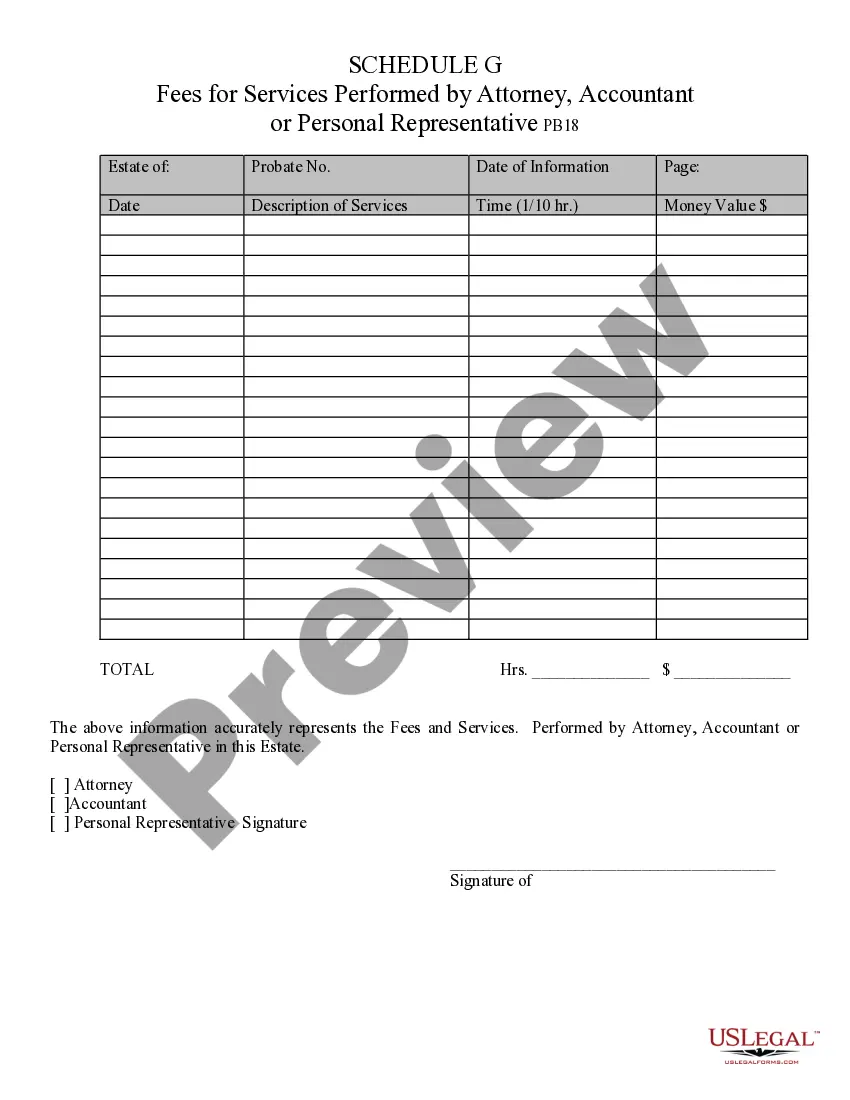

Fees for Services Performed by Attorney, Accountant, or Personal Representative - Arizona: This form is used when an administrator of an estate is called upon to list all the fees of any professional services, such as attorney or accountant fees, paid by the estate. It states the amount of the fee, as well as the duties performed for that amount. It is available for download in both Word and Rich Text formats.

