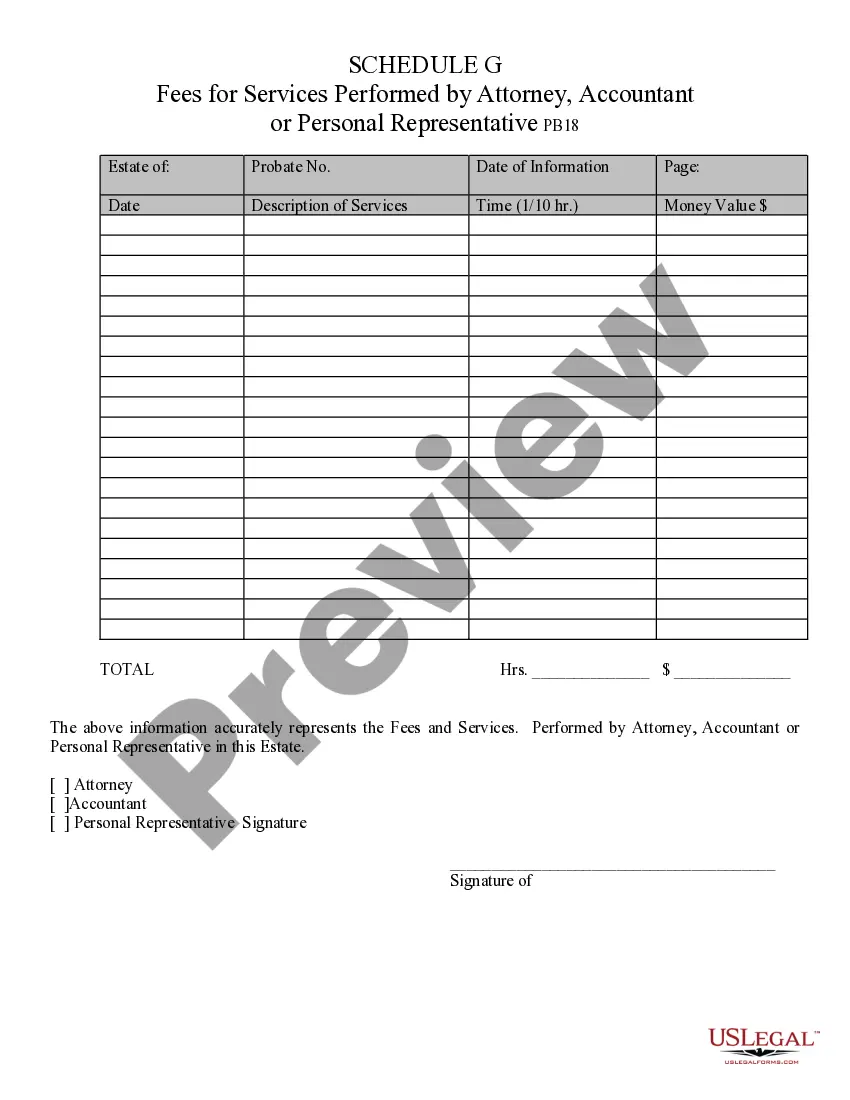

Fees for Services Performed by Attorney, Accountant, or Personal Representative - Arizona: This form is used when an administrator of an estate is called upon to list all the fees of any professional services, such as attorney or accountant fees, paid by the estate. It states the amount of the fee, as well as the duties performed for that amount. It is available for download in both Word and Rich Text formats.

