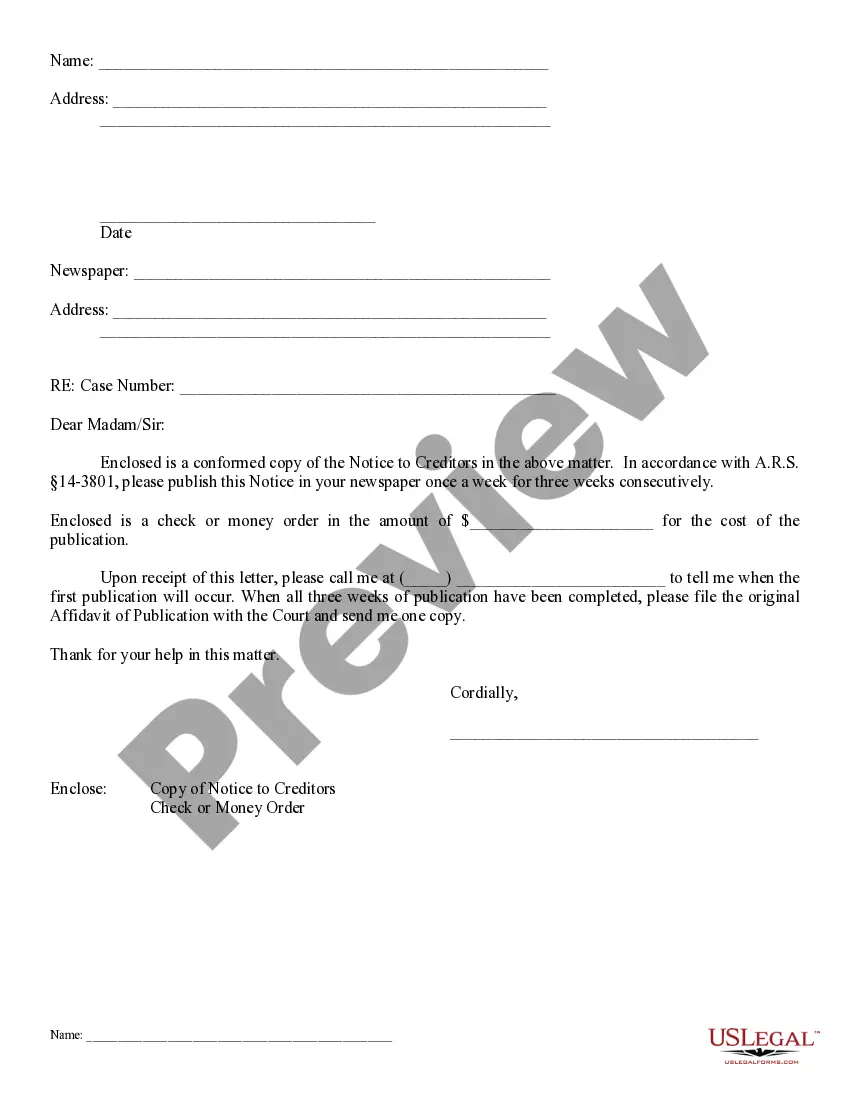

A Notice form provides legal notification to a party of an important aspect of a legal matter. Failure to provide proper notice is often the cause of delays in the progress of lawsuits and other legal matters. This model form, a Notice to Creditors in Probate - Arizona, provides notice of the stated matter. Because each case is unique, you will need to adapt the form to fit your specific facts and circumstances. Available for download now.

