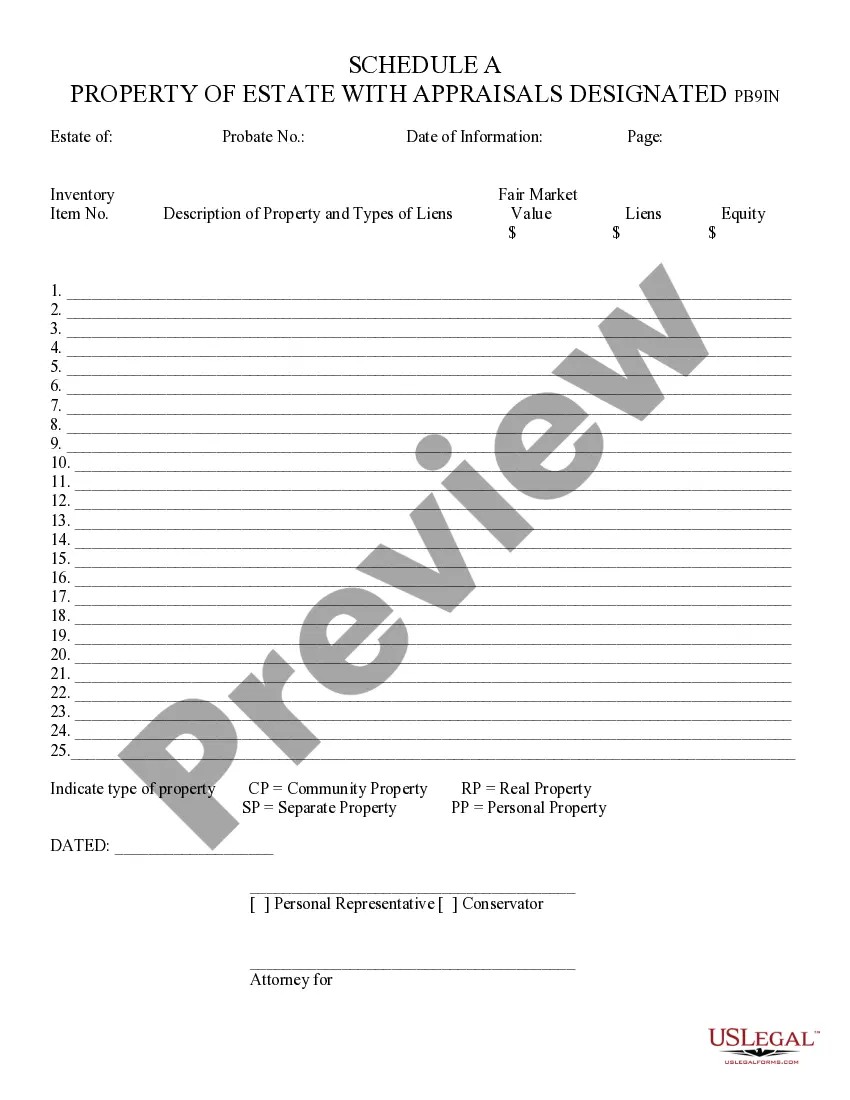

Property of Estate with Appraisals Designated - Schedule A - Arizona: This form is used when an administrator of an estate is called upon to list all the property, with appraisals of said property, of the estate. It is to be signed by the conservator, administrator in front of a Notary Public. It is available for download in both Word and Rich Text formats.

Tempe, Arizona is a bustling city located in Maricopa County known for its vibrant culture, diverse community, and economic opportunities. Within this city, there are various types of properties available, including Tempe Arizona Property of Estate with Appraisals Designated — Schedule A. Let's delve into what this entails. Tempe Arizona Property of Estate with Appraisals Designated — Schedule A refers to a specific category of real estate properties in Tempe that undergo a comprehensive appraisal process. This appraisal is conducted by professional appraisers who assess the market value, condition, and other relevant factors of the property. The primary purpose of assigning the "Schedule A" designation to a property is to provide accurate and detailed information about its appraised value. This information is crucial for estate planning, tax assessment, and other legal processes related to property transactions. There exist various types of Tempe Arizona Property of Estate with Appraisals Designated — Schedule A, depending on the nature of the estate and its specific characteristics. These types may include: 1. Residential Properties: These encompass single-family homes, townhouses, condominiums, and apartments in Tempe. Appraisals consider factors like the property's size, condition, location, amenities, and recent sales in the area to determine its market value. 2. Commercial Properties: This category includes office buildings, retail spaces, industrial properties, and other commercial real estate in Tempe. The appraisal process for these properties takes into account factors like location, tenant occupancy, rental income, infrastructure, and market trends to determine their value. 3. Vacant Land: Appraisals for vacant land in Tempe assess factors such as location, zoning regulations, soil condition, accessibility, potential development opportunities, and market demand. These appraisals serve as a valuable tool for buyers, sellers, and developers to make informed decisions regarding land use and development projects. 4. Special Purpose Properties: Certain properties in Tempe possess unique characteristics or serve specific purposes. Examples may include hotels, hospitals, recreational facilities, educational institutions, or religious institutions. Appraisals of such properties consider their specialized features and income-generating potential, providing an accurate valuation for various purposes. In conclusion, Tempe Arizona Property of Estate with Appraisals Designated — Schedule A refers to a category of real estate properties in Tempe that have undergone a comprehensive appraisal process. This designation includes various types of properties such as residential, commercial, vacant land, and special purpose properties. Through meticulous appraisals, these properties have accurate valuation information necessary for estate planning, tax assessment, and other legal processes.