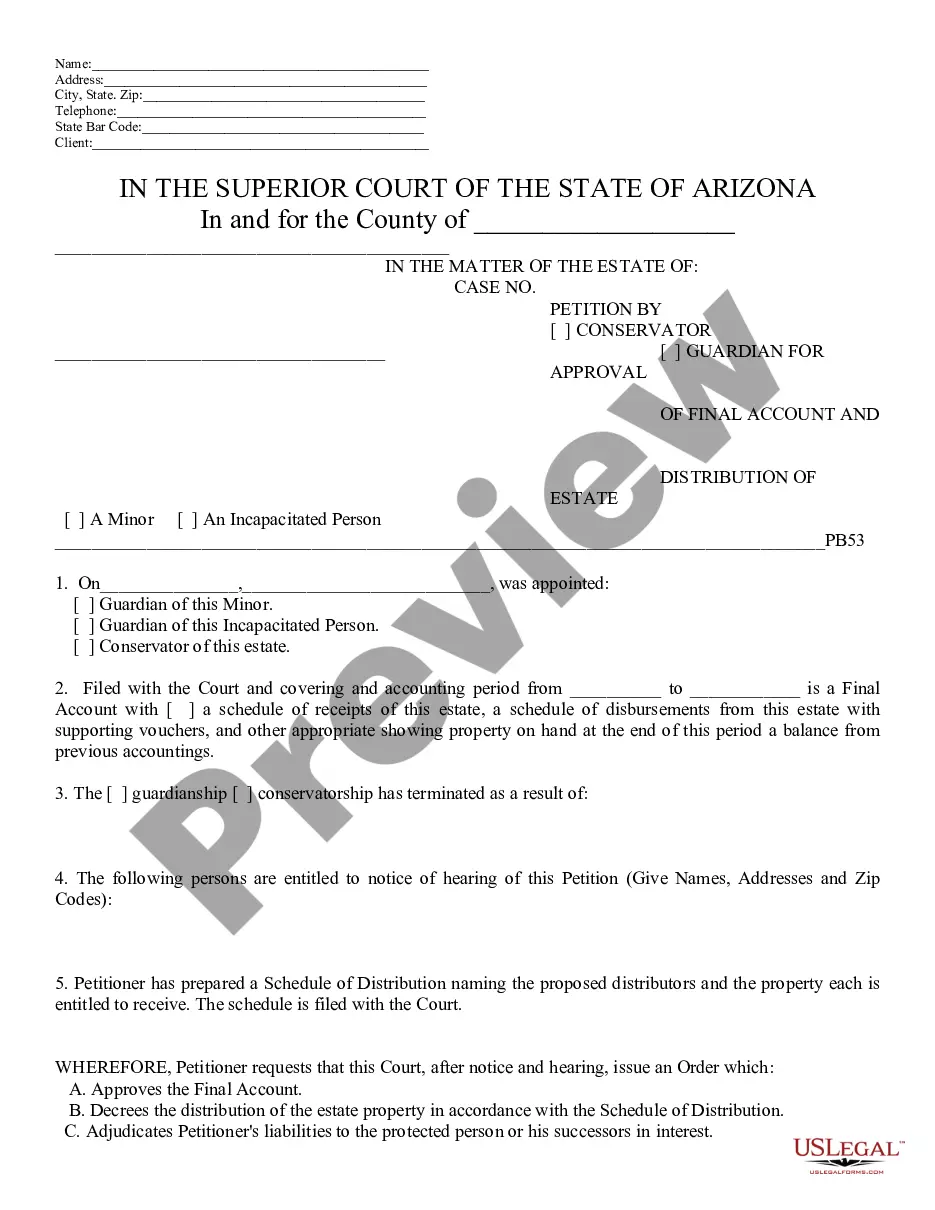

This model form, a Petition by Cons./Guard for Approval of Final Acct. Dist. of Estate - Arizona, is intended for use to initiate a request to the court to take the stated action. The form can be easily completed by filling in the blanks and/or adapted to fit your specific facts and circumstances. Available in for download now, in standard format(s).

