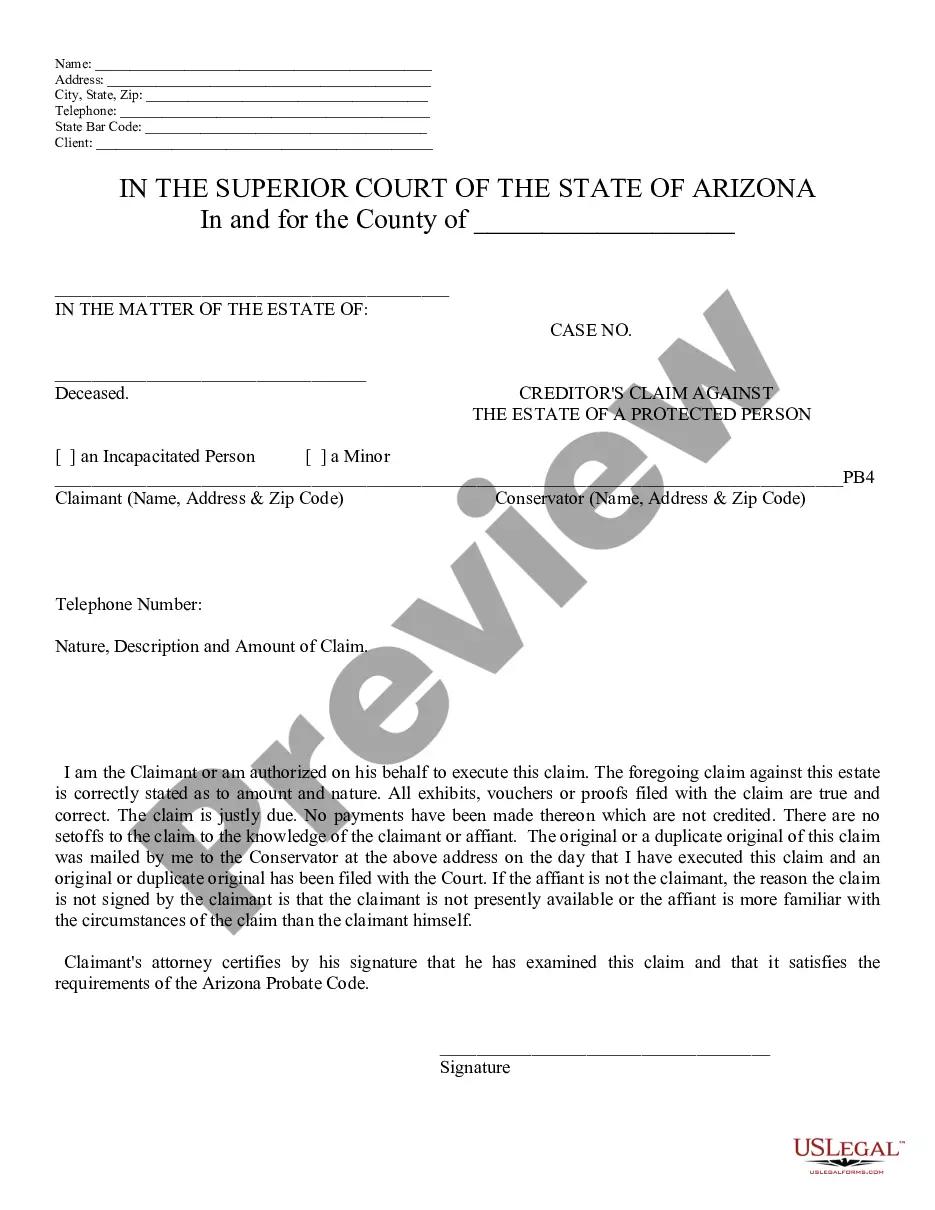

Creditors Claim in Probate - Arizona: This form is signed by a creditor, stating that he/she has a claim against the decedent's estate. The form further lists the claim, and the services performed for said claim. It is available for download in both Word and Rich Text formats.

Maricopa Arizona Creditors Claim in Probate

Description

How to fill out Arizona Creditors Claim In Probate?

Take advantage of the US Legal Forms and gain instant access to any form template you need.

