Annual Minutes document any changes or other organizational activities of a Professional Corporation during a given year.

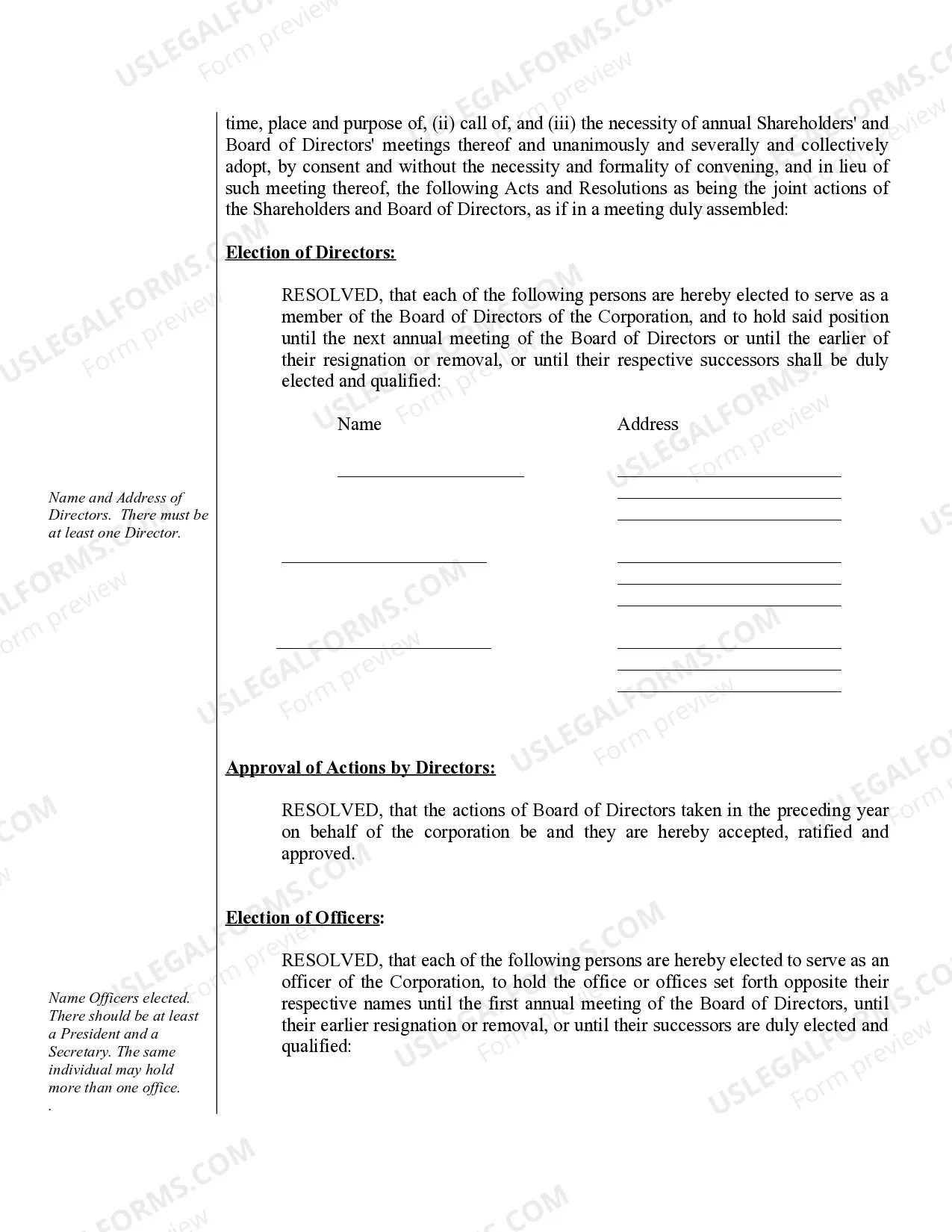

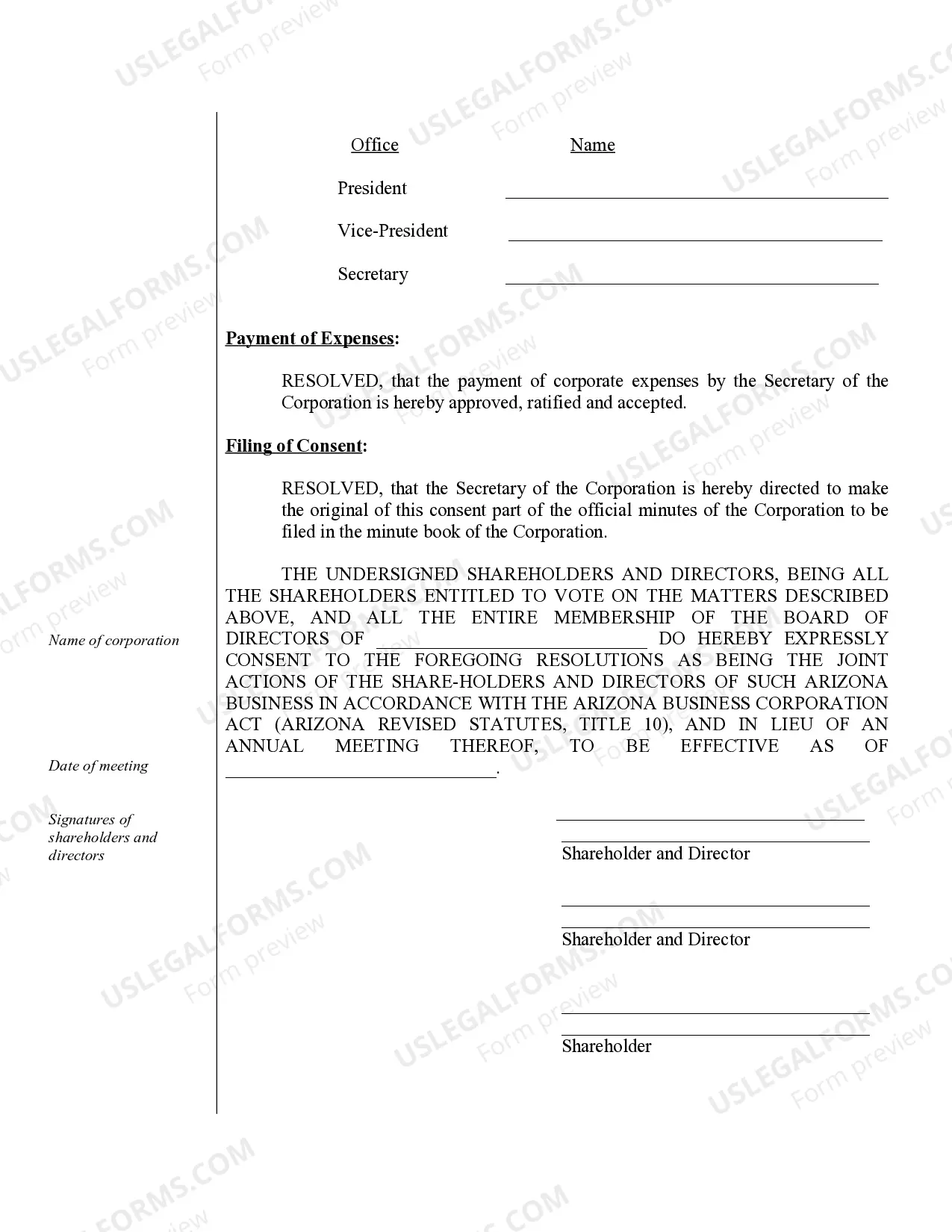

Glendale Annual Minutes for an Arizona Professional Corporation are an essential part of maintaining corporate compliance and record-keeping for businesses operating in Glendale, Arizona. These minutes serve as an official documentation of the proceedings held during the annual meeting of the corporation's board of directors and shareholders. They outline important decisions made, actions taken, and resolutions adopted during the meeting. Key topics discussed in Glendale Annual Minutes may include the appointment or reelection of board members, the approval of financial statements, the declaration of dividends, the adoption of corporate policies, and the review of the corporation's overall performance. These minutes also highlight any changes made to the corporation's bylaws, amendments to the articles of incorporation, and the appointment of officers such as the president, secretary, treasurer, and other executives. In addition to the general Glendale Annual Minutes, there may be different types of minutes based on the nature of the meeting or the corporation's specific requirements. For instance, some variations include: 1. Glendale Special Minutes: These minutes are generated for any special meetings held outside the annual meeting. Special meetings are convened to discuss specific matters or urgent issues that require immediate attention, such as mergers, acquisitions, or major policy changes. 2. Glendale Incorporated Minutes: These minutes are prepared during the initial stages of the corporation's formation. They document the actions taken by the incorporates, who are responsible for establishing the corporation, drafting its bylaws and articles of incorporation, appointing initial directors, and other necessary organizational tasks. 