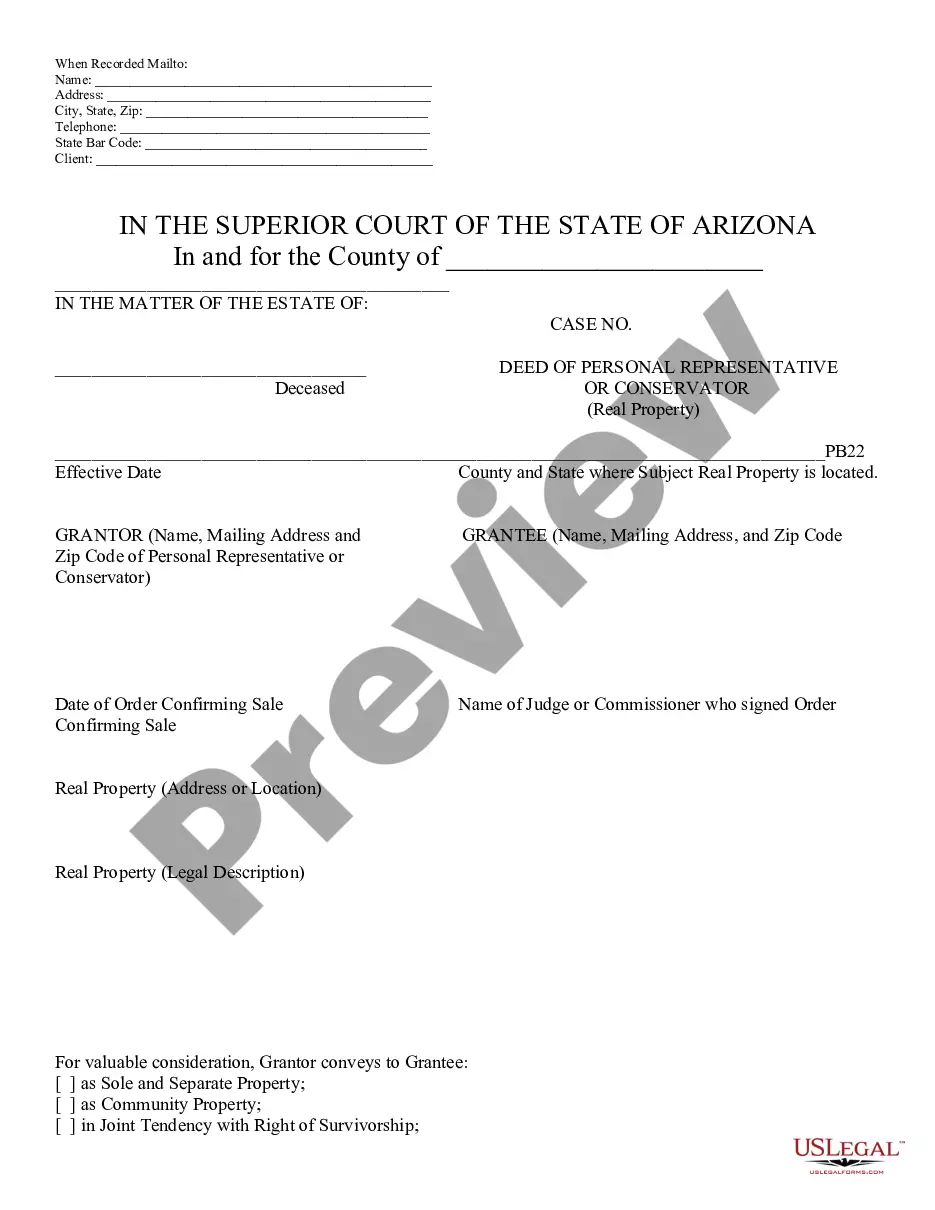

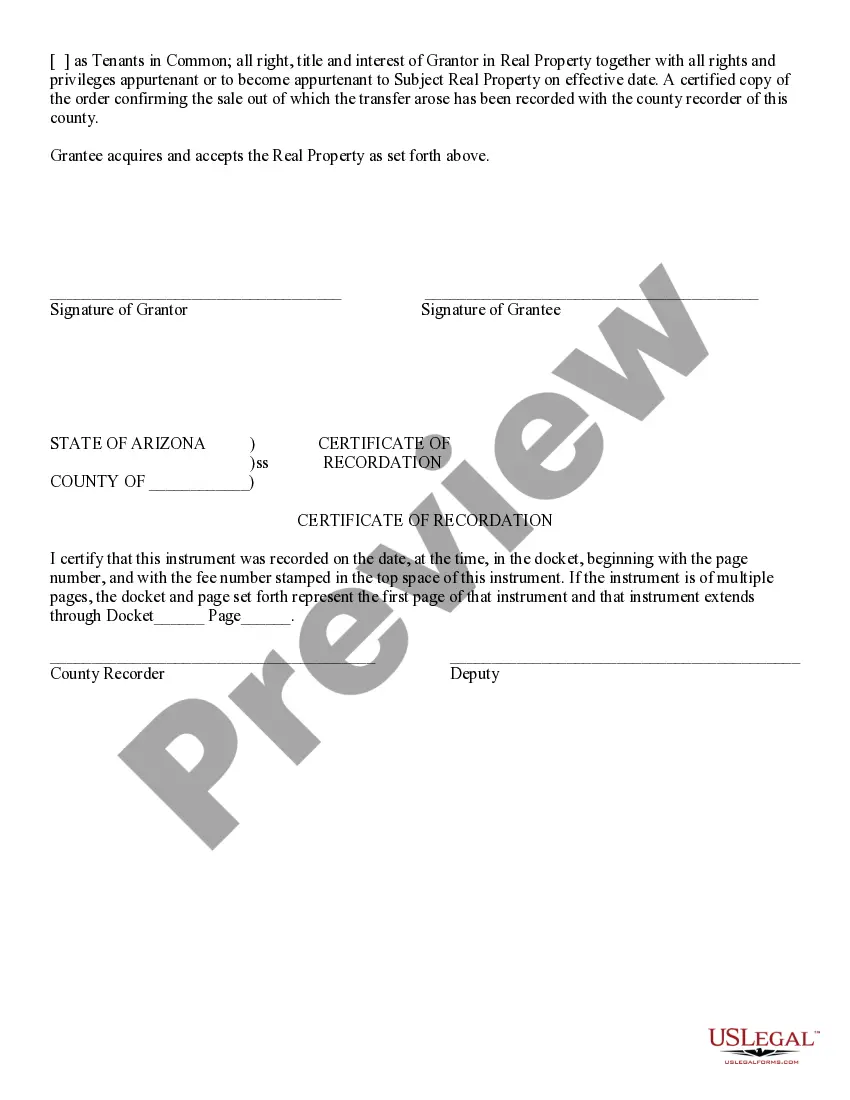

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Deed of Personal Rep. or Cons. of Real Property - Arizona, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s).

The Tucson Arizona Deed of Personal Representative or Conservator of Real Property is a legal document that enables an individual, known as the personal representative or conservator, to transfer real property assets of a deceased person or a protected person to their rightful beneficiaries or heirs. This deed serves as a proof of ownership and provides a legal framework for the distribution of assets in accordance with the wishes of the deceased or the court-appointed conservator. There are several types of Tucson Arizona Deeds of Personal Representative or Conservator of Real Property, each pertaining to specific scenarios and circumstances. Some common types include: 1. Deed of Personal Representative: This type of deed is utilized when the deceased person had a valid will in place. The personal representative, who is typically named in the will, uses this deed to transfer the real property to the beneficiaries mentioned in the will. 2. Deed of Special Administrator: In situations where the deceased did not have a will, a special administrator is appointed by the court to handle the distribution of assets. This deed allows the special administrator to transfer the real property to the heirs determined by the state's intestacy laws. 3. Deed of Conservator: In cases where an individual is deemed mentally incapacitated or unable to make decisions regarding their property and financial affairs, a conservator is appointed by the court. The conservator uses this deed to manage and potentially transfer the real property on behalf of the protected person. 4. Deed in Lieu of Foreclosure: This type of deed can be used when the personal representative or conservator needs to transfer the real property to satisfy outstanding debts or mortgage obligations. It allows the lender or creditor to accept the property in lieu of foreclosure, preventing further legal complications. Regardless of the specific type of Tucson Arizona Deed of Personal Representative or Conservator of Real Property, it is crucial to consult with an experienced attorney or legal professional to ensure compliance with state laws and regulations. Failure to adhere to the appropriate procedures and requirements may result in complications or even legal disputes regarding the distribution of the property assets.