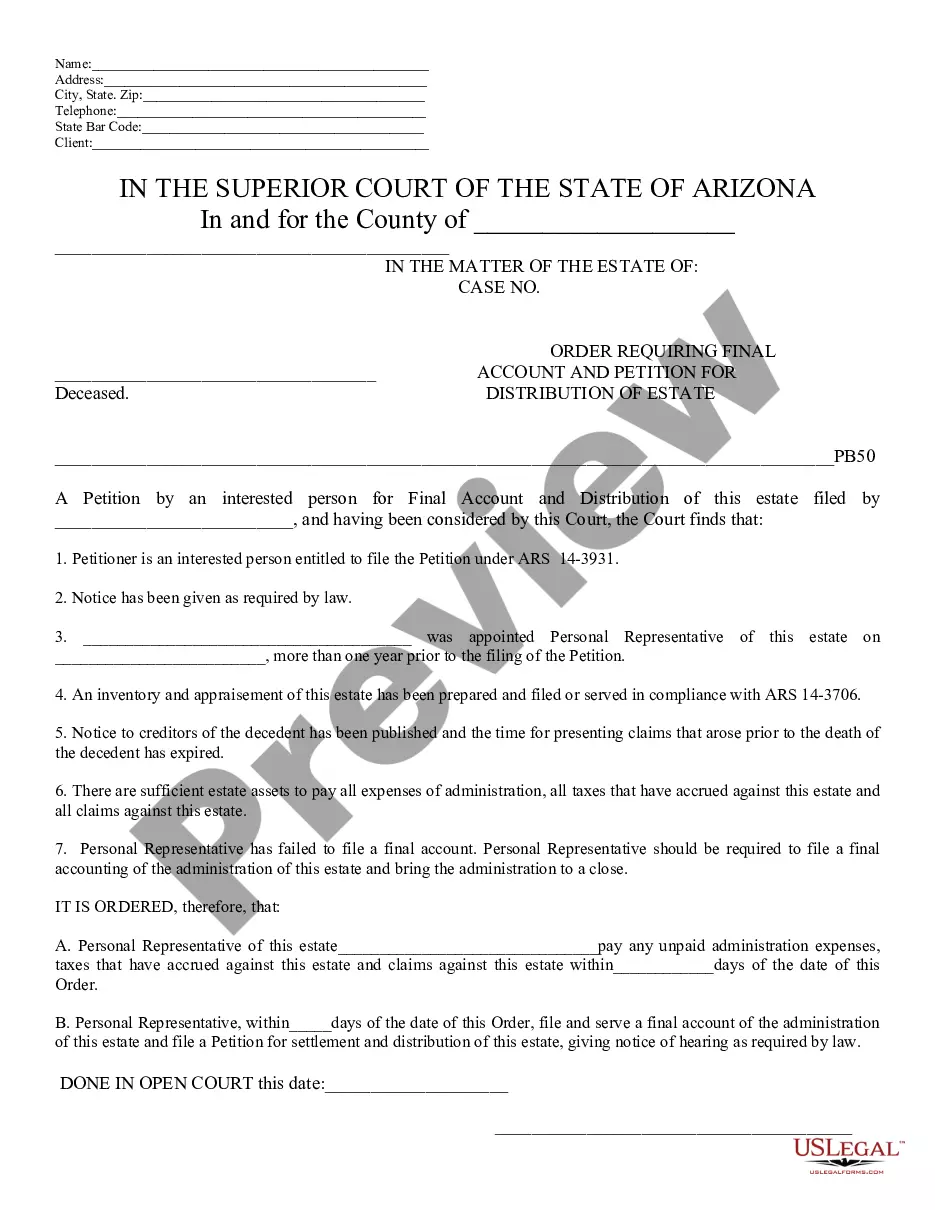

An Order is an official written statement from the court commanding a certain action, and is signed by the judge. Failure to comply with the order is unlawful and may result in contempt of court charges. This document, a sample Order Requiring Final Accounting and Petition for Distribution of Estate - Arizona, can be used as a model to draft an order requested for submission by the court (the court often directs a party to draft an order). Adapt the language to the facts and circumstances of your case. Available for download now in standard format(s).

