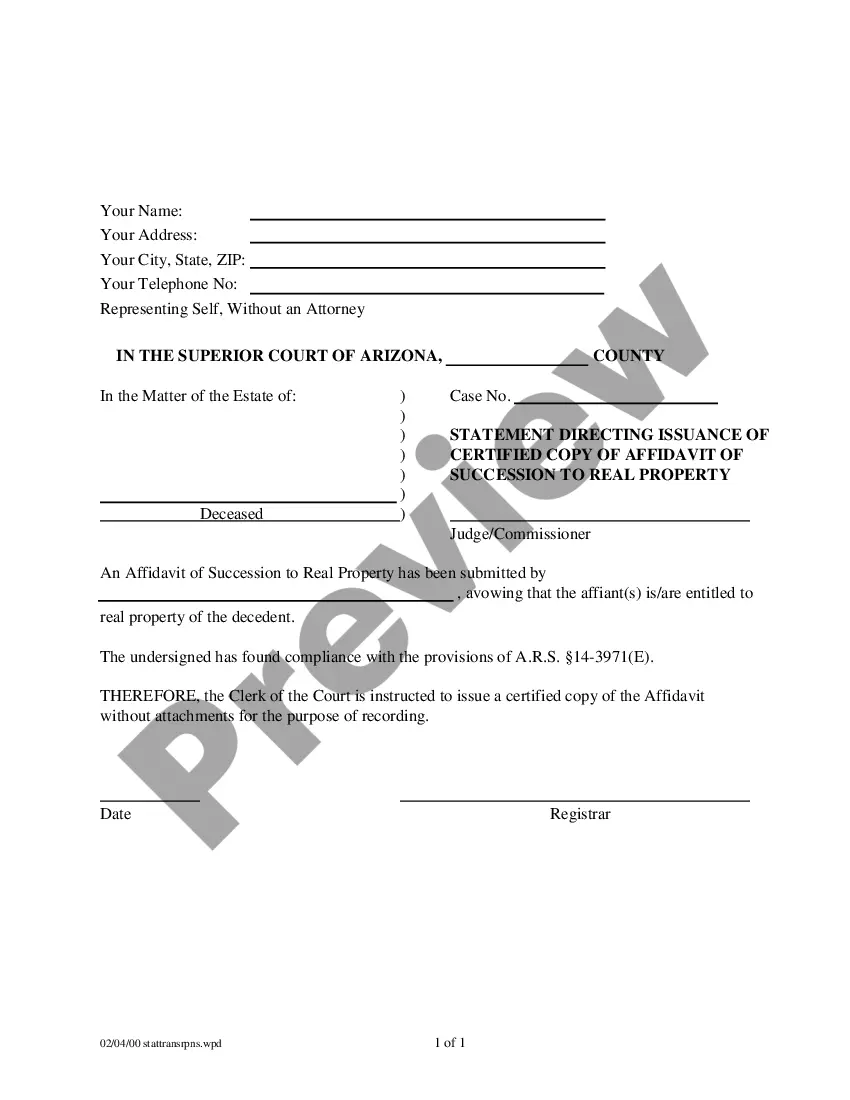

This form lists all required forms for Transfer of Real Property of a Decedent. This is an official form from the Arizona Court System, which complies with all applicable laws and statutes. USLF amends and updates forms as is required by Arizona statutes and law.