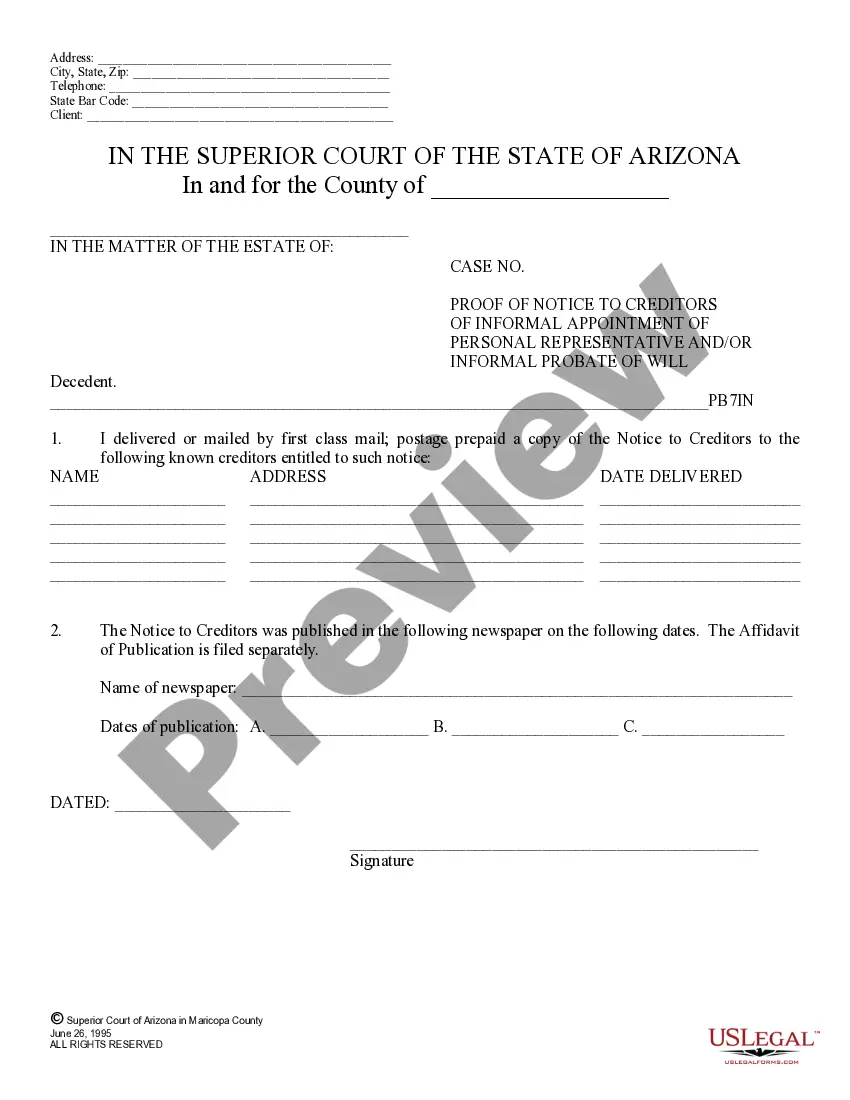

Maricopa Arizona Notice to Creditors in Probate is an important legal document that notifies potential creditors of a deceased person's estate, informing them of their rights to make claims for unpaid debts or obligations against the estate. This notice serves as a crucial step in the probate process, ensuring transparency and fairness for all parties involved. In Maricopa, Arizona, there are two primary types of Notice to Creditors in Probate that can be filed: formal notice and informal notice. It is important to understand the distinction between these two types and their respective requirements. 1. Formal Notice to Creditors in Probate: Formal notice is typically filed by the personal representative or executor appointed to administer the decedent's estate. This notice is published in a local newspaper according to Arizona probate law requirements, ensuring that potential creditors have reasonable access to information about the deceased's estate. The published notice generally provides relevant details such as the name of the decedent, date of death, and the contact information of the personal representative or their legal counsel. Creditors are given a specific time frame, which is usually four months, to present any claims they may have against the estate. 2. Informal Notice to Creditors in Probate: An informal notice is an alternative option available in Maricopa, Arizona. Unlike formal notice, an informal notice does not involve publishing in a newspaper. Instead, the personal representative directly notifies known creditors about the deceased's estate and provides them with the necessary information to file a claim. This type of notice is often simpler and more cost-effective but still ensures creditors have an opportunity to assert their claims within the specified timeframe. The purpose of Maricopa Arizona Notice to Creditors in Probate is to protect the interests of both the deceased person's estate and potential creditors. By notifying creditors of the probate proceedings, it allows them to come forward and assert any legitimate claims they may have. This is crucial for the equitable distribution of the estate's assets and the resolution of outstanding debts or obligations. It is essential for anyone involved in the probate process in Maricopa, Arizona, to fully understand the requirements and implications of the Notice to Creditors in Probate. Seeking guidance from an experienced probate attorney can help ensure compliance with the necessary legal procedures, minimize potential disputes, and facilitate a smoother probate administration.