In Phoenix, Arizona, an Order Requiring Final Accounting and Petition for Distribution of Estate is a legal document that outlines the necessary steps to settle and distribute the assets of an individual's estate after their death. This order is typically obtained from the probate court and helps to ensure that all debts, taxes, and expenses associated with the estate are accounted for and properly paid. The Order Requiring Final Accounting and Petition for Distribution of Estate serves as a directive to the personal representative or executor of the deceased person's estate, providing them with a clear set of instructions on how to proceed. It requires the personal representative to compile a detailed final accounting, which is a comprehensive list of all the assets, liabilities, and expenses associated with the estate. The final accounting should include an inventory of all the estate's assets, such as real estate, bank accounts, investments, and personal property, as well as any outstanding debts or obligations that need to be settled. The personal representative must also provide an account of any income earned by the estate during the probate process and any expenses incurred. Additionally, the Order Requiring Final Accounting and Petition for Distribution of Estate requires the personal representative to distribute the remaining assets of the estate to the beneficiaries or heirs according to the deceased person's will, if one exists, or according to the laws of intestate succession if there is no will. This process involves identifying the beneficiaries, determining their share of the estate, and ensuring the assets are transferred to them accurately. It is important to note that there may be variations or specific types of Order Requiring Final Accounting and Petition for Distribution of Estate in Phoenix, Arizona, depending on the specific circumstances of the deceased person's estate. For example, if the estate is subject to a Trust, there may be a separate order and petition specifically related to Trust distribution. In summary, the Order Requiring Final Accounting and Petition for Distribution of Estate in Phoenix, Arizona, is a crucial legal document that ensures the proper settlement and distribution of a deceased person's estate. It requires the personal representative to provide a detailed final accounting of the estate's assets, liabilities, and expenses, and to distribute the remaining assets to the beneficiaries or heirs in accordance with the deceased person's will or the laws of intestate succession.In Phoenix, Arizona, an Order Requiring Final Accounting and Petition for Distribution of Estate is a legal document that outlines the necessary steps to settle and distribute the assets of an individual's estate after their death. This order is typically obtained from the probate court and helps to ensure that all debts, taxes, and expenses associated with the estate are accounted for and properly paid. The Order Requiring Final Accounting and Petition for Distribution of Estate serves as a directive to the personal representative or executor of the deceased person's estate, providing them with a clear set of instructions on how to proceed. It requires the personal representative to compile a detailed final accounting, which is a comprehensive list of all the assets, liabilities, and expenses associated with the estate. The final accounting should include an inventory of all the estate's assets, such as real estate, bank accounts, investments, and personal property, as well as any outstanding debts or obligations that need to be settled. The personal representative must also provide an account of any income earned by the estate during the probate process and any expenses incurred. Additionally, the Order Requiring Final Accounting and Petition for Distribution of Estate requires the personal representative to distribute the remaining assets of the estate to the beneficiaries or heirs according to the deceased person's will, if one exists, or according to the laws of intestate succession if there is no will. This process involves identifying the beneficiaries, determining their share of the estate, and ensuring the assets are transferred to them accurately. It is important to note that there may be variations or specific types of Order Requiring Final Accounting and Petition for Distribution of Estate in Phoenix, Arizona, depending on the specific circumstances of the deceased person's estate. For example, if the estate is subject to a Trust, there may be a separate order and petition specifically related to Trust distribution. In summary, the Order Requiring Final Accounting and Petition for Distribution of Estate in Phoenix, Arizona, is a crucial legal document that ensures the proper settlement and distribution of a deceased person's estate. It requires the personal representative to provide a detailed final accounting of the estate's assets, liabilities, and expenses, and to distribute the remaining assets to the beneficiaries or heirs in accordance with the deceased person's will or the laws of intestate succession.