This form lists all required forms for Transfer of Real Property of a Decedent. This is an official form from the Arizona Court System, which complies with all applicable laws and statutes. USLF amends and updates forms as is required by Arizona statutes and law.

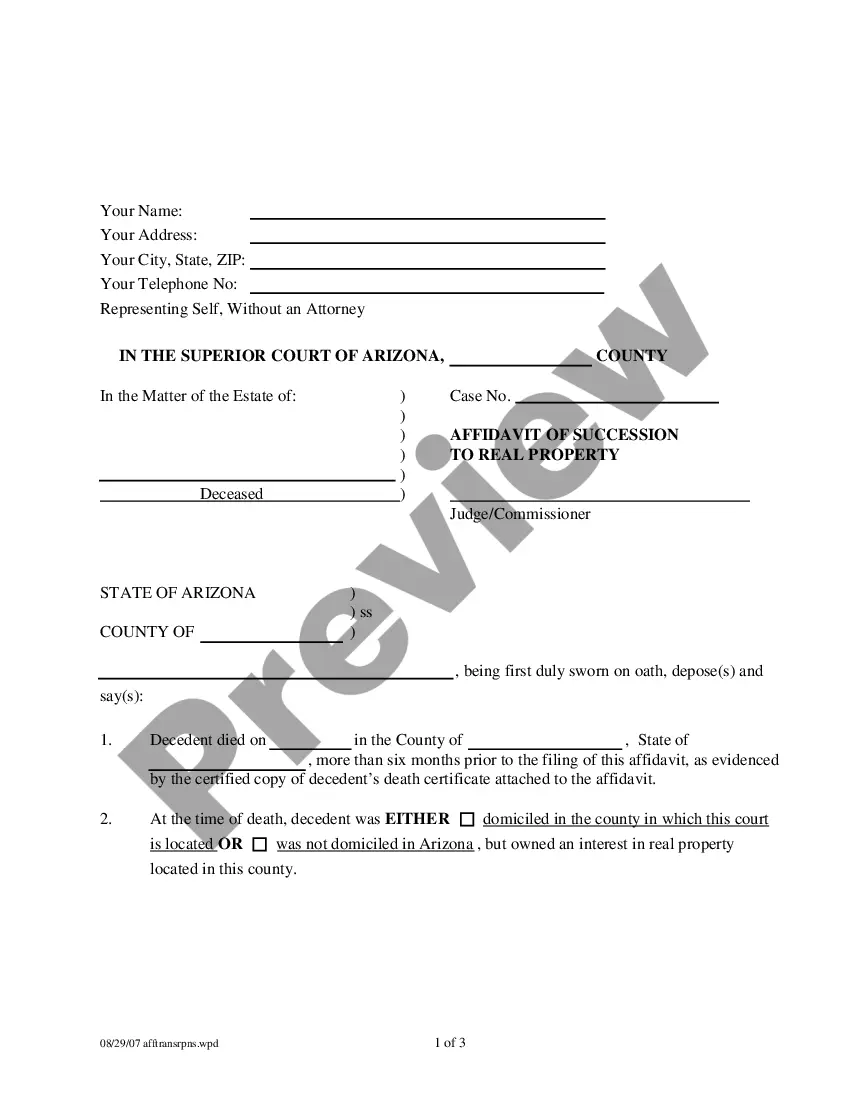

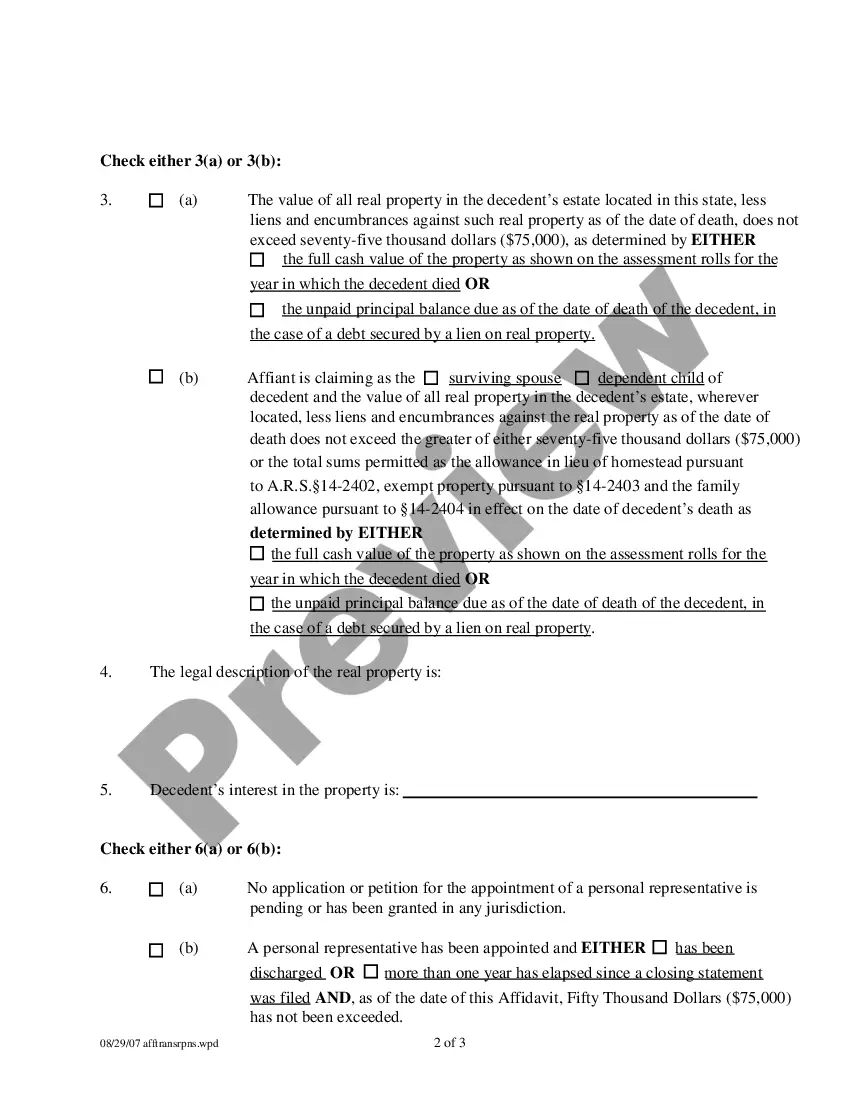

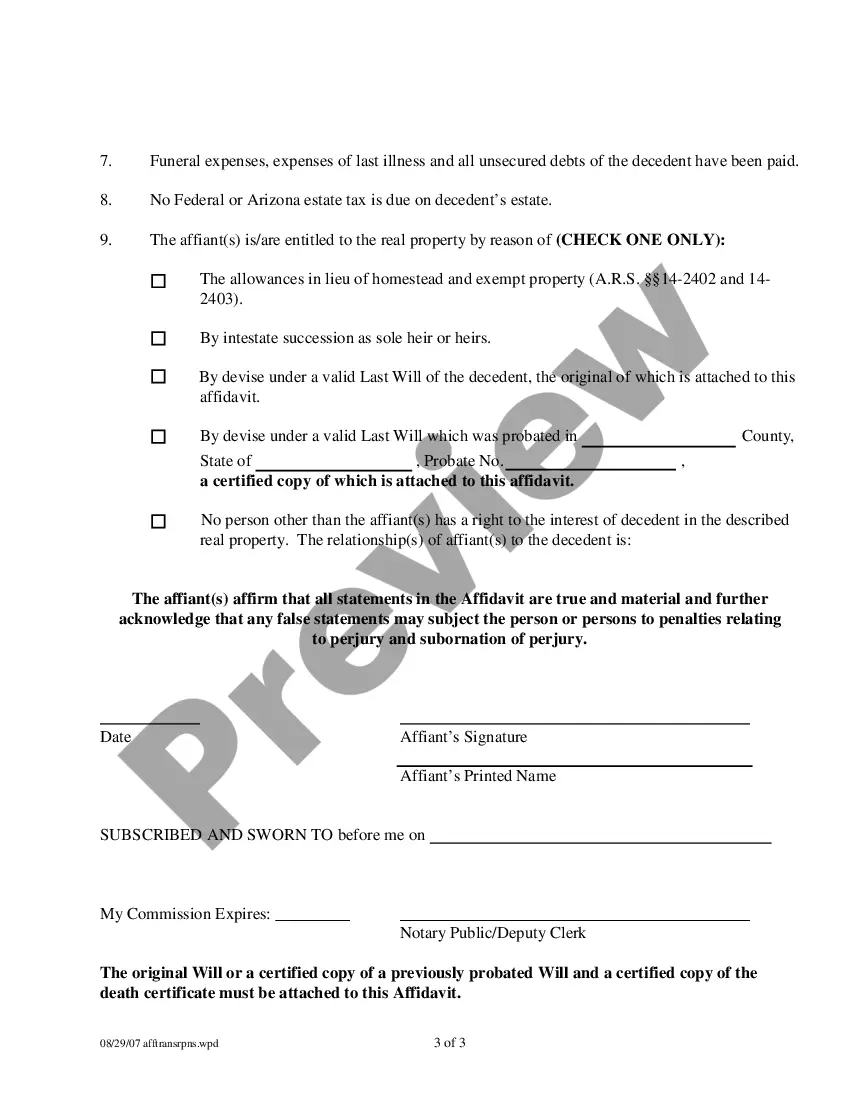

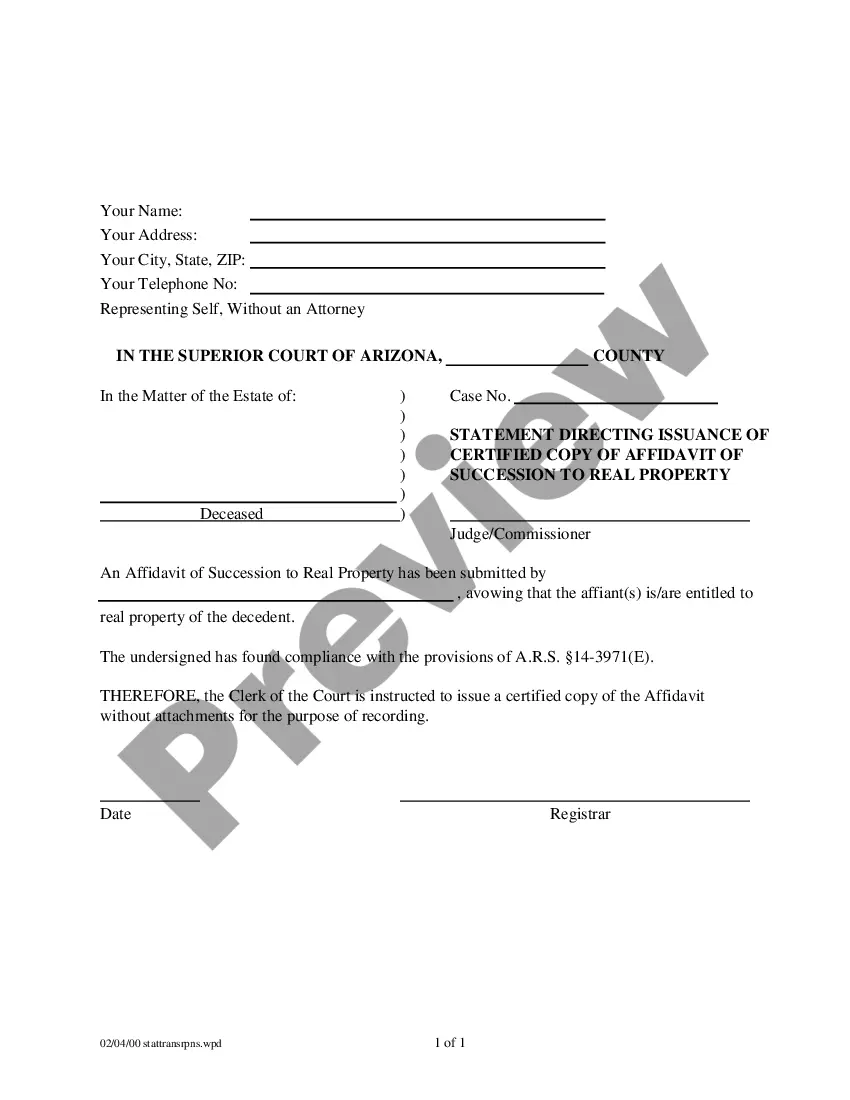

The Phoenix Arizona Required Forms for Transfer of Real Property of a Decedent — No Right of Survivorship refer to the necessary documentation needed when transferring the ownership of real estate from a deceased individual to their heirs or beneficiaries. This specific form is applicable when the property does not have a right of survivorship, which means that it does not automatically transfer to a co-owner upon the death of one of the owners. To ensure a smooth transfer of real property, several crucial forms must be completed accurately. The primary form required is the Affidavit of Succession to Real Property, which is used to establish the legal authority of the successor(s) to inherit and manage the decedent's real estate. This form should contain the