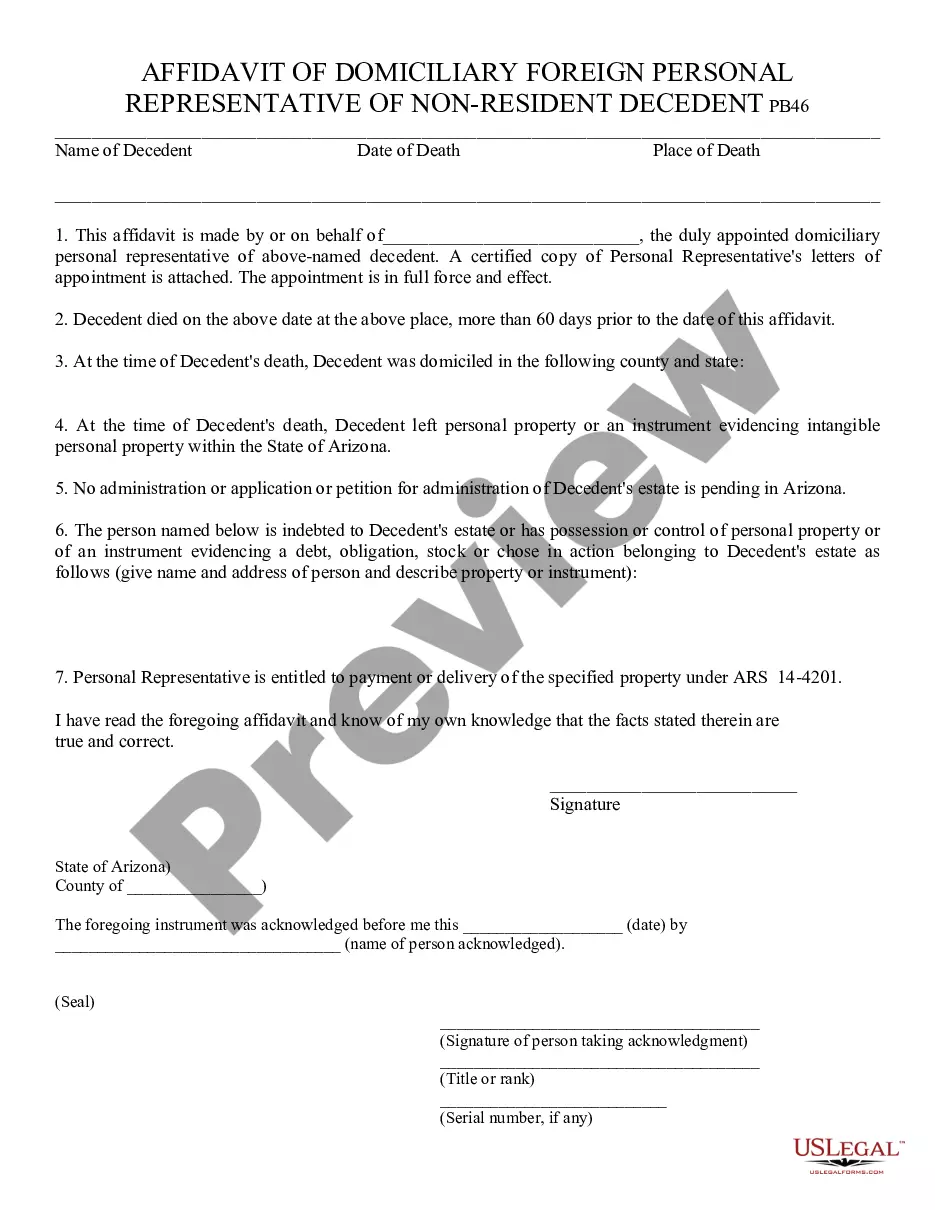

An Affidavit is a sworn, written statement of facts, signed by the 'affiant' (the person making the statement) before a notary public or other official witness. The affiant swears to the truth and accuracy of the statement contained in the affidavit. This document, an Affidavit of Domiciliary Foreign Per. Rep. of Non-Resident Decedent - Arizona , is a model affidavit for recording the type of information stated. It must be signed before a notary, who must sign and stamp the document. Adapt the text to fit your facts. Available for download now in standard format(s).

