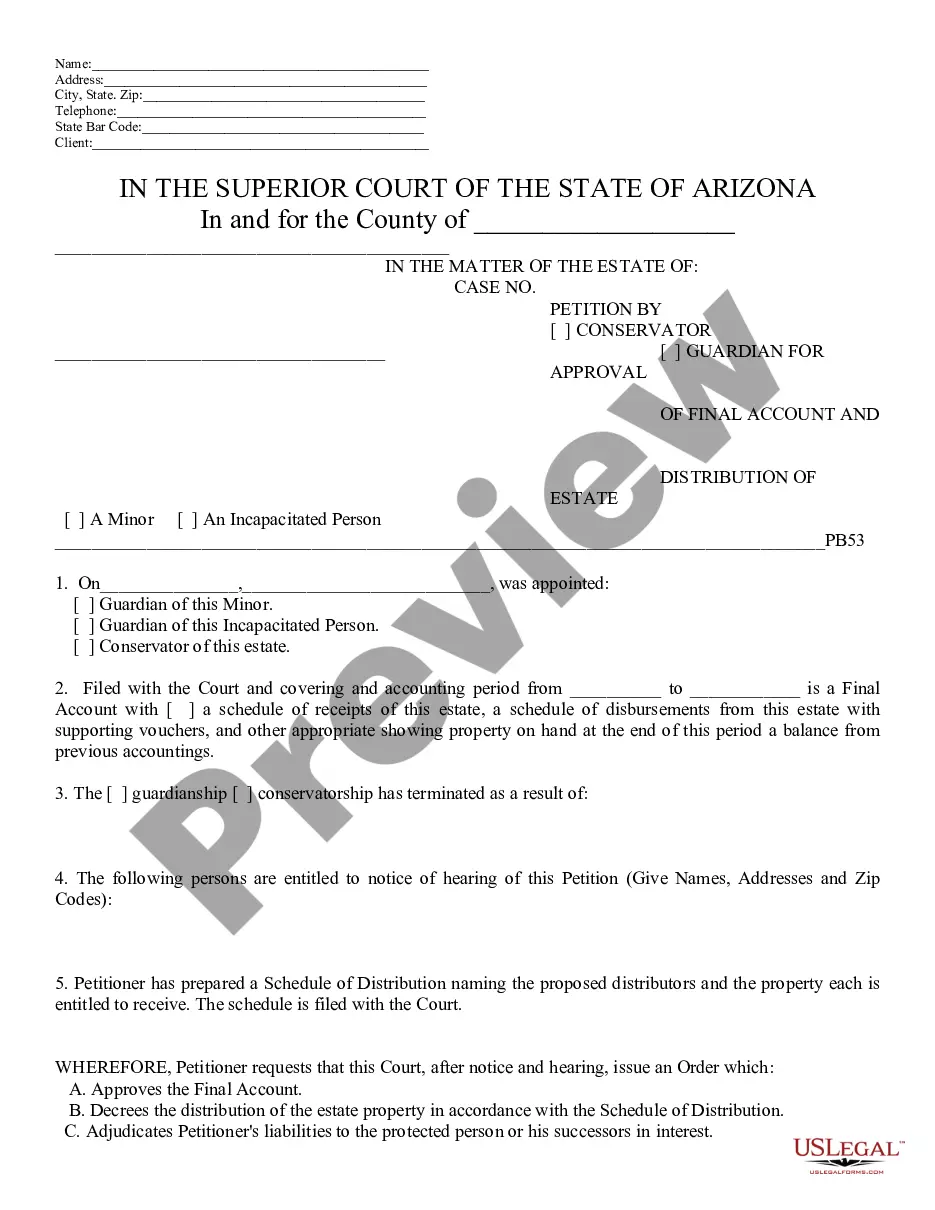

This model form, a Petition by Cons./Guard for Approval of Final Acct. Dist. of Estate - Arizona, is intended for use to initiate a request to the court to take the stated action. The form can be easily completed by filling in the blanks and/or adapted to fit your specific facts and circumstances. Available in for download now, in standard format(s).

