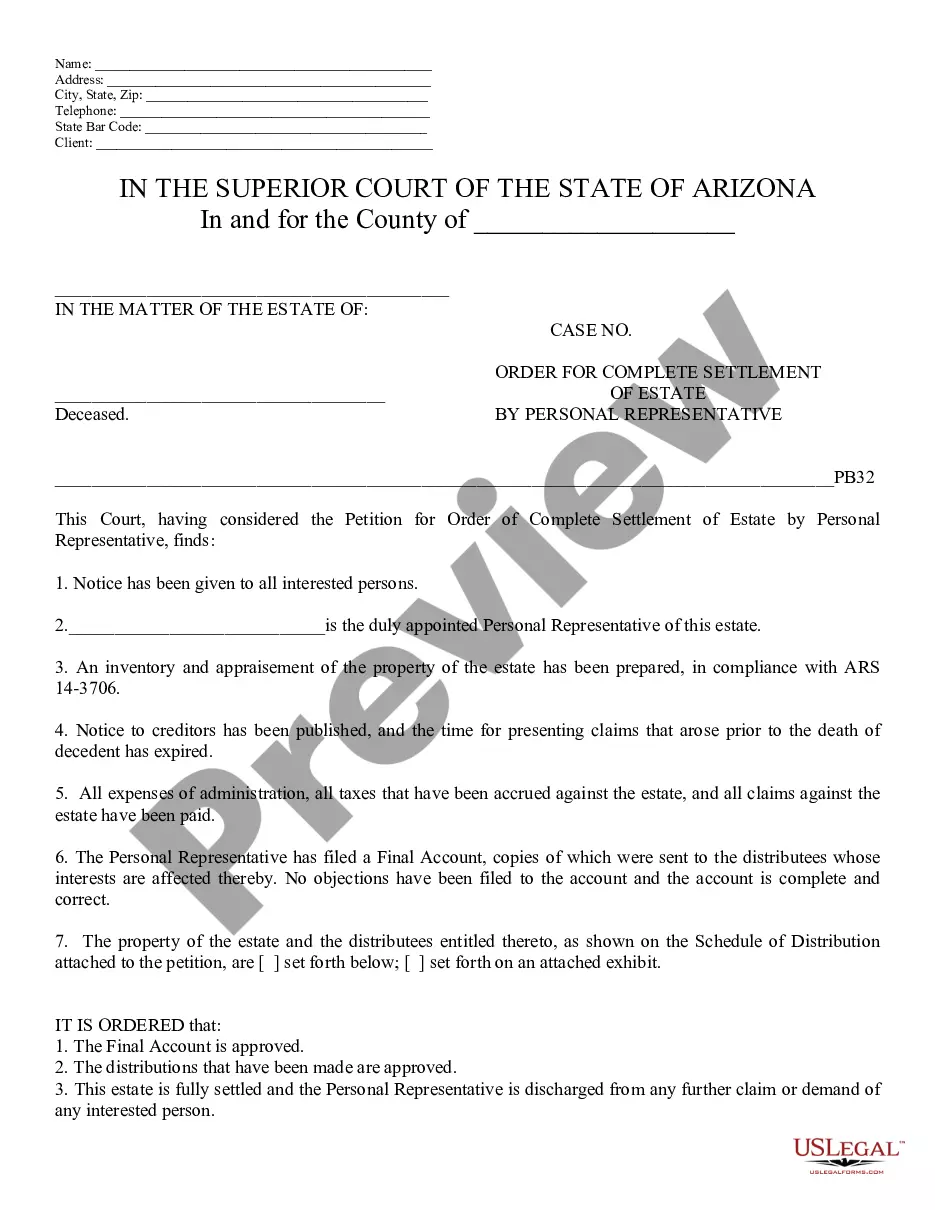

An Order is an official written statement from the court commanding a certain action, and is signed by the judge. Failure to comply with the order is unlawful and may result in contempt of court charges. This document, a sample Order of Complete Settlement of Estate by Personal Representative - Arizona, can be used as a model to draft an order requested for submission by the court (the court often directs a party to draft an order). Adapt the language to the facts and circumstances of your case. Available for download now in standard format(s).