The Chandler Arizona Affidavit of Domiciliary Foreign Personal Representative of Nonresident Decedent is a legal document that plays a crucial role in estate administration. It is specifically designed to handle the affairs of nonresident decedents who held assets in Chandler, Arizona. This affidavit enables the appointed personal representative to carry out necessary tasks, such as distributing assets, settling debts, and fulfilling legal responsibilities on behalf of the deceased individual. Keywords: Chandler Arizona, affidavit, domiciliary, foreign personal representative, nonresident decedent, estate administration, assets, debts, legal responsibilities. Different types of Chandler Arizona Affidavit of Domiciliary Foreign Personal Representative of Nonresident Decedent may include: 1. General Affidavit of Domiciliary Foreign Personal Representative: This is the standard form used when a nonresident decedent owned assets in Chandler, Arizona. It allows the appointed personal representative to fulfill their duties and responsibilities in accordance with Arizona state laws. 2. Real Estate Affidavit of Domiciliary Foreign Personal Representative: This specific type of affidavit is used when the nonresident decedent owned real estate properties within Chandler, Arizona. It helps the personal representative handle the transfer or sale of these properties, ensuring compliance with local regulations. 3. Financial Assets Affidavit of Domiciliary Foreign Personal Representative: When the nonresident decedent had financial assets, such as bank accounts or investment portfolios, in Chandler, Arizona, this affidavit allows the personal representative to access and manage these assets. It helps them distribute the funds according to the decedent's wishes or legal requirements. 4. Business Assets Affidavit of Domiciliary Foreign Personal Representative: If the nonresident decedent owned a business or had business interests in Chandler, Arizona, this affidavit becomes essential. It empowers the personal representative to oversee the management, sale, or transfer of the business, ensuring its continuity or closure as required. 5. Inheritance Tax Affidavit of Domiciliary Foreign Personal Representative: In certain cases, an affidavit is needed to address any inheritance tax obligations associated with the nonresident decedent's assets in Chandler, Arizona. This document guides the personal representative in calculating and paying the required taxes to the relevant authorities. Overall, the Chandler Arizona Affidavit of Domiciliary Foreign Personal Representative of Nonresident Decedent is a critical tool for handling the affairs of nonresident decedents with assets in Chandler. It promotes a systematic and legally compliant approach to managing and distributing these assets, ensuring transparency and fairness throughout the estate administration process.The Chandler Arizona Affidavit of Domiciliary Foreign Personal Representative of Nonresident Decedent is a legal document that plays a crucial role in estate administration. It is specifically designed to handle the affairs of nonresident decedents who held assets in Chandler, Arizona. This affidavit enables the appointed personal representative to carry out necessary tasks, such as distributing assets, settling debts, and fulfilling legal responsibilities on behalf of the deceased individual. Keywords: Chandler Arizona, affidavit, domiciliary, foreign personal representative, nonresident decedent, estate administration, assets, debts, legal responsibilities. Different types of Chandler Arizona Affidavit of Domiciliary Foreign Personal Representative of Nonresident Decedent may include: 1. General Affidavit of Domiciliary Foreign Personal Representative: This is the standard form used when a nonresident decedent owned assets in Chandler, Arizona. It allows the appointed personal representative to fulfill their duties and responsibilities in accordance with Arizona state laws. 2. Real Estate Affidavit of Domiciliary Foreign Personal Representative: This specific type of affidavit is used when the nonresident decedent owned real estate properties within Chandler, Arizona. It helps the personal representative handle the transfer or sale of these properties, ensuring compliance with local regulations. 3. Financial Assets Affidavit of Domiciliary Foreign Personal Representative: When the nonresident decedent had financial assets, such as bank accounts or investment portfolios, in Chandler, Arizona, this affidavit allows the personal representative to access and manage these assets. It helps them distribute the funds according to the decedent's wishes or legal requirements. 4. Business Assets Affidavit of Domiciliary Foreign Personal Representative: If the nonresident decedent owned a business or had business interests in Chandler, Arizona, this affidavit becomes essential. It empowers the personal representative to oversee the management, sale, or transfer of the business, ensuring its continuity or closure as required. 5. Inheritance Tax Affidavit of Domiciliary Foreign Personal Representative: In certain cases, an affidavit is needed to address any inheritance tax obligations associated with the nonresident decedent's assets in Chandler, Arizona. This document guides the personal representative in calculating and paying the required taxes to the relevant authorities. Overall, the Chandler Arizona Affidavit of Domiciliary Foreign Personal Representative of Nonresident Decedent is a critical tool for handling the affairs of nonresident decedents with assets in Chandler. It promotes a systematic and legally compliant approach to managing and distributing these assets, ensuring transparency and fairness throughout the estate administration process.