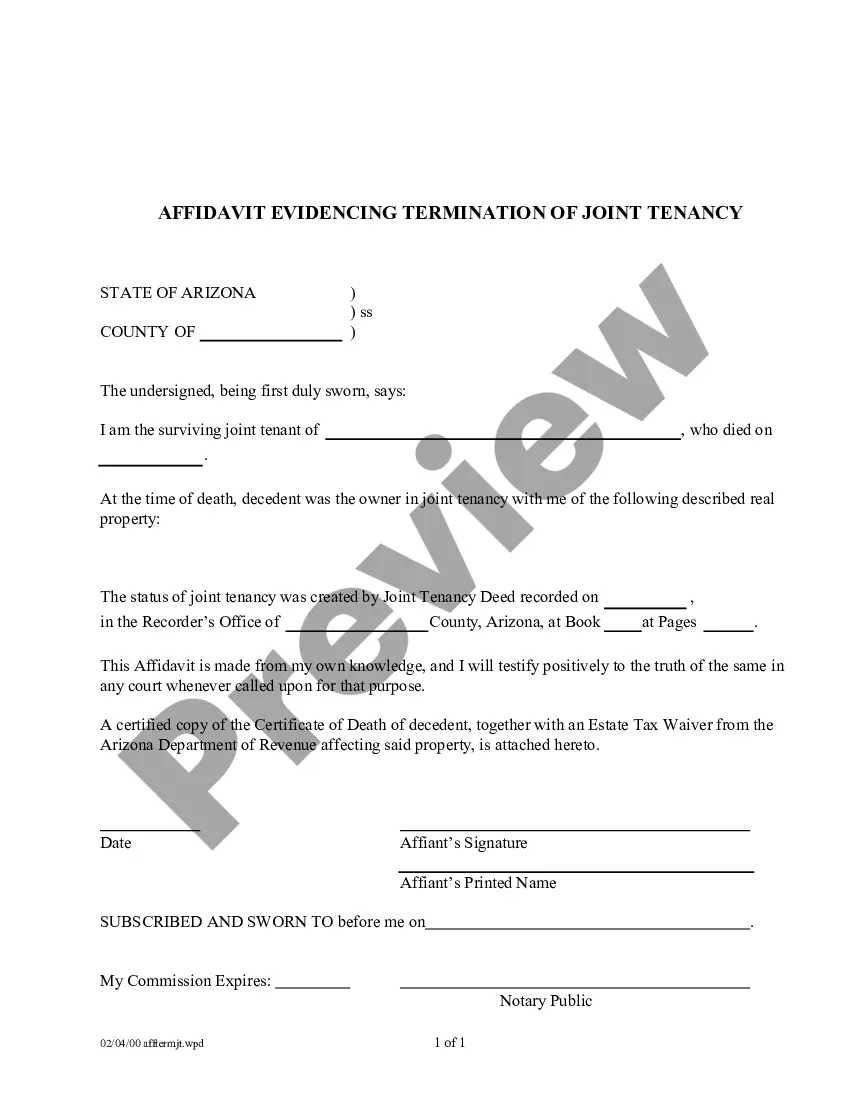

This form is an affidavit evidencing the survivorship of the joint tenant of the decedent and testifying to his/her right to the real property. This is an official form from the Arizona Court System, which complies with all applicable laws and statutes. USLF amends and updates forms as is required by Arizona statutes and law.

