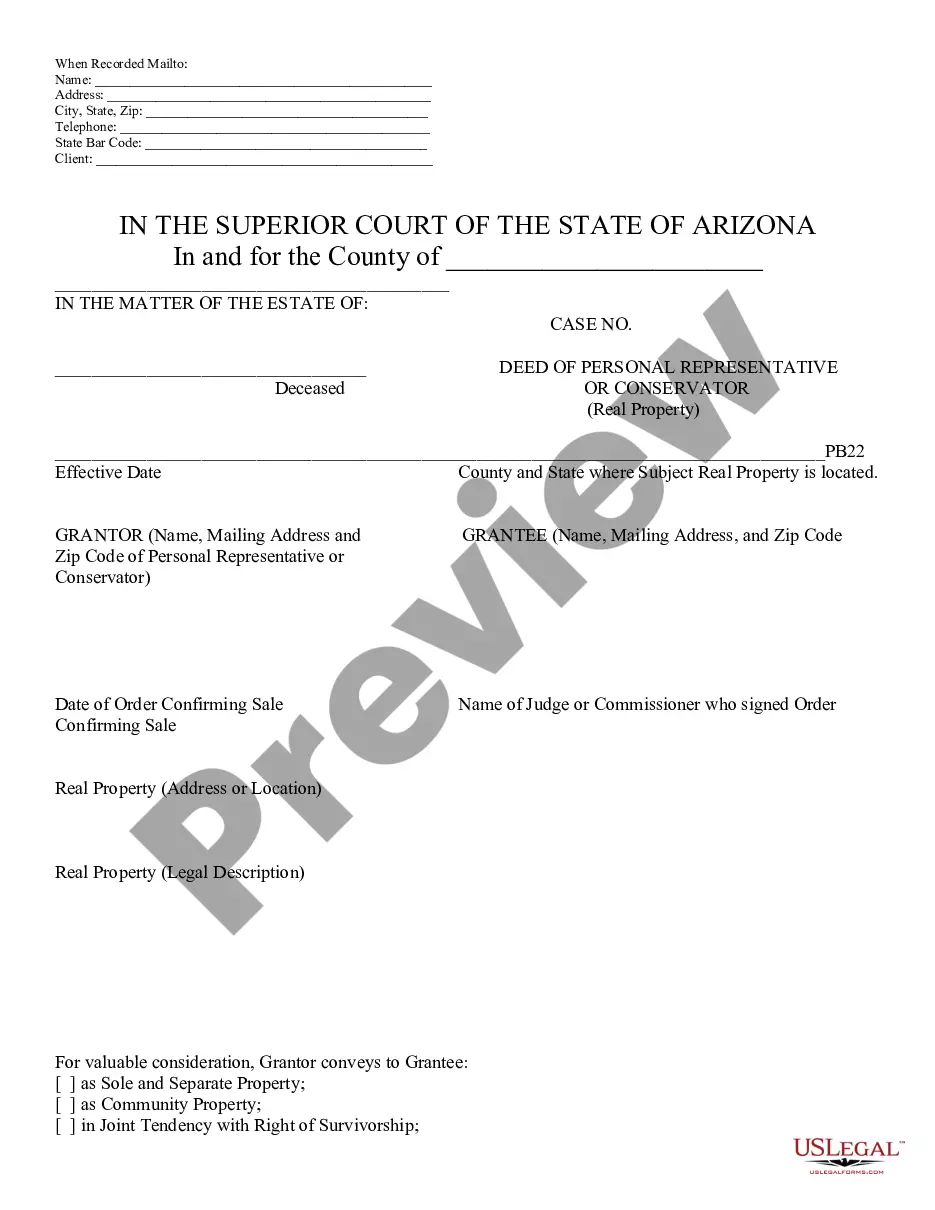

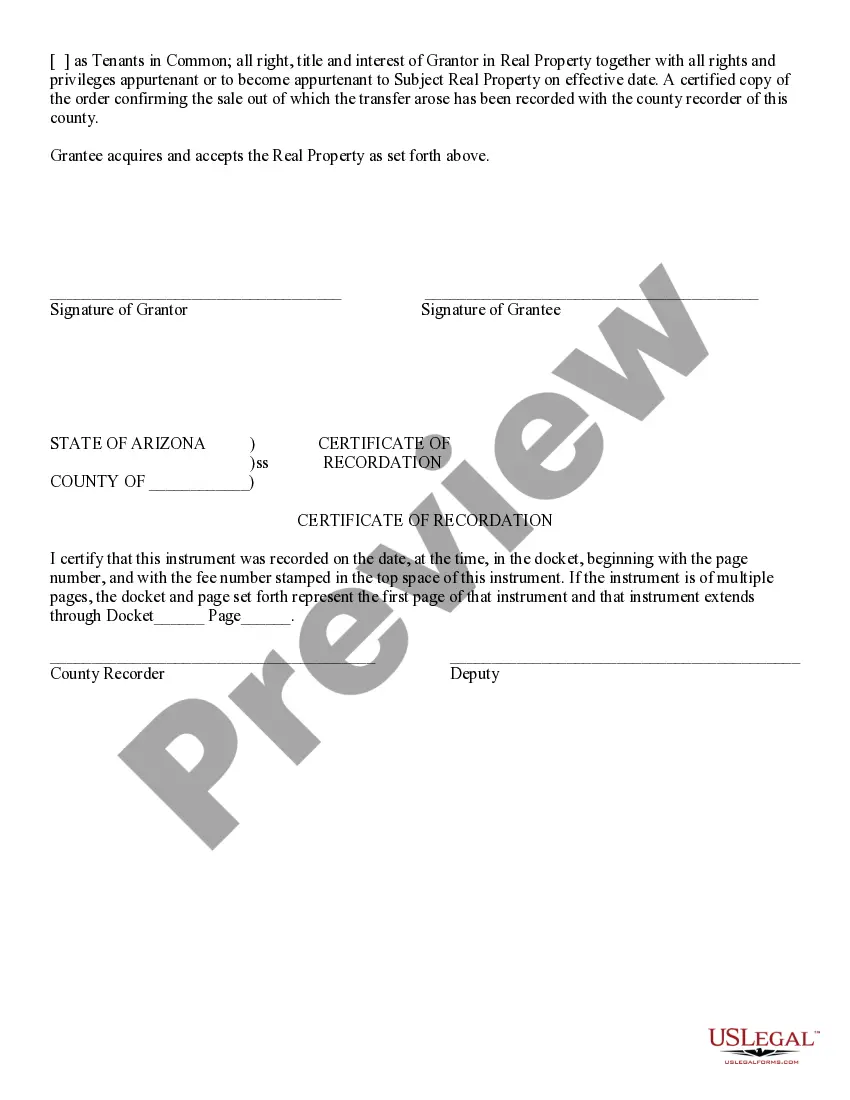

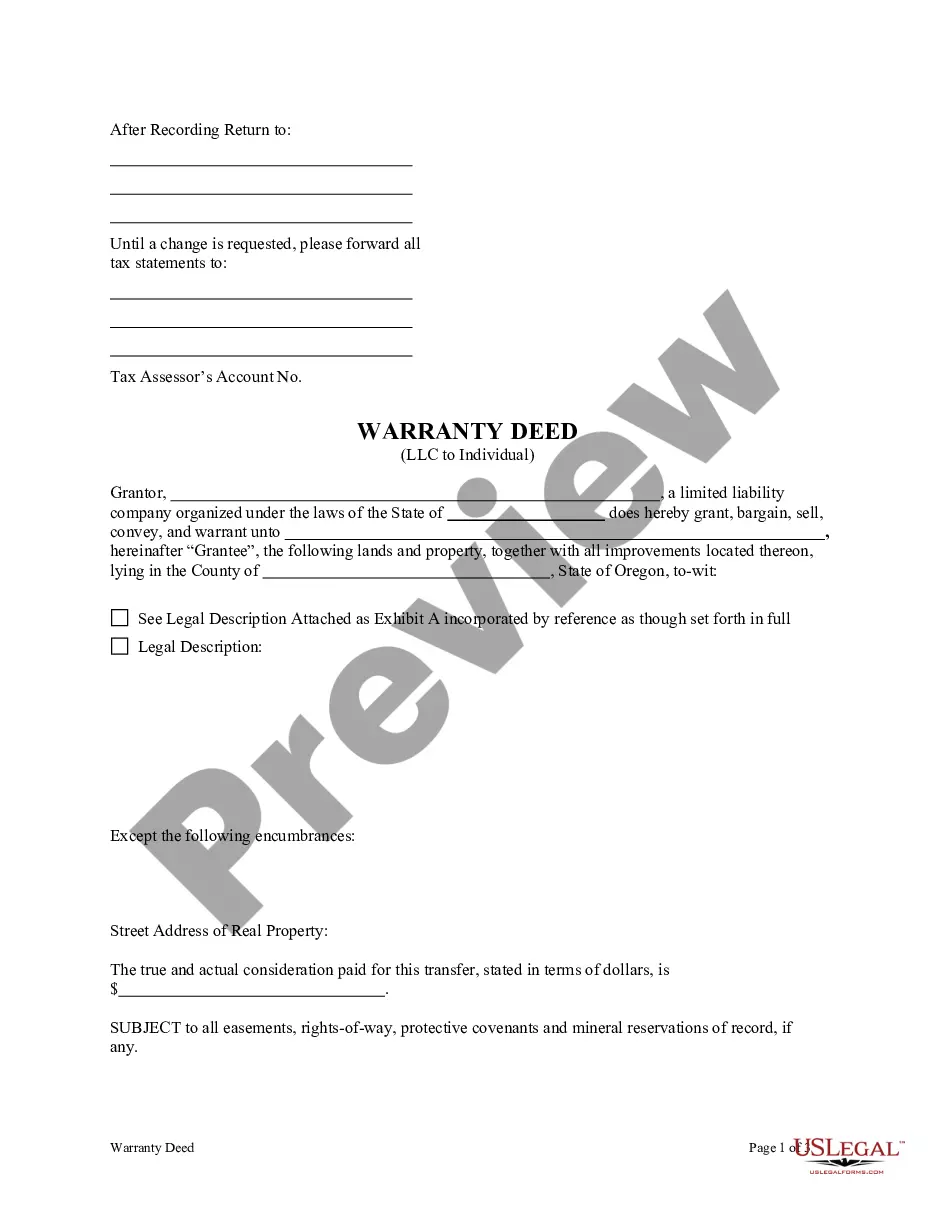

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Deed of Personal Rep. or Cons. of Real Property - Arizona, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s).