When seeking legal, financial, or estate planning assistance in Tempe, Arizona, it is essential to understand the fees associated with services provided by attorneys, accountants, or personal representatives. This detailed description will outline the various types of fees applicable and their relevance to your specific needs. 1. Attorney Fees for Services: Attorney fees refer to the charges imposed by lawyers for their professional services. In Tempe, Arizona, attorneys may charge using several fee structures, including: — Hourly Rate: Attorneys bill clients based on the amount of time spent working on a case, with each hour charged at a predetermined rate. — Flat Fee: Some attorneys charge a fixed fee for specific services, regardless of the time spent. This arrangement is common in tasks like drafting contracts, wills, or handling uncontested divorces. — Contingency Fee: In certain cases, attorneys may work on a contingency basis, where they receive a percentage of the client's financial recovery only if the case is successful. This fee structure is typical in personal injury or medical malpractice cases. — Retainer Fee: Attorneys may require clients to pay an upfront retainer fee, which is a predetermined sum of money, from which future services are billed as they arise. The retainer fee acts as a client's prepayment for legal services. 2. Accountant Fees for Services: Accountants offer valuable financial expertise, including tax planning, bookkeeping, auditing, and financial reporting. In Tempe, Arizona, accountants may charge using various fee structures: — Hourly Rate: Similar to attorneys, accountants may charge by the hour, with rates determined based on their experience and specialization. — Monthly or Annual Retainer Fee: Some accountants offer ongoing services, such as bookkeeping, tax planning, or financial analysis, on a monthly or annual retainer basis. Clients pay a fixed fee regularly to secure their accountant's services throughout a specified period. — Project-Based Fee: For one-time or specific projects like tax preparation or financial audits, accountants may charge a flat fee based on the complexity and scope of the work. — Percentage of Assets or Revenue: In cases involving managing investment portfolios or providing financial consulting, accountants may charge a percentage of the client's assets under management or revenue generated. 3. Personal Representative Fees: Personal representatives, often appointed in estate planning or probate situations, handle various administrative tasks, ensuring the smooth execution of an individual's wishes. In Tempe, Arizona, personal representatives, such as executors or trustees, may charge the following fees: — Statutory Fee: In most cases, personal representatives are entitled to a statutorily defined fee that is a percentage of the total estate value. The fee is typically calculated on a sliding scale, decreasing as the estate's value increases. — Reasonable Compensation: If the personal representative's fee is not specified by law, they may request reasonable compensation for their services, considering factors like the complexity of the estate, time spent, and expertise required. It's important to note that exact fee structures vary by attorney, accountant, or personal representative, so it is advisable to discuss and negotiate fees during the initial consultation or engagement agreement. Understanding these fees will help you anticipate costs, budget accordingly, and ensure transparency in your professional engagements in Tempe, Arizona.When seeking legal, financial, or estate planning assistance in Tempe, Arizona, it is essential to understand the fees associated with services provided by attorneys, accountants, or personal representatives. This detailed description will outline the various types of fees applicable and their relevance to your specific needs. 1. Attorney Fees for Services: Attorney fees refer to the charges imposed by lawyers for their professional services. In Tempe, Arizona, attorneys may charge using several fee structures, including: — Hourly Rate: Attorneys bill clients based on the amount of time spent working on a case, with each hour charged at a predetermined rate. — Flat Fee: Some attorneys charge a fixed fee for specific services, regardless of the time spent. This arrangement is common in tasks like drafting contracts, wills, or handling uncontested divorces. — Contingency Fee: In certain cases, attorneys may work on a contingency basis, where they receive a percentage of the client's financial recovery only if the case is successful. This fee structure is typical in personal injury or medical malpractice cases. — Retainer Fee: Attorneys may require clients to pay an upfront retainer fee, which is a predetermined sum of money, from which future services are billed as they arise. The retainer fee acts as a client's prepayment for legal services. 2. Accountant Fees for Services: Accountants offer valuable financial expertise, including tax planning, bookkeeping, auditing, and financial reporting. In Tempe, Arizona, accountants may charge using various fee structures: — Hourly Rate: Similar to attorneys, accountants may charge by the hour, with rates determined based on their experience and specialization. — Monthly or Annual Retainer Fee: Some accountants offer ongoing services, such as bookkeeping, tax planning, or financial analysis, on a monthly or annual retainer basis. Clients pay a fixed fee regularly to secure their accountant's services throughout a specified period. — Project-Based Fee: For one-time or specific projects like tax preparation or financial audits, accountants may charge a flat fee based on the complexity and scope of the work. — Percentage of Assets or Revenue: In cases involving managing investment portfolios or providing financial consulting, accountants may charge a percentage of the client's assets under management or revenue generated. 3. Personal Representative Fees: Personal representatives, often appointed in estate planning or probate situations, handle various administrative tasks, ensuring the smooth execution of an individual's wishes. In Tempe, Arizona, personal representatives, such as executors or trustees, may charge the following fees: — Statutory Fee: In most cases, personal representatives are entitled to a statutorily defined fee that is a percentage of the total estate value. The fee is typically calculated on a sliding scale, decreasing as the estate's value increases. — Reasonable Compensation: If the personal representative's fee is not specified by law, they may request reasonable compensation for their services, considering factors like the complexity of the estate, time spent, and expertise required. It's important to note that exact fee structures vary by attorney, accountant, or personal representative, so it is advisable to discuss and negotiate fees during the initial consultation or engagement agreement. Understanding these fees will help you anticipate costs, budget accordingly, and ensure transparency in your professional engagements in Tempe, Arizona.