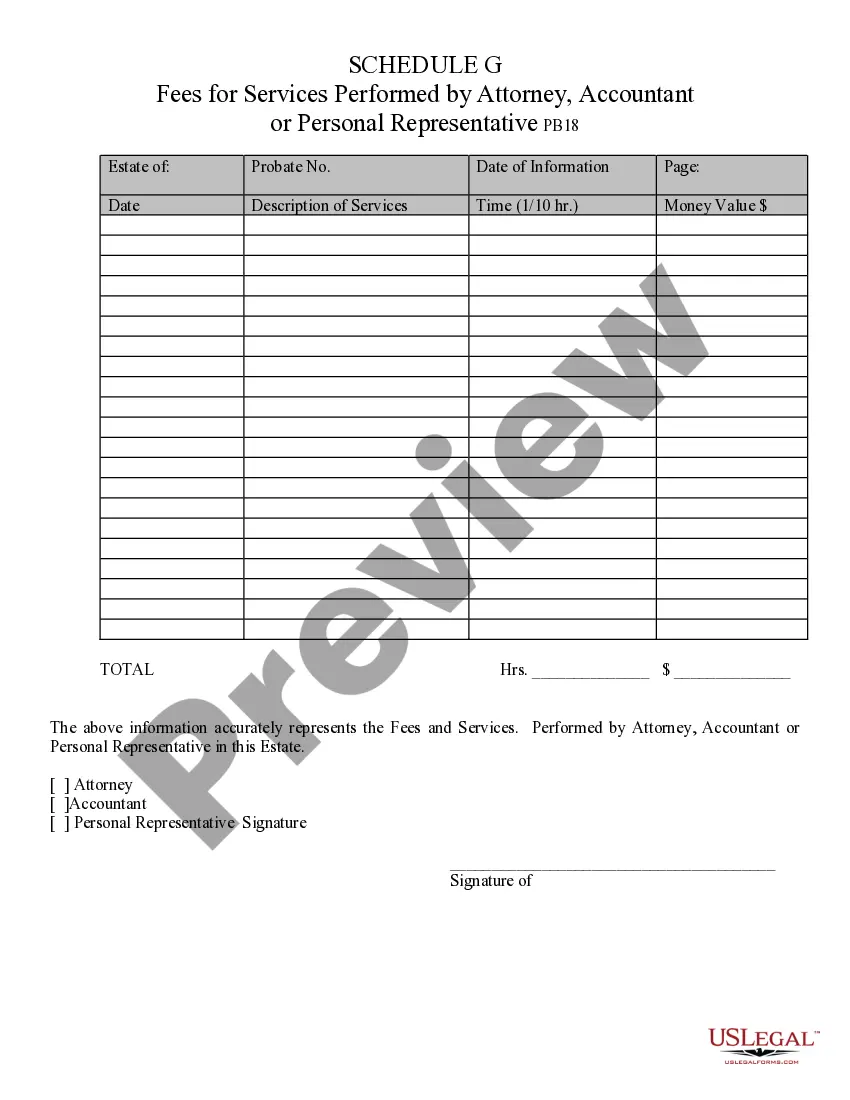

Fees for Services Performed by Attorney, Accountant, or Personal Representative - Arizona: This form is used when an administrator of an estate is called upon to list all the fees of any professional services, such as attorney or accountant fees, paid by the estate. It states the amount of the fee, as well as the duties performed for that amount. It is available for download in both Word and Rich Text formats.