Description: The Surprise Arizona Petition by Conservator or Guardian for Approval of Final Accounting and Distribution of Estate is a legal document that is filed by a conservator or guardian to seek court approval for the final accounting and distribution of the estate under their care. This petition ensures that all assets and liabilities of the estate are accounted for and properly distributed to the designated beneficiaries or heirs. In Surprise, Arizona, there are different types of petitions that can be filed by a conservator or guardian for the approval of final accounting and distribution of estate. These petitions may vary based on the specific circumstances of the case. Some common types of petitions under this category include: 1. Petition for Approval of Final Accounting: This type of petition is filed when the conservator or guardian has completed their duties of managing the estate and wishes to present a final accounting of all assets, income, expenses, and transactions conducted during their tenure. The petition requests the court to approve this final accounting and distribution plan. 2. Petition for Distribution of Estate Assets: In cases where the conservator or guardian has already completed the final accounting and seeks approval for the distribution of the estate assets, this petition is filed. It provides a detailed breakdown of the assets and their intended distribution among the beneficiaries or heirs as per the estate plan or court orders. 3. Petition for Distribution of Estate Proceeds: This type of petition is filed when the conservator or guardian needs to distribute the proceeds from the sale of estate assets, such as real estate or investments. The petition outlines the specific proceeds involved, their source, and the proposed plan for distributing the funds to the beneficiaries or heirs. 4. Petition for Distribution of Personal Property: If the estate includes personal property, such as furniture, jewelry, or collectibles, this specific petition is filed to request court approval for the fair distribution of these items. It may include an attached inventory listing the items and their proposed distribution among the designated recipients. Regardless of the specific type of petition, it is essential for the conservator or guardian to provide a comprehensive and accurate final accounting of the estate, along with a well-structured plan for distribution. The court will review the petition, assess its compliance with legal requirements, and approve the final accounting and distribution if deemed appropriate. Keywords: Surprise Arizona, petition, conservator, guardian, approval, final accounting, distribution, estate, assets, liabilities, beneficiaries, heirs, court.Description: The Surprise Arizona Petition by Conservator or Guardian for Approval of Final Accounting and Distribution of Estate is a legal document that is filed by a conservator or guardian to seek court approval for the final accounting and distribution of the estate under their care. This petition ensures that all assets and liabilities of the estate are accounted for and properly distributed to the designated beneficiaries or heirs. In Surprise, Arizona, there are different types of petitions that can be filed by a conservator or guardian for the approval of final accounting and distribution of estate. These petitions may vary based on the specific circumstances of the case. Some common types of petitions under this category include: 1. Petition for Approval of Final Accounting: This type of petition is filed when the conservator or guardian has completed their duties of managing the estate and wishes to present a final accounting of all assets, income, expenses, and transactions conducted during their tenure. The petition requests the court to approve this final accounting and distribution plan. 2. Petition for Distribution of Estate Assets: In cases where the conservator or guardian has already completed the final accounting and seeks approval for the distribution of the estate assets, this petition is filed. It provides a detailed breakdown of the assets and their intended distribution among the beneficiaries or heirs as per the estate plan or court orders. 3. Petition for Distribution of Estate Proceeds: This type of petition is filed when the conservator or guardian needs to distribute the proceeds from the sale of estate assets, such as real estate or investments. The petition outlines the specific proceeds involved, their source, and the proposed plan for distributing the funds to the beneficiaries or heirs. 4. Petition for Distribution of Personal Property: If the estate includes personal property, such as furniture, jewelry, or collectibles, this specific petition is filed to request court approval for the fair distribution of these items. It may include an attached inventory listing the items and their proposed distribution among the designated recipients. Regardless of the specific type of petition, it is essential for the conservator or guardian to provide a comprehensive and accurate final accounting of the estate, along with a well-structured plan for distribution. The court will review the petition, assess its compliance with legal requirements, and approve the final accounting and distribution if deemed appropriate. Keywords: Surprise Arizona, petition, conservator, guardian, approval, final accounting, distribution, estate, assets, liabilities, beneficiaries, heirs, court.