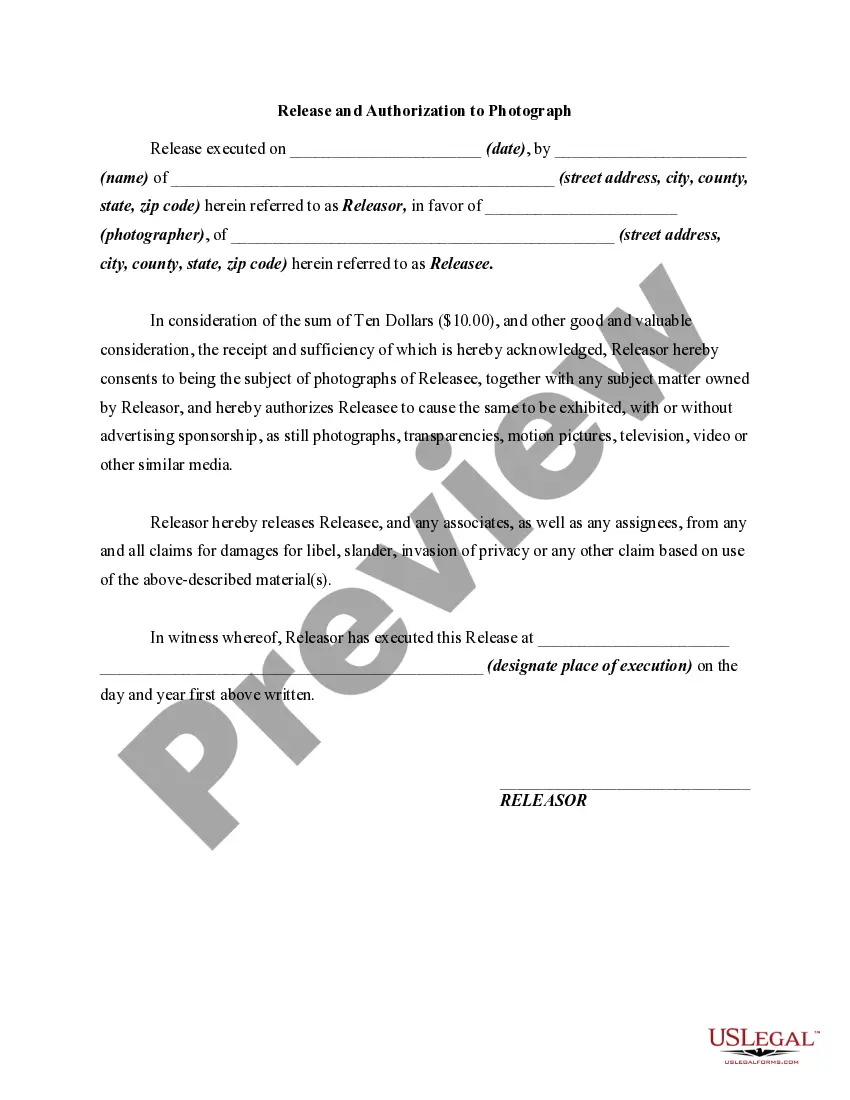

Instrument of Distribution from Probate Estate - Per. Rep. - Arizona: This instrument lists the distribution to all property of an estate. In basic terms, it is a list of what each heir received. It is signed in front of a Notary Public, and is available for download in both Word and Rich Text formats.

Surprise Arizona Instrument of Distribution from Probate Estate - Personal Representative

Description

How to fill out Arizona Instrument Of Distribution From Probate Estate - Personal Representative?

Irrespective of societal or occupational rank, completing legal documents is a regrettable obligation in contemporary society.

Frequently, it’s nearly unfeasible for an individual with no legal training to draft such documents from the beginning, primarily due to the intricate language and legal subtleties they encompass.

This is where US Legal Forms can assist you.

Confirm that the template you have located is tailored to your locality since the laws of one state or county do not apply to another.

Examine the document and consider a brief summary (if available) of instances in which the form can be utilized.

- Our platform offers an extensive archive with over 85,000 ready-to-use forms specific to each state, suitable for nearly any legal circumstance.

- US Legal Forms also serves as an excellent tool for associates or legal advisors aiming to conserve time by using our DIY forms.

