A Notice form provides legal notification to a party of an important aspect of a legal matter. Failure to provide proper notice is often the cause of delays in the progress of lawsuits and other legal matters. This model form, a Notice to Creditors in Probate - Arizona, provides notice of the stated matter. Because each case is unique, you will need to adapt the form to fit your specific facts and circumstances. Available for download now.

Glendale Arizona Notice to Creditors in Probate

Description

How to fill out Arizona Notice To Creditors In Probate?

Regardless of your social or professional position, completing legal paperwork is a regrettable requirement in today's occupational landscape.

Frequently, it’s almost unfeasible for an individual without a legal background to construct such documentation from scratch, primarily due to the intricate terminology and legal subtleties they involve.

This is where US Legal Forms can come to the rescue.

Confirm that the template you have located is appropriate for your area since regulations from one state or county do not apply to another.

Examine the form and read a brief summary (if available) of situations for which the document can be utilized. If the one you selected doesn’t fulfill your requirements, you can begin afresh and search for the proper form.

- Our service offers an extensive collection of over 85,000 ready-to-use state-specific documents applicable to nearly any legal situation.

- US Legal Forms also acts as a valuable resource for associates or legal advisors seeking to optimize their time with our DIY forms.

- Whether you need the Glendale Arizona Notice to Creditors in Probate or any other document that is valid in your jurisdiction, with US Legal Forms, everything is readily available.

- Here’s how to swiftly acquire the Glendale Arizona Notice to Creditors in Probate using our reliable service.

- If you are currently a member, feel free to Log In to your account to download the correct form.

- If you are new to our library, ensure to follow these steps before acquiring the Glendale Arizona Notice to Creditors in Probate.

Form popularity

FAQ

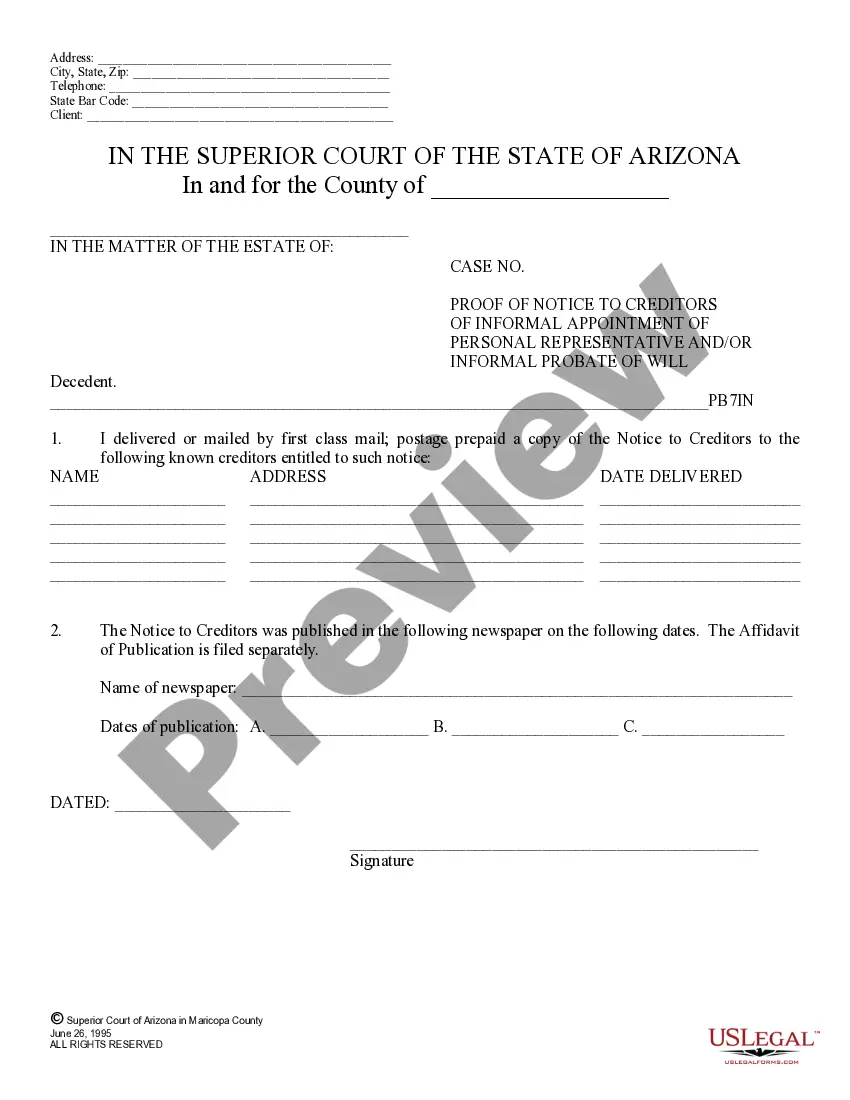

Rule 51 in probate matters in Arizona emphasizes the requirement for creditors to submit their claims against an estate within a specific timeframe. This regulation ensures that after issuing a Glendale Arizona Notice to Creditors in Probate, creditors are given a fair opportunity to present their claims. By adhering to Rule 51, executors can maintain the integrity of the probate process and work towards resolving the estate efficiently. This rule serves as a crucial guideline for managing creditor relations.

