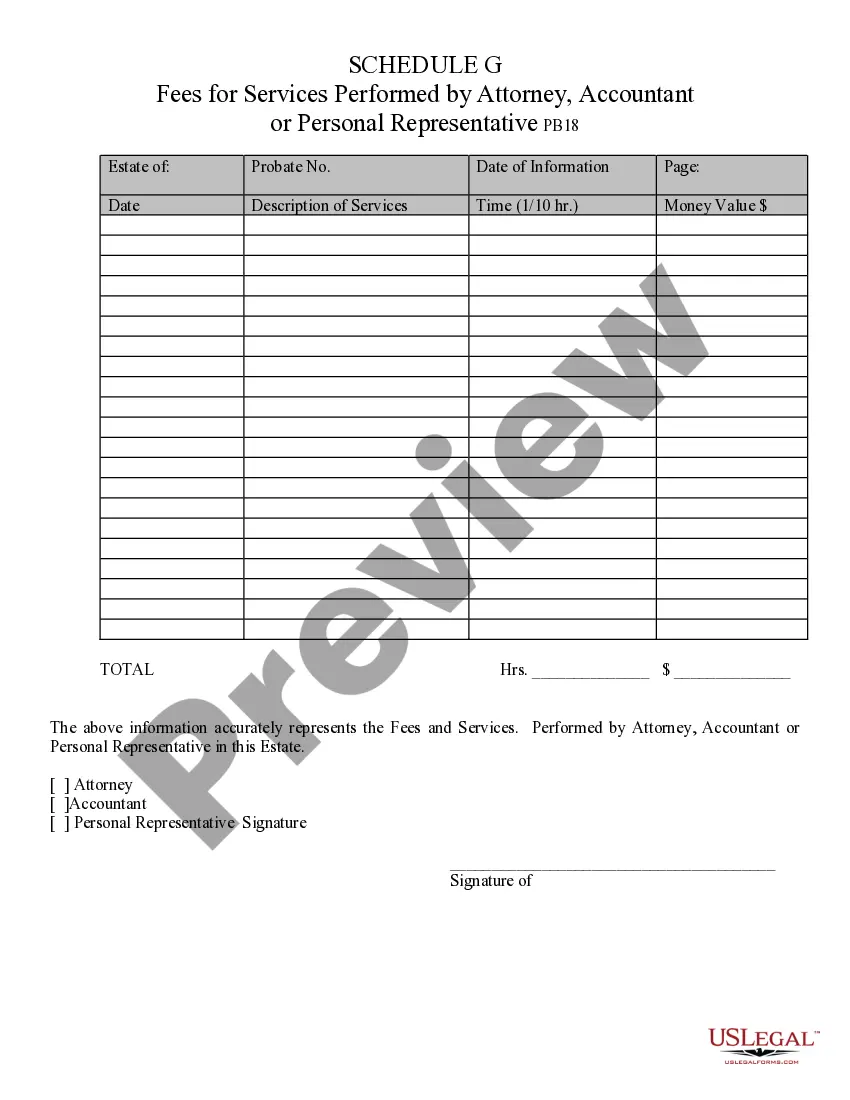

Fees for Services Performed by Attorney, Accountant, or Personal Representative - Arizona: This form is used when an administrator of an estate is called upon to list all the fees of any professional services, such as attorney or accountant fees, paid by the estate. It states the amount of the fee, as well as the duties performed for that amount. It is available for download in both Word and Rich Text formats.

Chandler Arizona Fees for Services Performed by Attorney, Accountant, or Personal Representative

Description

How to fill out Chandler Arizona Fees For Services Performed By Attorney, Accountant, Or Personal Representative?

Utilize the US Legal Forms and gain instant access to any form template you require.

Our helpful website with an extensive array of documents simplifies the process of finding and acquiring nearly any document sample you need.

You can save, complete, and sign the Chandler Arizona Fees for Services Rendered by Attorney, Accountant, or Personal Representative in just a few minutes instead of spending hours online searching for an appropriate template.

