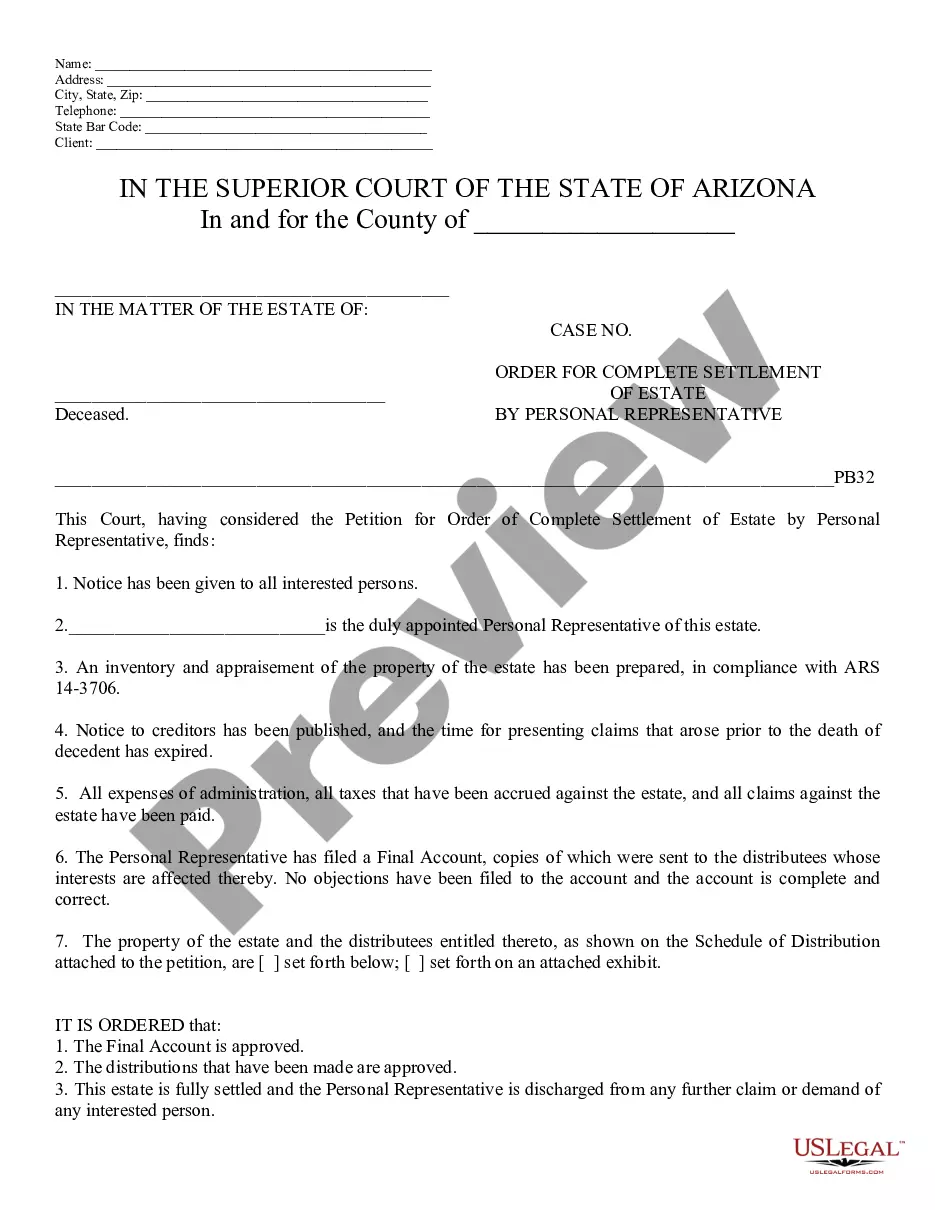

An Order is an official written statement from the court commanding a certain action, and is signed by the judge. Failure to comply with the order is unlawful and may result in contempt of court charges. This document, a sample Order of Complete Settlement of Estate by Personal Representative - Arizona, can be used as a model to draft an order requested for submission by the court (the court often directs a party to draft an order). Adapt the language to the facts and circumstances of your case. Available for download now in standard format(s).

