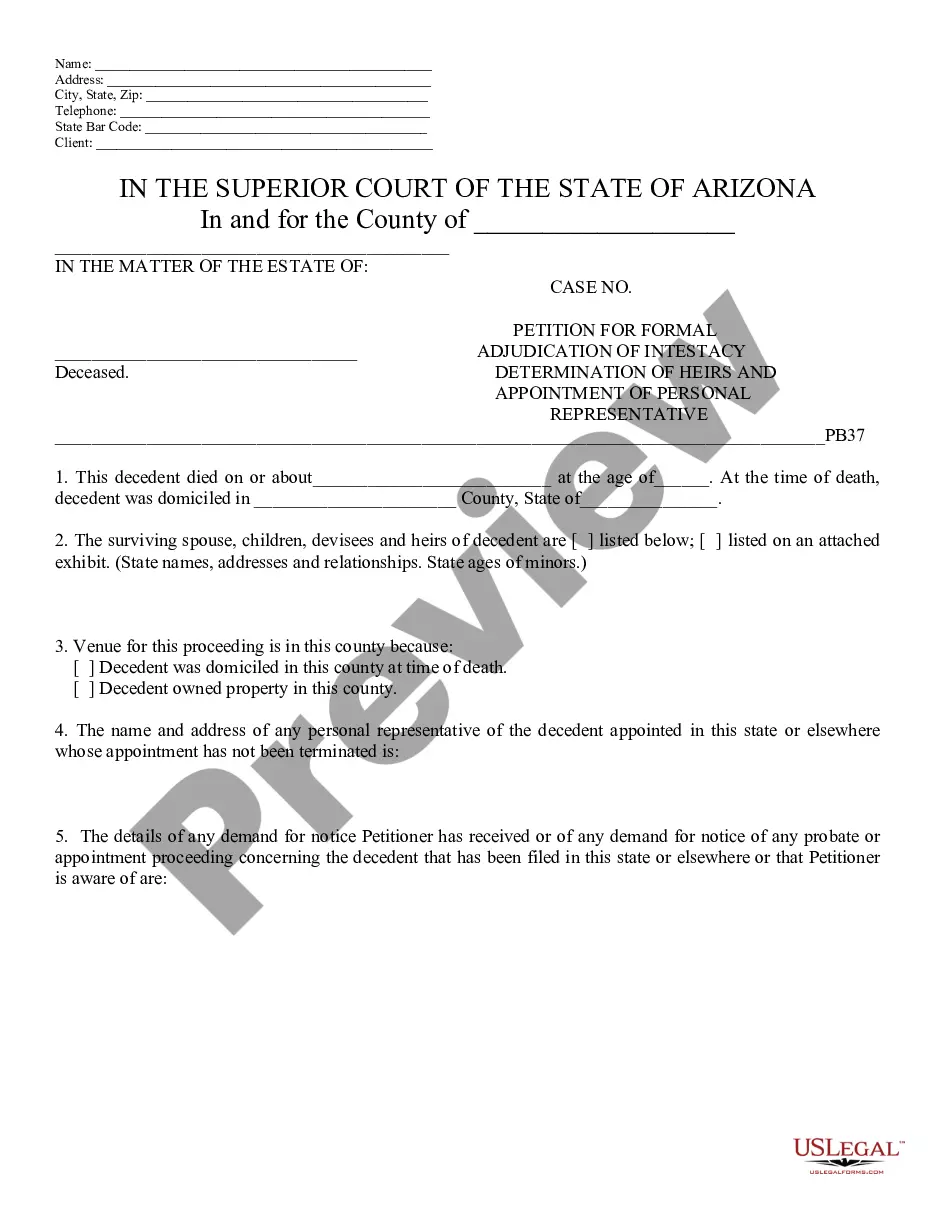

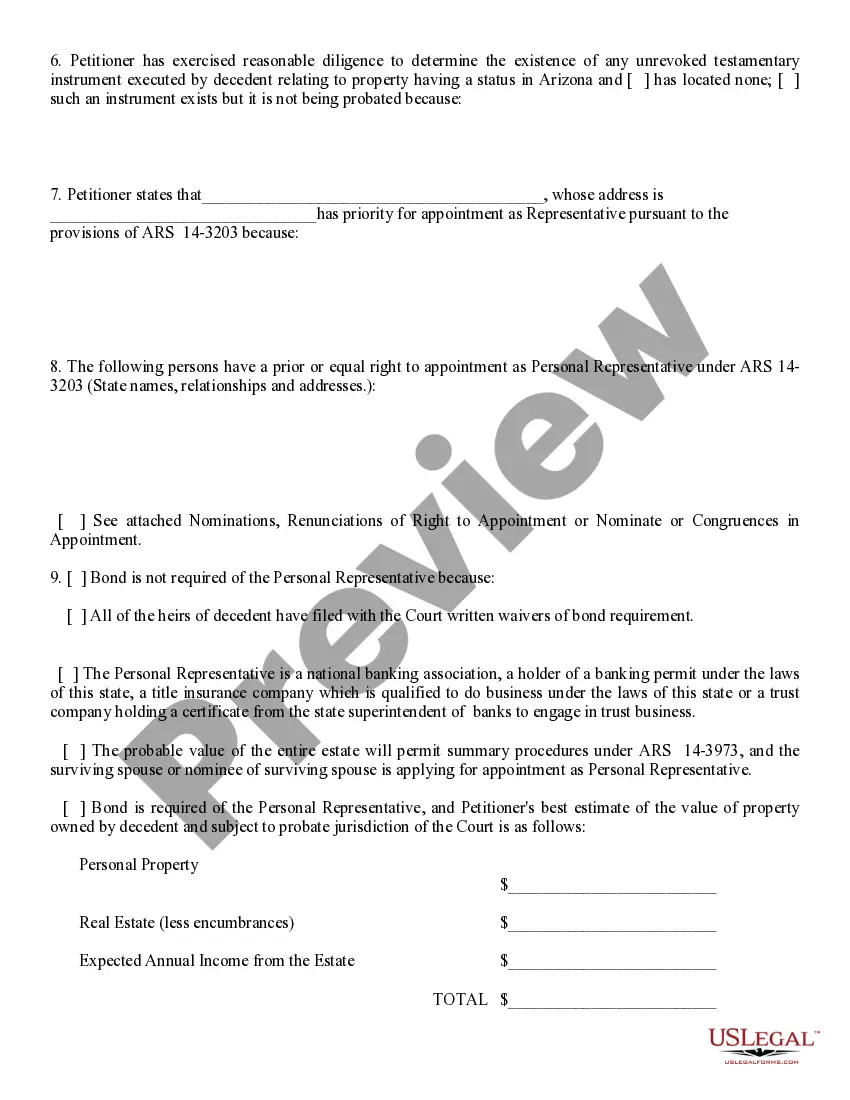

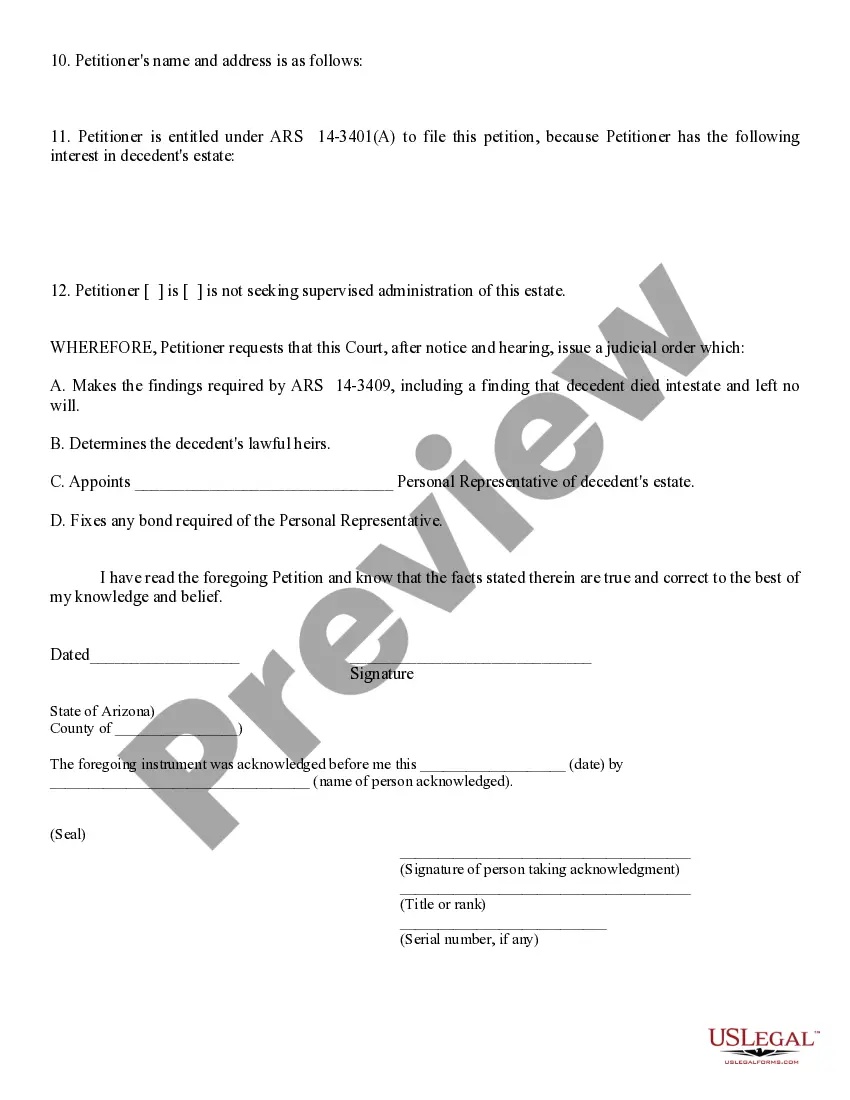

This model form, a Petition for Formal Adjunction of Intestacy Debt of Heirs and; Appt. of Personal Rep. - Arizona, is intended for use to initiate a request to the court to take the stated action. The form can be easily completed by filling in the blanks and/or adapted to fit your specific facts and circumstances. Available in for download now, in standard format(s).

The Lima Arizona Petition for Formal Ad junction of Intestacy Debt of Heirs and Appointment of Personal Representative is a legal document that pertains to the resolution of intestate debts and the appointment of a representative to manage the estate in Lima, Arizona. This petition is typically used in cases where a person passes away without leaving a valid will, resulting in intestacy. The petition seeks