A Notice form provides legal notification to a party of an important aspect of a legal matter. Failure to provide proper notice is often the cause of delays in the progress of lawsuits and other legal matters. This model form, a Notice to Creditors in Probate - Arizona, provides notice of the stated matter. Because each case is unique, you will need to adapt the form to fit your specific facts and circumstances. Available for download now.

Pima Arizona Notice to Creditors in Probate

Description

How to fill out Arizona Notice To Creditors In Probate?

We consistently aim to lessen or evade legal complications when handling intricate legal or financial matters.

To achieve this, we seek legal services that are typically quite expensive.

However, not all legal issues are equally complicated.

Most can be managed by ourselves.

Make the most of US Legal Forms whenever you need to obtain and download the Pima Arizona Notice to Creditors in Probate or any other document with ease and security.

- US Legal Forms is an online repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and termination petitions.

- Our platform enables you to take control of your matters independently, without the necessity of hiring an attorney.

- We provide access to legal document templates that are not always available to the public.

- Our templates are tailored to specific states and regions, which greatly simplifies the search process.

Form popularity

FAQ

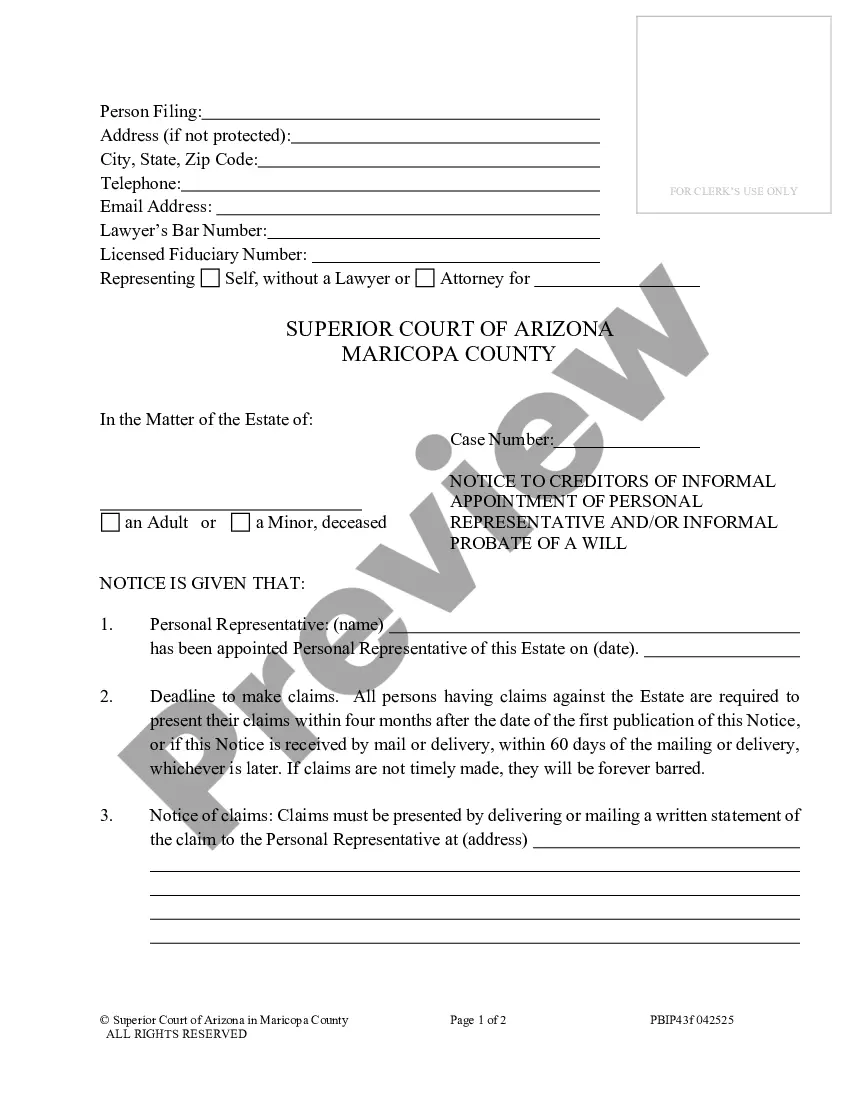

The notice sent to creditors is known as the 'Notice to Creditors,' which informs them of the probate proceedings. This notice is a key element of the Pima Arizona Notice to Creditors in Probate system, and it provides instructions on how and where to file claims against the estate. Ensuring all creditors receive this notice is essential for the probate process. Executors often turn to platforms like USLegalForms to generate compliant notices that fulfill state requirements.