Glendale Arizona Transfer of Real Property of a Decedent — Joint Tenancy with Right of Survivorship refers to the legal process by which ownership of a deceased individual's property is transferred to the surviving joint tenant. This type of property ownership arrangement is commonly utilized by individuals who wish to pass their assets directly to a chosen joint tenant upon their death, bypassing the probate process. In Glendale, Arizona, there are two main types of Transfer of Real Property of a Decedent — Joint Tenancy with Right of Survivorship: 1. Regular Joint Tenancy with Right of Survivorship: This type of joint tenancy is established when two or more parties, typically spouses, acquire property with an expressed intention to hold the title as joint tenants. In the event of the death of one joint tenant, the surviving tenant automatically becomes the sole owner of the property, without the need for probate. 2. Enhanced Life Estate Deed (also known as "Lady Bird Deed"): This specialized type of joint tenancy allows the property owner, typically an elderly individual, to retain full control and ownership rights over the property during their lifetime. Upon their death, the enhanced life estate deed ensures that the property is automatically transferred to the named joint tenant(s) without the need for probate. This type of transfer avoids potential Medicaid estate recovery as well. To initiate the Glendale Arizona Transfer of Real Property of a Decedent — Joint Tenancy with Right of Survivorship, certain steps need to be followed. Firstly, the surviving joint tenant must obtain a certified copy of the deceased joint tenant's death certificate. This document serves as proof of the tenant's passing and is required during the property transfer process. Next, the surviving joint tenant must complete the necessary legal forms, such as an Affidavit of Death of Joint Tenant, which states the details surrounding the decedent's passing. Additionally, an Affidavit of Identity and Survivorship, along with a certified copy of the property's deed, may be required to establish the surviving tenant's rightful ownership. To successfully transfer the real property, the aforementioned forms must be filed with the appropriate county recorder's office in Glendale, Arizona. Along with these documents, applicable recording fees must be paid. It is crucial to ensure accurate completion of all paperwork to avoid any potential complications or delays in the property transfer process. Glendale Arizona Transfer of Real Property of a Decedent — Joint Tenancy with Right of Survivorship offers a streamlined approach to property inheritance, allowing for a seamless transfer of ownership upon the death of one joint tenant. This eliminates the need for probate court involvement and simplifies the distribution of assets, providing peace of mind to property owners and their chosen beneficiaries.Glendale Arizona Transfer of Real Property of a Decedent — Joint Tenancy with Right of Survivorship refers to the legal process by which ownership of a deceased individual's property is transferred to the surviving joint tenant. This type of property ownership arrangement is commonly utilized by individuals who wish to pass their assets directly to a chosen joint tenant upon their death, bypassing the probate process. In Glendale, Arizona, there are two main types of Transfer of Real Property of a Decedent — Joint Tenancy with Right of Survivorship: 1. Regular Joint Tenancy with Right of Survivorship: This type of joint tenancy is established when two or more parties, typically spouses, acquire property with an expressed intention to hold the title as joint tenants. In the event of the death of one joint tenant, the surviving tenant automatically becomes the sole owner of the property, without the need for probate. 2. Enhanced Life Estate Deed (also known as "Lady Bird Deed"): This specialized type of joint tenancy allows the property owner, typically an elderly individual, to retain full control and ownership rights over the property during their lifetime. Upon their death, the enhanced life estate deed ensures that the property is automatically transferred to the named joint tenant(s) without the need for probate. This type of transfer avoids potential Medicaid estate recovery as well. To initiate the Glendale Arizona Transfer of Real Property of a Decedent — Joint Tenancy with Right of Survivorship, certain steps need to be followed. Firstly, the surviving joint tenant must obtain a certified copy of the deceased joint tenant's death certificate. This document serves as proof of the tenant's passing and is required during the property transfer process. Next, the surviving joint tenant must complete the necessary legal forms, such as an Affidavit of Death of Joint Tenant, which states the details surrounding the decedent's passing. Additionally, an Affidavit of Identity and Survivorship, along with a certified copy of the property's deed, may be required to establish the surviving tenant's rightful ownership. To successfully transfer the real property, the aforementioned forms must be filed with the appropriate county recorder's office in Glendale, Arizona. Along with these documents, applicable recording fees must be paid. It is crucial to ensure accurate completion of all paperwork to avoid any potential complications or delays in the property transfer process. Glendale Arizona Transfer of Real Property of a Decedent — Joint Tenancy with Right of Survivorship offers a streamlined approach to property inheritance, allowing for a seamless transfer of ownership upon the death of one joint tenant. This eliminates the need for probate court involvement and simplifies the distribution of assets, providing peace of mind to property owners and their chosen beneficiaries.