Annual Minutes document any changes or other organizational activities of a Professional Corporation during a given year.

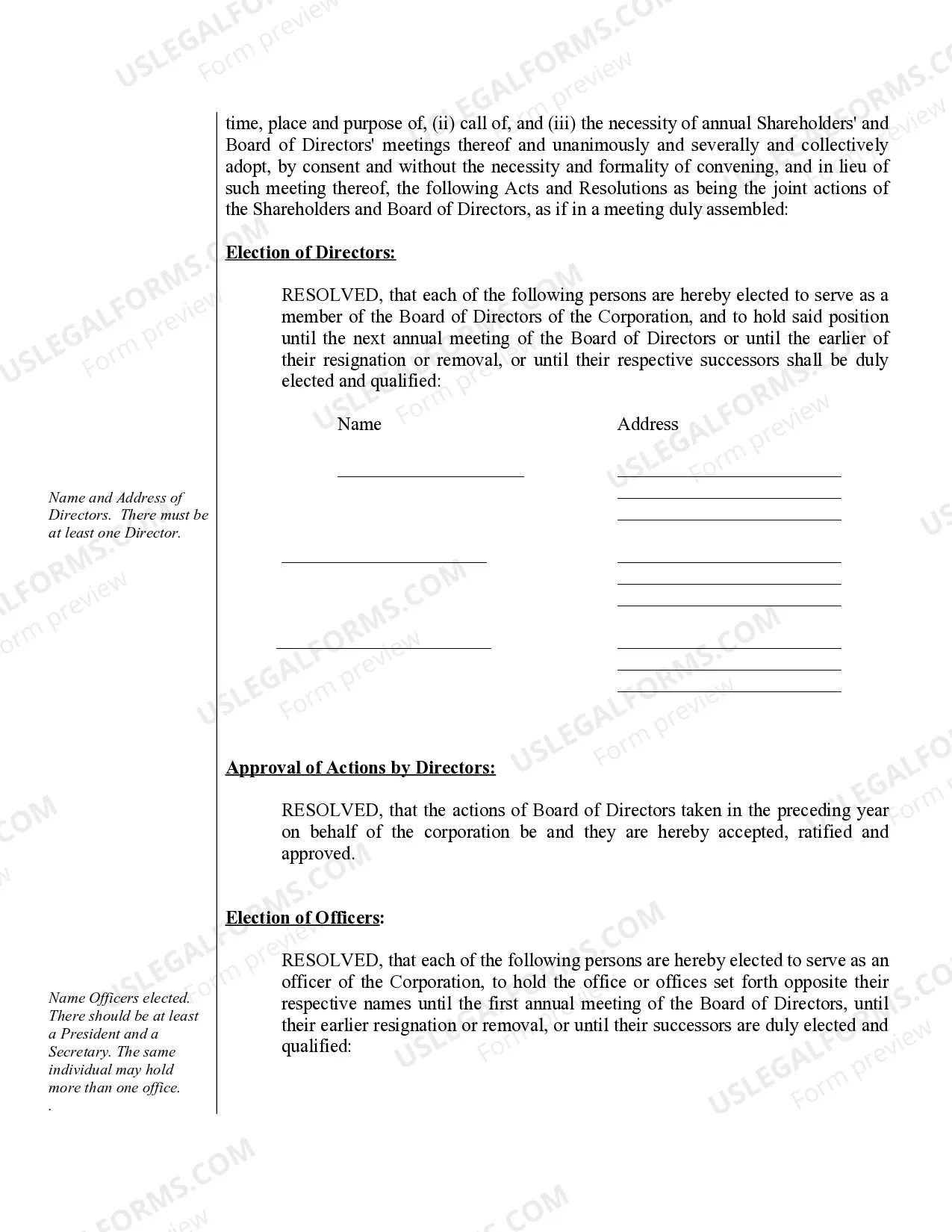

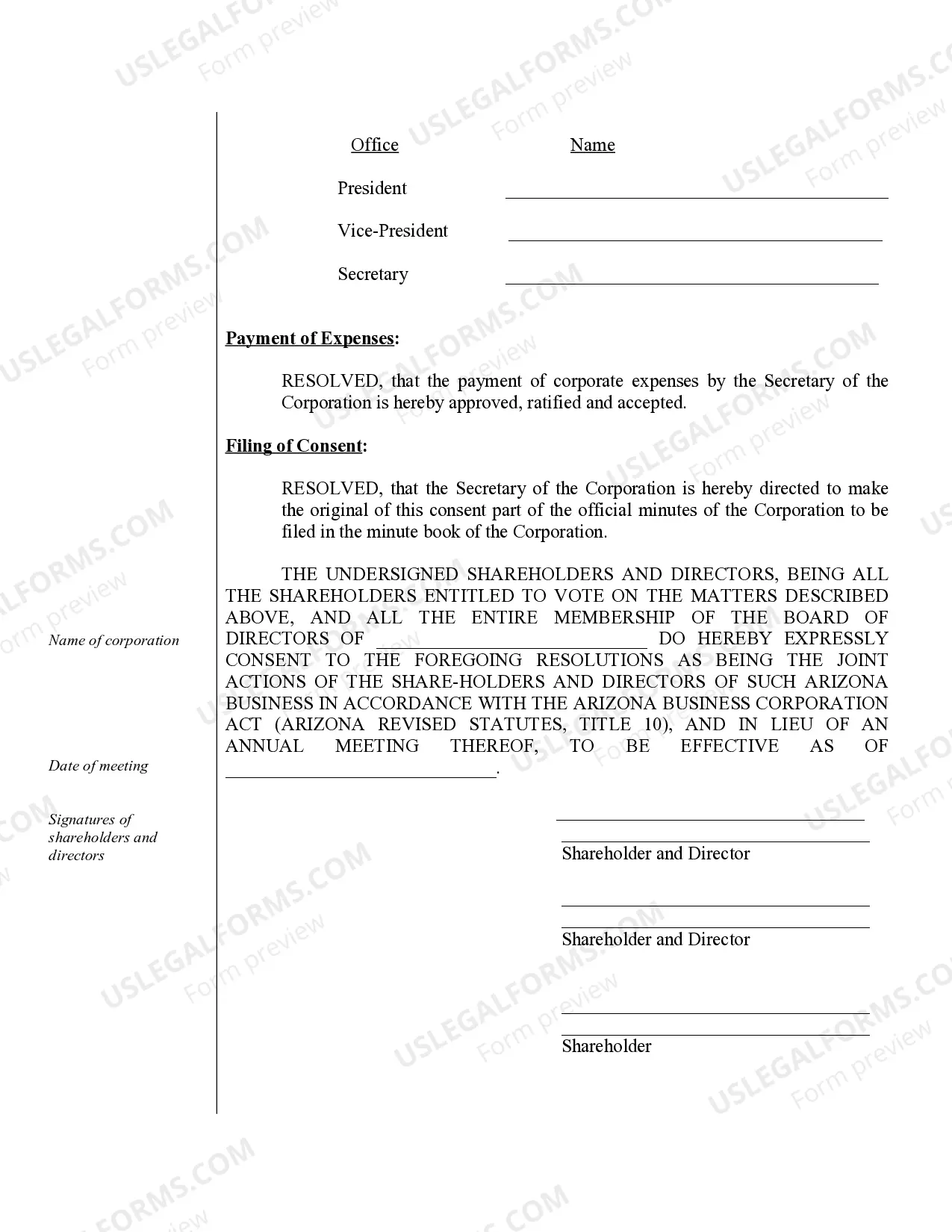

Lima Annual Minutes represent a crucial aspect of corporate governance in Arizona for Professional Corporations. These minutes are formal written records that document the discussions, decisions, and actions taken during the annual meeting of a Professional Corporation's board of directors or shareholders. They serve as a valuable resource for legal compliance, internal communication, and long-term record-keeping. The Lima Annual Minutes capture important details, such as the date, time, and location of the meeting, as well as a comprehensive account of all discussions that took place. They provide a platform for directors and shareholders to review the corporation's progress, financial performance, upcoming goals, and major decisions made during the year. The content covered in Lima Annual Minutes can vary depending on the nature of the Professional Corporation and its specific requirements. However, some common elements include: 1. Appointment of Officers: The minutes often highlight the election or re-election of officers, such as the President, Vice President, Secretary, and Treasurer. 2. Financial Review: A summary of the corporation's financial statements, including the balance sheet, income statement, and cash flow statement, may be included. This provides an opportunity to discuss financial performance and identify potential areas for improvement. 3. Approval of Previous Minutes: The minutes typically discuss the approval of the minutes from the previous annual meeting to ensure accuracy and continuity. 4. Reports and Updates: Directors and officers may present reports on various aspects of the corporation's operations, including marketing strategies, legal matters, regulatory compliance, and human resources. 5. Declaration of Dividends: If the Professional Corporation has shareholders who are entitled to dividends, the minutes may record the declaration and distribution of dividends. 6. Appointment of Auditors: In cases where an external audit is required, the minutes may note the appointment of auditors to review the corporation's financial records and ensure compliance with regulations. 