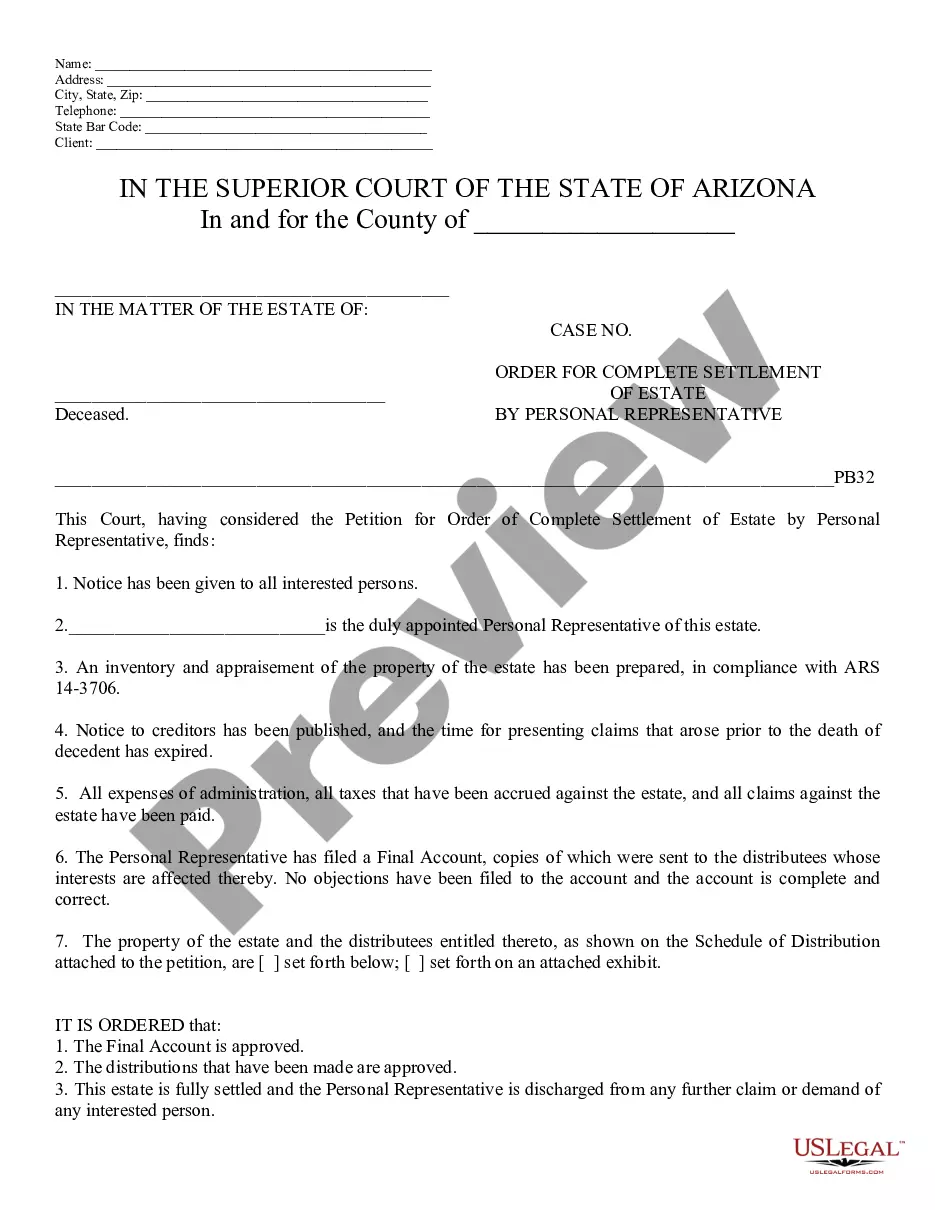

An Order is an official written statement from the court commanding a certain action, and is signed by the judge. Failure to comply with the order is unlawful and may result in contempt of court charges. This document, a sample Order of Complete Settlement of Estate by Personal Representative - Arizona, can be used as a model to draft an order requested for submission by the court (the court often directs a party to draft an order). Adapt the language to the facts and circumstances of your case. Available for download now in standard format(s).

