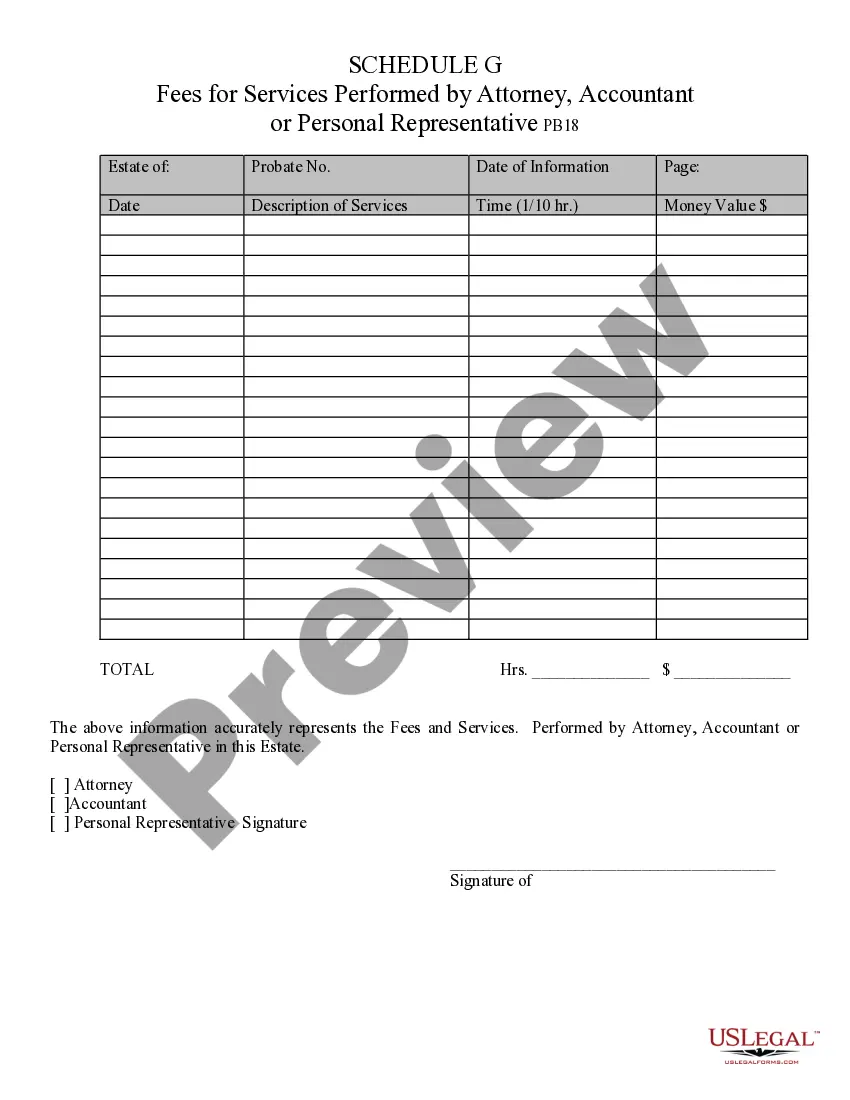

Fees for Services Performed by Attorney, Accountant, or Personal Representative - Arizona: This form is used when an administrator of an estate is called upon to list all the fees of any professional services, such as attorney or accountant fees, paid by the estate. It states the amount of the fee, as well as the duties performed for that amount. It is available for download in both Word and Rich Text formats.

