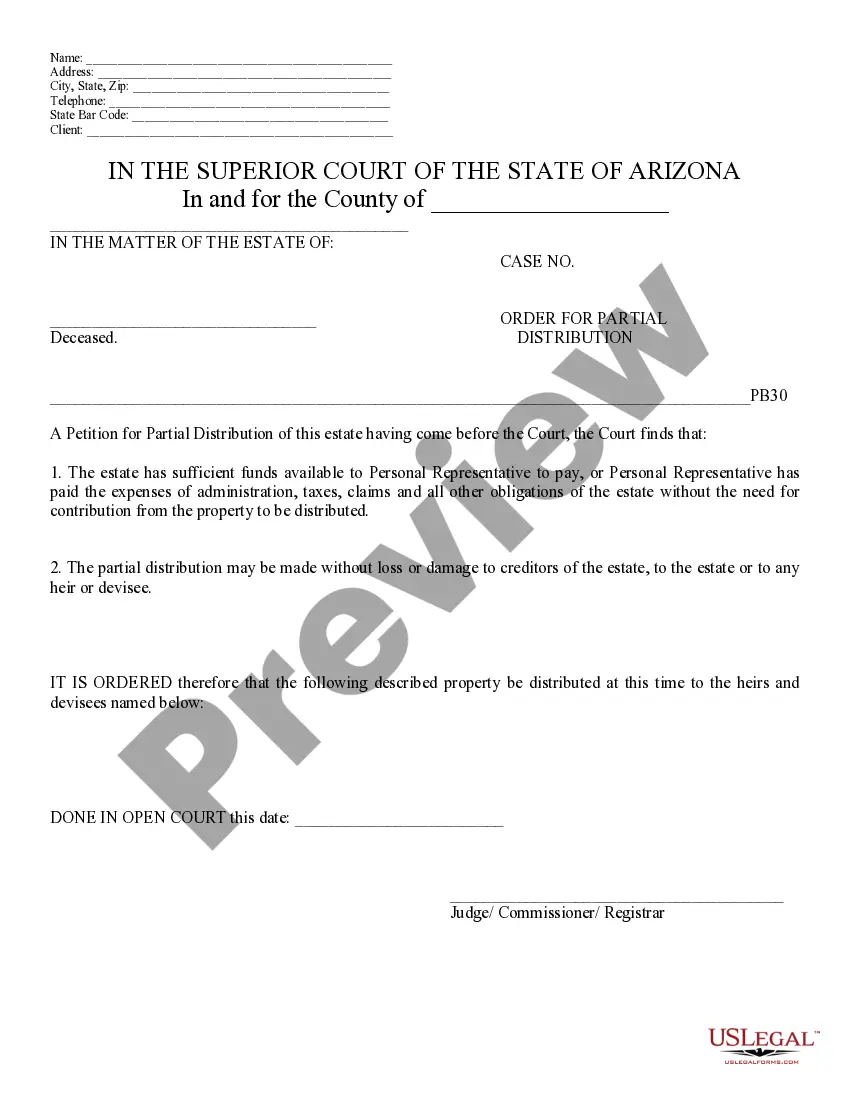

An Order is an official written statement from the court commanding a certain action, and is signed by the judge. Failure to comply with the order is unlawful and may result in contempt of court charges. This document, a sample Order for Partial Distribution - Arizona, can be used as a model to draft an order requested for submission by the court (the court often directs a party to draft an order). Adapt the language to the facts and circumstances of your case. Available for download now in standard format(s).

The Phoenix Arizona Order for Partial Distribution is a legal document issued by a court in Phoenix, Arizona, that authorizes the distribution of assets from an estate or trust prior to the final settlement. It enables the executor or trustee to distribute a portion of the assets to the beneficiaries even though the administration of the estate or trust is not yet complete. This order is typically requested when there is a need for immediate financial support or when certain assets can be distributed separately from the rest of the estate or trust. It allows for a partial distribution of assets while still preserving enough remaining assets to cover any potential debts, taxes, or expenses. There are different types of Phoenix Arizona Orders for Partial Distribution, including: 1. Partial Distribution for Support: This type of order is sought when one or more beneficiaries require immediate financial assistance for living expenses, education, healthcare, or any other legitimate needs. 2. Partial Distribution of Specific Assets: In some cases, there may be specific assets within the estate or trust that can be easily distributed without affecting the administration of the rest of the estate or trust. This order allows for the distribution of those specific assets while the remaining administration continues. 3. Partial Distribution for Tax Purposes: When there are significant tax liabilities associated with the estate or trust, a partial distribution order may be requested to distribute some assets to cover the tax obligations, thereby reducing the overall tax burden. 4. Partial Distribution to Satisfy Debts: In situations where there are outstanding debts owed by the estate or trust, a partial distribution order can be sought to distribute assets that can satisfy those debts partially or in full. It is important to note that a Phoenix Arizona Order for Partial Distribution is subject to court approval and should be requested through the appropriate legal channels. The court will carefully review the request to ensure that the partial distribution is in the best interest of all parties involved and will not jeopardize the final settlement of the estate or trust.The Phoenix Arizona Order for Partial Distribution is a legal document issued by a court in Phoenix, Arizona, that authorizes the distribution of assets from an estate or trust prior to the final settlement. It enables the executor or trustee to distribute a portion of the assets to the beneficiaries even though the administration of the estate or trust is not yet complete. This order is typically requested when there is a need for immediate financial support or when certain assets can be distributed separately from the rest of the estate or trust. It allows for a partial distribution of assets while still preserving enough remaining assets to cover any potential debts, taxes, or expenses. There are different types of Phoenix Arizona Orders for Partial Distribution, including: 1. Partial Distribution for Support: This type of order is sought when one or more beneficiaries require immediate financial assistance for living expenses, education, healthcare, or any other legitimate needs. 2. Partial Distribution of Specific Assets: In some cases, there may be specific assets within the estate or trust that can be easily distributed without affecting the administration of the rest of the estate or trust. This order allows for the distribution of those specific assets while the remaining administration continues. 3. Partial Distribution for Tax Purposes: When there are significant tax liabilities associated with the estate or trust, a partial distribution order may be requested to distribute some assets to cover the tax obligations, thereby reducing the overall tax burden. 4. Partial Distribution to Satisfy Debts: In situations where there are outstanding debts owed by the estate or trust, a partial distribution order can be sought to distribute assets that can satisfy those debts partially or in full. It is important to note that a Phoenix Arizona Order for Partial Distribution is subject to court approval and should be requested through the appropriate legal channels. The court will carefully review the request to ensure that the partial distribution is in the best interest of all parties involved and will not jeopardize the final settlement of the estate or trust.