to address any outstanding debts owed by the deceased and nominate a personal representative to oversee the distribution of assets and settle financial obligations. In cases where there are different types of Lima Arizona Petitions for Formal Ad junction of Intestacy Debt of Heirs and Appointment of Personal Representative, they may be classified based on specific circumstances. These may include: 1. Standard Petition for Formal Ad junction of Intestacy Debt: This type of petition is commonly used when there are no complex issues or disputes surrounding the deceased's estate. It aims to settle outstanding debts and appoint a representative to handle the distribution process smoothly. 2. Petition for Formal Ad junction of Intestacy Debt Involving Multiple Heirs: When multiple heirs are involved, such as siblings, children, or extended family members, this type of petition addresses the division of assets and debts among them. It ensures fair distribution and appoints a representative capable of handling the complexities of multiple claims. 3. Petition for Formal Ad junction of Intestacy Debt with Contested Heirs: In situations where there are disputes or controversies regarding the rightful heirs, this petition is filed to mediate the conflicting claims and resolve the intestate debts accordingly. The court may appoint a personal representative to carry out this process and make impartial decisions. Overall, the Lima Arizona Petition for Formal Ad junction of Intestacy Debt of Heirs and Appointment of Personal Representative is an essential legal tool used to manage the affairs of deceased individuals who pass away intestate. It helps ensure an orderly distribution of assets, settlement of financial obligations, and appointment of a capable representative to navigate the complex process.