In Phoenix, Arizona, the Order of Complete Settlement of Estate by Personal Representative refers to a legal document issued by a court to formally conclude the administration of the estate of a deceased person. This order is typically obtained by the personal representative (also known as the executor or administrator) who has been appointed by the court to oversee the estate's distribution and settlement. The Order of Complete Settlement of Estate is a crucial step in the probate process as it signifies that all necessary tasks and obligations have been fulfilled, allowing for the final distribution of assets to the beneficiaries. It serves as a confirmation that the personal representative has successfully administered the estate in accordance with the law and the deceased's wishes. To obtain this order, the personal representative is required to complete various tasks, including but not limited to: 1. Inventory and Appraisal: The personal representative must compile a comprehensive list of all assets belonging to the deceased, from real estate properties to bank accounts, investments, personal belongings, and any other items of value. These assets are then appraised to determine their fair market value. 2. Payment of Debts: The personal representative is responsible for settling any outstanding debts or obligations owed by the deceased. This includes paying off creditors, resolving outstanding taxes, and clearing any other liabilities. 3. Distribution of Assets: Following the payment of debts, the personal representative is tasked with distributing the remaining assets to the beneficiaries named in the decedent's will or determined by intestate succession laws if no will exists. The distribution must adhere to the instructions provided by the court, the law, and the deceased's final wishes. 4. Accounting: The personal representative is required to maintain accurate and detailed records of all financial transactions related to the estate. This includes income, expenses, disbursements, and any other financial activities. These records are essential to support the final accounting of the estate and ensure transparency during the settlement process. There are no specific types of Order of Complete Settlement of Estate by Personal Representative in Phoenix, Arizona. However, there may be variations depending on the complexity of the estate or unique circumstances of it. The basic requirements remain the same, but additional documentation or court hearings may be necessary in certain cases. In conclusion, the Order of Complete Settlement of Estate by Personal Representative in Phoenix, Arizona, encapsulates the final stage of the probate process. It represents the successful resolution of an estate, allowing for the distribution of assets to beneficiaries in accordance with the decedent's wishes.In Phoenix, Arizona, the Order of Complete Settlement of Estate by Personal Representative refers to a legal document issued by a court to formally conclude the administration of the estate of a deceased person. This order is typically obtained by the personal representative (also known as the executor or administrator) who has been appointed by the court to oversee the estate's distribution and settlement. The Order of Complete Settlement of Estate is a crucial step in the probate process as it signifies that all necessary tasks and obligations have been fulfilled, allowing for the final distribution of assets to the beneficiaries. It serves as a confirmation that the personal representative has successfully administered the estate in accordance with the law and the deceased's wishes. To obtain this order, the personal representative is required to complete various tasks, including but not limited to: 1. Inventory and Appraisal: The personal representative must compile a comprehensive list of all assets belonging to the deceased, from real estate properties to bank accounts, investments, personal belongings, and any other items of value. These assets are then appraised to determine their fair market value. 2. Payment of Debts: The personal representative is responsible for settling any outstanding debts or obligations owed by the deceased. This includes paying off creditors, resolving outstanding taxes, and clearing any other liabilities. 3. Distribution of Assets: Following the payment of debts, the personal representative is tasked with distributing the remaining assets to the beneficiaries named in the decedent's will or determined by intestate succession laws if no will exists. The distribution must adhere to the instructions provided by the court, the law, and the deceased's final wishes. 4. Accounting: The personal representative is required to maintain accurate and detailed records of all financial transactions related to the estate. This includes income, expenses, disbursements, and any other financial activities. These records are essential to support the final accounting of the estate and ensure transparency during the settlement process. There are no specific types of Order of Complete Settlement of Estate by Personal Representative in Phoenix, Arizona. However, there may be variations depending on the complexity of the estate or unique circumstances of it. The basic requirements remain the same, but additional documentation or court hearings may be necessary in certain cases. In conclusion, the Order of Complete Settlement of Estate by Personal Representative in Phoenix, Arizona, encapsulates the final stage of the probate process. It represents the successful resolution of an estate, allowing for the distribution of assets to beneficiaries in accordance with the decedent's wishes.