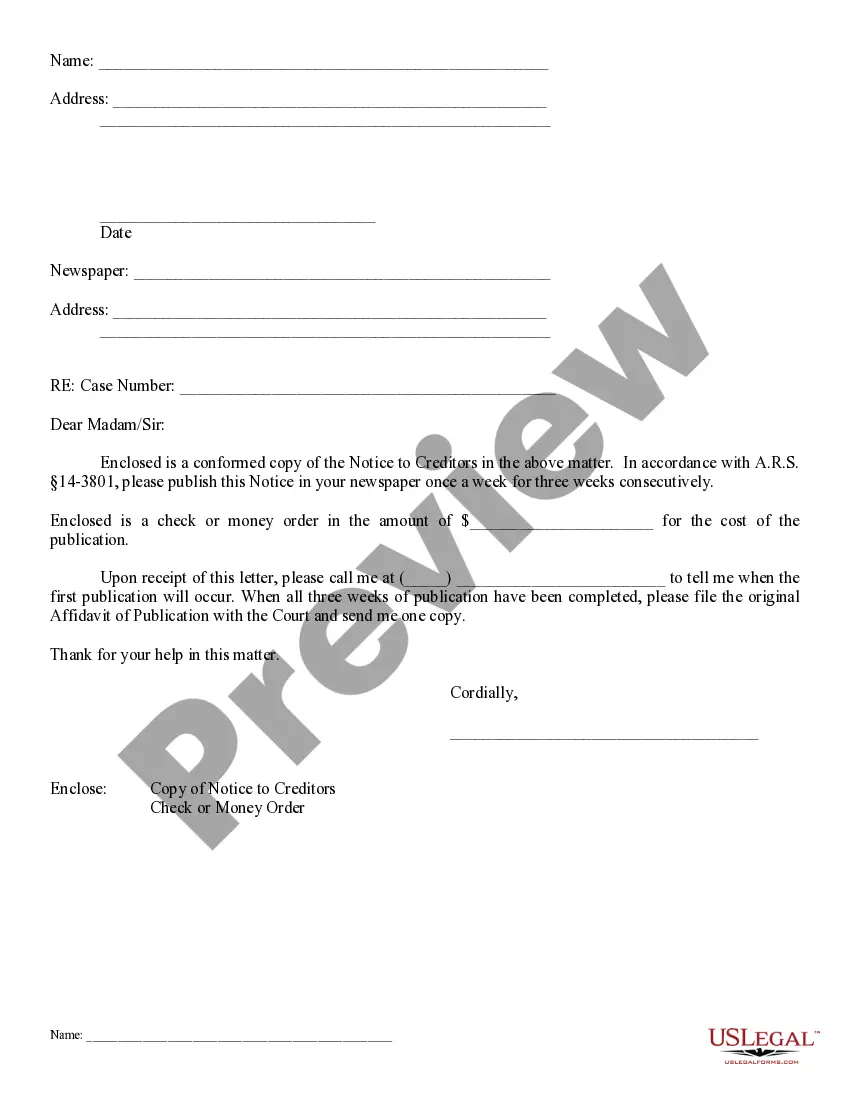

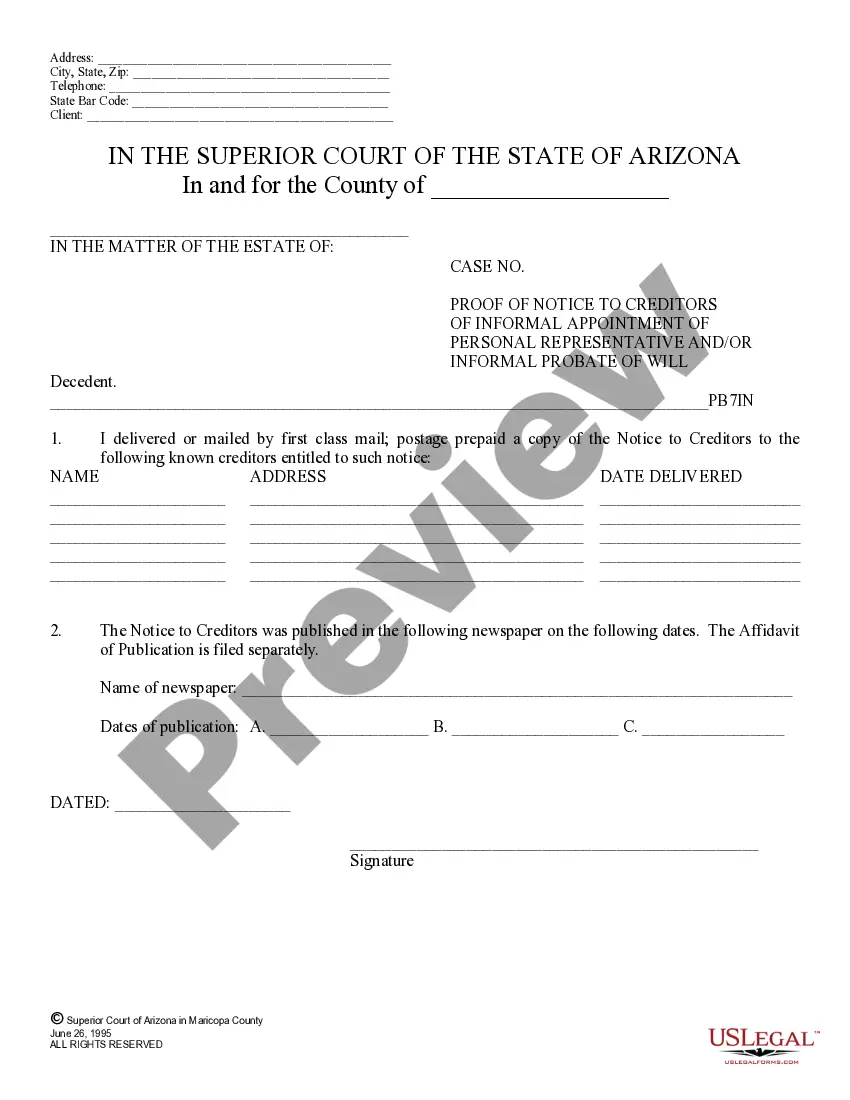

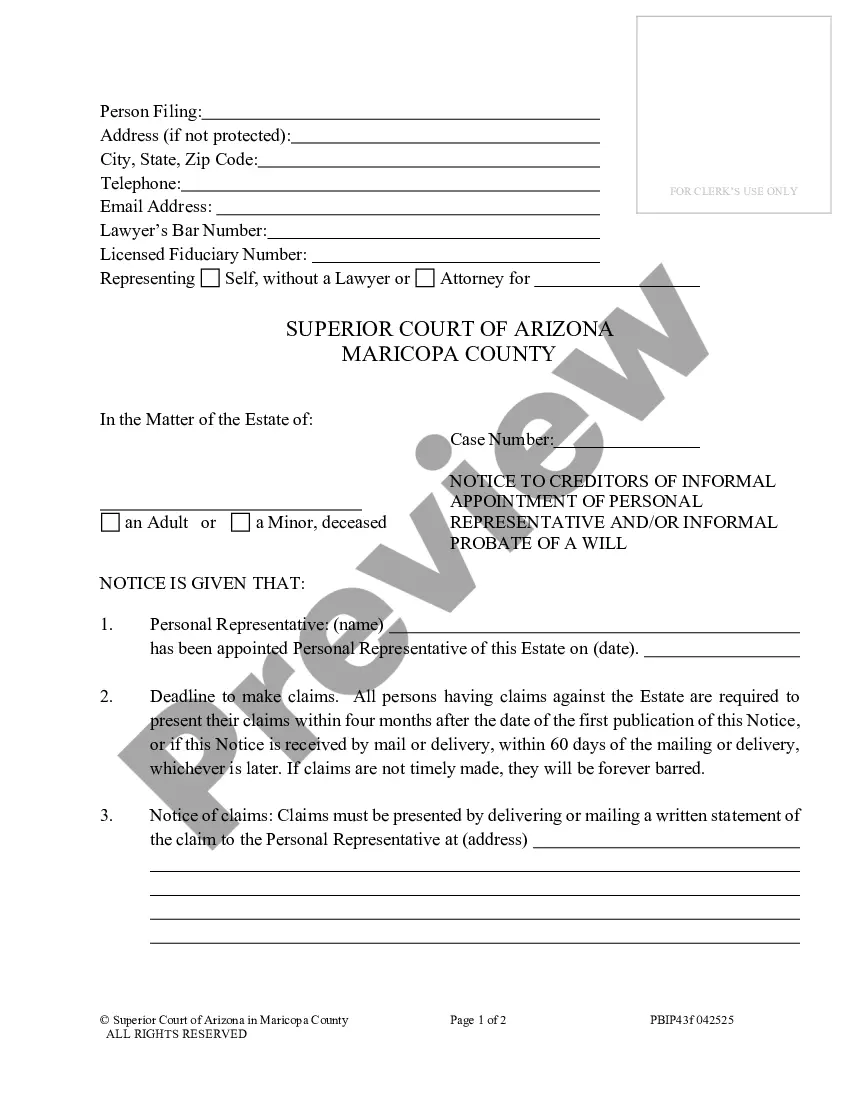

A Notice form provides legal notification to a party of an important aspect of a legal matter. Failure to provide proper notice is often the cause of delays in the progress of lawsuits and other legal matters. This model form, a Notice to Creditors in Probate - Arizona, provides notice of the stated matter. Because each case is unique, you will need to adapt the form to fit your specific facts and circumstances. Available for download now.

Mesa Arizona Notice to Creditors in Probate

Description

How to fill out Arizona Notice To Creditors In Probate?

If you’ve previously employed our service, sign in to your account and retrieve the Mesa Arizona Notice to Creditors in Probate on your device by clicking the Download button. Ensure your subscription is active. If not, renew it as per your payment arrangement.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You have continuous access to every document you have purchased: you can find it in your profile within the My documents menu whenever you need to reuse it. Utilize the US Legal Forms service to swiftly locate and download any template for your personal or professional requirements!

