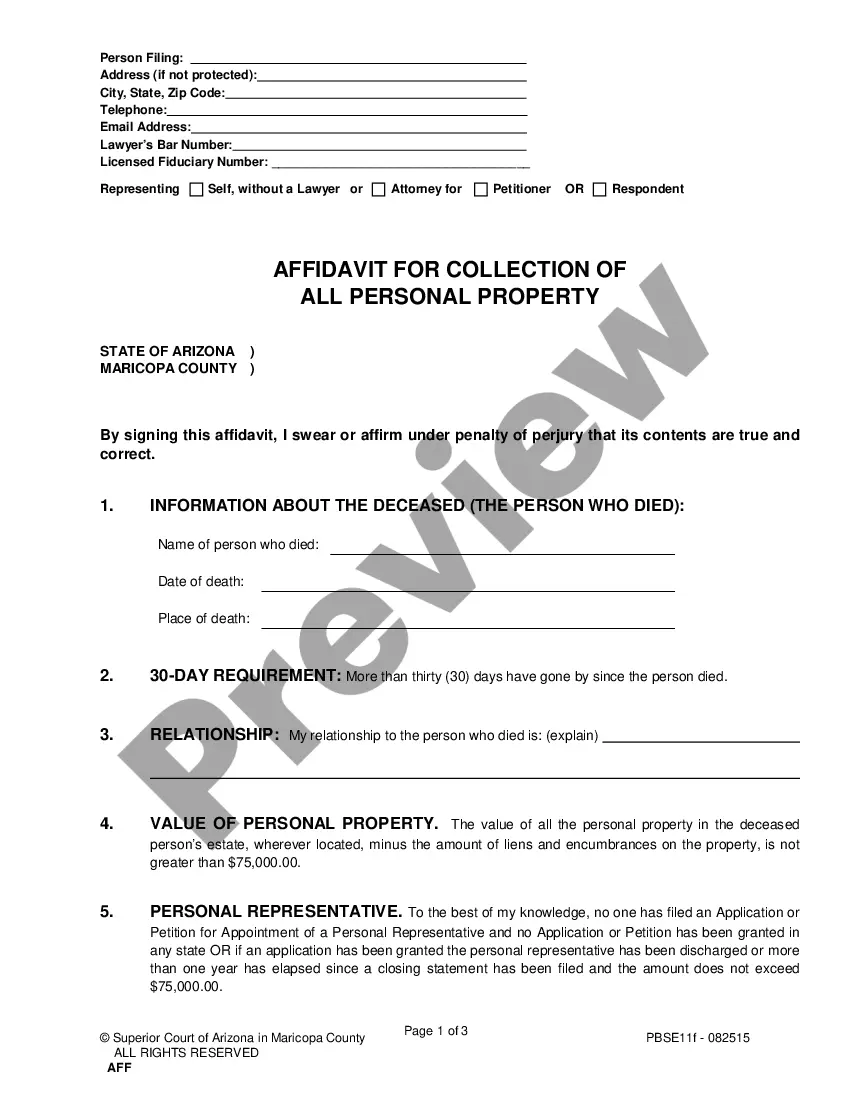

An Affidavit is a sworn, written statement of facts, signed by the 'affiant' (the person making the statement) before a notary public or other official witness. The affiant swears to the truth and accuracy of the statement contained in the affidavit. This document, an Affidavit for Collection of Real Property of Decedent - Arizona , is a model affidavit for recording the type of information stated. It must be signed before a notary, who must sign and stamp the document. Adapt the text to fit your facts. Available for download now in standard format(s).

Gilbert Arizona Affidavit for Collection of Real Property of Decedent

Description

How to fill out Arizona Affidavit For Collection Of Real Property Of Decedent?

Finding authentic templates relevant to your local regulations can be difficult unless you utilize the US Legal Forms repository.

It’s a digital collection of over 85,000 legal documents for both personal and professional requirements as well as various real-life situations.