Our helpful website with a wealth of document templates makes it easy to locate and acquire nearly any document example you desire.

You can export, complete, and sign the Maricopa Arizona Creditors Claim in Probate within minutes instead of searching the Internet for hours for an appropriate template.

Using our repository is an excellent method to enhance the security of your document filing.

Locate the template you need. Make sure that it is the document you were seeking: check its title and description, and use the Preview feature when available. If not, make use of the Search option to find the correct one.

Initiate the saving process. Click Buy Now and choose your desired pricing plan. Then, register for an account and finalize your order using a credit card or PayPal.

- Our knowledgeable attorneys frequently review all the documents to ensure that the forms are applicable for a specific jurisdiction and adhere to current laws and regulations.

- How do you procure the Maricopa Arizona Creditors Claim in Probate.

- If you already hold a subscription, simply Log In to your account. The Download option will be activated for all documents you view.

- Additionally, you can access all your previously saved documents in the My documents section.

- If you do not yet have an account, follow the instructions below.

Form popularity

FAQ

When a creditor files a claim against an estate in Maricopa, Arizona, the executor or administrator of the estate must review the claim. They will determine whether the claim is valid based on the estate's assets and outstanding debts. If the claim is approved, the estate pays the creditor from available funds. For efficient management of this process, you can utilize USLegalForms, which offers resources and templates to navigate Maricopa Arizona Creditors Claim in Probate effectively.

Yes, credit card companies can pursue debts owed to them after a person's death, and they may file a claim against the deceased's estate. Under Arizona law, all legitimate debts must be settled before any assets can be distributed to heirs. It is vital to address any outstanding claims or debts, including those from credit card companies, to comply with the Maricopa Arizona Creditors Claim in Probate process. For assistance, consider platforms like USLegalForms to guide you in navigating these legal obligations.

The probate code governing creditor's claims is outlined in the Arizona Revised Statutes, specifically within Title 14, Chapter 3. These statues provide guidelines on how and when creditors can submit their claims against an estate. Familiarizing yourself with these laws can help streamline the process of making a Maricopa Arizona Creditors Claim in Probate.

Creditors typically find out about estates through notices published in local newspapers or through direct communication from the estate's executor. Additionally, probate courts often post public notices regarding new probate cases, which can inform creditors about the opportunity to file a claim. It’s important for creditors to stay informed, especially for Maricopa Arizona Creditors Claims in Probate, to ensure they don’t miss their chance to pursue debts.

Claiming an estate of a deceased person in Maricopa requires you to initiate the probate process, which begins by filing a petition with the probate court. Once the court appoints a personal representative, they can begin managing the estate’s assets and liabilities. You may also need to notify creditors of the estate, allowing them to make claims, including any Maricopa Arizona Creditors Claims in Probate they may have.

To file a claim against an estate in Maricopa, Arizona, a creditor must first prepare a written claim that includes specific details about the debt owed. This claim must be submitted to the personal representative or executor of the estate within the timeframe set by the probate court. After filing, it is essential to keep copies of all documents for your records. Remember, timely submission is crucial in a Maricopa Arizona Creditors Claim in Probate.

To present a claim against a decedent's estate in Arizona, a creditor must file their claim with the probate court and provide proper documentation. This process must be completed within the designated time frame outlined by Arizona law. Understanding the process around Maricopa Arizona Creditors Claim in Probate provides clarity for creditors seeking to recover outstanding debts.

Probate rule 53 in Arizona primarily deals with claims against the estate and specifies the requirements for how creditors must present their claims. This rule is crucial for maintaining the order within probate proceedings. Familiarity with this guideline facilitates easier handling of Maricopa Arizona Creditors Claim in Probate.

An executor can notify creditors by sending them written notices and publishing announcements in local newspapers. This ensures that all known and potential creditors are informed about the probate process. Successful execution of Maricopa Arizona Creditors Claim in Probate relies on proper notification to prevent future disputes.

In the context of probate, rule 51 serves as a guideline for notifying creditors regarding their potential claims. It mandates certain methods of communication and documentation that the executor must follow to ensure all interested parties are informed. This understanding is pivotal for managing Maricopa Arizona Creditors Claim in Probate effectively.