In Arizona, an executor typically has a year to settle an estate, although this period can vary based on the complexity of the estate and any potential disputes. During this time, an executor is responsible for addressing all claims, including those highlighted in a Glendale Arizona Notice to Creditors in Probate. By adhering to this timeline, executors can efficiently manage the estate and distribute assets to beneficiaries effectively. Proper organization and understanding of probate rules can greatly aid in this process.

Probate Rule 53 addresses issues related to the filing of objections to a claim against an estate. This rule sets forth the procedures for disputing creditor claims, vital for maintaining a fair probate process. When handling a Glendale Arizona Notice to Creditors in Probate, understanding Rule 53 can assist executors in managing any objections that may arise. Proper compliance ensures a smoother resolution for everyone involved.

Rule 51 in Arizona relates to the rules of civil procedure for probate cases. It details the requirements for filing claims against an estate and specifies the necessary notifications to creditors. This rule is particularly relevant when issuing a Glendale Arizona Notice to Creditors in Probate, ensuring that all parties are informed and can respond appropriately. Familiarity with Rule 51 can help streamline the probate process.

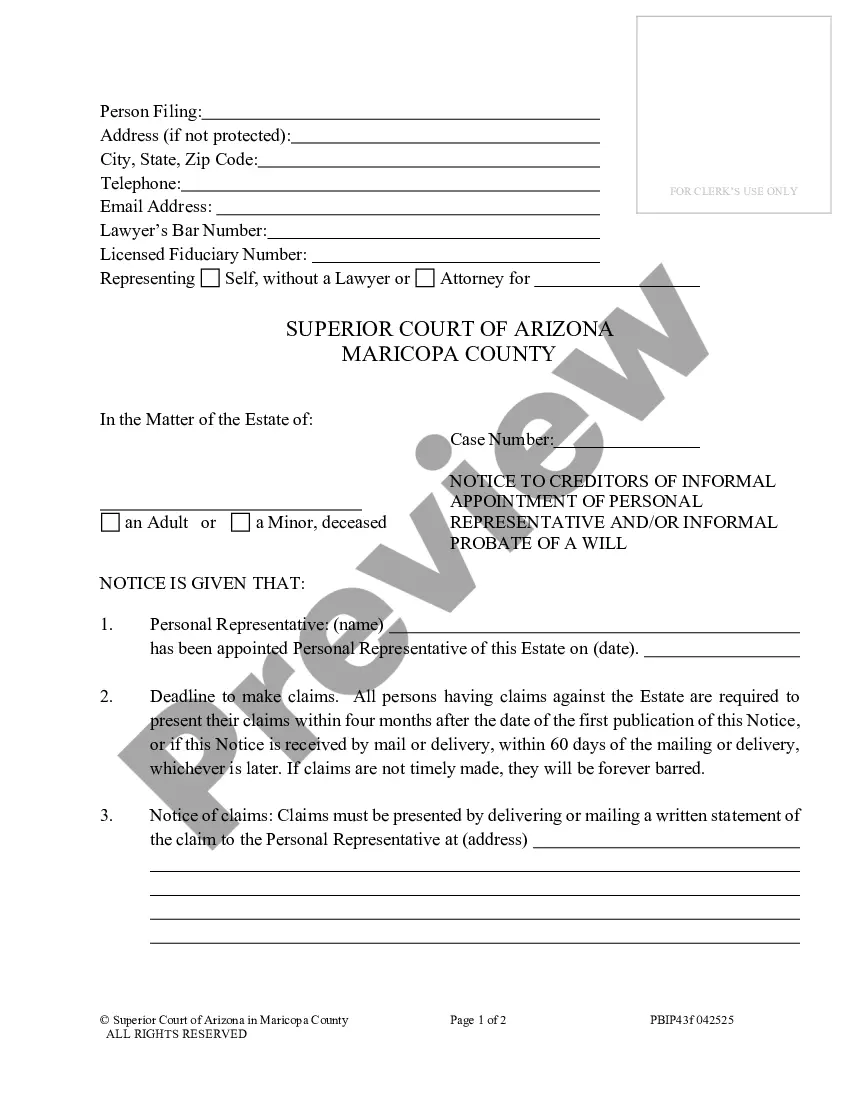

In Arizona, probate rules govern the administration of estates after a person passes away. The rules ensure that the deceased's assets are distributed according to their wishes or state law if no will exists. A key component of this process is the Glendale Arizona Notice to Creditors in Probate, which informs creditors of the estate and allows them to make claims. Understanding these rules is essential for executors and beneficiaries navigating the probate process.