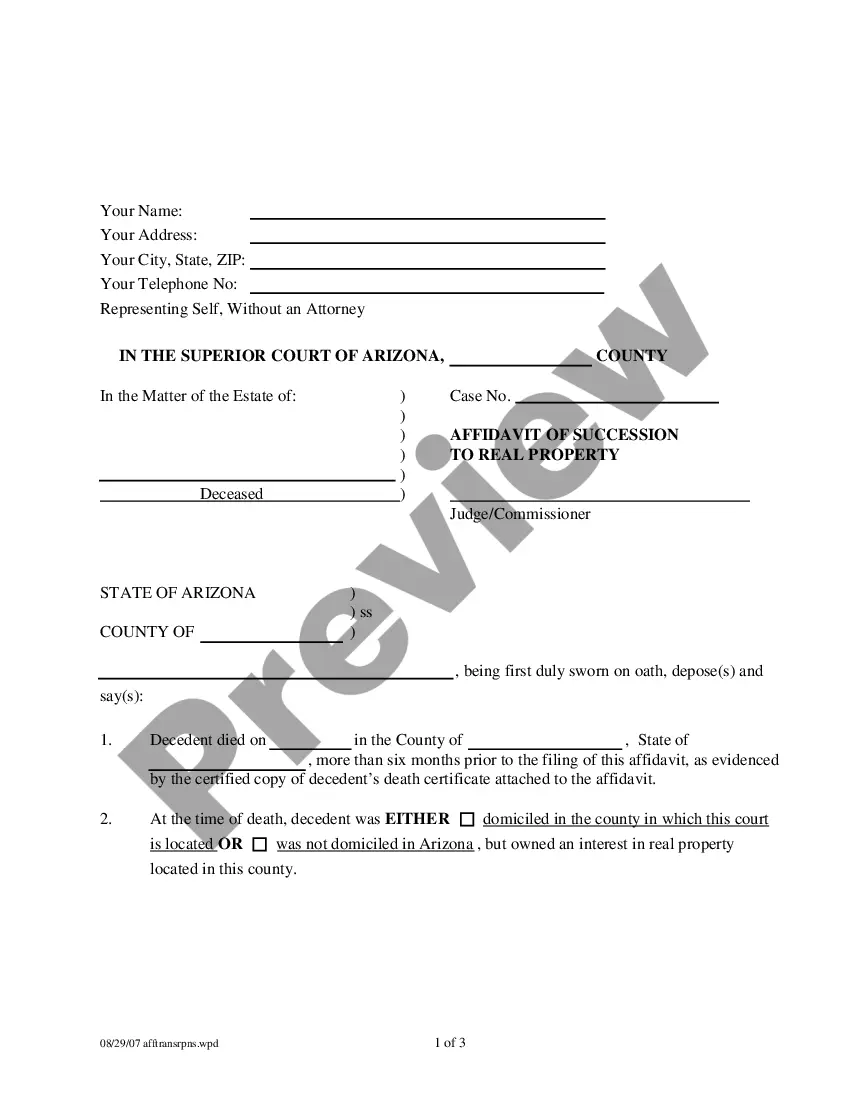

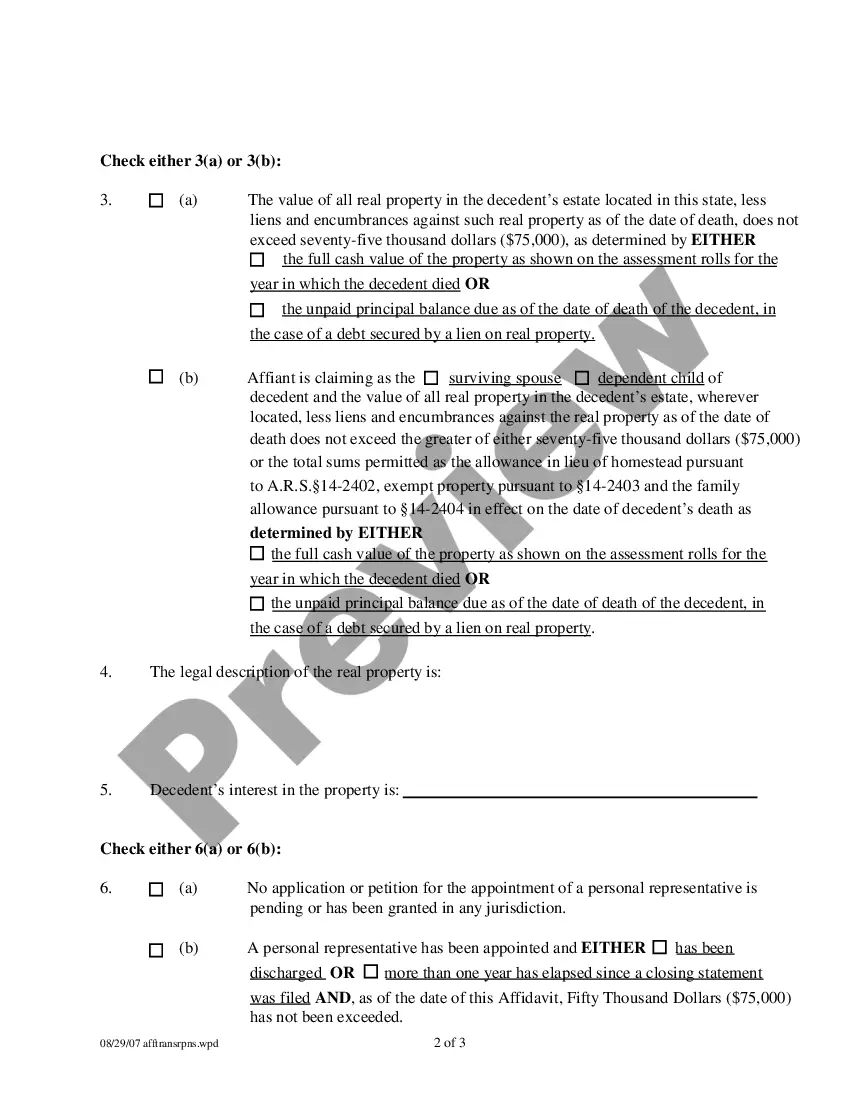

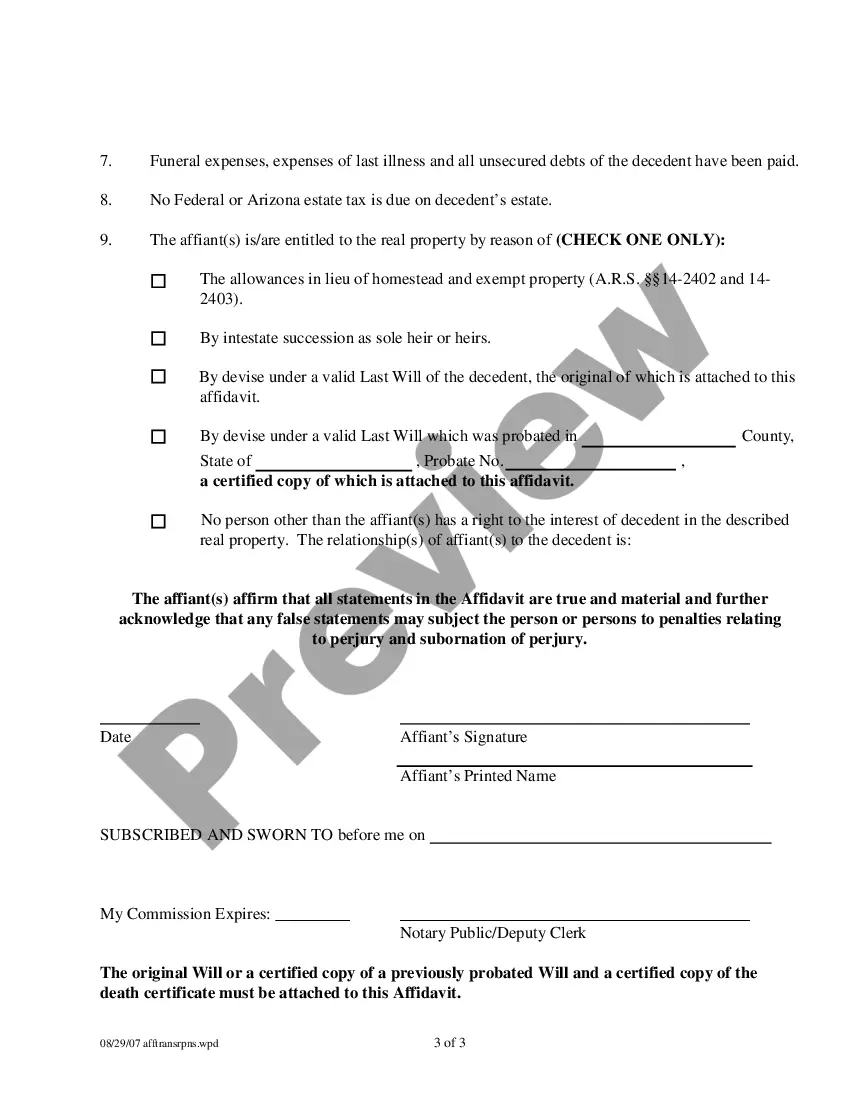

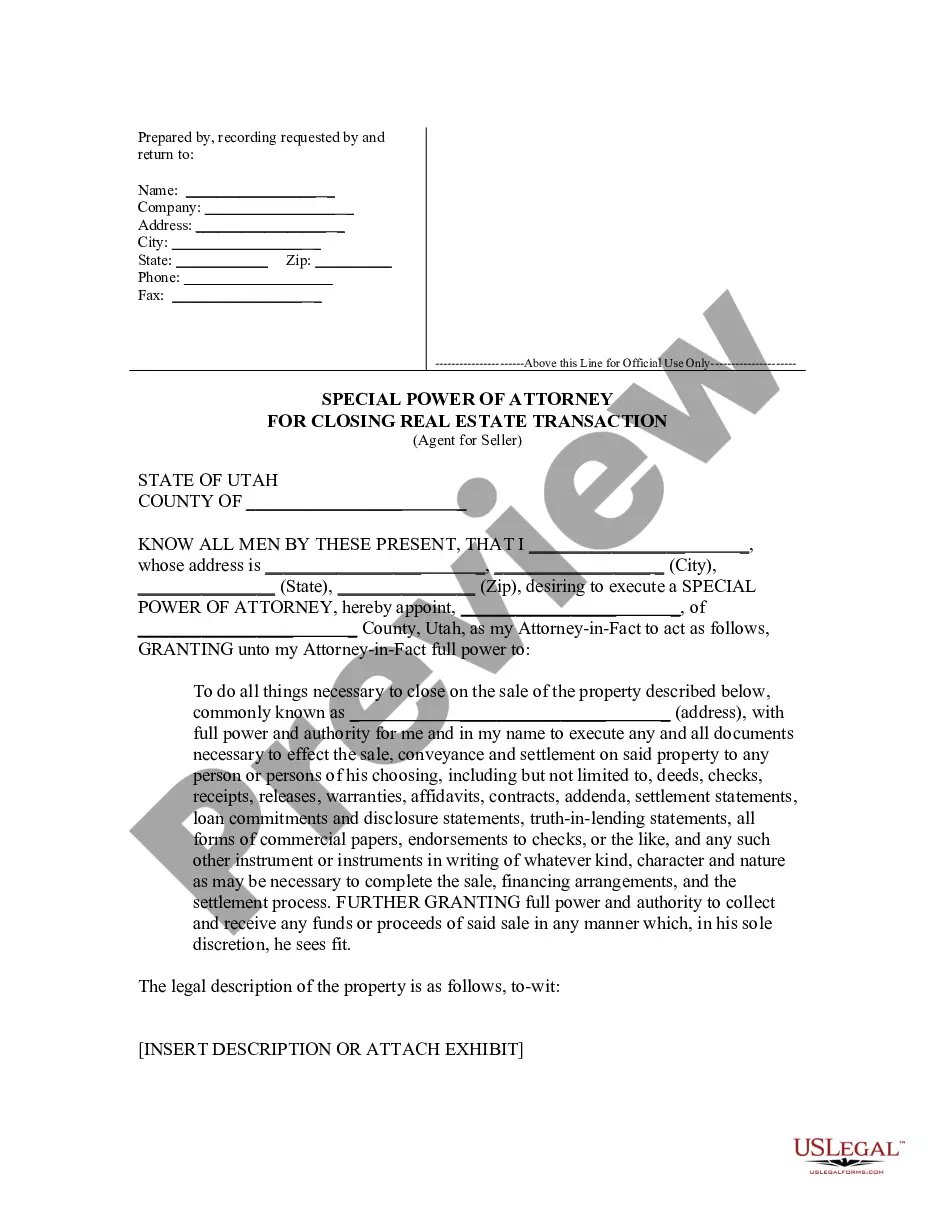

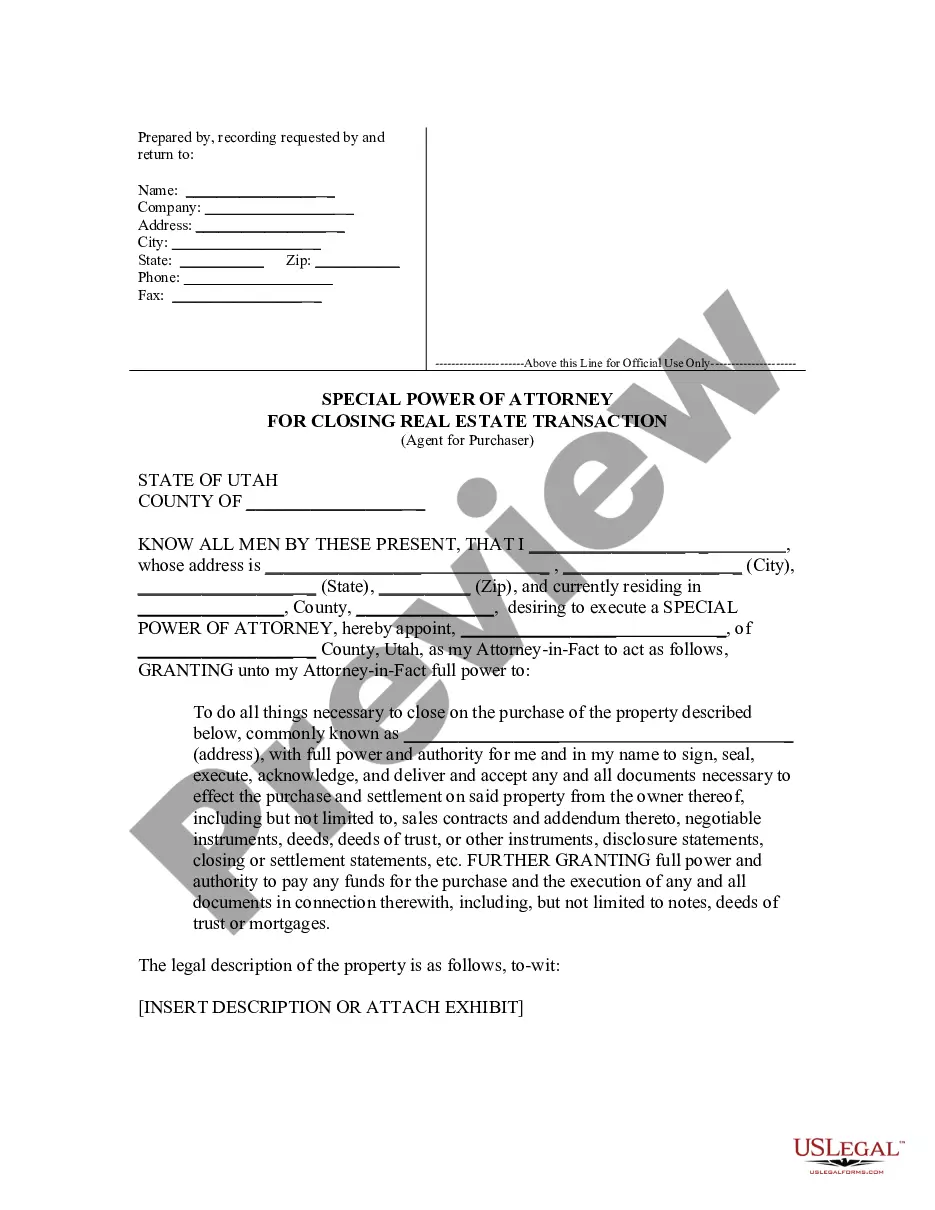

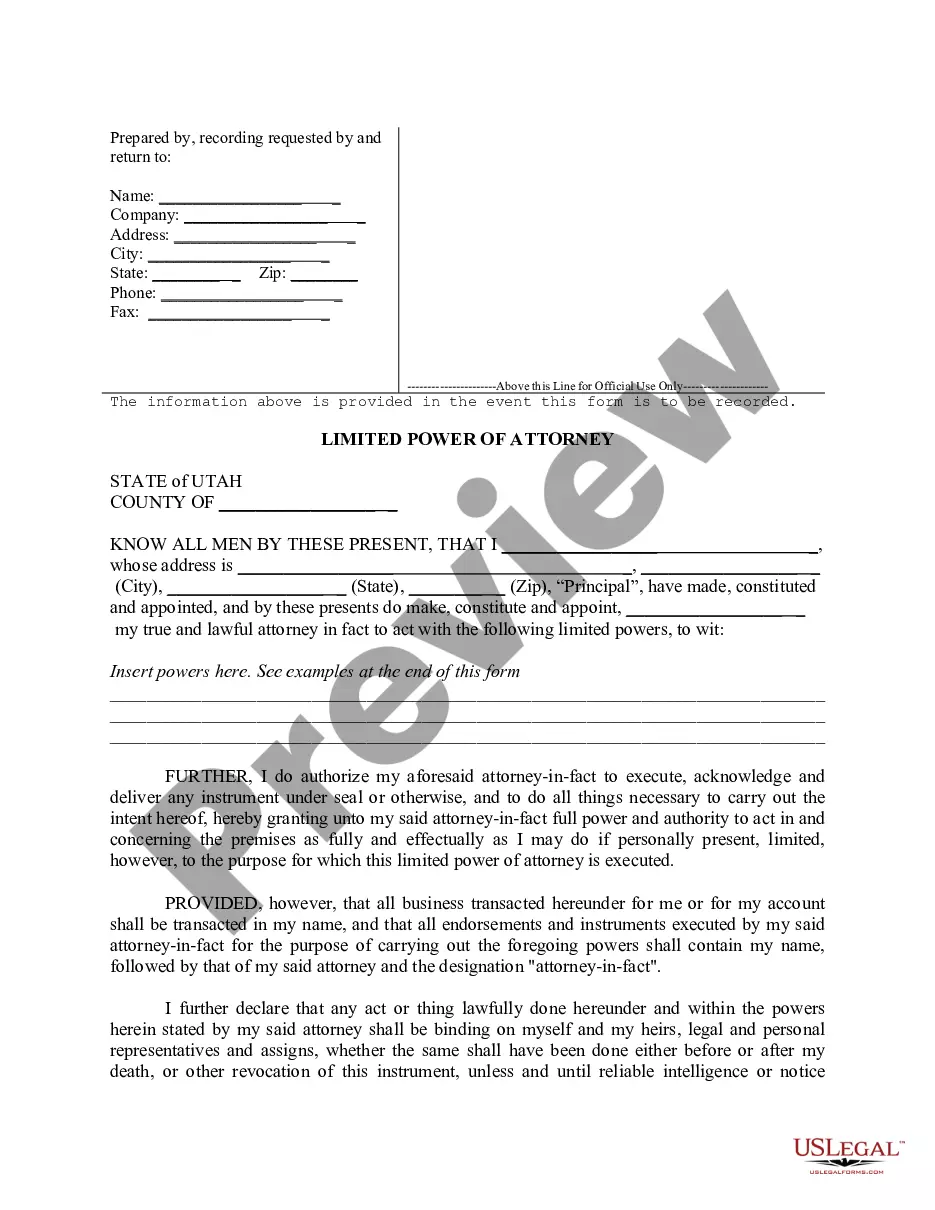

When it comes to transferring real property of a decedent in Scottsdale, Arizona, the process involves certain forms that need to be completed and submitted. These forms are crucial for legally transferring the ownership rights from the deceased individual to the designated beneficiaries or heirs. In cases where there is no right of survivorship, the following Scottsdale Arizona Required Forms for Transfer of Real Property of a Decedent — No Right of Survivorship are typically used: 1. Affidavit of Successor Trustee: This form is necessary when the decedent's real property is held in a trust. The successor trustee must complete this form, providing details