All the paperwork is systematically classified by application area and jurisdictional regions, so searching for the Gilbert Arizona Affidavit for Collection of Real Property of Decedent is as quick and easy as 1-2-3.

Maintaining documentation orderly and in compliance with legal requirements is critically important. Leverage the US Legal Forms library to always have vital document templates for any purpose right at your fingertips!

- Review the Preview mode and document description.

- Ensure you’ve selected the right one that fulfills your needs and fully aligns with your local jurisdiction criteria.

- Look for an alternative template, if necessary.

- When you detect any discrepancies, use the Search tab above to find the correct document.

- If it meets your standards, proceed to the next step.

Form popularity

FAQ

An affidavit of legal heirs is a document that identifies the rightful heirs of a deceased person's estate. This affidavit simplifies the process of transferring property to these heirs by confirming their relationship to the decedent. For those utilizing the Gilbert Arizona Affidavit for Collection of Real Property of Decedent, this document can streamline claiming the property by establishing legal ownership.

In Arizona, the limit for a small estate affidavit is set at $75,000 for personal property and $100,000 for real property. If the total value of the estate falls below these thresholds, beneficiaries may use the Gilbert Arizona Affidavit for Collection of Real Property of Decedent to claim assets without going through lengthy probate. This streamlined process can save time and reduce stress for family members dealing with their loss. Always consult with a professional to confirm eligibility for this approach.

To transfer a property deed from a deceased relative in Arizona, you usually need to gather several documents, including the death certificate and any relevant affidavits. The Gilbert Arizona Affidavit for Collection of Real Property of Decedent serves as an efficient tool to initiate this transfer smoothly. It's crucial to ensure all paperwork is accurately completed and submitted to the appropriate county office for recording. This process helps prevent legal disputes among surviving family members.

An affidavit of heirship in Arizona is a legal document that proves the relationship between heirs and the deceased person. Specifically, it serves to establish heirs for property distribution when a will is unavailable. Utilizing the Gilbert Arizona Affidavit for Collection of Real Property of Decedent can facilitate this process and ensure rightful heirs can access property without extensive probate proceedings. This form can help streamline property transfer among family members.

When someone dies without a will in Arizona, their property, including a house, typically goes through a legal process called intestate succession. In this situation, the Gilbert Arizona Affidavit for Collection of Real Property of Decedent can simplify property distribution. The state’s laws dictate who inherits the property, usually favoring close relatives. It’s advisable to seek legal advice to navigate this process effectively.

An affidavit of succession to real property in Arizona is a document that confirms the rightful heirs to a specific piece of real estate. This affidavit allows heirs to bypass the probate process and collect property directly. Using the Gilbert Arizona Affidavit for Collection of Real Property of Decedent can simplify your experience and help finalize succession efficiently.

An Affidavit of property value may be necessary to verify the worth of a decedent’s property when distributing assets. This affidavit ensures clarity regarding asset value among heirs and beneficiaries. Utilizing the Gilbert Arizona Affidavit for Collection of Real Property of Decedent can provide the documentation you need for a smoother transfer.

Filing a small estate affidavit in Arizona involves completing the required form and submitting it to the appropriate court. Generally, this applies when the decedent’s assets are valued below a certain threshold. The Gilbert Arizona Affidavit for Collection of Real Property of Decedent can make this process straightforward and help you claim your inheritance quickly.

An Affidavit of succession is a legal document that establishes who inherits property following a person's death. This document can be filed in court to expedite the distribution of assets. The Gilbert Arizona Affidavit for Collection of Real Property of Decedent offers a useful option for heirs who wish to manage property succession efficiently.

In Arizona, you generally have a four-month window to file a claim against a decedent’s estate after being notified of their death. Understanding this timeframe is crucial to ensure your claim is recognized. If you need assistance, the Gilbert Arizona Affidavit for Collection of Real Property of Decedent can help streamline your involvement in the process.