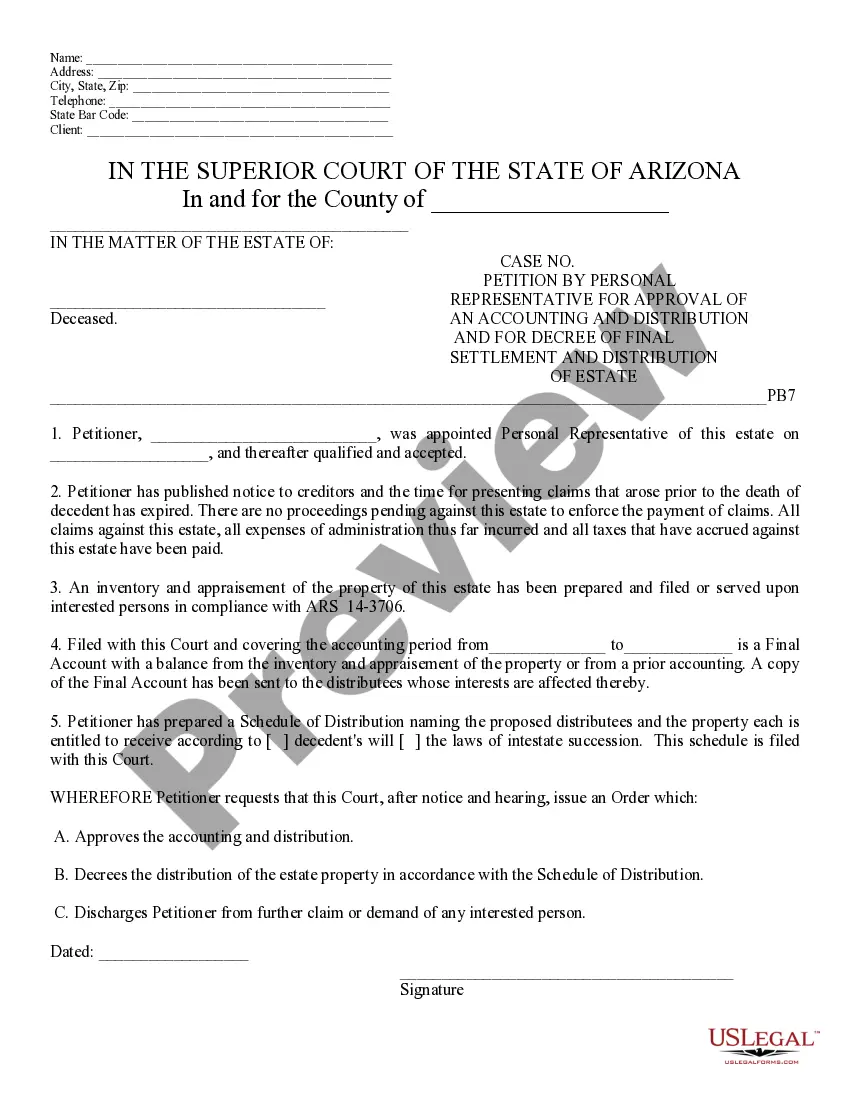

This model form, a Petition by Personal Representative for Approval of an Account and Distribution and for Decree of Settlement - Arizona, is intended for use to initiate a request to the court to take the stated action. The form can be easily completed by filling in the blanks and/or adapted to fit your specific facts and circumstances. Available in for download now, in standard format(s).