Glendale, Arizona Fees for Services Performed by Attorney, Accountant, or Personal Representative Introduction: In Glendale, Arizona, individuals often require the services of attorneys, accountants, and personal representatives to handle various legal, financial, and estate matters. These professionals provide valuable expertise and assistance, ensuring that individuals receive the necessary guidance and support. However, it is important to be aware of the fees associated with their services. This detailed description will outline the fees concerning attorneys, accountants, and personal representatives in Glendale, Arizona, providing an insight into the different types available. 1. Attorney Fees: Attorney fees in Glendale, Arizona, can vary depending on several factors, including the nature and complexity of the legal matter being addressed. Common fee structures employed by attorneys include: a. Hourly rate: Many attorneys charge an hourly rate for their services. The specific rate will be determined by the attorney's expertise, experience, and reputation. Clients are billed based on the time spent working on their case, typically in increments (e.g., six-minute intervals). b. Flat fee: Some attorneys may offer flat fees for specific legal services. This predetermined amount covers the entire scope of work required for the case, regardless of the time spent on it. c. Contingency fee: In certain situations, such as personal injury cases, attorneys may work on a contingency fee basis. This means that their fee is contingent upon successfully obtaining compensation for the client. If a favorable outcome is achieved, the attorney receives a percentage of the awarded amount. 2. Accountant Fees: Accountant fees in Glendale, Arizona, depend on the complexity and extent of the financial services provided. Here are some common fee structures utilized by accountants: a. Hourly rate: Similar to attorneys, accountants may charge an hourly rate for their services, with the rate varying based on factors like experience and specialization. b. Fixed fee: Certain routine accounting services, such as tax return preparation or bookkeeping, may be offered at a fixed fee. These services have a predetermined cost that covers the specific tasks mentioned. c. Project-based fee: For more extensive financial projects, accountants may quote a project-based fee. This fee covers a comprehensive range of services related to a particular task or objective, such as financial analysis or audit services. 3. Personal Representative Fees: A personal representative, often appointed in estate planning or probate matters, helps ensure the proper administration of an individual's estate. The fees for personal representative services can vary and may include: a. Commission-based fee: Personal representatives in Glendale, Arizona, are often compensated via a commission-based fee structure. Typically, this fee is a percentage of the total value of the estate that they oversee. State laws govern the maximum allowable commission rates within the probate process. b. Hourly or flat fee: Depending on the circumstances and complexity of the estate, personal representatives may charge an hourly rate or flat fee for specific tasks not covered by commission fees. This could include additional legal or administrative assistance required throughout the process. Conclusion: When seeking the services of attorneys, accountants, or personal representatives in Glendale, Arizona, it is crucial to consider the various fee structures available. Understanding the different options presented in this detailed description can help individuals make informed decisions based on their specific requirements. The ultimate goal is to strike a balance between the level of expertise required and the associated costs, ensuring efficient and effective handling of legal, financial, or estate matters in Glendale, Arizona.Glendale, Arizona Fees for Services Performed by Attorney, Accountant, or Personal Representative Introduction: In Glendale, Arizona, individuals often require the services of attorneys, accountants, and personal representatives to handle various legal, financial, and estate matters. These professionals provide valuable expertise and assistance, ensuring that individuals receive the necessary guidance and support. However, it is important to be aware of the fees associated with their services. This detailed description will outline the fees concerning attorneys, accountants, and personal representatives in Glendale, Arizona, providing an insight into the different types available. 1. Attorney Fees: Attorney fees in Glendale, Arizona, can vary depending on several factors, including the nature and complexity of the legal matter being addressed. Common fee structures employed by attorneys include: a. Hourly rate: Many attorneys charge an hourly rate for their services. The specific rate will be determined by the attorney's expertise, experience, and reputation. Clients are billed based on the time spent working on their case, typically in increments (e.g., six-minute intervals). b. Flat fee: Some attorneys may offer flat fees for specific legal services. This predetermined amount covers the entire scope of work required for the case, regardless of the time spent on it. c. Contingency fee: In certain situations, such as personal injury cases, attorneys may work on a contingency fee basis. This means that their fee is contingent upon successfully obtaining compensation for the client. If a favorable outcome is achieved, the attorney receives a percentage of the awarded amount. 2. Accountant Fees: Accountant fees in Glendale, Arizona, depend on the complexity and extent of the financial services provided. Here are some common fee structures utilized by accountants: a. Hourly rate: Similar to attorneys, accountants may charge an hourly rate for their services, with the rate varying based on factors like experience and specialization. b. Fixed fee: Certain routine accounting services, such as tax return preparation or bookkeeping, may be offered at a fixed fee. These services have a predetermined cost that covers the specific tasks mentioned. c. Project-based fee: For more extensive financial projects, accountants may quote a project-based fee. This fee covers a comprehensive range of services related to a particular task or objective, such as financial analysis or audit services. 3. Personal Representative Fees: A personal representative, often appointed in estate planning or probate matters, helps ensure the proper administration of an individual's estate. The fees for personal representative services can vary and may include: a. Commission-based fee: Personal representatives in Glendale, Arizona, are often compensated via a commission-based fee structure. Typically, this fee is a percentage of the total value of the estate that they oversee. State laws govern the maximum allowable commission rates within the probate process. b. Hourly or flat fee: Depending on the circumstances and complexity of the estate, personal representatives may charge an hourly rate or flat fee for specific tasks not covered by commission fees. This could include additional legal or administrative assistance required throughout the process. Conclusion: When seeking the services of attorneys, accountants, or personal representatives in Glendale, Arizona, it is crucial to consider the various fee structures available. Understanding the different options presented in this detailed description can help individuals make informed decisions based on their specific requirements. The ultimate goal is to strike a balance between the level of expertise required and the associated costs, ensuring efficient and effective handling of legal, financial, or estate matters in Glendale, Arizona.