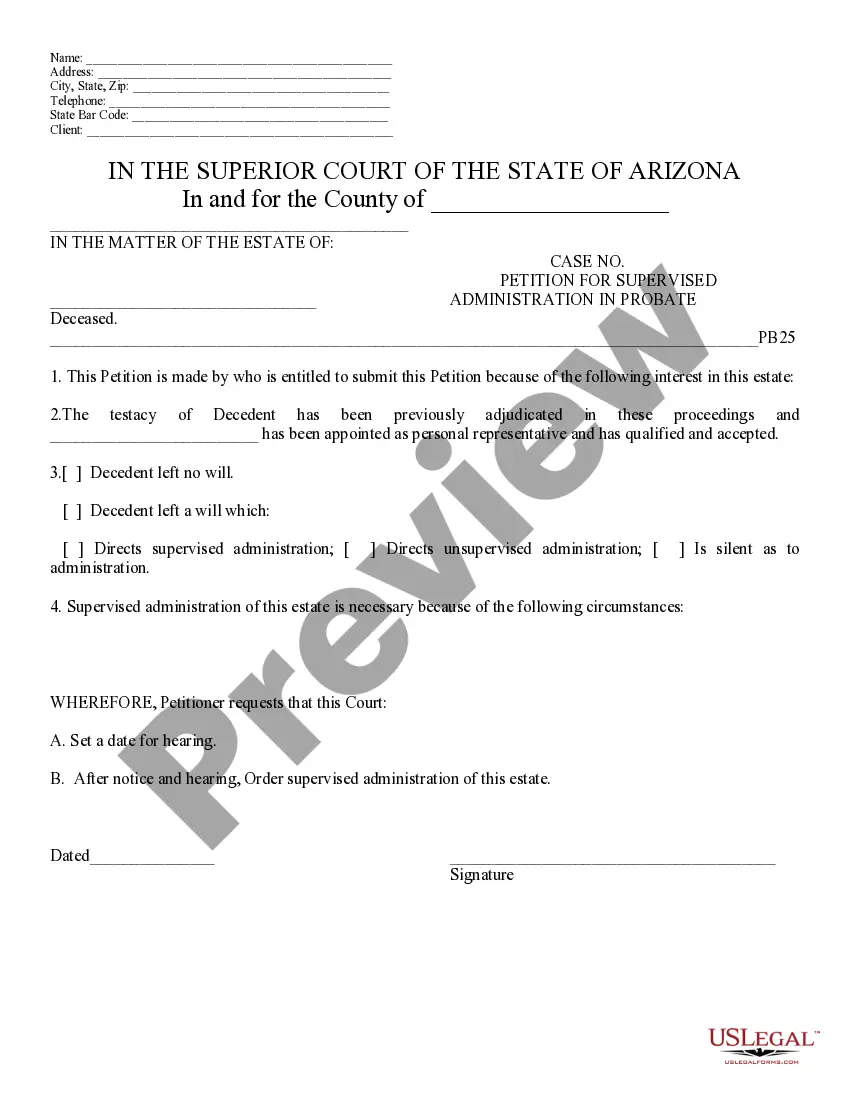

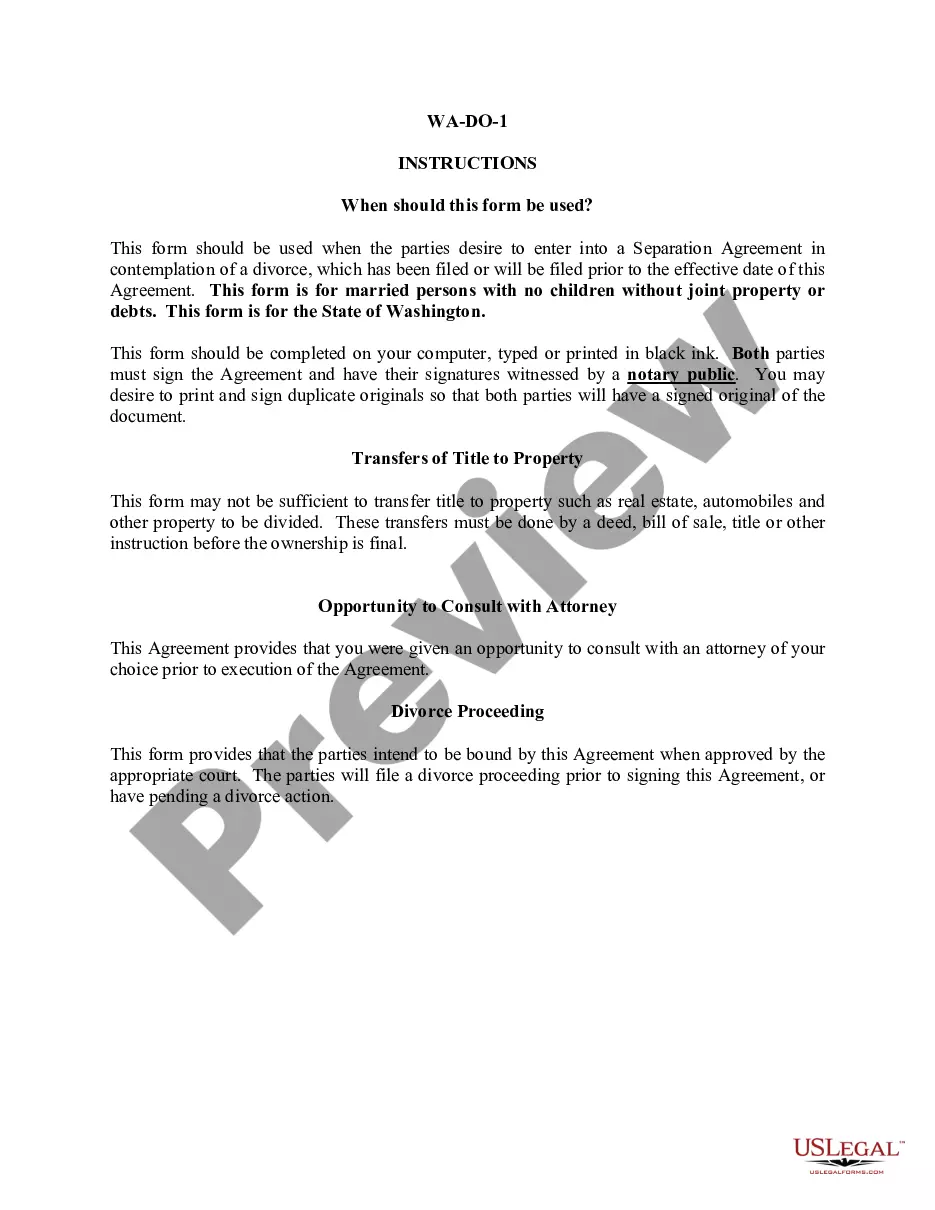

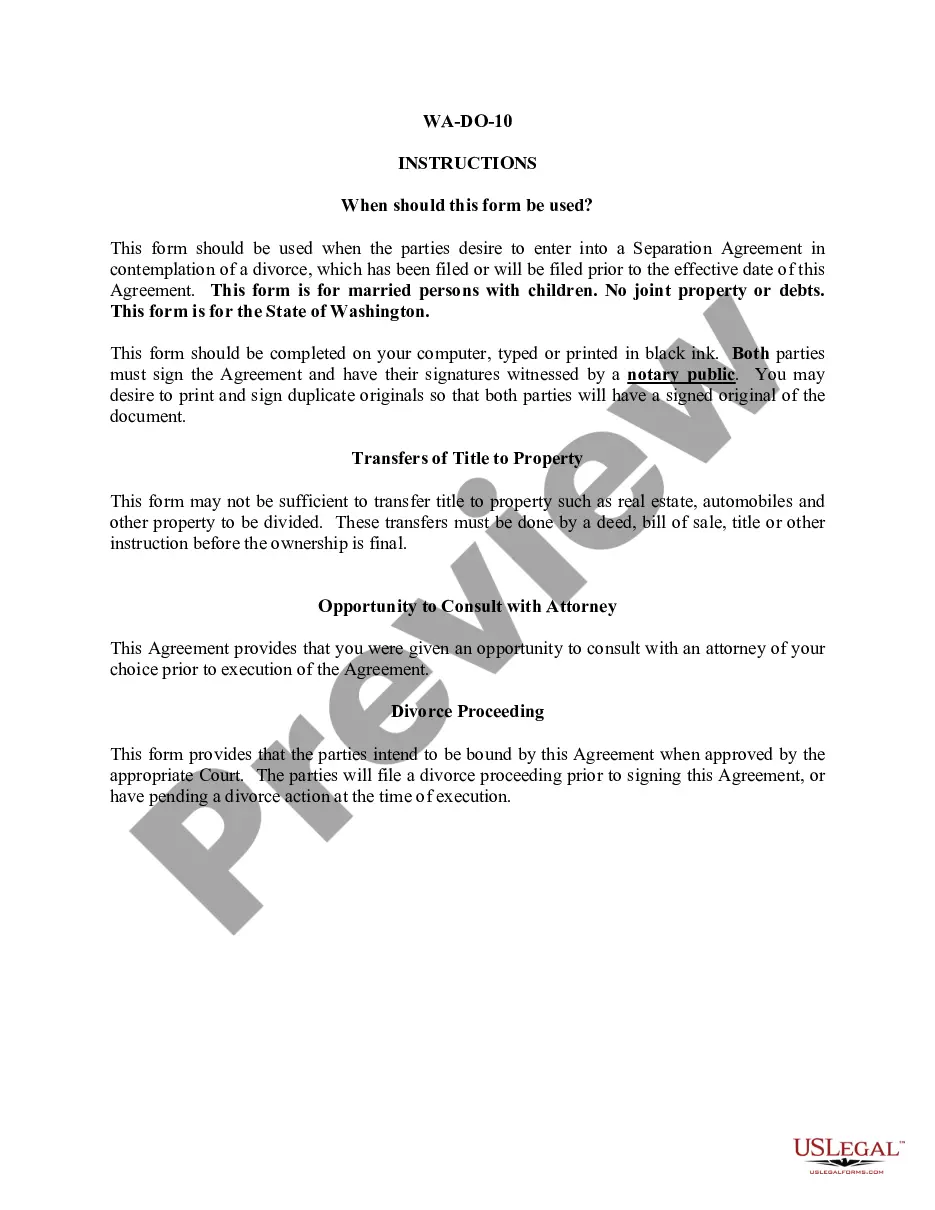

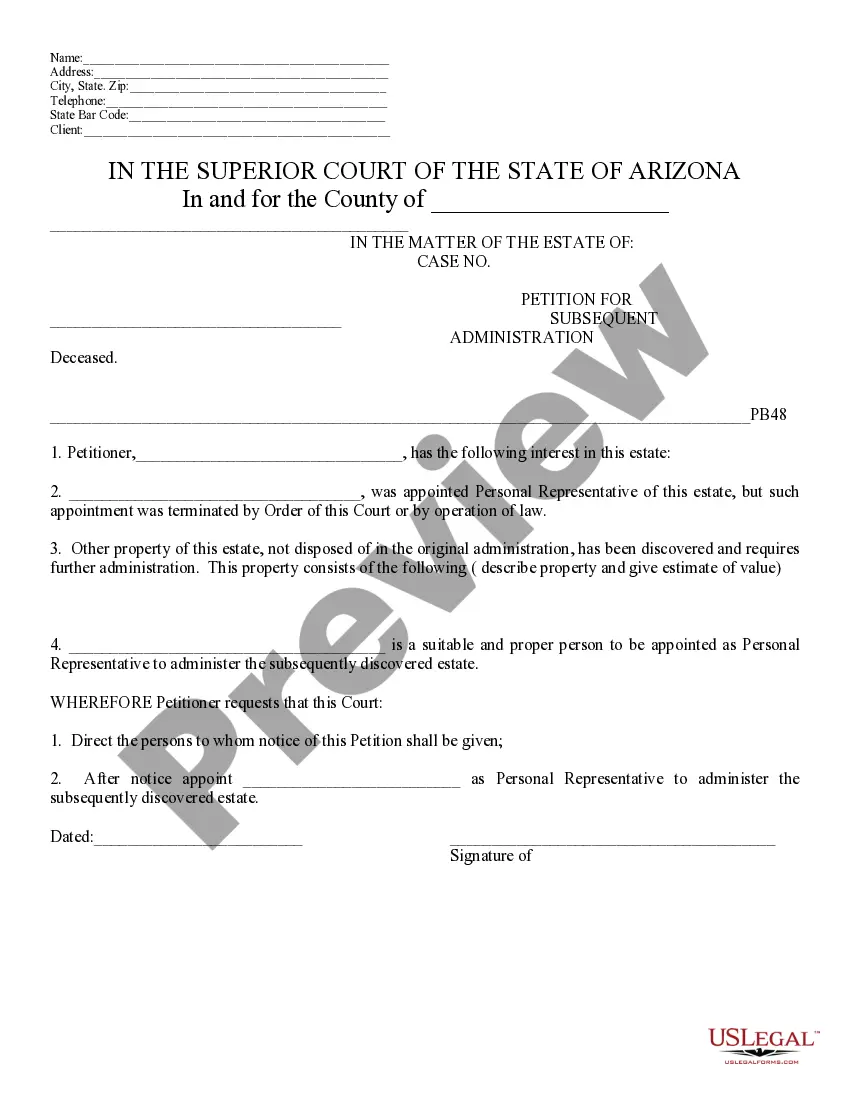

This model form, a Petition for Subsequent Administration - Arizona, is intended for use to initiate a request to the court to take the stated action. The form can be easily completed by filling in the blanks and/or adapted to fit your specific facts and circumstances. Available in for download now, in standard format(s).

Phoenix Arizona Petition for Subsequent Administration

Description

How to fill out Arizona Petition For Subsequent Administration?

If you are looking for a legitimate form template, it’s challenging to find a superior platform than the US Legal Forms site – likely the most extensive libraries available online.

Here you can locate a vast array of document samples for organizational and personal purposes categorized by types and states, or by keywords.

With our enhanced search feature, locating the most current Phoenix Arizona Petition for Subsequent Administration is as simple as 1-2-3.

Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Retrieve the template. Select the format and download it to your device.

