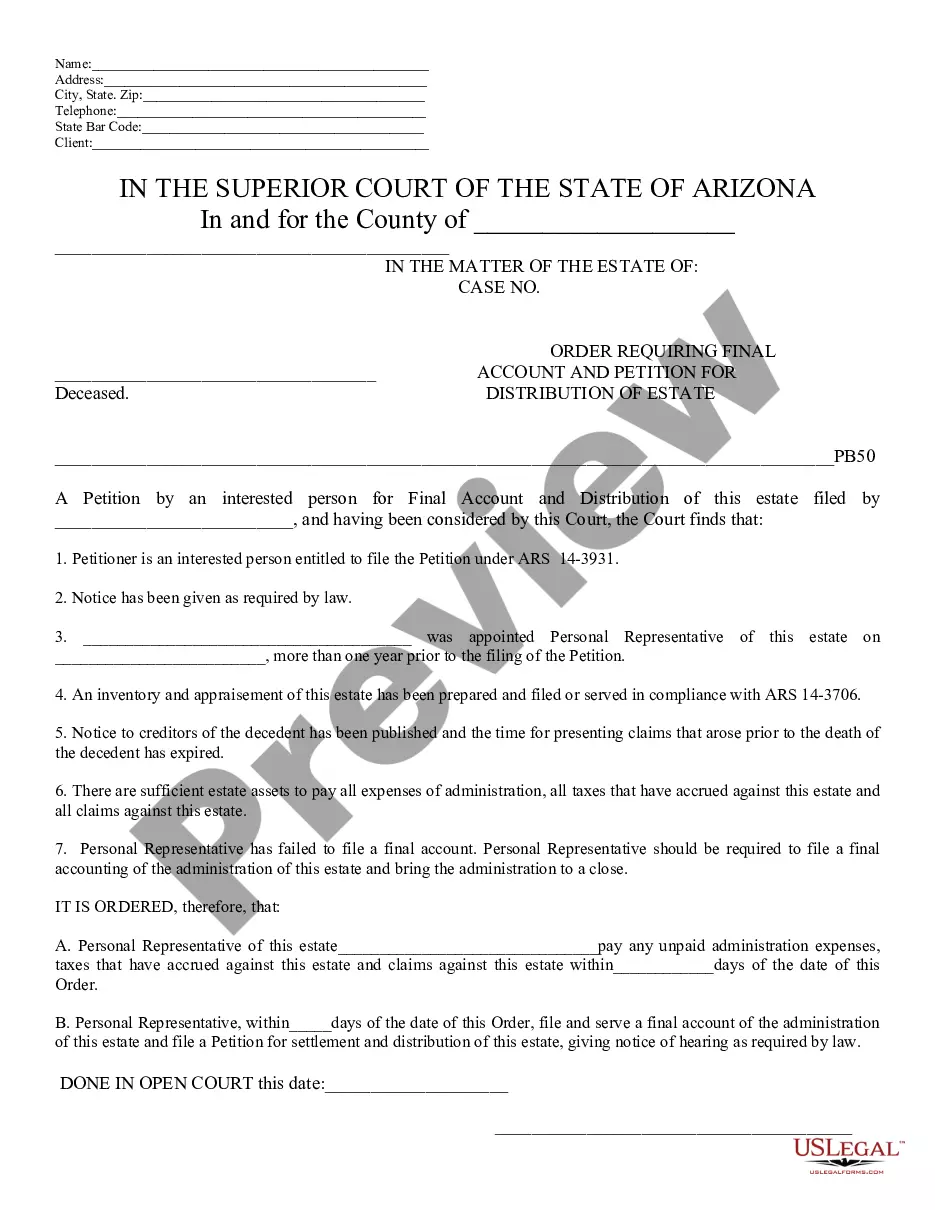

An Order is an official written statement from the court commanding a certain action, and is signed by the judge. Failure to comply with the order is unlawful and may result in contempt of court charges. This document, a sample Order Requiring Final Accounting and Petition for Distribution of Estate - Arizona, can be used as a model to draft an order requested for submission by the court (the court often directs a party to draft an order). Adapt the language to the facts and circumstances of your case. Available for download now in standard format(s).

Glendale Arizona Order Requiring Final Accounting and Petition for Distribution of Estate is a legal process that ensures a proper and fair distribution of assets and liabilities in the estate of a deceased person. This procedure is crucial in closing the estate and providing beneficiaries or heirs with their rightful share. The Glendale Arizona Order Requiring Final Accounting and Petition for Distribution of Estate is typically filed by the personal representative of the estate, also known as the executor or administrator, to present an accurate account of the estate's financial transactions, including income, expenses, and distributions made during the probate process. This order is essential to obtain court approval before distributing the remaining assets to the beneficiaries. There are several types of Glendale Arizona Order Requiring Final Accounting and Petition for Distribution of Estate, including: 1. Order Requiring Final Accounting: This specific order is filed when the personal representative has completed the necessary tasks of inventorying estate assets, paying outstanding debts, and settling any pending claims against the estate. It seeks court approval for the final accounting before distributing the remaining assets. 2. Order for Distribution of Estate: This order is requested by the personal representative once the final accounting has been approved by the court. It outlines the proposed distribution plan and seeks the court's authorization to carry out the distribution of assets to the designated beneficiaries. 3. Order Denying Final Accounting and Petition for Distribution of Estate: In certain cases, when the court identifies discrepancies or issues with the accounting or distribution plan, it may choose to deny the petition and order the personal representative to revise and resubmit the accounting and distribution proposal. The Glendale Arizona Order Requiring Final Accounting and Petition for Distribution of Estate is an essential legal document that ensures transparency, accountability, and compliance with the probate laws of Arizona. It safeguards the interests of the beneficiaries and guarantees a just distribution of assets, ensuring the deceased's wishes are respected.Glendale Arizona Order Requiring Final Accounting and Petition for Distribution of Estate is a legal process that ensures a proper and fair distribution of assets and liabilities in the estate of a deceased person. This procedure is crucial in closing the estate and providing beneficiaries or heirs with their rightful share. The Glendale Arizona Order Requiring Final Accounting and Petition for Distribution of Estate is typically filed by the personal representative of the estate, also known as the executor or administrator, to present an accurate account of the estate's financial transactions, including income, expenses, and distributions made during the probate process. This order is essential to obtain court approval before distributing the remaining assets to the beneficiaries. There are several types of Glendale Arizona Order Requiring Final Accounting and Petition for Distribution of Estate, including: 1. Order Requiring Final Accounting: This specific order is filed when the personal representative has completed the necessary tasks of inventorying estate assets, paying outstanding debts, and settling any pending claims against the estate. It seeks court approval for the final accounting before distributing the remaining assets. 2. Order for Distribution of Estate: This order is requested by the personal representative once the final accounting has been approved by the court. It outlines the proposed distribution plan and seeks the court's authorization to carry out the distribution of assets to the designated beneficiaries. 3. Order Denying Final Accounting and Petition for Distribution of Estate: In certain cases, when the court identifies discrepancies or issues with the accounting or distribution plan, it may choose to deny the petition and order the personal representative to revise and resubmit the accounting and distribution proposal. The Glendale Arizona Order Requiring Final Accounting and Petition for Distribution of Estate is an essential legal document that ensures transparency, accountability, and compliance with the probate laws of Arizona. It safeguards the interests of the beneficiaries and guarantees a just distribution of assets, ensuring the deceased's wishes are respected.