The Scottsdale Arizona Order of Complete Settlement of Estate by Personal Representative is a legal document that outlines the process and requirements for the final settlement of a deceased person's estate in Scottsdale, Arizona. This order is typically issued by the probate court and serves as confirmation that all necessary steps for the administration and distribution of the estate have been completed. To initiate the order, the personal representative, also known as the executor or administrator, must file a petition with the probate court. The petition should include details about the deceased person's assets, liabilities, and beneficiaries. The court will then review the petition and ensure that all legal requirements have been satisfied before granting the order of complete settlement. The order of complete settlement of estate by a personal representative is crucial in Scottsdale, Arizona, as it provides a final authorization for the distribution of assets to the rightful beneficiaries. This legal document helps protect the rights and interests of both the deceased person's estate and the heirs. Key aspects involved in the order of complete settlement may include: 1. Inventory and Appraisal: The personal representative is responsible for creating a comprehensive inventory of all the deceased person's assets, including bank accounts, real estate, stocks, and personal belongings. An appraisal of the assets may also be required in order to determine their value accurately. 2. Notification of Creditors: It is essential for the personal representative to notify any known creditors of the deceased person's estate. This provides an opportunity for them to submit their claims and receive payment from the estate, if applicable. In Scottsdale, Arizona, specific timelines and processes must be followed for creditor notifications. 3. Payment of Debts and Taxes: Before the estate can be settled, the personal representative must ensure that all outstanding debts, including funeral expenses, taxes, and outstanding bills, are paid by using the estate's funds. This step is crucial to prevent any future legal complications or claims against the estate. 4. Distribution of Assets: Once all the debts and taxes have been settled, the personal representative can proceed with the distribution of the deceased person's assets according to their wishes as stated in their will. If there is no will, the assets will be distributed according to Arizona state laws on intestate succession. Different types of Scottsdale Arizona Orders of Complete Settlement of Estate by Personal Representative may include: 1. Small Estate Affidavit: If the total value of the deceased person's estate falls below a certain threshold, typically $75,000 in Arizona, the personal representative may file a small estate affidavit instead of going through the formal probate process. This allows for a simplified and expedited settlement of the estate. 2. Summary Administration: In certain cases, when the deceased person has been deceased for at least two years or the assets are relatively small, the personal representative may petition the court for a summary administration. This streamlined procedure enables a faster settlement of the estate without the need for full probate. In summary, the Scottsdale Arizona Order of Complete Settlement of Estate by Personal Representative is a legal document that formalizes the final steps in administering a deceased person's estate. It ensures that all proper procedures have been followed, debts are paid, and assets are distributed to the beneficiaries. Different types of settlement orders may exist, depending on the size and complexity of the estate. It is advisable to seek professional legal counsel to navigate the process effectively.The Scottsdale Arizona Order of Complete Settlement of Estate by Personal Representative is a legal document that outlines the process and requirements for the final settlement of a deceased person's estate in Scottsdale, Arizona. This order is typically issued by the probate court and serves as confirmation that all necessary steps for the administration and distribution of the estate have been completed. To initiate the order, the personal representative, also known as the executor or administrator, must file a petition with the probate court. The petition should include details about the deceased person's assets, liabilities, and beneficiaries. The court will then review the petition and ensure that all legal requirements have been satisfied before granting the order of complete settlement. The order of complete settlement of estate by a personal representative is crucial in Scottsdale, Arizona, as it provides a final authorization for the distribution of assets to the rightful beneficiaries. This legal document helps protect the rights and interests of both the deceased person's estate and the heirs. Key aspects involved in the order of complete settlement may include: 1. Inventory and Appraisal: The personal representative is responsible for creating a comprehensive inventory of all the deceased person's assets, including bank accounts, real estate, stocks, and personal belongings. An appraisal of the assets may also be required in order to determine their value accurately. 2. Notification of Creditors: It is essential for the personal representative to notify any known creditors of the deceased person's estate. This provides an opportunity for them to submit their claims and receive payment from the estate, if applicable. In Scottsdale, Arizona, specific timelines and processes must be followed for creditor notifications. 3. Payment of Debts and Taxes: Before the estate can be settled, the personal representative must ensure that all outstanding debts, including funeral expenses, taxes, and outstanding bills, are paid by using the estate's funds. This step is crucial to prevent any future legal complications or claims against the estate. 4. Distribution of Assets: Once all the debts and taxes have been settled, the personal representative can proceed with the distribution of the deceased person's assets according to their wishes as stated in their will. If there is no will, the assets will be distributed according to Arizona state laws on intestate succession. Different types of Scottsdale Arizona Orders of Complete Settlement of Estate by Personal Representative may include: 1. Small Estate Affidavit: If the total value of the deceased person's estate falls below a certain threshold, typically $75,000 in Arizona, the personal representative may file a small estate affidavit instead of going through the formal probate process. This allows for a simplified and expedited settlement of the estate. 2. Summary Administration: In certain cases, when the deceased person has been deceased for at least two years or the assets are relatively small, the personal representative may petition the court for a summary administration. This streamlined procedure enables a faster settlement of the estate without the need for full probate. In summary, the Scottsdale Arizona Order of Complete Settlement of Estate by Personal Representative is a legal document that formalizes the final steps in administering a deceased person's estate. It ensures that all proper procedures have been followed, debts are paid, and assets are distributed to the beneficiaries. Different types of settlement orders may exist, depending on the size and complexity of the estate. It is advisable to seek professional legal counsel to navigate the process effectively.