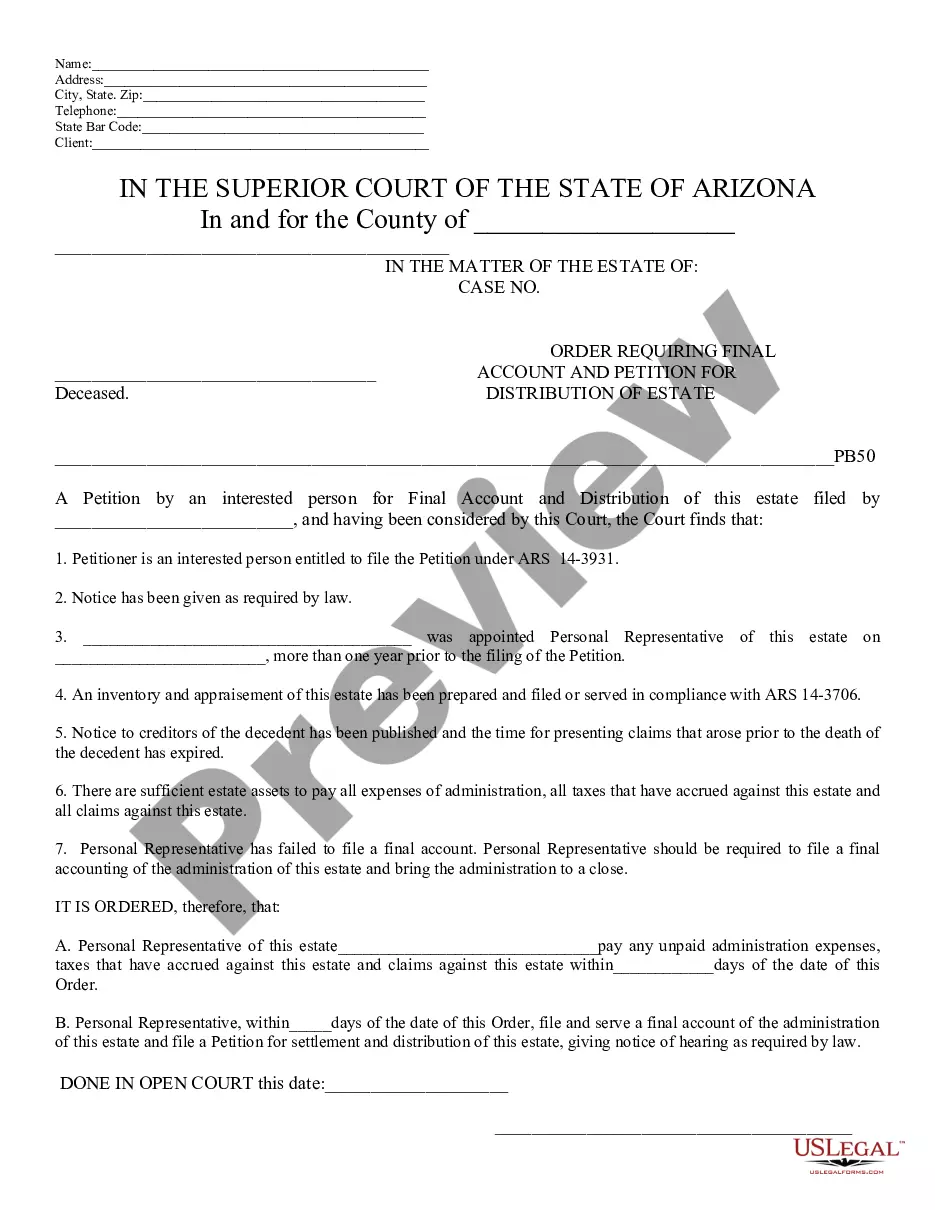

An Order is an official written statement from the court commanding a certain action, and is signed by the judge. Failure to comply with the order is unlawful and may result in contempt of court charges. This document, a sample Order Requiring Final Accounting and Petition for Distribution of Estate - Arizona, can be used as a model to draft an order requested for submission by the court (the court often directs a party to draft an order). Adapt the language to the facts and circumstances of your case. Available for download now in standard format(s).

