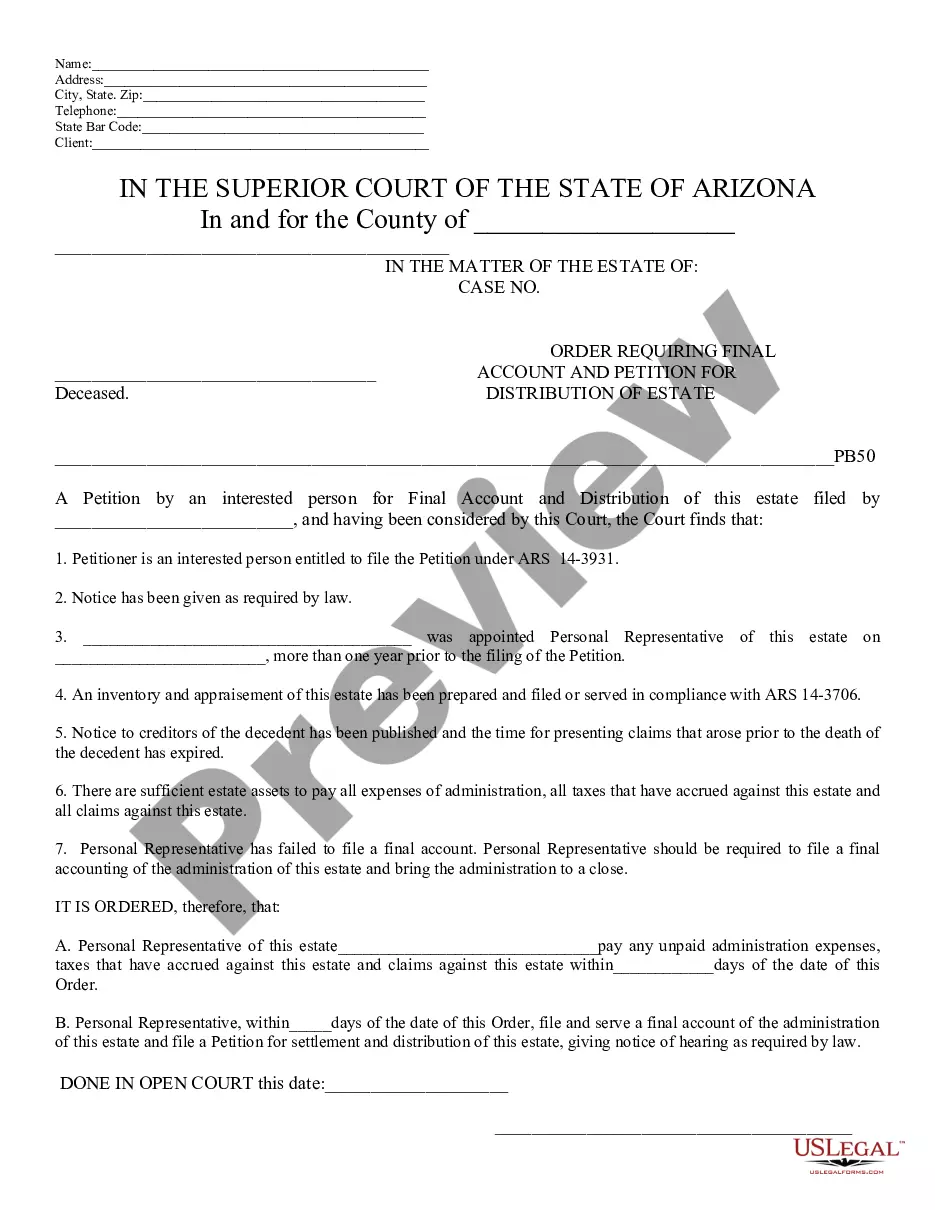

An Order is an official written statement from the court commanding a certain action, and is signed by the judge. Failure to comply with the order is unlawful and may result in contempt of court charges. This document, a sample Order Requiring Final Accounting and Petition for Distribution of Estate - Arizona, can be used as a model to draft an order requested for submission by the court (the court often directs a party to draft an order). Adapt the language to the facts and circumstances of your case. Available for download now in standard format(s).

A Surprise Arizona Order Requiring Final Accounting and Petition for Distribution of Estate refers to a legal document that is filed in the Surprise, Arizona jurisdiction, specifically in the context of estate administration. This order and petition are typically submitted to the court to settle the financial affairs of a deceased individual. This legal process ensures that all assets, debts, and liabilities are properly accounted for and distributed among the beneficiaries or heirs of the estate. It allows the court to verify the accuracy of the estate's financial records and ensures that the estate administration is conducted transparently. The Surprise Arizona Order Requiring Final Accounting and Petition for Distribution of Estate serves as a request to the court to review and approve the final accounting statement, which includes a detailed breakdown of all the assets, debts, income, expenses, and distributions related to the estate. Keywords: Surprise Arizona, Order Requiring Final Accounting, Petition for Distribution of Estate, legal document, estate administration, financial affairs, deceased individual, assets, debts, liabilities, beneficiaries, heirs, court, verify, accuracy, financial records, transparent manner, final accounting statement, breakdown, income, expenses, distributions. Different types of Surprise Arizona Order Requiring Final Accounting and Petition for Distribution of Estate may include: 1. Standard Order Requiring Final Accounting and Petition for Distribution of Estate: This is the most common type of order and petition, used for the ordinary settlement of an estate in Surprise, Arizona. 2. Contested Order Requiring Final Accounting and Petition for Distribution of Estate: This type of order and petition are filed when there are disputes or disagreements among the beneficiaries or potential creditors regarding the distribution of assets or the accuracy of the accounting. 3. Simplified Order Requiring Final Accounting and Petition for Distribution of Estate: In certain cases where the estate is small or uncomplicated, a simplified version of the order and petition may be used to streamline the process. 4. Joint Order Requiring Final Accounting and Petition for Distribution of Estate: This type of order and petition are filed when multiple parties are involved in the estate administration, such as co-executors or co-administrators. Keywords: Standard, Contested, Simplified, Joint, order, petition, settlement, estate, disputes, disagreements, beneficiaries, creditors, assets, accounting, accuracy, small, uncomplicated, streamline, parties, co-executors, co-administrators.