7. Amendments to Bylaws or Articles of Incorporation: Any proposed amendments to the Professional Corporation's bylaws or articles of incorporation are typically discussed and recorded in the minutes. 8. Key Decisions: The minutes serve as a platform to document and explain significant decisions made during the annual meeting, such as approving major contracts, initiating new business ventures, or amending corporate policies. 9. Future Plans and Goals: Directors and shareholders may discuss future plans, set goals, and outline strategies for the corporation's growth and development. 10. Voting Record: The minutes detail the outcome of any votes taken during the meeting, including the number of votes cast in favor, against, or abstaining. While Lima Annual Minutes generally follow these contents, the specific requirements may vary for different types of Arizona Professional Corporations. For example, medical or legal professional corporations may have additional documentation requirements related to compliance with industry-specific regulations and ethical standards. In summary, Lima Annual Minutes are critical for maintaining transparent governance within Arizona Professional Corporations. They provide a comprehensive record of discussions, decisions, and actions taken during the annual meeting, ensuring compliance, effective communication, and legal integrity.Lima Annual Minutes represent a crucial aspect of corporate governance in Arizona for Professional Corporations. These minutes are formal written records that document the discussions, decisions, and actions taken during the annual meeting of a Professional Corporation's board of directors or shareholders. They serve as a valuable resource for legal compliance, internal communication, and long-term record-keeping. The Lima Annual Minutes capture important details, such as the date, time, and location of the meeting, as well as a comprehensive account of all discussions that took place. They provide a platform for directors and shareholders to review the corporation's progress, financial performance, upcoming goals, and major decisions made during the year. The content covered in Lima Annual Minutes can vary depending on the nature of the Professional Corporation and its specific requirements. However, some common elements include: 1. Appointment of Officers: The minutes often highlight the election or re-election of officers, such as the President, Vice President, Secretary, and Treasurer. 