- Furthermore, the accuracy of every document is verified by a team of experienced attorneys who consistently review the templates on our platform and refresh them in line with the latest state and county regulations.

- If you are already familiar with our system and possess an account, all you need to obtain the Phoenix Arizona Petition for Subsequent Administration is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, simply adhere to the guidelines below.

- Ensure you have found the sample you need. Review its description and utilize the Preview feature to examine its content. If it doesn’t meet your needs, employ the Search option at the top of the page to find the suitable document.

- Verify your choice. Click the Buy now button. Subsequently, select the desired subscription plan and submit your information to register for an account.

Form popularity

FAQ

Executors' year However, many beneficiaries don't realise that executors and administrators have twelve months before they are obliged to distribute the estate to the beneficiaries. Time runs from the date of death.

How Long Do You Have to File Probate After Death in Arizona? According to Arizona law (ARS14-3108), the executor of an estate has two years from the date of death to file probate. This timeframe can be extended under certain circumstances, such as if the deceased left behind minor children.

How Long Does Probate Take in Arizona. According to Arizona law, probate proceedings must be kept open for at least 4 months to allow any creditors to make their claims. Informal probates typically last between 6-8 months, depending on how quickly the Personal Representative completes their required duties.

Intestate Succession That is unless the decedent excluded or limited the rights of an heir through a will. In the unlikely event that there is no one qualified to claim the estate ? there is no spouse and there are no heirs, then the intestate estate will pass to the State of Arizona.

When is a probate action required in Arizona? Under Arizona law, the general rule is that if the deceased person owned more than $100,000 of equity in real estate, or more than $75,000 of personal property (including physical possessions and money), then a probate action is required to transfer the assets to the heirs.

Assuming probate is necessary, there can be a number of consequences for not petitioning to open probate: Individually-titled assets will remain frozen in the decedent's name. The estate's assets are subject to losses. Another interested party may petition to open probate.

Settling an Estate in Arizona The first step is to file the will and a petition for probate with the county court where the deceased person lived or where they had property if they lived out of state. A personal representative is appointed by the court, which is usually the person named in the will.

When someone dies, their beneficiaries have up to two years to open probate. Once probate is opened, there aren't any time limits that will cause the case to expire.

How to Start Probate for an Estate Open the Decedent's Last Will and Testament.Determine Who Will be the Personal Representative.Compile a List of the Estate's Interested Parties.Take an Inventory of the Decedent's Assets.Calculate the Decedent's Liabilities.Determine if Probate is Necessary.Seek a Waiver of Bond.

In the state of Arizona, probate is only required if the decedent has any assets that did not transfer automatically upon their death. These assets tend to be titled individually in the decedent's name and will require a probate court to transfer the title of ownership to the intended beneficiary.