Annual Minutes document any changes or other organizational activities of a Professional Corporation during a given year.

Phoenix Annual Minutes for a Arizona Professional Corporation

Description

How to fill out Annual Minutes For A Arizona Professional Corporation?

Finding authenticated templates tailored to your local regulations can be challenging unless you utilize the US Legal Forms library.

It’s a digital repository of over 85,000 legal documents for both personal and professional purposes and various real-world scenarios.

All the files are systematically categorized by usage area and jurisdiction, making the task of locating the Phoenix Annual Minutes for an Arizona Professional Corporation as simple as pie.

Maintaining documents organized and compliant with legal standards is crucial. Leverage the US Legal Forms library to always have vital document templates for any needs right at your fingertips!

- Review the Preview mode and document description.

- Ensure you’ve chosen the correct one that fulfills your needs and aligns perfectly with your local jurisdiction requirements.

- Look for another template, if necessary.

- If you notice any discrepancies, use the Search tab above to locate the appropriate one.

- If it meets your needs, proceed to the next step.

Form popularity

FAQ

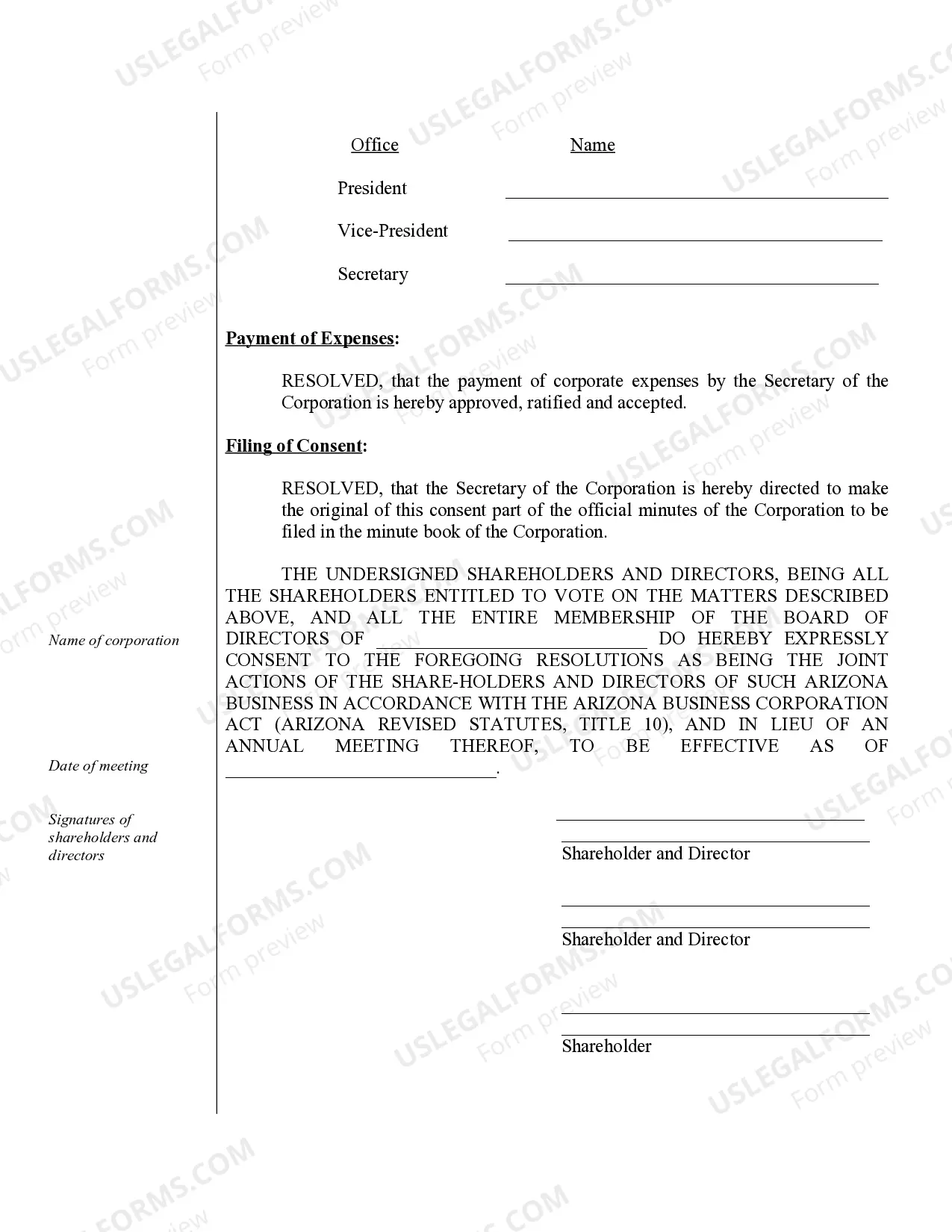

Pursuant to Arizona law, only Corporations are required to file annual reports, on or before their prescribed due date.

Arizona LLC Articles of Organization ($50 or $85) The Articles of Organization can be filed by mail or online. The fees for both are the same: $50 for regular filing and $85 for expedited filing. The filing fee is a one-time fee. You don't have to pay any monthly (or annual) fees to maintain your Arizona LLC.

The license is valid for one calendar year, from January 1 through December 31 and businesses must renew annually by January 1. Even if you get licensed in late in the year, you still must renew your license in January. Business owners must pay their renewal fees when they submit their renewal.

