accordingly and make informed decisions about managing their portion of the estate. In conclusion, Surprise Arizona Disbursements from Estate Schedule E is a crucial component of estate planning and ensures a smooth distribution of assets after someone passes away. Whether it involves cash payments, real estate transfers, investment holdings, personal property, or digital assets, adhering to the estate plan and legal procedures is vital for a fair and efficient distribution process.