decedent's name, date of death, description of the property being transferred, and the names and addresses of the successors. Another essential form is the Transfer on Death Deed, also known as a beneficiary deed, which allows the transfer of real property upon the owner's death without the need for probate. This document designates a beneficiary who will inherit the property, granted that they survive the owner. It is crucial to have this document properly executed, notarized, and recorded with the county recorder's office. Additionally, it may be necessary to provide a Certified Copy of the Death Certificate, which serves as official proof of the decedent's passing. This document is typically required by financial institutions, title companies, and government agencies to proceed with the property transfer. To ensure compliance with Arizona law, it is recommended to consult with an attorney or a qualified professional experienced in probate and real estate matters. They can guide and assist in completing the appropriate forms accurately and timely, streamlining the transfer process and avoiding potential errors or delays. Remember, the specific required forms and documentation may vary depending on the unique circumstances of the decedent's estate and the property involved. It is crucial to research and consult with relevant authorities or legal professionals to ensure the correct forms are utilized.

The Phoenix Arizona Required Forms for Transfer of Real Property of a Decedent — No Right of Survivorship refer to the necessary documentation needed when transferring the ownership of real estate from a deceased individual to their heirs or beneficiaries. This specific form is applicable when the property does not have a right of survivorship, which means that it does not automatically transfer to a co-owner upon the death of one of the owners. To ensure a smooth transfer of real property, several crucial forms must be completed accurately. The primary form required is the Affidavit of Succession to Real Property, which is used to establish the legal authority of the successor(s) to inherit and manage the decedent's real estate. This form should contain the decedent's name, date of death, description of the property being transferred, and the names and addresses of the successors. Another essential form is the Transfer on Death Deed, also known as a beneficiary deed, which allows the transfer of real property upon the owner's death without the need for probate. This document designates a beneficiary who will inherit the property, granted that they survive the owner. It is crucial to have this document properly executed, notarized, and recorded with the county recorder's office. Additionally, it may be necessary to provide a Certified Copy of the Death Certificate, which serves as official proof of the decedent's passing. This document is typically required by financial institutions, title companies, and government agencies to proceed with the property transfer. To ensure compliance with Arizona law, it is recommended to consult with an attorney or a qualified professional experienced in probate and real estate matters. They can guide and assist in completing the appropriate forms accurately and timely, streamlining the transfer process and avoiding potential errors or delays. Remember, the specific required forms and documentation may vary depending on the unique circumstances of the decedent's estate and the property involved. It is crucial to research and consult with relevant authorities or legal professionals to ensure the correct forms are utilized.