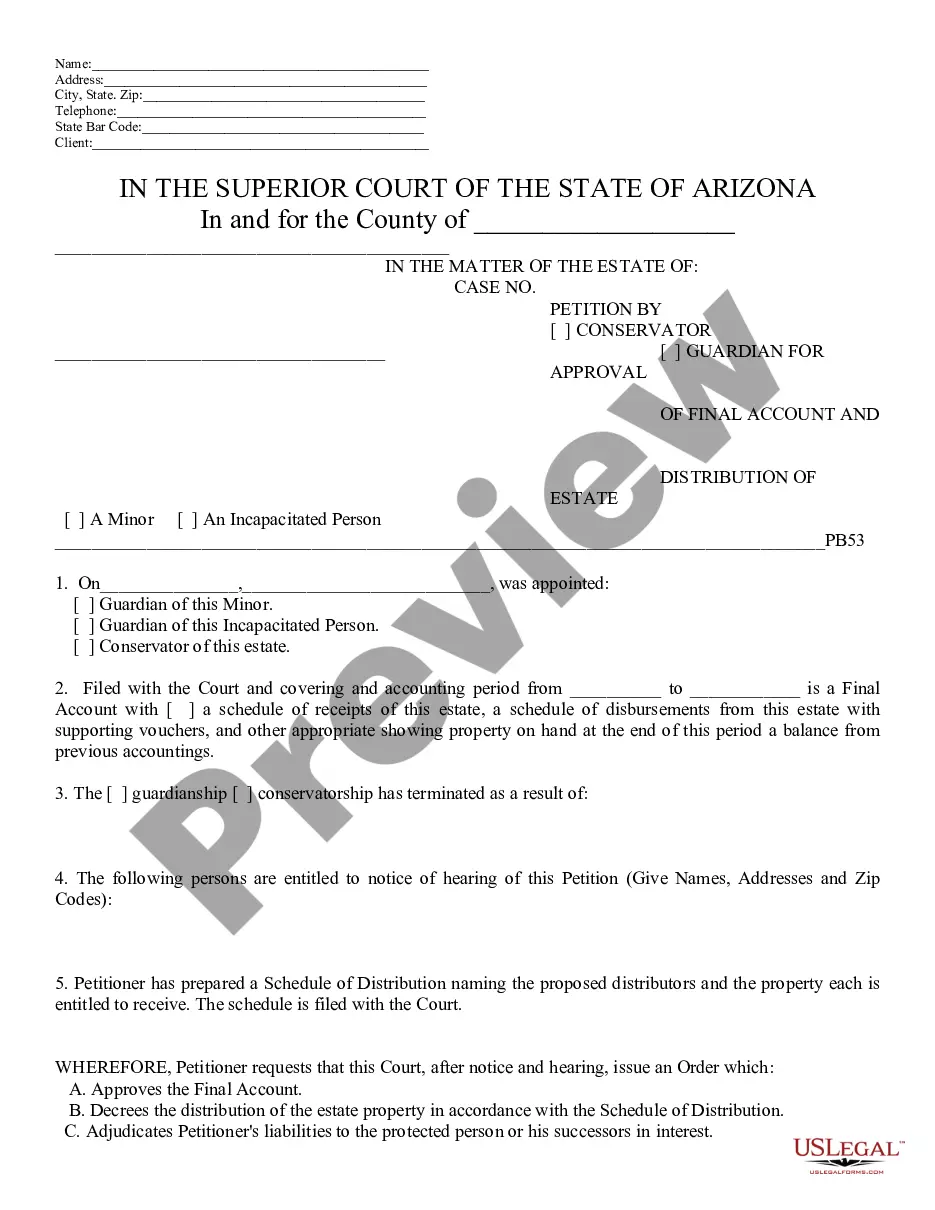

This model form, a Petition by Cons./Guard for Approval of Final Acct. Dist. of Estate - Arizona, is intended for use to initiate a request to the court to take the stated action. The form can be easily completed by filling in the blanks and/or adapted to fit your specific facts and circumstances. Available in for download now, in standard format(s).