3. Glendale Shareholders' Meeting Minutes: While annual minutes encompass details pertaining to shareholders' meetings, separate minutes can be generated specifically for shareholder-only meetings. These minutes focus on matters that solely involve the interests and rights of the shareholders, including voting on key company decisions or electing directors. 4. Glendale Directors' Meeting Minutes: Directors' meeting minutes are crafted when board members congregate to discuss company strategies and policies. These minutes record the deliberations, resolutions, and actions taken by the board of directors during their meetings, ensuring transparency and accountability towards the corporation's stakeholders. Effective management of Glendale Annual Minutes reinforces corporate governance, confirms compliance with the Arizona Corporations Code, and serves as a reliable historical reference for future decision-making processes. Adhering to the proper documentation and retention practices of these minutes is crucial to maintaining the legal standing and credibility of an Arizona Professional Corporation in Glendale.Glendale Annual Minutes for an Arizona Professional Corporation are an essential part of maintaining corporate compliance and record-keeping for businesses operating in Glendale, Arizona. These minutes serve as an official documentation of the proceedings held during the annual meeting of the corporation's board of directors and shareholders. They outline important decisions made, actions taken, and resolutions adopted during the meeting. Key topics discussed in Glendale Annual Minutes may include the appointment or reelection of board members, the approval of financial statements, the declaration of dividends, the adoption of corporate policies, and the review of the corporation's overall performance. These minutes also highlight any changes made to the corporation's bylaws, amendments to the articles of incorporation, and the appointment of officers such as the president, secretary, treasurer, and