Lima, Arizona Fees for Services Performed by Attorney, Accountant, or Personal Representative: In Lima, Arizona, various fees are associated with services provided by an attorney, accountant, or personal representative when handling legal, financial, or estate matters. These professionals play crucial roles in ensuring the smooth functioning of legal and financial processes, bridging the gap between clients' needs and the complexities of the legal and financial systems. Attorney Fees: Attorneys in Lima, Arizona generally charge fees based on their experience, complexity of the case, and the amount of time and effort required. Common fee structures include: 1. Hourly Rate: Attorneys bill their clients based on the number of hours spent on the case. The hourly rate may vary depending on the attorney's expertise and reputation. 2. Flat Fee: Some attorneys offer services at a predetermined flat fee, particularly for routine legal matters such as drafting contracts, wills, or real estate transactions. 3. Contingency Fee: In certain cases, such as personal injury or medical malpractice claims, attorneys may enter into a contingency fee arrangement. They only receive payment if they successfully obtain compensation for the client. The fee is a percentage of the amount recovered. Accountant Fees: Accountants in Lima, Arizona provide various financial services to individuals, businesses, and estates. Fee structures often depend on the complexity of the work required and the scope of services provided. Common types of fees charged by accountants include: 1. Hourly Rate: Accountants charge an hourly fee for services such as bookkeeping, tax preparation, and financial analysis. This rate may vary based on the accountant's experience and qualifications. 2. Fixed Fee: Accountants may offer fixed fees for specific services, including tax return preparation or financial statement analysis. These fees are determined based on the accountant's estimate of the time and effort involved. Personal Representative Fees: A personal representative, commonly referred to as an executor or administrator, is responsible for managing and distributing a deceased person's estate. Their fees are subject to Arizona laws and may vary depending on the circumstances. Common types of personal representative fees include: 1. Statutory Fees: In Arizona, personal representatives are entitled to receive reasonable fees based on a percentage of the value of the probate estate. This percentage may vary depending on the total value of the assets. 2. Court-Approved Fees: In cases where the estate's complexity exceeds the statutory fees, the personal representative can request additional fees through court approval by providing justification for the increased workload and complexity. It's important for individuals seeking legal, financial, or estate-related services in Lima, Arizona to discuss fee structures and arrangements with their attorney, accountant, or personal representative upfront to ensure transparency and clarity regarding potential costs. Each professional may have their own fee structure, so it is wise to obtain multiple quotes and consider the specific needs of your case before making a decision.Lima, Arizona Fees for Services Performed by Attorney, Accountant, or Personal Representative: In Lima, Arizona, various fees are associated with services provided by an attorney, accountant, or personal representative when handling legal, financial, or estate matters. These professionals play crucial roles in ensuring the smooth functioning of legal and financial processes, bridging the gap between clients' needs and the complexities of the legal and financial systems. Attorney Fees: Attorneys in Lima, Arizona generally charge fees based on their experience, complexity of the case, and the amount of time and effort required. Common fee structures include: 1. Hourly Rate: Attorneys bill their clients based on the number of hours spent on the case. The hourly rate may vary depending on the attorney's expertise and reputation. 2. Flat Fee: Some attorneys offer services at a predetermined flat fee, particularly for routine legal matters such as drafting contracts, wills, or real estate transactions. 3. Contingency Fee: In certain cases, such as personal injury or medical malpractice claims, attorneys may enter into a contingency fee arrangement. They only receive payment if they successfully obtain compensation for the client. The fee is a percentage of the amount recovered. Accountant Fees: Accountants in Lima, Arizona provide various financial services to individuals, businesses, and estates. Fee structures often depend on the complexity of the work required and the scope of services provided. Common types of fees charged by accountants include: 1. Hourly Rate: Accountants charge an hourly fee for services such as bookkeeping, tax preparation, and financial analysis. This rate may vary based on the accountant's experience and qualifications. 2. Fixed Fee: Accountants may offer fixed fees for specific services, including tax return preparation or financial statement analysis. These fees are determined based on the accountant's estimate of the time and effort involved. Personal Representative Fees: A personal representative, commonly referred to as an executor or administrator, is responsible for managing and distributing a deceased person's estate. Their fees are subject to Arizona laws and may vary depending on the circumstances. Common types of personal representative fees include: 1. Statutory Fees: In Arizona, personal representatives are entitled to receive reasonable fees based on a percentage of the value of the probate estate. This percentage may vary depending on the total value of the assets. 2. Court-Approved Fees: In cases where the estate's complexity exceeds the statutory fees, the personal representative can request additional fees through court approval by providing justification for the increased workload and complexity. It's important for individuals seeking legal, financial, or estate-related services in Lima, Arizona to discuss fee structures and arrangements with their attorney, accountant, or personal representative upfront to ensure transparency and clarity regarding potential costs. Each professional may have their own fee structure, so it is wise to obtain multiple quotes and consider the specific needs of your case before making a decision.