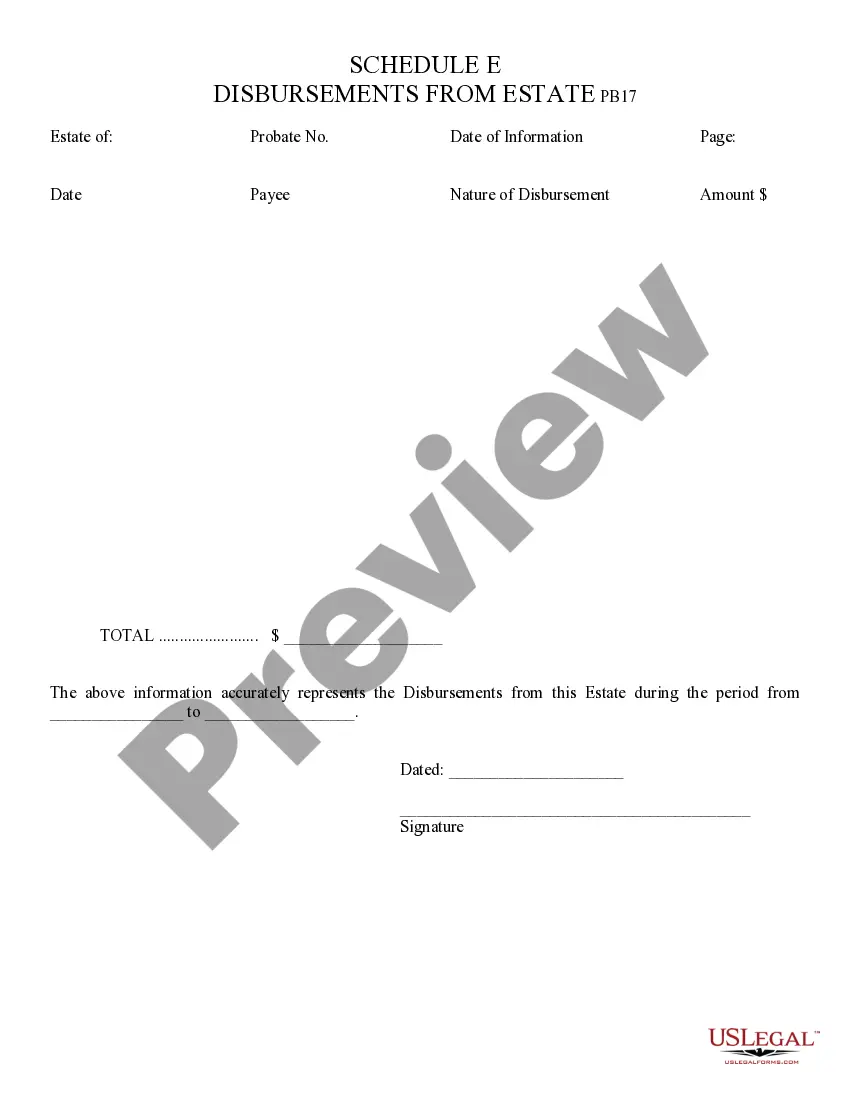

Disbursements from Estate Schedule E - Arizona: This document lists all of the disbursements, or payments, made by the estate during the year. It states the amount paid, as well as to who the payment was made. It is available for download in both Word and Rich Text formats.

Tempe Arizona Disbursements from Estate Schedule E refer to the various payments or distributions made from an estate in Tempe, Arizona, as outlined in Schedule E of the estate's filing. This schedule provides a detailed breakdown of the funds distributed and the beneficiaries who received them. The types of disbursements that can be recorded on Schedule E include: 1. Cash Payments: This category encompasses any monetary disbursements made to beneficiaries, creditors, or other parties involved in the estate settlement. Cash payments may cover debts, funeral expenses, taxes, or any other financial obligations of the estate. 2. Real Estate Transfers: In certain cases, the estate may include real estate properties that need to be transferred to beneficiaries or sold to settle outstanding debts. Schedule E will list any disbursements related to real estate transfers, such as sales proceeds or allocations of property. 3. Investments and Securities: If the deceased owned stocks, bonds, mutual funds, or any other investments, Schedule E will detail any sales, transfers, or distributions of these assets. It may specify the amount disbursed to each beneficiary or any capital gains or losses associated with the transaction. 4. Business Interests: In cases where the estate includes ownership stakes in a business or partnership, Schedule E will outline any disbursements related to the transfer, sale, or liquidation of these interests. This might include payments to buy out other shareholders or funds distributed to beneficiaries. 5. Personal Property Distribution: Personal belongings like jewelry, artwork, vehicles, or furniture may be distributed among the beneficiaries. Schedule E will provide information on any disbursements made regarding these assets, including their estimated value and the recipient of each item. 6. Other Disbursements: This category covers any disbursements not falling into the above classifications. It could include insurance payouts, annuity distributions, royalties from intellectual property, or any other residual payments made from the estate. It is important to note that Schedule E is a vital part of the probate process and requires meticulous record-keeping. For accurate and compliant reporting, it is recommended to consult with a qualified attorney or estate practitioner familiar with estate administration in Tempe, Arizona. In summary, Tempe Arizona Disbursements from Estate Schedule E specifically document the various payments and distributions made from an estate during the probate process. By closely examining this schedule, interested parties can gain a comprehensive understanding of how the estate's assets were disbursed among the beneficiaries, creditors, and other relevant parties.Tempe Arizona Disbursements from Estate Schedule E refer to the various payments or distributions made from an estate in Tempe, Arizona, as outlined in Schedule E of the estate's filing. This schedule provides a detailed breakdown of the funds distributed and the beneficiaries who received them. The types of disbursements that can be recorded on Schedule E include: 1. Cash Payments: This category encompasses any monetary disbursements made to beneficiaries, creditors, or other parties involved in the estate settlement. Cash payments may cover debts, funeral expenses, taxes, or any other financial obligations of the estate. 2. Real Estate Transfers: In certain cases, the estate may include real estate properties that need to be transferred to beneficiaries or sold to settle outstanding debts. Schedule E will list any disbursements related to real estate transfers, such as sales proceeds or allocations of property. 3. Investments and Securities: If the deceased owned stocks, bonds, mutual funds, or any other investments, Schedule E will detail any sales, transfers, or distributions of these assets. It may specify the amount disbursed to each beneficiary or any capital gains or losses associated with the transaction. 4. Business Interests: In cases where the estate includes ownership stakes in a business or partnership, Schedule E will outline any disbursements related to the transfer, sale, or liquidation of these interests. This might include payments to buy out other shareholders or funds distributed to beneficiaries. 5. Personal Property Distribution: Personal belongings like jewelry, artwork, vehicles, or furniture may be distributed among the beneficiaries. Schedule E will provide information on any disbursements made regarding these assets, including their estimated value and the recipient of each item. 6. Other Disbursements: This category covers any disbursements not falling into the above classifications. It could include insurance payouts, annuity distributions, royalties from intellectual property, or any other residual payments made from the estate. It is important to note that Schedule E is a vital part of the probate process and requires meticulous record-keeping. For accurate and compliant reporting, it is recommended to consult with a qualified attorney or estate practitioner familiar with estate administration in Tempe, Arizona. In summary, Tempe Arizona Disbursements from Estate Schedule E specifically document the various payments and distributions made from an estate during the probate process. By closely examining this schedule, interested parties can gain a comprehensive understanding of how the estate's assets were disbursed among the beneficiaries, creditors, and other relevant parties.