other executives. In addition to the general Glendale Annual Minutes, there may be different types of minutes based on the nature of the meeting or the corporation's specific requirements. For instance, some variations include: 1. Glendale Special Minutes: These minutes are generated for any special meetings held outside the annual meeting. Special meetings are convened to discuss specific matters or urgent issues that require immediate attention, such as mergers, acquisitions, or major policy changes. 2. Glendale Incorporated Minutes: These minutes are prepared during the initial stages of the corporation's formation. They document the actions taken by the incorporates, who are responsible for establishing the corporation, drafting its bylaws and articles of incorporation, appointing initial directors, and other necessary organizational tasks. 3. Glendale Shareholders' Meeting Minutes: While annual minutes encompass details pertaining to shareholders' meetings, separate minutes can be generated specifically for shareholder-only meetings. These minutes focus on matters that solely involve the interests and rights of the shareholders, including voting on key company decisions or electing directors. 4. Glendale Directors' Meeting Minutes: Directors' meeting minutes are crafted when board members congregate to discuss company strategies and policies. These minutes record the deliberations, resolutions, and actions taken by the board of directors during their meetings, ensuring transparency and accountability towards the corporation's stakeholders. Effective management of Glendale Annual Minutes reinforces corporate governance, confirms compliance with the Arizona Corporations Code, and serves as a reliable historical reference for future decision-making processes. Adhering to the proper documentation and retention practices of these minutes is crucial to maintaining the legal standing and credibility of an Arizona Professional Corporation in Glendale.