- Confirm you’ve found an appropriate document. Review the details and use the Preview option, if available, to verify if it fulfills your requirements. If it doesn’t fit your needs, utilize the Search tab above to locate the correct one.

- Acquire the template. Click the Buy Now button and choose a monthly or yearly subscription option.

- Create an account and process a payment. Provide your credit card information or the PayPal option to finalize the transaction.

- Receive your Mesa Arizona Notice to Creditors in Probate. Choose the file format for your document and save it onto your device.

- Complete your document. Print it or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

Executors' year However, many beneficiaries don't realise that executors and administrators have twelve months before they are obliged to distribute the estate to the beneficiaries. Time runs from the date of death.

According to Arizona law (ARS14-3108), the executor of an estate has two years from the date of death to file probate. This timeframe can be extended under certain circumstances, such as if the deceased left behind minor children.

When is probate required in Arizona? In Arizona, probate is required when an estate is worth more than $75,000. If the estate is worth less than that amount, the beneficiaries can file a Small Estate Affidavit to claim their inheritance without going through probate.

How Long Does Probate Take in Arizona. According to Arizona law, probate proceedings must be kept open for at least 4 months to allow any creditors to make their claims. Informal probates typically last between 6-8 months, depending on how quickly the Personal Representative completes their required duties.

Four Ways to Avoid Probate in Arizona Establish a Trust.Title Property with Rights of Survivorship.Make Accounts Payable on Death or Transfer of Death.Provisions for Small Estates.

When someone dies, their beneficiaries have up to two years to open probate. Once probate is opened, there aren't any time limits that will cause the case to expire.

How Long Do You Have to File Probate After Death in Arizona? According to Arizona Code 14-3108, probate must be filed within two years of the person's death.

In the state of Arizona, probate is only required if the decedent has any assets that did not transfer automatically upon their death. These assets tend to be titled individually in the decedent's name and will require a probate court to transfer the title of ownership to the intended beneficiary.

For those claims, under ARS §14-3803(C)(2), the creditor must present a claim within four months after it arises or ?two years after the decedent's death plus the time remaining in the period commenced by an actual or published notice pursuant to § 14-3801, subsection A or B,? whichever is later.