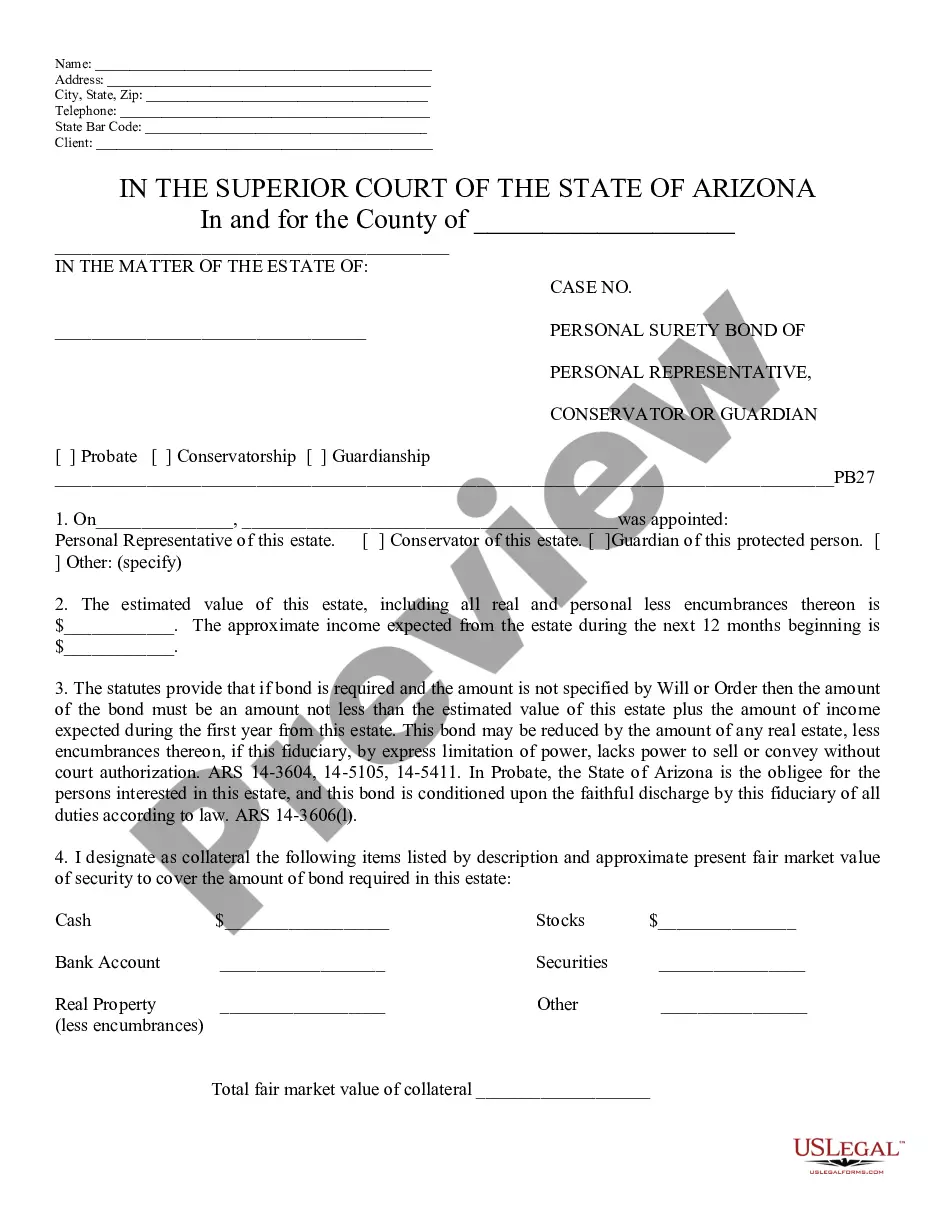

Personal Surety Bond of Personal Rep. - Arizona: This form lists personal items to be used as collateral for the surety bond of the personal representative. The bond is to be of an amount less than the estate's worth, along with the expected income of the estate, during the year. It is available for download in both Word and Rich Text formats.

A Phoenix Arizona Personal Surety Bond of Personal Representative is a type of surety bond that is required by the court system in Phoenix, Arizona, for individuals serving as personal representatives or executors of an estate. This bond acts as a form of insurance, providing financial protection for the beneficiaries of the estate in the event that the personal representative fails to fulfill their duties and responsibilities. The purpose of the Phoenix Arizona Personal Surety Bond of Personal Representative is to ensure that the personal representative handles the estate in accordance with applicable laws and regulations, as well as any orders issued by the court. It helps safeguard the estate's assets from any potential misuse or mismanagement by the personal representative. The bond offers several key benefits for the beneficiaries of the estate. Firstly, it provides a guarantee that any debts, taxes, or other financial obligations of the estate will be paid appropriately. Secondly, it protects against any fraudulent or negligent acts committed by the personal representative that could result in financial losses for the estate. There are different types of Phoenix Arizona Personal Surety Bond of Personal Representative based on the size and complexity of the estate. These include: 1. Small Estate Bond: This type of bond is required for estates of lesser value, typically in cases where the total value of the assets is below a certain threshold, as determined by the court. 2. Regular Estate Bond: This is the most common type of personal representative bond and is required for estates of average size and complexity. 3. Large Estate Bond: This bond is necessary for estates with significant assets and complex financial arrangements. The court may require a higher bond amount to offer additional protection for the beneficiaries. Applying for a Phoenix Arizona Personal Surety Bond of Personal Representative involves several steps. The personal representative must first identify a reputable surety company authorized to issue bonds in Arizona. The surety company will require the personal representative to complete an application form, provide relevant documentation, and pay a premium based on the bond amount. Once approved, the surety company will issue the bond, and the personal representative will need to file it with the court as part of the estate administration process. The bond remains in effect until the court releases the personal representative from their duties, often after the estate distribution has been completed successfully. In summary, a Phoenix Arizona Personal Surety Bond of Personal Representative is a critical requirement for those serving as personal representatives of estates in Phoenix, Arizona. It provides financial protection for the estate's beneficiaries, ensuring that the personal representative fulfills their duties in accordance with the law. Different types of bonds are available based on the size and complexity of the estate, providing tailored coverage for various situations.