Surprise, Arizona Fees for Services Performed by Attorney, Accountant, or Personal Representative: Explained Are you residing in Surprise, Arizona, and seeking professional assistance from an Attorney, Accountant, or Personal Representative? If so, it is essential to familiarize yourself with the various fees associated with these services. In this detailed description, we will discuss the different types of fees involved when engaging the services of an Attorney, Accountant, or Personal Representative in Surprise, Arizona. 1. Attorney Fees: Attorney fees refer to the charges levied by legal professionals for their services. In Surprise, Arizona, these fees can vary depending on the nature and complexity of the legal issue at hand. Some common types of attorney fees include: — Hourly Fees: Attorneys may charge an hourly rate for the time spent working on your case. This fee is calculated by multiplying the attorney's hourly rate by the number of hours dedicated to your matter. — Flat Fees: Attorneys might establish a fixed fee for a specific service or legal matter, irrespective of the time spent. This arrangement provides clients with a clear upfront understanding of costs. — Contingency Fees: In certain cases, attorneys may work on a contingency basis. This means that they will only be paid if they secure a favorable outcome for the client. Typically, a percentage of the resulting settlement or award is taken as the contingency fee. — Retainer Fees: Some attorneys may require clients to pay a retainer fee upfront, which acts as a deposit. The attorney will then deduct their fees from the retainer as they work on the case. 2. Accountant Fees: Accountant fees encompass the charges associated with availing accounting services provided by certified professionals. The fees for accountants in Surprise, Arizona can depend on the complexity of the financial tasks involved. Some common accountant fees include: — Hourly Fees: Accountants may charge an hourly rate for their services, which can vary based on their experience and qualifications. — Flat Fees: Similar to attorneys, accountants may offer a fixed fee for specific services like tax preparation or financial statement compilation. — Monthly or Annual Retainers: In certain cases, accountants may establish a retainer fee arrangement where clients pay a regular fee for ongoing accounting assistance. 3. Personal Representative Fees: Personal representatives, also known as executors or administrators, handle various responsibilities during the probate process or estate administration. In Surprise, Arizona, personal representative fees typically involve: — Commission Fees: The personal representative may receive a commission based on the value of the estate they manage. The exact percentage can be subject to state laws or the estate's specific provisions. — Hourly Fees: Some personal representatives may charge an hourly fee for their services, especially if their responsibilities extend beyond the standard duties. It is important to note that fees for services performed by Attorney, Accountant, or Personal Representative can vary across professionals and specific circumstances. Always consult with the service provider beforehand to gain a clear understanding of the fees involved in your particular case. By understanding the various types of fees associated with Attorney, Accountant, or Personal Representative services in Surprise, Arizona, you can make informed decisions when seeking professional assistance for legal, financial, or estate matters.Surprise, Arizona Fees for Services Performed by Attorney, Accountant, or Personal Representative: Explained Are you residing in Surprise, Arizona, and seeking professional assistance from an Attorney, Accountant, or Personal Representative? If so, it is essential to familiarize yourself with the various fees associated with these services. In this detailed description, we will discuss the different types of fees involved when engaging the services of an Attorney, Accountant, or Personal Representative in Surprise, Arizona. 1. Attorney Fees: Attorney fees refer to the charges levied by legal professionals for their services. In Surprise, Arizona, these fees can vary depending on the nature and complexity of the legal issue at hand. Some common types of attorney fees include: — Hourly Fees: Attorneys may charge an hourly rate for the time spent working on your case. This fee is calculated by multiplying the attorney's hourly rate by the number of hours dedicated to your matter. — Flat Fees: Attorneys might establish a fixed fee for a specific service or legal matter, irrespective of the time spent. This arrangement provides clients with a clear upfront understanding of costs. — Contingency Fees: In certain cases, attorneys may work on a contingency basis. This means that they will only be paid if they secure a favorable outcome for the client. Typically, a percentage of the resulting settlement or award is taken as the contingency fee. — Retainer Fees: Some attorneys may require clients to pay a retainer fee upfront, which acts as a deposit. The attorney will then deduct their fees from the retainer as they work on the case. 2. Accountant Fees: Accountant fees encompass the charges associated with availing accounting services provided by certified professionals. The fees for accountants in Surprise, Arizona can depend on the complexity of the financial tasks involved. Some common accountant fees include: — Hourly Fees: Accountants may charge an hourly rate for their services, which can vary based on their experience and qualifications. — Flat Fees: Similar to attorneys, accountants may offer a fixed fee for specific services like tax preparation or financial statement compilation. — Monthly or Annual Retainers: In certain cases, accountants may establish a retainer fee arrangement where clients pay a regular fee for ongoing accounting assistance. 3. Personal Representative Fees: Personal representatives, also known as executors or administrators, handle various responsibilities during the probate process or estate administration. In Surprise, Arizona, personal representative fees typically involve: — Commission Fees: The personal representative may receive a commission based on the value of the estate they manage. The exact percentage can be subject to state laws or the estate's specific provisions. — Hourly Fees: Some personal representatives may charge an hourly fee for their services, especially if their responsibilities extend beyond the standard duties. It is important to note that fees for services performed by Attorney, Accountant, or Personal Representative can vary across professionals and specific circumstances. Always consult with the service provider beforehand to gain a clear understanding of the fees involved in your particular case. By understanding the various types of fees associated with Attorney, Accountant, or Personal Representative services in Surprise, Arizona, you can make informed decisions when seeking professional assistance for legal, financial, or estate matters.