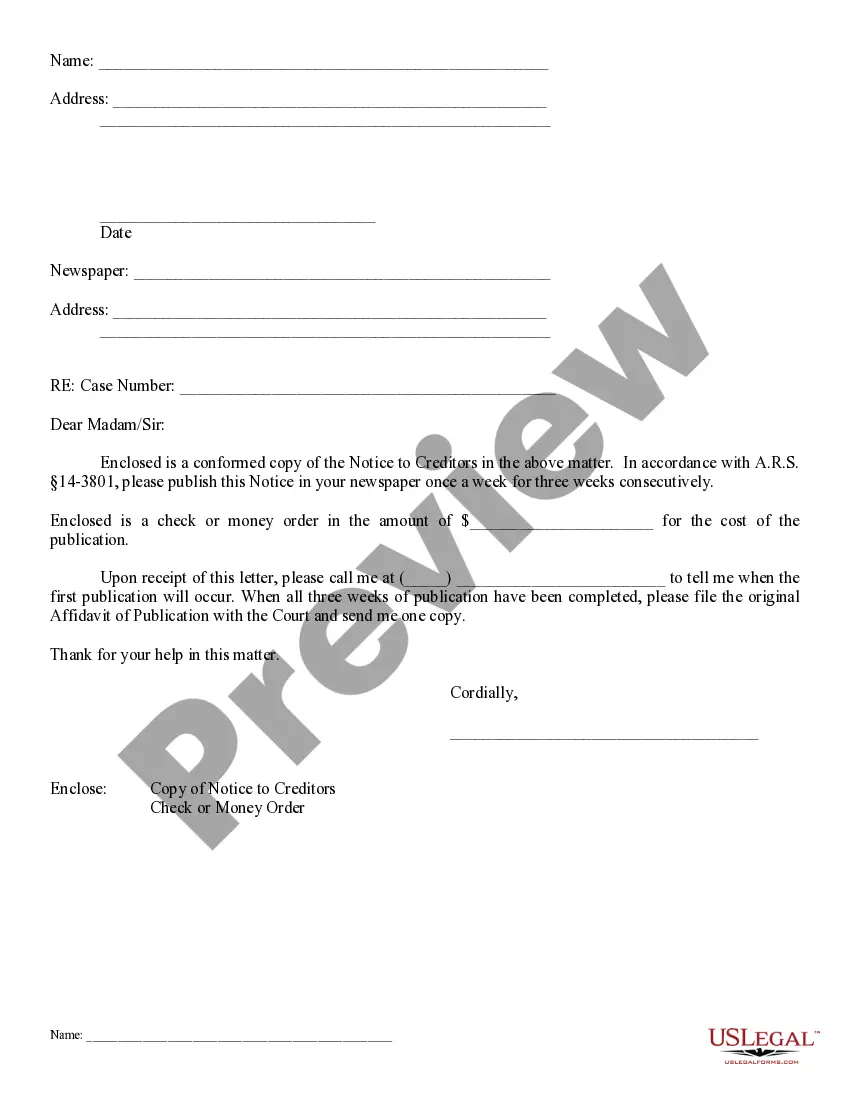

The letter to creditors serves as a formal notification that the estate is in probate and invites creditors to submit their claims. Executors must send this letter as part of the Pima Arizona Notice to Creditors in Probate process. It is a vital step for ensuring that all debts of the decedent are addressed properly. For executors, using USLegalForms can simplify the process of drafting and sending these letters to satisfy legal requirements.

Creditors can pursue claims against an estate in Pima, Arizona, typically for one year from the date of death of the decedent. This period allows creditors to assert their rights regarding debts owed. However, if a claim is not filed by the deadline specified in the Pima Arizona Notice to Creditors in Probate, the opportunity to recover debts may be lost. It is crucial for creditors to know these timelines to ensure they can act in a timely manner.

