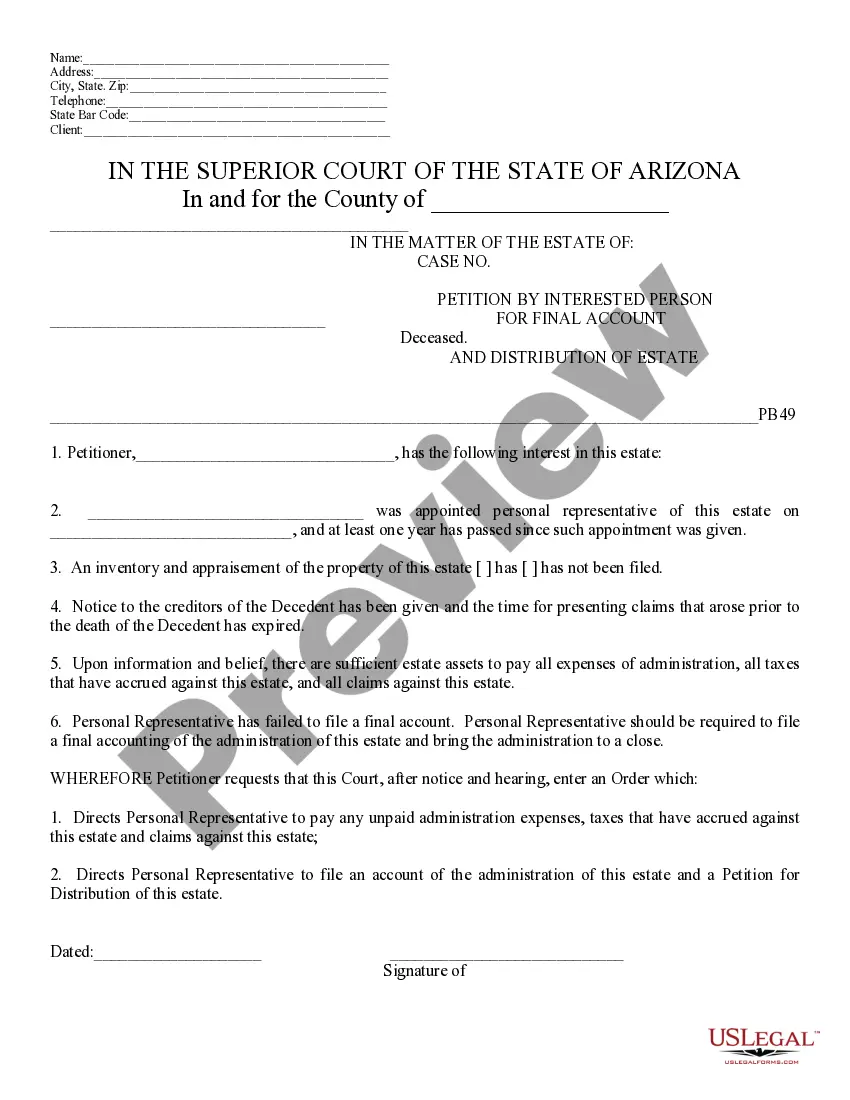

This model form, a Petition by Interested Person for Final Acct. and; Distribution of Estate - Arizona, is intended for use to initiate a request to the court to take the stated action. The form can be easily completed by filling in the blanks and/or adapted to fit your specific facts and circumstances. Available in for download now, in standard format(s).

Title: Tucson Arizona Petition by Interested Person for Final Account and Distribution of Estate Description: A "Tucson Arizona Petition by Interested Person for Final Account and Distribution of Estate" is a legal document filed in Tucson, Arizona, by an interested person involved in an estate administration process. This petition is aimed at seeking the court's approval for the final account and distribution of assets held within an estate. Keywords: Tucson Arizona, Petition, Interested Person, Final Account, Distribution of Estate, Estate Administration, Court Approval Types of Tucson Arizona Petition by Interested Person for Final Account and Distribution of Estate include: 1. Tucson Arizona Petition by Beneficiary for Final Account and Distribution of Estate: When a person is named as a beneficiary in a decedent's will or designated as a recipient of assets from an estate, they can file this petition to request the court's approval for the final account and distribution. The beneficiary may also need to provide supporting documents to validate their entitlement. 2. Tucson Arizona Petition by Executor/Personal Representative for Final Account and Distribution of Estate: If a person is appointed as an executor (also known as a personal representative) of an estate, they can file this petition to seek the court's approval for the final account and distribution of estate assets. The executor should provide a detailed account of all financial transactions, debts paid, and assets distributed during the administration of the estate. 3. Tucson Arizona Petition by Heir for Final Account and Distribution of Estate: In cases where there is no valid will, or if the will did not name any beneficiaries, heirs may file this petition to request the court's approval for the final account and distribution of the estate's assets. The petitioner must establish their status as an heir and may need to provide relevant documentation, such as birth certificates or family tree records. 4. Tucson Arizona Petition by Legatee for Final Account and Distribution of Estate: When a person is entitled to receive specific bequests or legacies outlined in a will, they can file this petition to seek the court's approval for the final account and distribution of the specific assets assigned to them. The legatee should provide documentation that establishes their rights to the specific bequest. 5. Tucson Arizona Petition by Creditor for Final Account and Distribution of Estate: In situations where a creditor has a claim against the estate, they can file this petition to request the court's approval for the final account and distribution of estate assets. The creditor must provide evidence of the debt owed and demonstrate that it is a valid and legitimate claim against the estate. Please note that this is a general description of the different types of Tucson Arizona Petition by Interested Persons for Final Account and Distribution of Estate. It is always advised to consult an attorney or legal professional for specific guidance and assistance in preparing and filing the appropriate petition.