about the trust, their appointment as the successor trustee, and their authority to transfer the property to the designated beneficiaries. 2. Affidavit of Warship: When there is no valid will or trust governing the transfer of the decedent's real property, an affidavit of warship is often used. This form requires the identification of all potential heirs and their respective shares in the property. It is essential to provide accurate and complete information to avoid any disputes in the future. 3. Estate Tax Waiver: In some cases, an estate tax waiver (also known as an inheritance tax waiver) is required for the transfer of real property. This form confirms that the estate of the decedent has no outstanding tax liabilities, ensuring a clean transfer of ownership. It may need to be obtained from the Arizona Department of Revenue or the Internal Revenue Service, depending on the specific circumstances. 4. Deed of Distribution: This form serves as the instrument to officially transfer the ownership rights of the real property from the decedent to the designated beneficiaries or heirs. It must be properly executed, notarized, and recorded with the appropriate county recorder's office to establish legal ownership. 5. Preliminary Change of Ownership Report (POOR): The POOR form is required by the county assessor's office in Scottsdale, Arizona, to record any changes in ownership. This form provides important information about the transfer of real property, including the purchase price or value, exemptions, and any other relevant details. It is important to note that the specific forms required for the transfer of real property of a decedent in Scottsdale, Arizona, may vary depending on the circumstances. Consulting with an attorney or a knowledgeable professional experienced in estate planning and probate matters