Surprise Arizona Deed of Personal Representative or Conservator of Real Property

Description

How to fill out Arizona Deed Of Personal Representative Or Conservator Of Real Property?

Regardless of your social or professional standing, finalizing law-related documents is a regrettable requirement in the modern world.

Frequently, it becomes nearly impossible for an individual without a legal background to develop such documentation from scratch, primarily due to the complicated terminology and legal nuances involved.

This is where US Legal Forms provides assistance.

Confirm that the document you selected is appropriate for your region, as the laws of one state or county don't apply to others.

Review the document and examine any brief description (if available) regarding situations for which the document can be utilized.

- Our platform features an extensive library with over 85,000 ready-to-use state-specific documents suitable for nearly any legal matter.

- US Legal Forms also serves as an excellent tool for attorneys or legal advisors who aim to enhance their efficiency in terms of time by utilizing our DIY documents.

- Whether you need the Surprise Arizona Deed of Personal Representative or the Conservator of Real Property, or any other form that will be acknowledged in your jurisdiction, US Legal Forms has it all available.

- Here’s how to swiftly obtain the Surprise Arizona Deed of Personal Representative or Conservator of Real Property using our dependable platform.

- If you are an existing customer, you can go ahead to Log In to your account to download the suitable form.

- However, if you are unfamiliar with our collection, make sure to follow these steps before acquiring the Surprise Arizona Deed of Personal Representative or Conservator of Real Property.

Form popularity

FAQ

For a Letter of Authority to be valid, it must be signed by the granting person, clearly specify the powers being granted, and include accurate dates. Additionally, the document often requires notarization to enhance its legal standing. Utilizing a resource like USLegalForms can simplify the process of creating a valid Letter related to the Surprise Arizona Deed of Personal Representative or Conservator of Real Property.

A Letter giving authority to someone is a formal document that grants permission to act on behalf of another person. This letter is critical in legal matters, particularly when dealing with financial or property concerns. If you need assistance in preparing this document related to a Surprise Arizona Deed of Personal Representative or Conservator of Real Property, USLegalForms can provide templates and guidance.

The primary purpose of a Letter of Authority is to officially empower a designated individual to act on behalf of another person, particularly in managing their real property affairs. This document ensures that the designated person's actions are recognized legally, which provides peace of mind in executing decisions regarding assets. When dealing with a Surprise Arizona Deed of Personal Representative or Conservator of Real Property, having a valid Letter of Authority is essential.

A Letter of Testamentary grants an executor the power to manage a deceased person's estate according to their will. Conversely, a Letter of Authority provides a conservator or personal representative the power to manage real property on behalf of an individual who is unable to do so themselves. Understanding these distinctions is crucial when dealing with the Surprise Arizona Deed of Personal Representative or Conservator of Real Property.

An executor is specifically appointed through a will, while a personal representative can be appointed by the court when there is no will in place. Both roles involve managing an estate, but the titles reflect different legal pathways. Understanding how a Surprise Arizona Deed of Personal Representative or Conservator of Real Property functions within these roles can clarify the responsibilities and ensure smooth estate management.

An executor can distribute assets to himself, but this must be done with transparency and legality. It is essential for the executor to act in accordance with the will and the laws governing the estate. When appropriately documented, such as with a Surprise Arizona Deed of Personal Representative or Conservator of Real Property, this distribution process can proceed without complications.

A personal representative wields significant powers, including taking control of the estate's assets, settling debts, and filing tax returns. Each power aims to ensure that the estate is managed efficiently and in accordance with the law. Utilizing a Surprise Arizona Deed of Personal Representative or Conservator of Real Property allows for clear and legal handling of real property ownership, further supporting the representative's responsibilities.

The powers of a personal representative of an estate include collecting and managing assets, paying debts, and distributing remaining property to beneficiaries. This role is pivotal in ensuring that the deceased's wishes are honored and that the estate is settled responsibly. By employing tools like a Surprise Arizona Deed of Personal Representative or Conservator of Real Property, the personal representative can effectively manage real estate transactions and protect the estate's integrity.

Similar to a personal representative, an executor can transfer property to himself if the transaction complies with legal standards. It is crucial that this transfer aligns with the estate's best interests and is properly documented. Utilizing a Surprise Arizona Deed of Personal Representative or Conservator of Real Property can aid in ensuring a smooth transfer of ownership and protect against future claims.

A personal representative may transfer property to himself, but specific legal requirements must be met. The transfer should be in the best interest of the estate and follow the guidelines set forth by the probate court. When dealing with property, such as a Surprise Arizona Deed of Personal Representative or Conservator of Real Property, proper documentation is essential to validate the transaction and avoid disputes.