The Surprise Arizona Petition by Personal Representative for Approval of an Account and Distribution and for Decree of Settlement is a legal document that serves to request the court's approval for the distribution of assets and final settlement of an estate by the personal representative. This petition is typically filed in probate court in Surprise, Arizona. The personal representative, also known as the executor or administrator, is responsible for managing the decedent's estate, ensuring that the assets are properly accounted for and distributed among the beneficiaries according to the terms of the will or applicable state laws of intestate succession. The purpose of this petition is to present a detailed account of all the assets, debts, expenses, and income related to the estate. The personal representative must provide comprehensive information about the assets, including any real estate, bank accounts, investments, personal property, and any other relevant assets. Furthermore, the petition should outline all the debts and expenses incurred during the administration of the estate, such as funeral costs, outstanding debts, and administrative fees. It is crucial to provide accurate and detailed information to demonstrate that the personal representative has acted prudently and in accordance with their fiduciary duty. Once the account is prepared, the personal representative must also propose the distribution plan, which outlines how the remaining assets will be distributed among the beneficiaries. It is essential to adhere to the deceased's wishes as expressed in their will or, in the absence of a will, observe the applicable state laws. In addition to approval of the account and distribution, the personal representative may also request a Decree of Settlement. This decree serves as the court's official determination that all matters related to the estate administration have been properly addressed and resolved. Different types or variations of this petition may arise depending on the complexity of the estate, the presence of disputes among beneficiaries, or other unique circumstances. Some specific types may include: 1. Surprise Arizona Petition by Personal Representative for Approval of an Account and Distribution for an Intestate Estate: This pertains to cases where the deceased did not leave a valid will, and the laws of intestate succession govern the distribution of assets. 2. Surprise Arizona Petition by Personal Representative for Approval of an Account and Distribution for a Testate Estate: This refers to situations where the deceased left a valid will, and the assets are to be distributed according to the instructions within the will. 3. Surprise Arizona Petition by Personal Representative for Approval of an Account and Distribution with Beneficiary Disputes: This occurs when there are disagreements or conflicts among the beneficiaries regarding the distribution of assets. In such cases, the court's intervention may be required to resolve the disputes and ensure a fair distribution. It is important to consult with an attorney experienced in probate law to ensure the accuracy and completeness of the petition. The attorney can guide the personal representative in providing all the necessary information and adhering to the local court rules and procedures, ensuring a smooth and successful settlement of the estate.The Surprise Arizona Petition by Personal Representative for Approval of an Account and Distribution and for Decree of Settlement is a legal document that serves to request the court's approval for the distribution of assets and final settlement of an estate by the personal representative. This petition is typically filed in probate court in Surprise, Arizona. The personal representative, also known as the executor or administrator, is responsible for managing the decedent's estate, ensuring that the assets are properly accounted for and distributed among the beneficiaries according to the terms of the will or applicable state laws of intestate succession. The purpose of this petition is to present a detailed account of all the assets, debts, expenses, and income related to the estate. The personal representative must provide comprehensive information about the assets, including any real estate, bank accounts, investments, personal property, and any other relevant assets. Furthermore, the petition should outline all the debts and expenses incurred during the administration of the estate, such as funeral costs, outstanding debts, and administrative fees. It is crucial to provide accurate and detailed information to demonstrate that the personal representative has acted prudently and in accordance with their fiduciary duty. Once the account is prepared, the personal representative must also propose the distribution plan, which outlines how the remaining assets will be distributed among the beneficiaries. It is essential to adhere to the deceased's wishes as expressed in their will or, in the absence of a will, observe the applicable state laws. In addition to approval of the account and distribution, the personal representative may also request a Decree of Settlement. This decree serves as the court's official determination that all matters related to the estate administration have been properly addressed and resolved. Different types or variations of this petition may arise depending on the complexity of the estate, the presence of disputes among beneficiaries, or other unique circumstances. Some specific types may include: 1. Surprise Arizona Petition by Personal Representative for Approval of an Account and Distribution for an Intestate Estate: This pertains to cases where the deceased did not leave a valid will, and the laws of intestate succession govern the distribution of assets. 2. Surprise Arizona Petition by Personal Representative for Approval of an Account and Distribution for a Testate Estate: This refers to situations where the deceased left a valid will, and the assets are to be distributed according to the instructions within the will. 3. Surprise Arizona Petition by Personal Representative for Approval of an Account and Distribution with Beneficiary Disputes: This occurs when there are disagreements or conflicts among the beneficiaries regarding the distribution of assets. In such cases, the court's intervention may be required to resolve the disputes and ensure a fair distribution. It is important to consult with an attorney experienced in probate law to ensure the accuracy and completeness of the petition. The attorney can guide the personal representative in providing all the necessary information and adhering to the local court rules and procedures, ensuring a smooth and successful settlement of the estate.