is highly recommended ensuring compliance with all necessary legal requirements and to navigate the transfer process smoothly.When it comes to transferring real property of a decedent in Scottsdale, Arizona, the process involves certain forms that need to be completed and submitted. These forms are crucial for legally transferring the ownership rights from the deceased individual to the designated beneficiaries or heirs. In cases where there is no right of survivorship, the following Scottsdale Arizona Required Forms for Transfer of Real Property of a Decedent — No Right of Survivorship are typically used: 1. Affidavit of Successor Trustee: This form is necessary when the decedent's real property is held in a trust. The successor trustee must complete this form, providing details about the trust, their appointment as the successor trustee, and their authority to transfer the property to the designated beneficiaries. 2. Affidavit of Warship: When there is no valid will or trust governing the transfer of the decedent's real property, an affidavit of warship is often used. This form requires the identification of all potential heirs and their respective shares in the property. It is essential to provide accurate and complete information to avoid any disputes in the future. 3. Estate Tax Waiver: In some cases, an estate tax waiver (also known as an inheritance tax waiver) is required for the transfer of real property. This form confirms that the estate of the decedent has no outstanding tax liabilities, ensuring a clean transfer of ownership. It may need to be obtained from the Arizona Department of Revenue or the Internal Revenue Service, depending on the specific circumstances. 4. Deed of Distribution: This form serves as the instrument to officially transfer the ownership rights of the real property from the decedent to the designated beneficiaries or heirs. It must be properly executed, notarized, and recorded with the appropriate county recorder's office to establish legal ownership. 5. Preliminary Change of Ownership Report (POOR): The POOR form is required by the county assessor's office in Scottsdale, Arizona, to record any changes in ownership. This form provides important information about the transfer of real property, including the purchase price or value, exemptions, and any other relevant details. It is important to note that the specific forms required for the transfer of real property of a decedent in Scottsdale, Arizona, may vary depending on the circumstances. Consulting with an attorney or a knowledgeable professional experienced in estate planning and probate matters is highly recommended ensuring compliance with all necessary legal requirements and to navigate the transfer process smoothly.