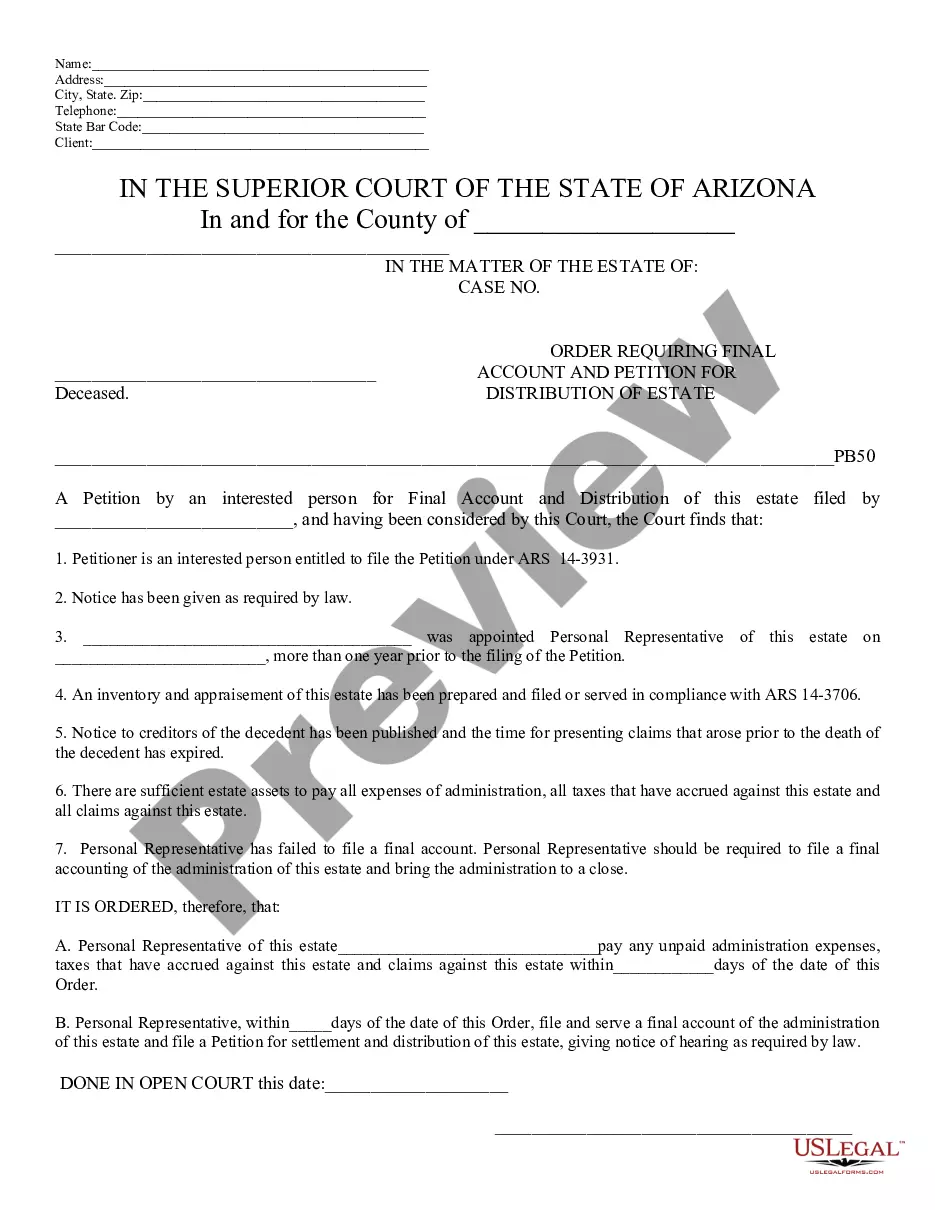

An Order is an official written statement from the court commanding a certain action, and is signed by the judge. Failure to comply with the order is unlawful and may result in contempt of court charges. This document, a sample Order Requiring Final Accounting and Petition for Distribution of Estate - Arizona, can be used as a model to draft an order requested for submission by the court (the court often directs a party to draft an order). Adapt the language to the facts and circumstances of your case. Available for download now in standard format(s).

