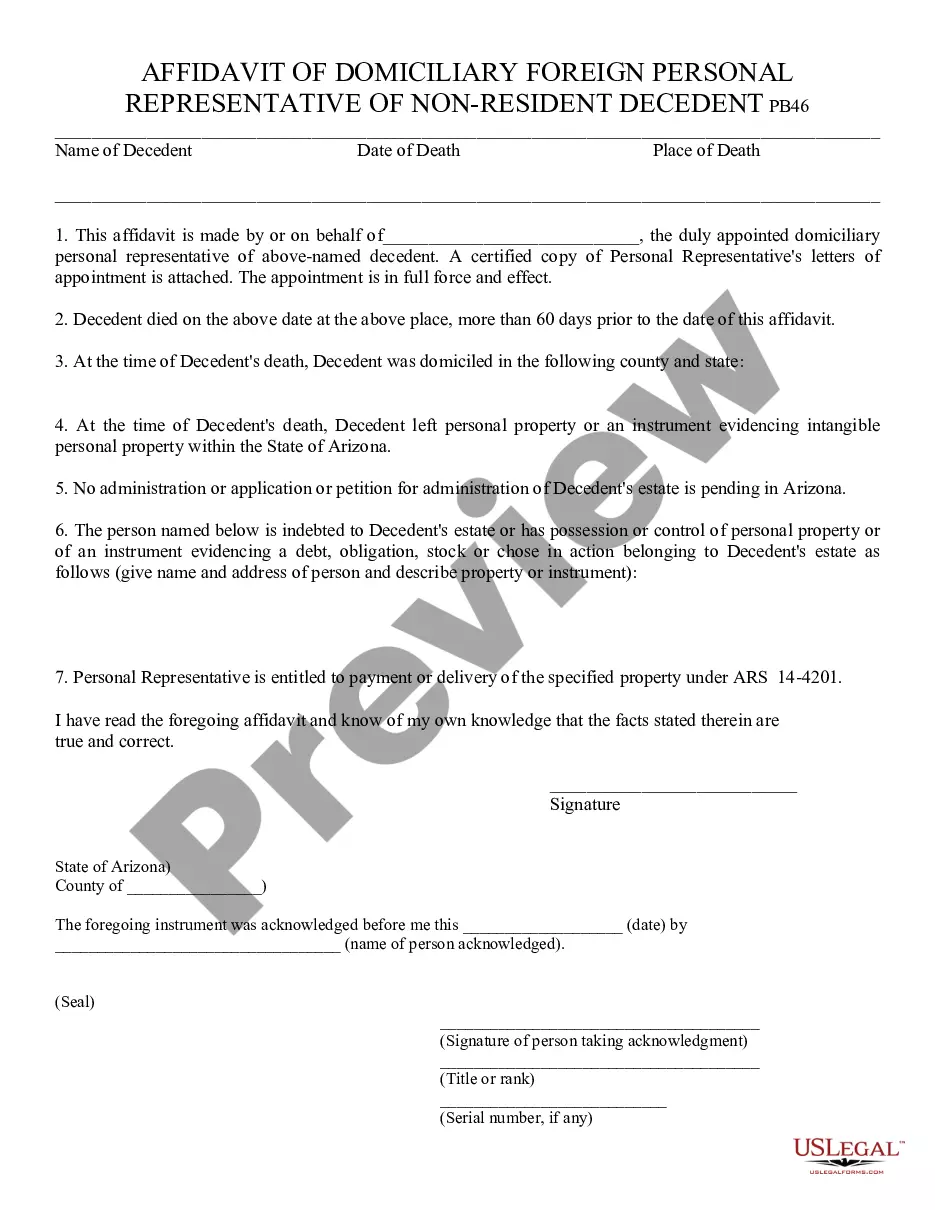

An Affidavit is a sworn, written statement of facts, signed by the 'affiant' (the person making the statement) before a notary public or other official witness. The affiant swears to the truth and accuracy of the statement contained in the affidavit. This document, an Affidavit of Domiciliary Foreign Per. Rep. of Non-Resident Decedent - Arizona , is a model affidavit for recording the type of information stated. It must be signed before a notary, who must sign and stamp the document. Adapt the text to fit your facts. Available for download now in standard format(s).

Phoenix Arizona Affidavit of Domiciliary Foreign Personal Representative of Nonresident Decedent

Description

How to fill out Arizona Affidavit Of Domiciliary Foreign Personal Representative Of Nonresident Decedent?

We consistently strive to lessen or evade legal repercussions when navigating intricate legal or financial matters.

To achieve this, we seek legal solutions that are generally very expensive.

Nevertheless, not all legal challenges are of the same level of complexity.

Most of these can be managed by ourselves.

Utilize US Legal Forms whenever you need to locate and download the Phoenix Arizona Affidavit of Domiciliary Foreign Personal Representative of Nonresident Decedent or any other document quickly and securely. Just Log In to your account and click the Get button next to it. If you lose the form, you can always redownload it from the My documents section.

- US Legal Forms is a digital repository of current DIY legal documents ranging from wills and powers of attorney to articles of incorporation and dissolution petitions.

- Our platform empowers you to manage your affairs independently without the need for legal representatives.

- We offer access to legal document templates that aren’t always readily accessible.

- Our templates are specific to states and regions, which greatly streamlines the search process.

Form popularity

FAQ

The Arizona beneficiary deed form allows property to be automatically transferred to a new owner when the current owner dies, without the need to go through probate. It also gives the current owner retained control over the property, including the right to change his or her mind about the transfer.

There is no time limit in applying for Probate. Unlike some legal processes, such as applying for compensation, your application will not be disqualified because it is late.

The Decedent's Creditors May Take Action Creditors have two years to file a valid claim against a decedent's estate if probate hasn't been opened. If the estate's beneficiaries and heirs fail to take action, the decedent's creditors can file a petition to start the estate settlement proceedings.

How Long Do You Have to File Probate After Death in Arizona? According to Arizona law (ARS14-3108), the executor of an estate has two years from the date of death to file probate. This timeframe can be extended under certain circumstances, such as if the deceased left behind minor children.

Cost Of The Small Estate Affidavit Procedure The clerks filing fee for this procedure is usually about $350. That is generally the only court expense.

According to Arizona Code 14-3108, probate must be filed within two years of the person's death. There are a few exceptions to this deadline, including timelines for contesting a will or when a previous proceeding has been dismissed.

In the state of Arizona, probate is only required if the decedent has any assets that did not transfer automatically upon their death. These assets tend to be titled individually in the decedent's name and will require a probate court to transfer the title of ownership to the intended beneficiary.

Assuming probate is necessary, there can be a number of consequences for not petitioning to open probate: Individually-titled assets will remain frozen in the decedent's name. The estate's assets are subject to losses. Another interested party may petition to open probate.

Arizona statutes offer an alternative to avoiding probate by using an Affidavit of Succession to Real Property in cases in which the real property value does not exceed a certain value. The estate value must be less than $100,000 minus all the liens and any other encumbrances when the decedent passed away.

Whether you have been named the executor or you're petitioning to be the administrator, the path to becoming a personal representative is the same?you'll need to submit a petition with the county court. A hearing will be scheduled to validate the will (if the decedent has one) and appoint the personal representative.