Maricopa Arizona Order of Complete Settlement of Estate by Personal Representative is a legal process that encompasses various steps and procedures to settle the estate of a deceased individual. This order ensures that all debts, assets, and distributions are handled in compliance with Arizona law. Let's explore the key components and types of this order in detail: 1. Personal Representative: The Personal Representative, also known as the Executor or Administrator, is the individual appointed by the court to manage the deceased person's estate. They are responsible for handling all legal matters, distributing assets, paying debts, and fulfilling the wishes outlined in the deceased's will or state law. 2. Estate Inventory: The Personal Representative is required to conduct a thorough inventory of the deceased person's assets, including real estate, bank accounts, investments, personal belongings, and other valuables. This inventory helps in determining the overall value of the estate and forms the basis for further settlement proceedings. 3. Notification and Creditors Claims: The Personal Representative is responsible for notifying all potential creditors and beneficiaries about the death of the individual and initiating a creditor claim period. During this period, creditors can submit claims against the estate for any debts owed by the deceased. This process ensures that all valid claims are addressed and paid accordingly. 4. Payment of Debts and Taxes: The Personal Representative must determine and prioritize any outstanding debts, such as mortgages, loans, credit card bills, and taxes owed by the deceased. They are responsible for ensuring the timely payment of these debts using funds from the estate. This step also involves filing the necessary tax returns for the deceased individual and the estate. 5. Beneficiary Distribution: Once all debts and taxes have been settled, the Personal Representative supervises the distribution of the remaining assets to the beneficiaries mentioned in the deceased person's will or according to state law if there is no will. It is crucial to follow the instructions and preferences outlined by the deceased to ensure a fair and legal distribution of assets. Different types of Maricopa Arizona Order of Complete Settlement of Estate by Personal Representative may include: 1. Summary Administration: This type of settlement is suitable when the estate's total value falls under certain thresholds specified by Arizona law. Summary administration simplifies the settlement process, making it quicker and more cost-effective. 2. Formal Administration: In cases where the estate's value exceeds the thresholds set for summary administration, a formal administration order may be required. This process involves more comprehensive court supervision and is often necessary for complex or contested estates. 3. Small Estate Affidavit: If the estate's total value is minimal, Arizona law provides an alternative option called a Small Estate Affidavit. This affidavit allows for a simplified settlement process without the need for court-supervised proceedings, often leading to a quicker resolution. In summary, Maricopa Arizona Order of Complete Settlement of Estate by Personal Representative is the legal procedure through which a deceased person's estate is settled. It involves various steps, including the inventory of assets, creditor notifications, debt payment, tax filings, and beneficiary distribution. Different types of settlement may include Summary Administration, Formal Administration, or Small Estate Affidavit, depending on the estate's value and complexity.Maricopa Arizona Order of Complete Settlement of Estate by Personal Representative is a legal process that encompasses various steps and procedures to settle the estate of a deceased individual. This order ensures that all debts, assets, and distributions are handled in compliance with Arizona law. Let's explore the key components and types of this order in detail: 1. Personal Representative: The Personal Representative, also known as the Executor or Administrator, is the individual appointed by the court to manage the deceased person's estate. They are responsible for handling all legal matters, distributing assets, paying debts, and fulfilling the wishes outlined in the deceased's will or state law. 2. Estate Inventory: The Personal Representative is required to conduct a thorough inventory of the deceased person's assets, including real estate, bank accounts, investments, personal belongings, and other valuables. This inventory helps in determining the overall value of the estate and forms the basis for further settlement proceedings. 3. Notification and Creditors Claims: The Personal Representative is responsible for notifying all potential creditors and beneficiaries about the death of the individual and initiating a creditor claim period. During this period, creditors can submit claims against the estate for any debts owed by the deceased. This process ensures that all valid claims are addressed and paid accordingly. 4. Payment of Debts and Taxes: The Personal Representative must determine and prioritize any outstanding debts, such as mortgages, loans, credit card bills, and taxes owed by the deceased. They are responsible for ensuring the timely payment of these debts using funds from the estate. This step also involves filing the necessary tax returns for the deceased individual and the estate. 5. Beneficiary Distribution: Once all debts and taxes have been settled, the Personal Representative supervises the distribution of the remaining assets to the beneficiaries mentioned in the deceased person's will or according to state law if there is no will. It is crucial to follow the instructions and preferences outlined by the deceased to ensure a fair and legal distribution of assets. Different types of Maricopa Arizona Order of Complete Settlement of Estate by Personal Representative may include: 1. Summary Administration: This type of settlement is suitable when the estate's total value falls under certain thresholds specified by Arizona law. Summary administration simplifies the settlement process, making it quicker and more cost-effective. 2. Formal Administration: In cases where the estate's value exceeds the thresholds set for summary administration, a formal administration order may be required. This process involves more comprehensive court supervision and is often necessary for complex or contested estates. 3. Small Estate Affidavit: If the estate's total value is minimal, Arizona law provides an alternative option called a Small Estate Affidavit. This affidavit allows for a simplified settlement process without the need for court-supervised proceedings, often leading to a quicker resolution. In summary, Maricopa Arizona Order of Complete Settlement of Estate by Personal Representative is the legal procedure through which a deceased person's estate is settled. It involves various steps, including the inventory of assets, creditor notifications, debt payment, tax filings, and beneficiary distribution. Different types of settlement may include Summary Administration, Formal Administration, or Small Estate Affidavit, depending on the estate's value and complexity.