Description: In Mesa, Arizona, an Order Requiring Final Accounting and Petition for Distribution of Estate is a crucial legal document that is filed with the court when administering an estate. This order is typically submitted by the personal representative or executor of the estate to account for all assets, debts, and expenses incurred throughout the probate process. It plays a significant role in finalizing the estate settlement and distributing the deceased person's remaining assets to the rightful beneficiaries or heirs. There are several types of Mesa, Arizona Orders Requiring Final Accounting and Petition for Distribution of Estate, including: 1. Order Requiring Final Accounting: This type of order is filed by the personal representative or executor to provide an accurate and comprehensive account of all the assets, debts, income, and expenses related to the estate. It ensures transparency and enables the court and other interested parties to assess the financial status of the estate. 2. Petition for Distribution of Estate: This petition is submitted along with the final accounting to request the court's approval for the distribution of the remaining assets to the beneficiaries or heirs. The personal representative provides a detailed plan for allocation based on the deceased individual's will or the state's intestacy laws if there is no will. 3. Order Approving Final Accounting and Distribution: Once the court reviews and approves the final accounting and distribution plan, it issues this order. It acts as a legal authorization for the personal representative to carry out the proposed distribution plan and disburse the estate's assets to the beneficiaries. 4. Order Denying Final Accounting and Petition for Distribution: In some cases, the court may deny the final accounting and distribution plan if it identifies discrepancies, inaccuracies, or objections raised by interested parties. This order signifies that further actions or modifications are required before the distribution process can proceed. It is crucial to navigate the Mesa, Arizona Order Requiring Final Accounting and Petition for Distribution of Estate process accurately and effectively. Hiring an experienced probate attorney who is well-versed in Arizona probate laws can greatly assist in preparing and filing these legal documents, ensuring compliance with all necessary requirements, and resolving any potential disputes throughout the estate administration process.Description: In Mesa, Arizona, an Order Requiring Final Accounting and Petition for Distribution of Estate is a crucial legal document that is filed with the court when administering an estate. This order is typically submitted by the personal representative or executor of the estate to account for all assets, debts, and expenses incurred throughout the probate process. It plays a significant role in finalizing the estate settlement and distributing the deceased person's remaining assets to the rightful beneficiaries or heirs. There are several types of Mesa, Arizona Orders Requiring Final Accounting and Petition for Distribution of Estate, including: 1. Order Requiring Final Accounting: This type of order is filed by the personal representative or executor to provide an accurate and comprehensive account of all the assets, debts, income, and expenses related to the estate. It ensures transparency and enables the court and other interested parties to assess the financial status of the estate. 2. Petition for Distribution of Estate: This petition is submitted along with the final accounting to request the court's approval for the distribution of the remaining assets to the beneficiaries or heirs. The personal representative provides a detailed plan for allocation based on the deceased individual's will or the state's intestacy laws if there is no will. 3. Order Approving Final Accounting and Distribution: Once the court reviews and approves the final accounting and distribution plan, it issues this order. It acts as a legal authorization for the personal representative to carry out the proposed distribution plan and disburse the estate's assets to the beneficiaries. 4. Order Denying Final Accounting and Petition for Distribution: In some cases, the court may deny the final accounting and distribution plan if it identifies discrepancies, inaccuracies, or objections raised by interested parties. This order signifies that further actions or modifications are required before the distribution process can proceed. It is crucial to navigate the Mesa, Arizona Order Requiring Final Accounting and Petition for Distribution of Estate process accurately and effectively. Hiring an experienced probate attorney who is well-versed in Arizona probate laws can greatly assist in preparing and filing these legal documents, ensuring compliance with all necessary requirements, and resolving any potential disputes throughout the estate administration process.