Title: Understanding Gilbert Arizona Petition by Conservator or Guardian for Approval of Final Accounting and Distribution of Estate Introduction: A Gilbert Arizona petition by a conservator or guardian for approval of final accounting and distribution of estate is a legal process that involves seeking court approval for the final accounting and distribution of an individual's estate. This detailed description will provide valuable insights into the purpose, requirements, and types of petitions associated with this topic. 1. Purpose of the Petition: The primary goal of a Gilbert Arizona petition by a conservator or guardian for approval of final accounting and distribution of estate is to obtain court approval for the final financial report of the estate and the distribution of assets to the beneficiaries, in line with the conservator or guardian's responsibilities. 2. Key Requirements: a. Detailed Accounting: The petitioner must provide a comprehensive account detailing all income, expenses, and disbursements from the estate, ensuring transparency and accuracy. b. Supporting Documentation: All relevant documents, such as receipts, invoices, bank statements, and tax records, should be included to validate the claims made in the final accounting. c. Notice to Interested Parties: The petitioner must serve notice to all interested parties, including beneficiaries and any other parties designated by the court, informing them of the final accounting and distribution. Types of Gilbert Arizona Petition by Conservator or Guardian for Approval of Final Accounting and Distribution of Estate: 1. Standard Petition: This type of petition is filed by a conservator or guardian to seek court approval for the final accounting and distribution of an estate, adhering to the legal requirements and procedures. 2. Simplified Petition: In some cases, if the estate is relatively small, a simplified petition might be filed. This allows for a streamlined process, with fewer procedural steps and simplified documentation requirements. 3. Modification Petition: A modification petition is submitted when the conservator or guardian needs to modify or update the previously approved final accounting and distribution due to unforeseen circumstances, changes in beneficiaries' circumstances, or other valid reasons. 4. Contested Petition: In rare instances, interested parties may contest the final accounting and distribution proposed by the conservator or guardian. This can lead to litigation, further extending the court process until a resolution is reached. Conclusion: The Gilbert Arizona petition by a conservator or guardian for approval of final accounting and distribution of an estate aims to ensure that all financial aspects of an estate are properly accounted for and that the rightful beneficiaries receive their due share. By following the necessary legal procedures and requirements, the conservator or guardian can seek court approval for the final accounting, ultimately bringing closure to the estate administration process.Title: Understanding Gilbert Arizona Petition by Conservator or Guardian for Approval of Final Accounting and Distribution of Estate Introduction: A Gilbert Arizona petition by a conservator or guardian for approval of final accounting and distribution of estate is a legal process that involves seeking court approval for the final accounting and distribution of an individual's estate. This detailed description will provide valuable insights into the purpose, requirements, and types of petitions associated with this topic. 1. Purpose of the Petition: The primary goal of a Gilbert Arizona petition by a conservator or guardian for approval of final accounting and distribution of estate is to obtain court approval for the final financial report of the estate and the distribution of assets to the beneficiaries, in line with the conservator or guardian's responsibilities. 2. Key Requirements: a. Detailed Accounting: The petitioner must provide a comprehensive account detailing all income, expenses, and disbursements from the estate, ensuring transparency and accuracy. b. Supporting Documentation: All relevant documents, such as receipts, invoices, bank statements, and tax records, should be included to validate the claims made in the final accounting. c. Notice to Interested Parties: The petitioner must serve notice to all interested parties, including beneficiaries and any other parties designated by the court, informing them of the final accounting and distribution. Types of Gilbert Arizona Petition by Conservator or Guardian for Approval of Final Accounting and Distribution of Estate: 1. Standard Petition: This type of petition is filed by a conservator or guardian to seek court approval for the final accounting and distribution of an estate, adhering to the legal requirements and procedures. 2. Simplified Petition: In some cases, if the estate is relatively small, a simplified petition might be filed. This allows for a streamlined process, with fewer procedural steps and simplified documentation requirements. 3. Modification Petition: A modification petition is submitted when the conservator or guardian needs to modify or update the previously approved final accounting and distribution due to unforeseen circumstances, changes in beneficiaries' circumstances, or other valid reasons. 4. Contested Petition: In rare instances, interested parties may contest the final accounting and distribution proposed by the conservator or guardian. This can lead to litigation, further extending the court process until a resolution is reached. Conclusion: The Gilbert Arizona petition by a conservator or guardian for approval of final accounting and distribution of an estate aims to ensure that all financial aspects of an estate are properly accounted for and that the rightful beneficiaries receive their due share. By following the necessary legal procedures and requirements, the conservator or guardian can seek court approval for the final accounting, ultimately bringing closure to the estate administration process.