The Lima Arizona Petition by Conservator or Guardian for Approval of Final Accounting and Distribution of Estate is a legal document filed in the state of Arizona. It is specifically used by conservators or guardians to seek approval for the final accounting and distribution of the estate they have been appointed to manage. This petition is usually filed in the probate court and serves as a formal request to the court to review and approve the conservator or guardian's financial records and detailed account of all transactions related to the estate. It is an essential step in the process of settling and distributing the assets and debts of the deceased individual. The Lima Arizona Petition by Conservator or Guardian for Approval of Final Accounting and Distribution of Estate ensures transparency and accountability in the management of the estate. It allows the court to evaluate the conservator or guardian's actions, ensuring they have fulfilled their fiduciary duties and acted in the best interest of the estate and its beneficiaries. Key elements typically included in the petition are: 1. The identity of the conservator or guardian filing the petition, including their contact information and relationship to the estate. 2. A detailed inventory of all assets and liabilities held within the estate, including real estate, financial accounts, personal property, outstanding debts, and any other relevant information. 3. A comprehensive account of all income received and expenses incurred during the period of the conservatorship or guardianship. 4. A summary of any significant transactions made on behalf of the estate, such as the sale of property or investments. 5. Documentation of any claims, disputes, or legal actions related to the estate. 6. Supporting documents, such as bank statements, receipts, invoices, and account statements, to validate the financial records provided. 7. A proposed distribution plan that outlines how the remaining assets in the estate should be divided among the beneficiaries or heirs, according to the applicable laws or the terms of a will or trust. Different types of Lima Arizona Petition by Conservator or Guardian for Approval of Final Accounting and Distribution of Estate may exist depending on the specific circumstances or complexities involved. For instance, variations may include specific petitions for estates with high-value assets, estates with significant debts, or estates subject to potential disputes among interested parties. In conclusion, the Lima Arizona Petition by Conservator or Guardian for Approval of Final Accounting and Distribution of Estate is a critical legal document that allows conservators or guardians to seek court approval for the final accounting and distribution of an estate they are responsible for managing. It ensures transparency, accountability, and fair distribution of assets, providing a safeguard for the interests of the estate's beneficiaries.The Lima Arizona Petition by Conservator or Guardian for Approval of Final Accounting and Distribution of Estate is a legal document filed in the state of Arizona. It is specifically used by conservators or guardians to seek approval for the final accounting and distribution of the estate they have been appointed to manage. This petition is usually filed in the probate court and serves as a formal request to the court to review and approve the conservator or guardian's financial records and detailed account of all transactions related to the estate. It is an essential step in the process of settling and distributing the assets and debts of the deceased individual. The Lima Arizona Petition by Conservator or Guardian for Approval of Final Accounting and Distribution of Estate ensures transparency and accountability in the management of the estate. It allows the court to evaluate the conservator or guardian's actions, ensuring they have fulfilled their fiduciary duties and acted in the best interest of the estate and its beneficiaries. Key elements typically included in the petition are: 1. The identity of the conservator or guardian filing the petition, including their contact information and relationship to the estate. 2. A detailed inventory of all assets and liabilities held within the estate, including real estate, financial accounts, personal property, outstanding debts, and any other relevant information. 3. A comprehensive account of all income received and expenses incurred during the period of the conservatorship or guardianship. 4. A summary of any significant transactions made on behalf of the estate, such as the sale of property or investments. 5. Documentation of any claims, disputes, or legal actions related to the estate. 6. Supporting documents, such as bank statements, receipts, invoices, and account statements, to validate the financial records provided. 7. A proposed distribution plan that outlines how the remaining assets in the estate should be divided among the beneficiaries or heirs, according to the applicable laws or the terms of a will or trust. Different types of Lima Arizona Petition by Conservator or Guardian for Approval of Final Accounting and Distribution of Estate may exist depending on the specific circumstances or complexities involved. For instance, variations may include specific petitions for estates with high-value assets, estates with significant debts, or estates subject to potential disputes among interested parties. In conclusion, the Lima Arizona Petition by Conservator or Guardian for Approval of Final Accounting and Distribution of Estate is a critical legal document that allows conservators or guardians to seek court approval for the final accounting and distribution of an estate they are responsible for managing. It ensures transparency, accountability, and fair distribution of assets, providing a safeguard for the interests of the estate's beneficiaries.