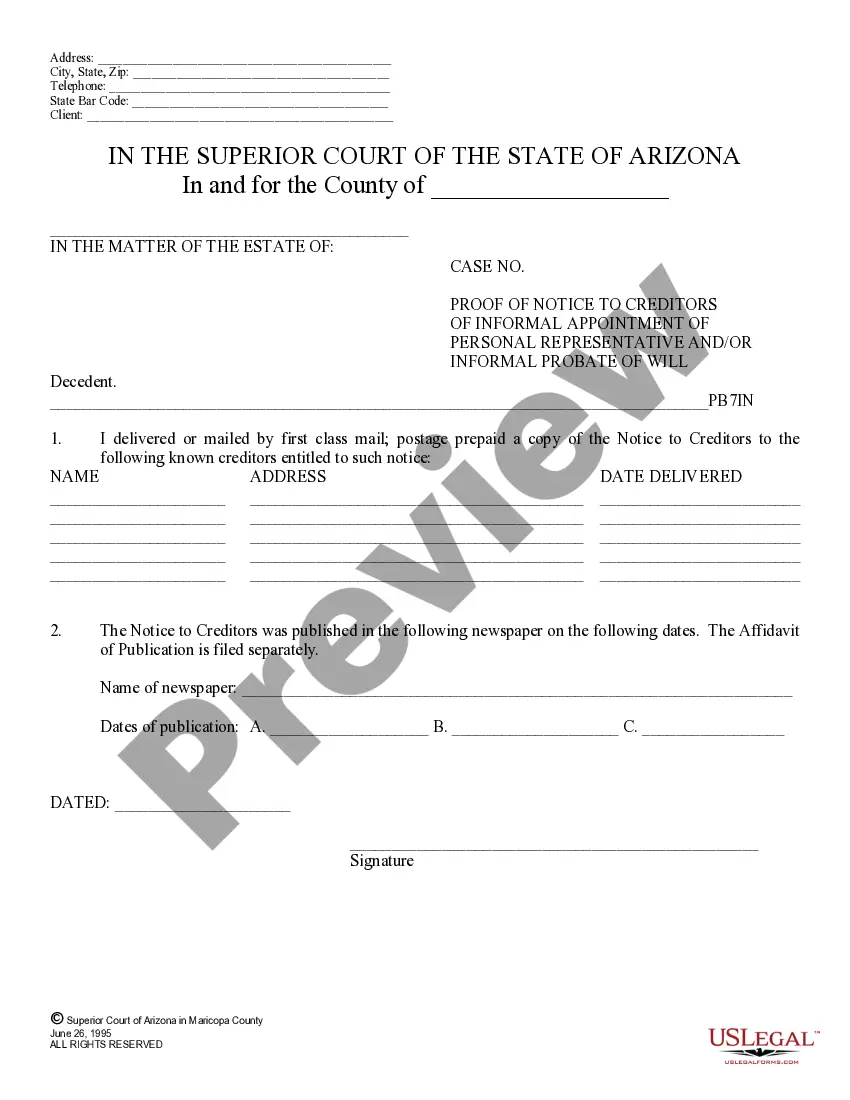

In Pima, Arizona, creditors have a strict timeline to file a claim against an estate in probate. Typically, they must submit their claims within four months from the date of the first publication of the notice to creditors. It is important for creditors to act quickly, as failure to file within this timeframe could result in the loss of their claim. Utilizing the Pima Arizona Notice to Creditors in Probate is essential in ensuring that all interested parties have the proper notice to protect their rights.

An executor notifies creditors by preparing and publishing a notice of the probate proceedings, ensuring it reaches all potential claimants. This often involves filing the notice with the probate court and posting it in a newspaper in Pima Arizona. Executors can use templates from services like US Legal Forms to make this process efficient and accurate.

To publish a notice to creditors in a newspaper, draft a suitable notice and then engage with a local newspaper in Pima Arizona that offers legal advertising. Submit your notice and confirm the publication date, ensuring it meets local legal requirements. This process enables all creditors to be informed about the probate proceedings and how to claim debts.

To publish a notice in a newspaper, first prepare the text you want to include, following the guidelines required for notices in Pima Arizona. Next, contact a local newspaper to arrange publication, ensuring it appears in the appropriate legal section. You can also employ services that specialize in probate notices to ensure compliance and visibility.

Noticing creditors in a deceased estate involves informing them of the probate case and inviting claims against the estate. This is typically done by publishing a notice in a local newspaper and filing it with the probate court in Pima Arizona. By following this procedure, you ensure that all potential creditors have the opportunity to present their claims in a timely manner.

Writing a notice to creditors for publication requires clear and concise information about the estate and any debts owed. Begin with the deceased's name, date of death, and the probate case number. Include a statement inviting creditors to present their claims, ensuring you follow the local regulations in Pima Arizona. Resources from US Legal Forms can help you format your notice correctly.

To post a notice to creditors in Pima Arizona, start by drafting a notice that includes specific information about the deceased and the probate process. You can then file this notice with the probate court and publish it in a local newspaper, ensuring it reaches all potential creditors. Utilizing a service like US Legal Forms can simplify this process, providing templates and guidance tailored for your needs.