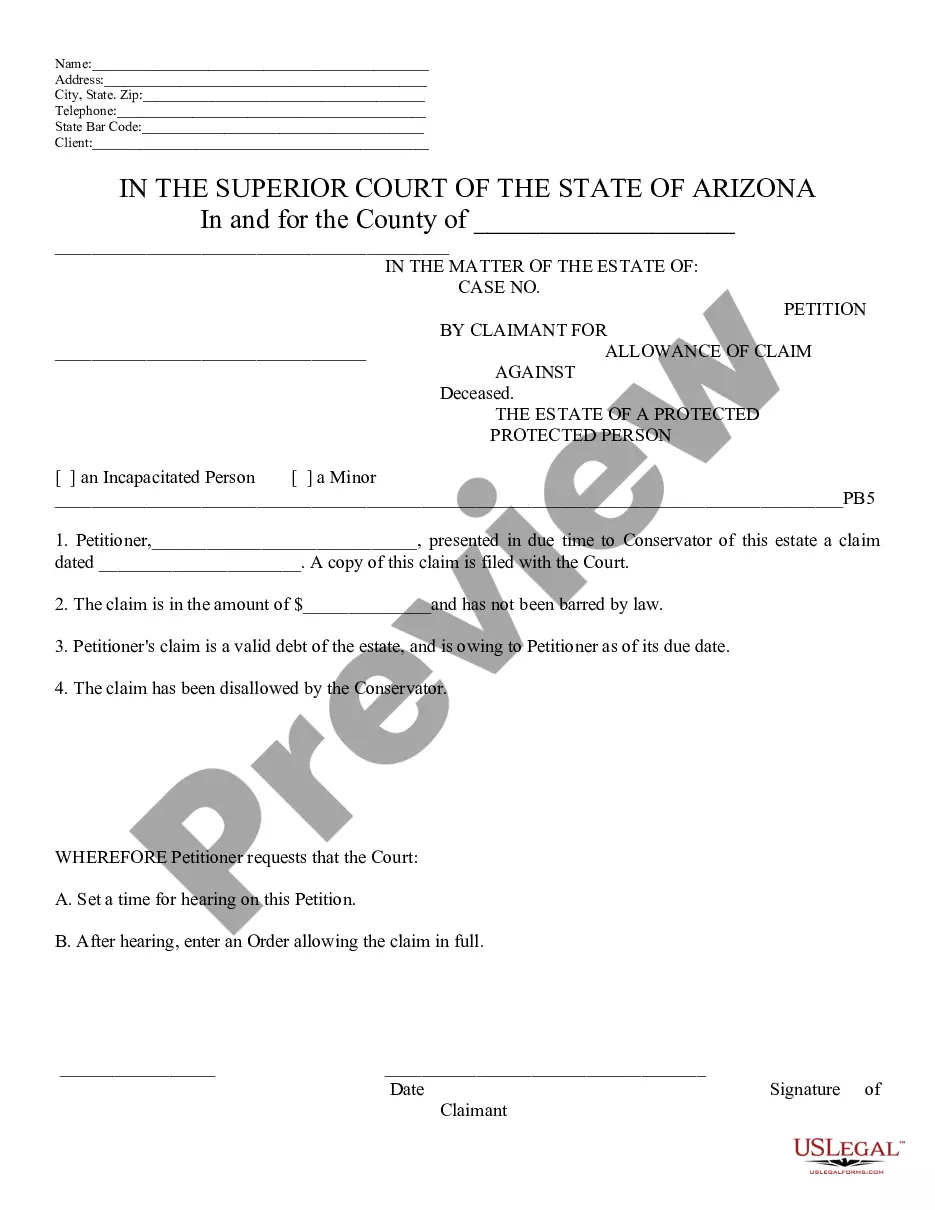

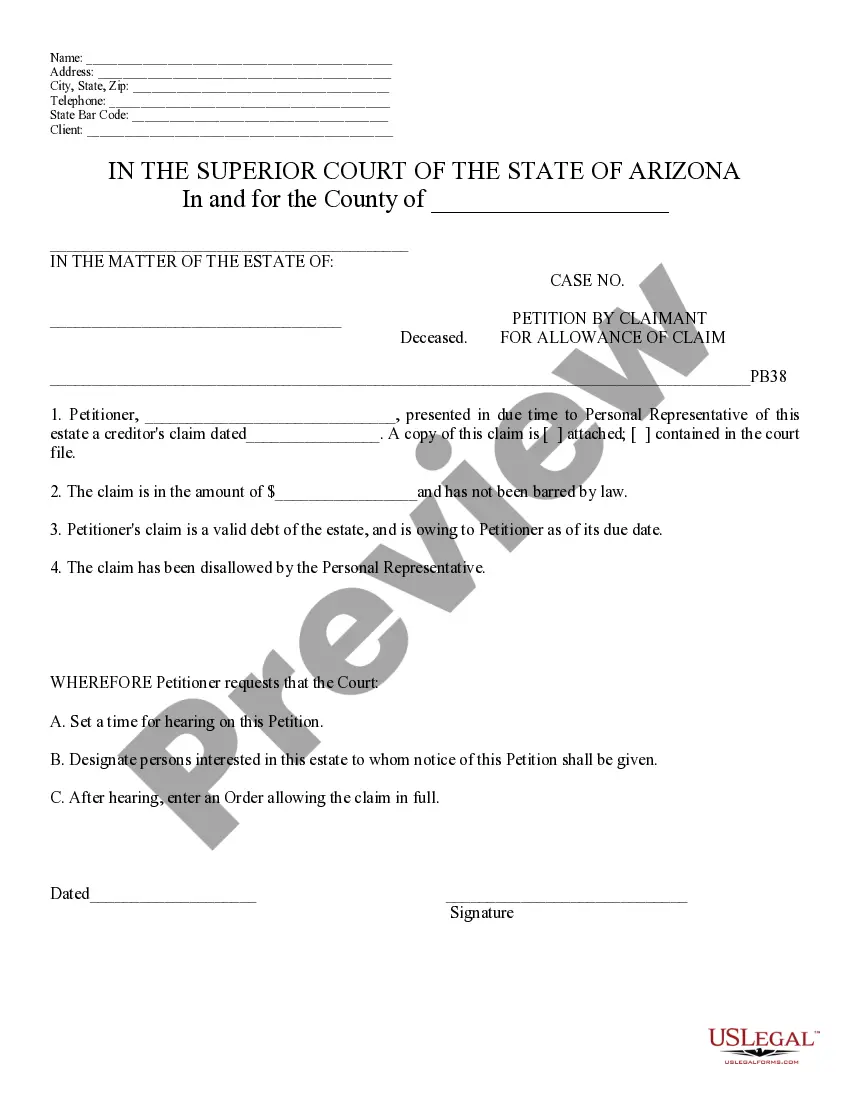

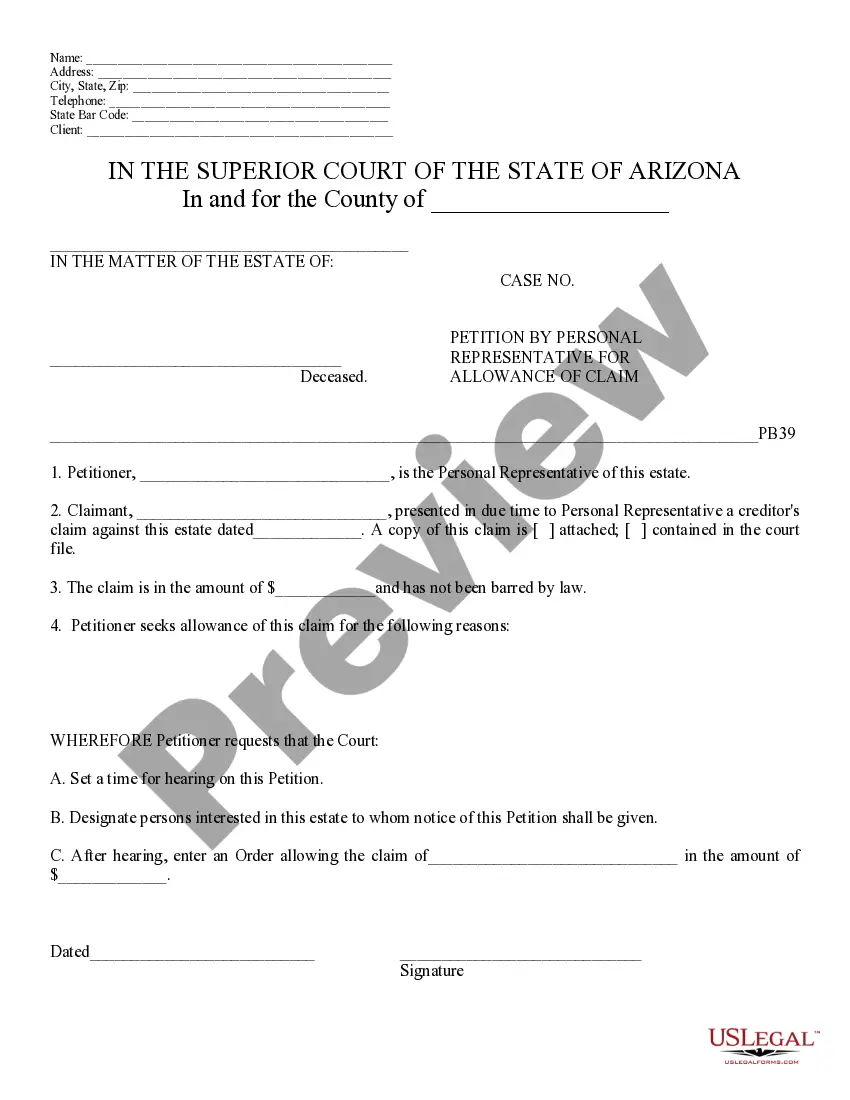

This model form, a Petition by Claimant for Allowance of Claim against Estate of a Protected Person - Arizona, is intended for use to initiate a request to the court to take the stated action. The form can be easily completed by filling in the blanks and/or adapted to fit your specific facts and circumstances. Available in for download now, in standard format(s).