All corporations registered with the Arizona Corporation Commission, whether for-profit or nonprofit, domestic or foreign, must file an Annual Report and a Certificate of Disclosure with the Arizona Corporation Commission each year on or before the corporation's due date. See A.R.S. §§ 10-1622 and 10-11622.

A PLLC is an LLC organized under Chapter 4 of Title 29 of the Arizona Revised Statutes for the purpose of providing one or more categories of service that may be lawfully rendered only by a person licensed, or otherwise authorized by a licensing authority in Arizona to render the service.

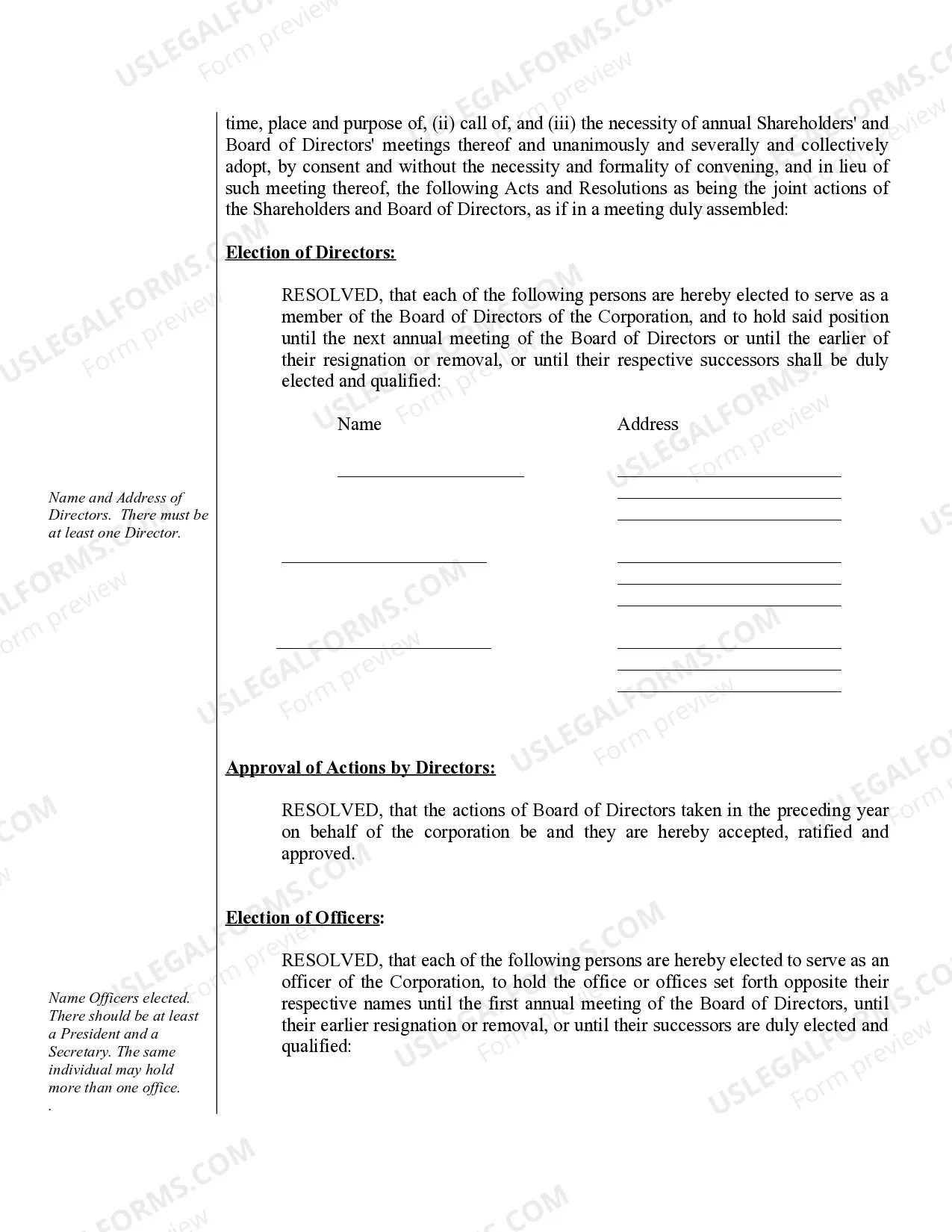

Pretty much anyone can form a regular corporation. Professional corporations, however, are more limited, as only certain professional groups can form one. Which professions qualify varies from one state to the next, but typical professions include doctors, attorneys, chiropractors, accountants, and similar trades.

Even if a company has all necessary business licenses, it still needs to file its annual reports. Annual report filing requirements continue even after forming your company. Just like tax returns and business licenses, formation and incorporation filings are different from annual report filings.

The difference between LLC and PC is straightforward. A limited liability company (LLC) combines the tax benefits of a partnership and the limited liability protection of a corporation. A professional corporation (PC) is organized according to the laws of the state where the professional is licensed to practice.

Currently, all states, except Ohio, require some sort of annual report filing. Specific filing requirements and deadlines vary by state. Some states also require an initial report when first starting a business. When businesses fail to file on time, they might get hit with fines or other penalties.

Arizona does not require LLCs to file an annual report. Taxes. For complete details on state taxes for Arizona LLCs, visit Business Owner's Toolkit or the State of Arizona . Federal tax identification number (EIN).