Accessing our collection is an excellent method to enhance the security of your record-keeping.

If you don't have an account yet, follow the steps below.

Locate the form you need. Confirm that it is the form you intend to find: check its title and description, and use the Preview feature if available. Alternatively, use the Search field to discover the necessary one.

- Our qualified legal experts regularly review all documents to ensure that the forms are applicable to a specific state and compliant with updated laws and regulations.

- How can you obtain the Chandler Arizona Fees for Services Rendered by Attorney, Accountant, or Personal Representative.

- If you already possess a profile, simply Log In to your account.

- The Download button will be activated on all the samples you view.

- Additionally, you can find all your previously saved documents in the My documents menu.

Form popularity

FAQ

In Arizona, any adult who is competent and not a felon can serve as a personal representative. This role typically involves managing the estate, paying debts, and distributing assets. It is essential to consider Chandler Arizona fees for services performed by an attorney, accountant, or personal representative when selecting someone for this important task. Given the responsibilities involved, choosing someone reliable can greatly influence the estate's administration.

While it is not a strict requirement to hire a probate lawyer in Arizona, it is highly recommended. A knowledgeable attorney can guide you through the complexities of the probate process, ensuring all legal requirements are met smoothly. Knowing the Chandler Arizona fees for services performed by an attorney can help you prepare financially while receiving the support you need. Having legal assistance can significantly ease the burden during a challenging time.

In Arizona, the law generally requires estates valued at more than $75,000 to go through probate. This process ensures that the deceased's debts are settled and assets are distributed according to their wishes. While Chandler Arizona fees for services performed by an attorney, accountant, or personal representative may vary, understanding the value of the estate can help you budget accordingly. Consulting a professional can provide clarity on expenses and necessary steps.

The American rule stipulates that each party in a legal case is responsible for paying their own attorney fees, regardless of the outcome. This rule contrasts with some other countries where the losing party pays for both sides' costs. By understanding Chandler Arizona fees for services performed by attorneys, accountants, and personal representatives, you can better navigate this aspect and prepare for your legal financial obligations.

In the United States, the party who hires the attorney generally pays for the attorney's fees. However, the responsibility for these fees can shift based on court decisions, settlements, or specific legal agreements between parties. Understanding the landscape of Chandler Arizona fees for services performed by attorneys will empower you to ensure you are making informed decisions about your legal representation.

In Arizona, a personal representative is appointed by the court to administer a deceased person's estate. This role includes managing assets, paying debts, and distributing property according to the will or state law. Understanding Chandler Arizona fees for services performed by attorneys, accountants, or personal representatives is crucial, as these fees may be deducted from the estate, impacting the overall process.

Statute 12-341 in Arizona addresses the awarding of attorney fees in civil actions. Under this statute, the winning party may be entitled to recover their Chandler Arizona fees for services performed by their attorney, accountant, or personal representative, if the court deems it appropriate. This provision encourages fair legal representation and helps recover costs incurred during legal proceedings.

The correct term is attorney's fees, which reflects that the fees belong to the attorney. However, you may also come across the phrase 'attorney fees' in some contexts, but it's less precise. Knowing this distinction helps in understanding the terminologies better, especially when dealing with Chandler Arizona Fees for Services Performed by Attorney, Accountant, or Personal Representative.

Writing off attorney fees can occur when these expenses qualify as deductible business costs. Ensure that you keep detailed records of the payments made, as this documentation will be essential for your tax filings. For residents in Chandler, Arizona, knowing how to properly manage these deductions can help you navigate the Chandler Arizona Fees for Services Performed by Attorney, Accountant, or Personal Representative effectively.

To write attorney fees, include the names of the parties involved, a breakdown of services rendered, and the total amount invoiced. By presenting the fees in an organized manner, you assist clients in understanding the costs associated with legal services. Utilizing resources from uslegalforms can further streamline the documentation, ensuring compliance with Chandler Arizona Fees for Services Performed by Attorney, Accountant, or Personal Representative.