Surprise Arizona Petition by Claimant for Allowance of Claim against Estate of a Protected Person

Description

How to fill out Arizona Petition By Claimant For Allowance Of Claim Against Estate Of A Protected Person?

Take advantage of the US Legal Templates and receive immediate access to any form sample you desire.

Our user-friendly site, featuring an extensive collection of templates, enables you to locate and acquire nearly any document sample you require.

You can download, fill out, and sign the Surprise Arizona Petition by Claimant for Allowance of Claim against Estate of a Protected Person in just a few minutes rather than spending hours online searching for an appropriate template.

Utilizing our library is an excellent method to enhance the security of your form submissions. Our skilled attorneys frequently review all documents to ensure that the forms are pertinent to a specific jurisdiction and adhere to new laws and regulations.

If you do not have an account yet, follow the instructions below.

Go to the page with the template you need. Ensure that it is the form you were looking for: confirm its title and description, and utilize the Preview option when available. Otherwise, make use of the Search field to find the correct one.

- How can you obtain the Surprise Arizona Petition by Claimant for Allowance of Claim against Estate of a Protected Person.

- If you already possess a subscription, simply Log In to your account. The Download button will become active on all samples you check.

- Additionally, you can find all previously saved documents in the My documents section.

Form popularity

FAQ

Creditors have a maximum of one year from the date of death to file a claim against an estate in Arizona. This timeframe allows creditors to secure payment for outstanding debts before the estate is closed. When navigating this process, especially through a Surprise Arizona Petition by Claimant for Allowance of Claim against Estate of a Protected Person, it is crucial to adhere to these timelines to ensure your claims are recognized.

In Arizona, debt can generally be collected for up to six months after a person's death, provided the creditor filed a claim within the applicable timeline. After this period, creditors must stop all collection efforts unless a legal claim is presented through probate. When submitting a Surprise Arizona Petition by Claimant for Allowance of Claim against Estate of a Protected Person, consider how these timeframes impact your claims.

An affidavit of succession to real property is a legal document that allows designated heirs to claim property without undergoing lengthy probate. This document simplifies the transfer process for real estate when the estate lacks other outstanding debts. For those processing a Surprise Arizona Petition by Claimant for Allowance of Claim against Estate of a Protected Person, understanding this affidavit can streamline property transitions.

In Arizona, creditors can pursue claims against an estate for up to four months after the estate is opened. However, if a claim is not filed promptly, it may be disallowed. This timeline is essential to understand when filing a Surprise Arizona Petition by Claimant for Allowance of Claim against Estate of a Protected Person, as it clarifies the boundaries within which you must act.

Claims against an estate can vary widely, but common examples include unpaid debts, outstanding loans, and claims for personal injury or property damage. Additionally, beneficiaries may contest the validity of a will or trust, leading to potential claims. When faced with such situations, filing a Surprise Arizona Petition by Claimant for Allowance of Claim against Estate of a Protected Person can provide you with a structured way to present your case and seek rightful compensation.

Filing a lien against an estate may be possible under certain circumstances, particularly if you have a valid claim against the estate. A lien allows you to secure a right to property until your claim is resolved. However, the process can be complicated, so it is advisable to consider submitting a Surprise Arizona Petition by Claimant for Allowance of Claim against Estate of a Protected Person first. This petition will allow the court to assess your claim and determine whether a lien is appropriate.

The 3-year rule typically refers to the time limit for filing a claim against a deceased person's estate. In many jurisdictions, including Arizona, claimants must submit their claims within three years of the decedent’s death. This law helps ensure that estates are settled efficiently and fairly, reducing the burden on surviving family members. If necessary, use a Surprise Arizona Petition by Claimant for Allowance of Claim against Estate of a Protected Person to properly present your claim within this timeframe.

Making a claim against an estate starts with identifying your legal standing and the nature of your claim. You should collect proof that establishes your right to claim, which could include personal loans or debts owed. After compiling your evidence, you must submit a Surprise Arizona Petition by Claimant for Allowance of Claim against Estate of a Protected Person to the probate court overseeing the estate. This formalizes your claim and allows the court to evaluate its merit.

To put a claim against someone's estate, you should first understand the legal process involved. Begin by gathering relevant documentation that supports your claim, such as contracts or invoices. Next, you may need to file a Surprise Arizona Petition by Claimant for Allowance of Claim against Estate of a Protected Person within the designated time frame. This petition will notify the estate's representative of your claim and initiate the review process.

In Arizona, if you need to file a lawsuit against an estate, you generally have one year from the date of the deceased person's death to initiate legal action. This timeline may vary depending on the specifics of your situation. If you plan to submit a Surprise Arizona Petition by Claimant for Allowance of Claim against Estate of a Protected Person, doing so within this timeframe is essential. Be sure to consult with legal professionals to understand your rights and obligations.