- Whether you need the Surprise Arizona Instrument of Distribution from Probate Estate - Personal Representative or any other document recognized in your locality, with US Legal Forms, everything is available.

- Here’s how to acquire the Surprise Arizona Instrument of Distribution from Probate Estate - Personal Representative in moments using our reliable platform.

- If you are a returning customer, feel free to Log In to your account to download the necessary form.

- However, if you are unfamiliar with our library, make sure to follow these steps before downloading the Surprise Arizona Instrument of Distribution from Probate Estate - Personal Representative.

Form popularity

FAQ

Settling an estate in Arizona involves collecting all the decedent's assets, paying any outstanding debts and taxes, and distributing the remaining assets to beneficiaries. The personal representative plays a key role in this process, ensuring fairness and compliance with legal guidelines. By adhering to the steps required for the Surprise Arizona Instrument of Distribution from Probate Estate - Personal Representative, you can facilitate an efficient settlement. Utilizing platforms like uslegalforms can help simplify this process by providing necessary forms and guidance.

To close an estate in Arizona, the personal representative must complete several steps, including settling debts, distributing assets, and filing the final account with the probate court. After all the necessary paperwork is filed and approved, the personal representative can submit a petition to close the estate. Properly managing these tasks is essential to successfully execute the Surprise Arizona Instrument of Distribution from Probate Estate - Personal Representative. It ensures that all legal obligations are fulfilled before concluding the probate process.

Yes, quit claim deeds are legal in Arizona. They allow a property owner to transfer their interest in a property without guaranteeing that the title is clear. While using a quit claim deed can simplify transfers, they may not provide the level of protection offered by a warranty deed. If you are involved with the Surprise Arizona Instrument of Distribution from Probate Estate - Personal Representative, understanding the implications of different deed types is crucial.

In Arizona, a beneficiary deed does not override a will; however, it can take effect before or alongside a will's provisions. This type of deed allows property to pass directly to a designated beneficiary outside of the probate process. Therefore, if you have a Surprise Arizona Instrument of Distribution from Probate Estate - Personal Representative, it’s essential to consider how your beneficiary deed and will interact. Always consult a professional to clarify your options.

A deed of distribution outlines how property should be distributed to heirs or beneficiaries after someone passes away. It acts as a formal record that the personal representative has effectively distributed the estate's assets. This is crucial in processing the Surprise Arizona Instrument of Distribution from Probate Estate - Personal Representative. By executing a deed of distribution, the personal representative ensures all parties receive their share as intended.

The most common type of deed used in Arizona is the warranty deed. This deed guarantees that the grantor has clear title to the property and can legally transfer ownership. In the context of the Surprise Arizona Instrument of Distribution from Probate Estate - Personal Representative, a warranty deed assures beneficiaries of the estate that they receive rightful ownership. It's essential for ensuring that all legal obligations in the transfer are met.

An alternative to a letter of testamentary is a small estate affidavit, which can be used when the estate's value falls below a certain threshold. This affidavit allows heirs to claim assets without going through the lengthy probate process. If you find yourself in this situation, using the resources available at US Legal Forms can guide you through the necessary steps involving the Surprise Arizona Instrument of Distribution from Probate Estate - Personal Representative options.

To secure letters of testamentary in Arizona, you need to submit a formal request to the probate court where the deceased lived. This request must include the appropriate forms, a copy of the will, and the death certificate. Leveraging services like US Legal Forms can aid you in obtaining the necessary Surprise Arizona Instrument of Distribution from Probate Estate - Personal Representative documentation efficiently.

Ordering a testamentary letter involves filing a petition with your local probate court, alongside the required documentation, including the will and proof of the decedent's identity. After the petition is filed, the court will review your application and may schedule a hearing. Accessing US Legal Forms can help in ordering the Surprise Arizona Instrument of Distribution from Probate Estate - Personal Representative smoothly.

To obtain a letter of testamentary in Arizona, you must file a petition with the probate court in the county where the deceased resided. This process involves providing necessary documents, such as the will, death certificate, and an application for appointment. Utilizing the Surprise Arizona Instrument of Distribution from Probate Estate - Personal Representative tools can simplify this process and ensure you have all required forms.