Certain properties are exempt from creditors in Arizona, helping protect the assets of the deceased’s estate. Common exemptions include primary residences, personal belongings, and specific retirement accounts. The Glendale Arizona Notice to Creditors in Probate provides guidance on identifying exempt properties, ensuring that rightful heirs are not unduly burdened. Knowing what is exempt can give peace of mind during the probate process.

In Arizona, the statute of limitations for creditors to make a claim is typically four months after a notice to creditors is published in accordance with the Glendale Arizona Notice to Creditors in Probate. This timeline is crucial for any claimant seeking to recover debts owed by the deceased. If creditors miss this deadline, they may lose their right to collect. Understanding these time frames can help you navigate the probate process more effectively.

Yes, publishing a creditor notice in Arizona probate is necessary. This notice informs creditors of the probate proceedings and allows them to make claims against the estate. Properly publishing this notice is crucial to ensure that all potential claims are addressed before the estate is settled. For an efficient way to handle this matter, you might explore the services offered by USLegalForms, which can assist in managing the Glendale Arizona Notice to Creditors in Probate.

In Arizona, you typically have to open probate within two years after the death of the individual. However, it is advisable to begin the process as soon as possible to avoid complications. If you delay longer than the two-year period, you might face challenges in gathering the deceased's assets. To navigate this process effectively, consider utilizing resources like USLegalForms to ensure that you meet all necessary deadlines regarding the Glendale Arizona Notice to Creditors in Probate.

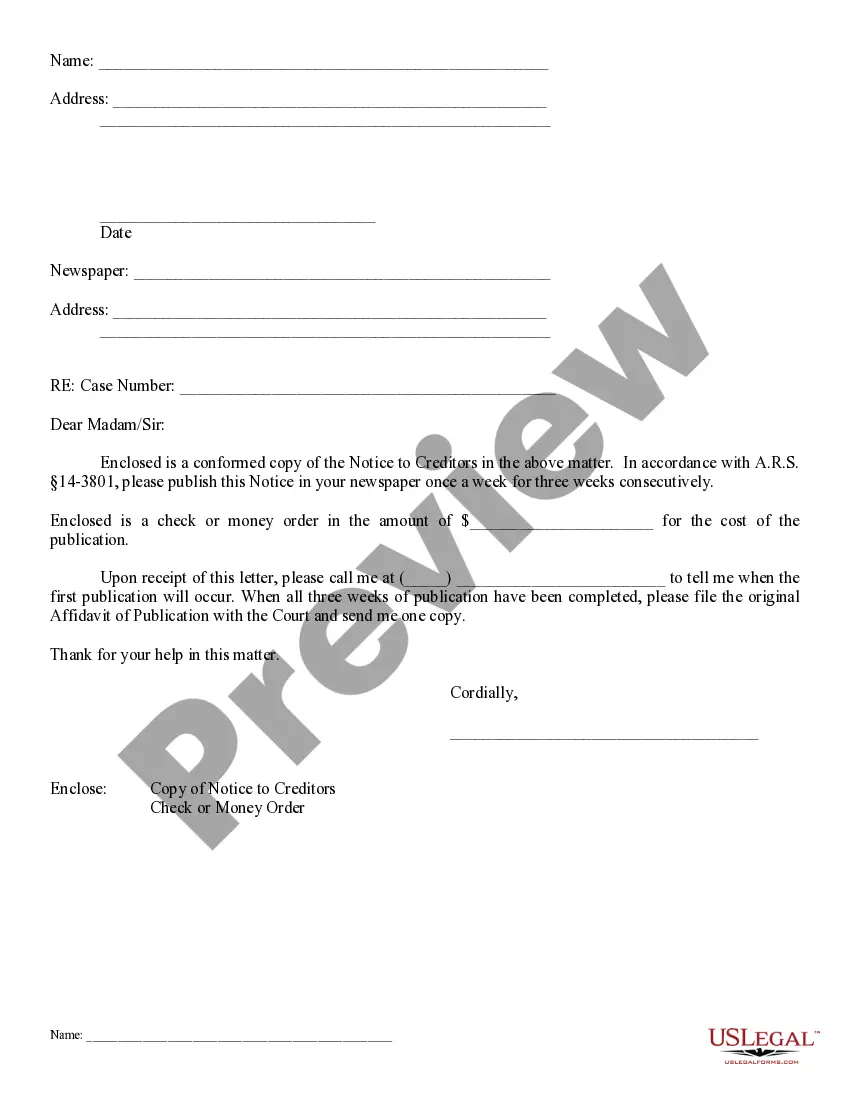

To publish a notice to creditors in Arizona, you must first prepare a formal Glendale Arizona Notice to Creditors in Probate, specifying the details of the estate and the deadlines for filing claims. This notice should then be published in a local newspaper that meets state requirements. Working with a knowledgeable platform like US Legal Forms can streamline this process, ensuring that you meet all legal obligations efficiently.