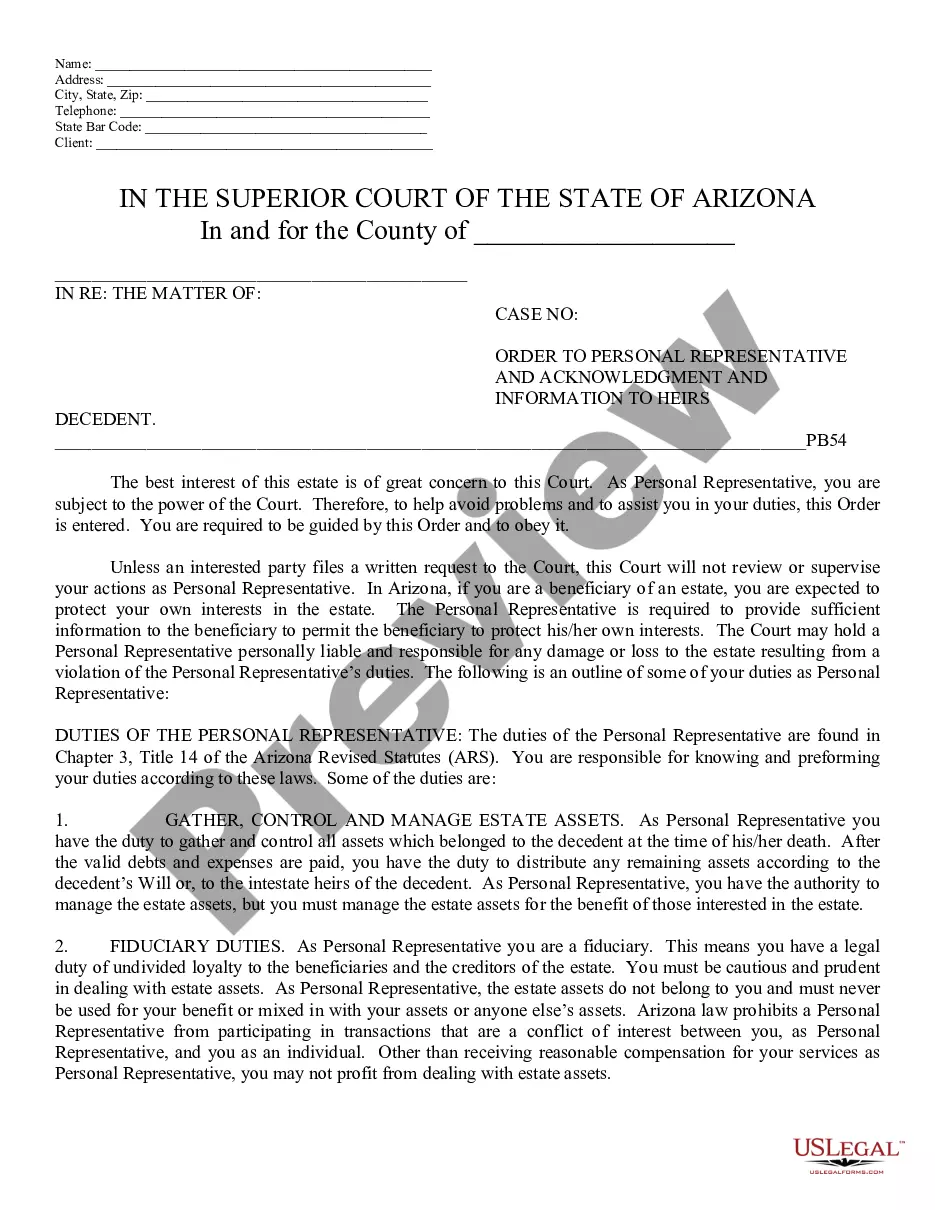

Lima Arizona Order Requiring Final Accounting and Petition for Distribution of Estate is a legal process that pertains to the final settlement of a deceased individual's estate in Lima, Arizona. This order and petition are crucial steps in ensuring the proper distribution of assets and settling any outstanding debts or claims. In Lima, Arizona, there are two main types of orders and petitions that can be filed for the final accounting and distribution of an estate: 1. Lima Arizona Order Requiring Final Accounting: This order is a formal directive issued by the court, compelling the executor or personal representative of the estate to submit a comprehensive and accurate final accounting of the deceased person's assets, liabilities, income, expenses, and distributions made during the probate process. This order ensures transparency and accountability in managing the estate. 2. Lima Arizona Petition for Distribution of Estate: This petition is a legal document filed by the executor or personal representative of the deceased person's estate, requesting the court's approval for the final distribution of assets according to the terms outlined in the deceased's will or the state's intestacy laws. The petition provides detailed information about the remaining assets, claims, pending taxes, and proposed distribution plan, seeking the court's validation and confirmation. When filing these orders and petitions in Lima, Arizona, it is essential to consider the following relevant keywords and phrases: — Pima County probatfourur— - Estate administration process — Final accounting requirement— - Distribution plan and proposal — Debts and claimsettlementen— - Assets valuation and inventory — Beneficiaries and heirs' right— - Probate laws and regulations — Intestacy ruleclimatemaArizonaon— - Executor or personal representative duties — Court approvainvalidationio— - Taxes and estate tax obligations — Disputes and objectionresolutionio— - Notification and communication with interested parties — Deadlines for filing and response. Remember, it is always advisable to consult with an attorney specializing in probate and estate matters to ensure compliance with local laws and to navigate the complex legal procedures involved in the Lima Arizona Order Requiring Final Accounting and Petition for Distribution of Estate.Lima Arizona Order Requiring Final Accounting and Petition for Distribution of Estate is a legal process that pertains to the final settlement of a deceased individual's estate in Lima, Arizona. This order and petition are crucial steps in ensuring the proper distribution of assets and settling any outstanding debts or claims. In Lima, Arizona, there are two main types of orders and petitions that can be filed for the final accounting and distribution of an estate: 1. Lima Arizona Order Requiring Final Accounting: This order is a formal directive issued by the court, compelling the executor or personal representative of the estate to submit a comprehensive and accurate final accounting of the deceased person's assets, liabilities, income, expenses, and distributions made during the probate process. This order ensures transparency and accountability in managing the estate. 2. Lima Arizona Petition for Distribution of Estate: This petition is a legal document filed by the executor or personal representative of the deceased person's estate, requesting the court's approval for the final distribution of assets according to the terms outlined in the deceased's will or the state's intestacy laws. The petition provides detailed information about the remaining assets, claims, pending taxes, and proposed distribution plan, seeking the court's validation and confirmation. When filing these orders and petitions in Lima, Arizona, it is essential to consider the following relevant keywords and phrases: — Pima County probatfourur— - Estate administration process — Final accounting requirement— - Distribution plan and proposal — Debts and claimsettlementen— - Assets valuation and inventory — Beneficiaries and heirs' right— - Probate laws and regulations — Intestacy ruleclimatemaArizonaon— - Executor or personal representative duties — Court approvainvalidationio— - Taxes and estate tax obligations — Disputes and objectionresolutionio— - Notification and communication with interested parties — Deadlines for filing and response. Remember, it is always advisable to consult with an attorney specializing in probate and estate matters to ensure compliance with local laws and to navigate the complex legal procedures involved in the Lima Arizona Order Requiring Final Accounting and Petition for Distribution of Estate.