2. Financial Review: A summary of the corporation's financial statements, including the balance sheet, income statement, and cash flow statement, may be included. This provides an opportunity to discuss financial performance and identify potential areas for improvement. 3. Approval of Previous Minutes: The minutes typically discuss the approval of the minutes from the previous annual meeting to ensure accuracy and continuity. 4. Reports and Updates: Directors and officers may present reports on various aspects of the corporation's operations, including marketing strategies, legal matters, regulatory compliance, and human resources. 5. Declaration of Dividends: If the Professional Corporation has shareholders who are entitled to dividends, the minutes may record the declaration and distribution of dividends. 6. Appointment of Auditors: In cases where an external audit is required, the minutes may note the appointment of auditors to review the corporation's financial records and ensure compliance with regulations. 7. Amendments to Bylaws or Articles of Incorporation: Any proposed amendments to the Professional Corporation's bylaws or articles of incorporation are typically discussed and recorded in the minutes. 8. Key Decisions: The minutes serve as a platform to document and explain significant decisions made during the annual meeting, such as approving major contracts, initiating new business ventures, or amending corporate policies. 9. Future Plans and Goals: Directors and shareholders may discuss future plans, set goals, and outline strategies for the corporation's growth and development. 10. Voting Record: The minutes detail the outcome of any votes taken during the meeting, including the number of votes cast in favor, against, or abstaining. While Lima Annual Minutes generally follow these contents, the specific requirements may vary for different types of Arizona Professional Corporations. For example, medical or legal professional corporations may have additional documentation requirements related to compliance with industry-specific regulations and ethical standards. In summary, Lima Annual Minutes are critical for maintaining transparent governance within Arizona Professional Corporations. They provide a comprehensive record of discussions, decisions, and actions taken during the annual meeting, ensuring compliance, effective communication, and legal integrity.