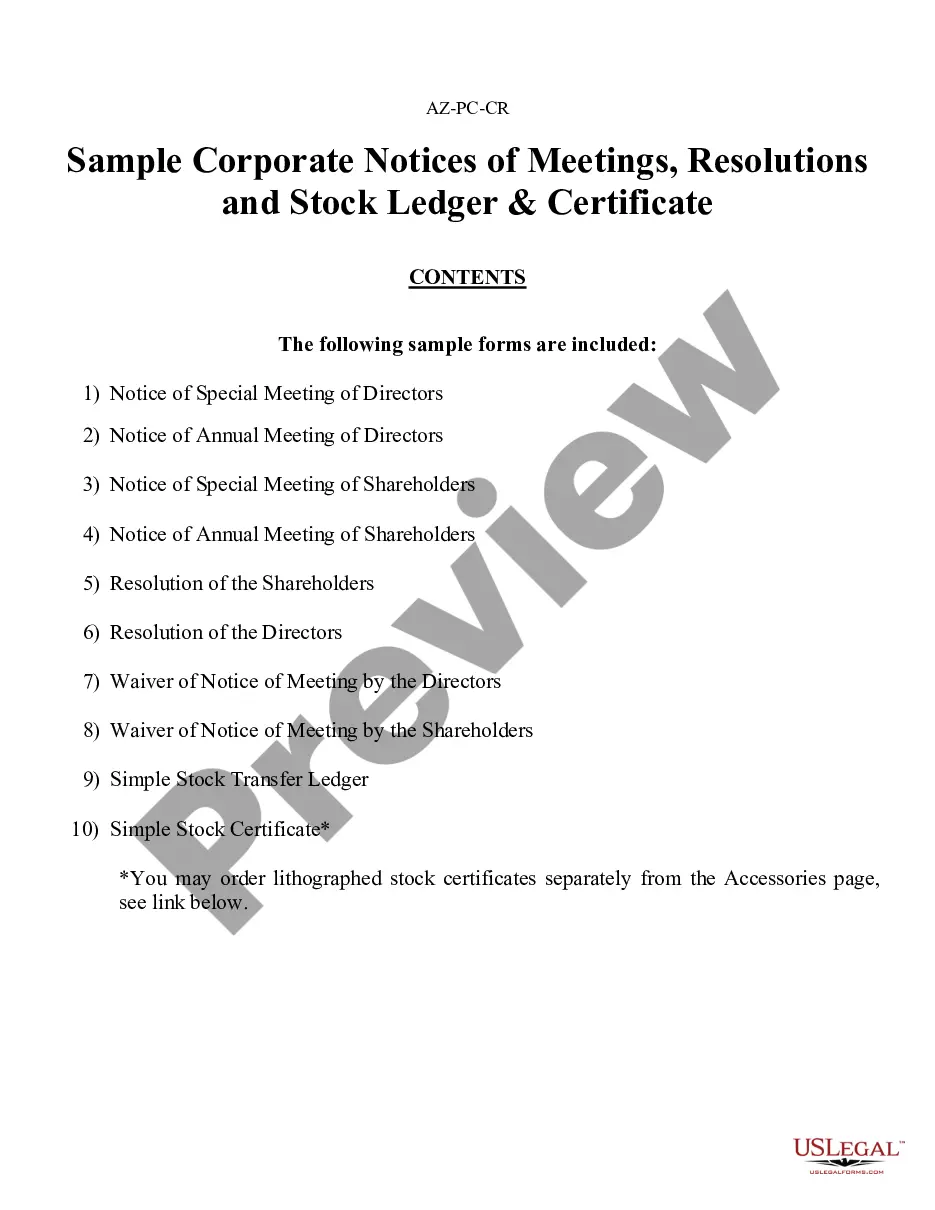

Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

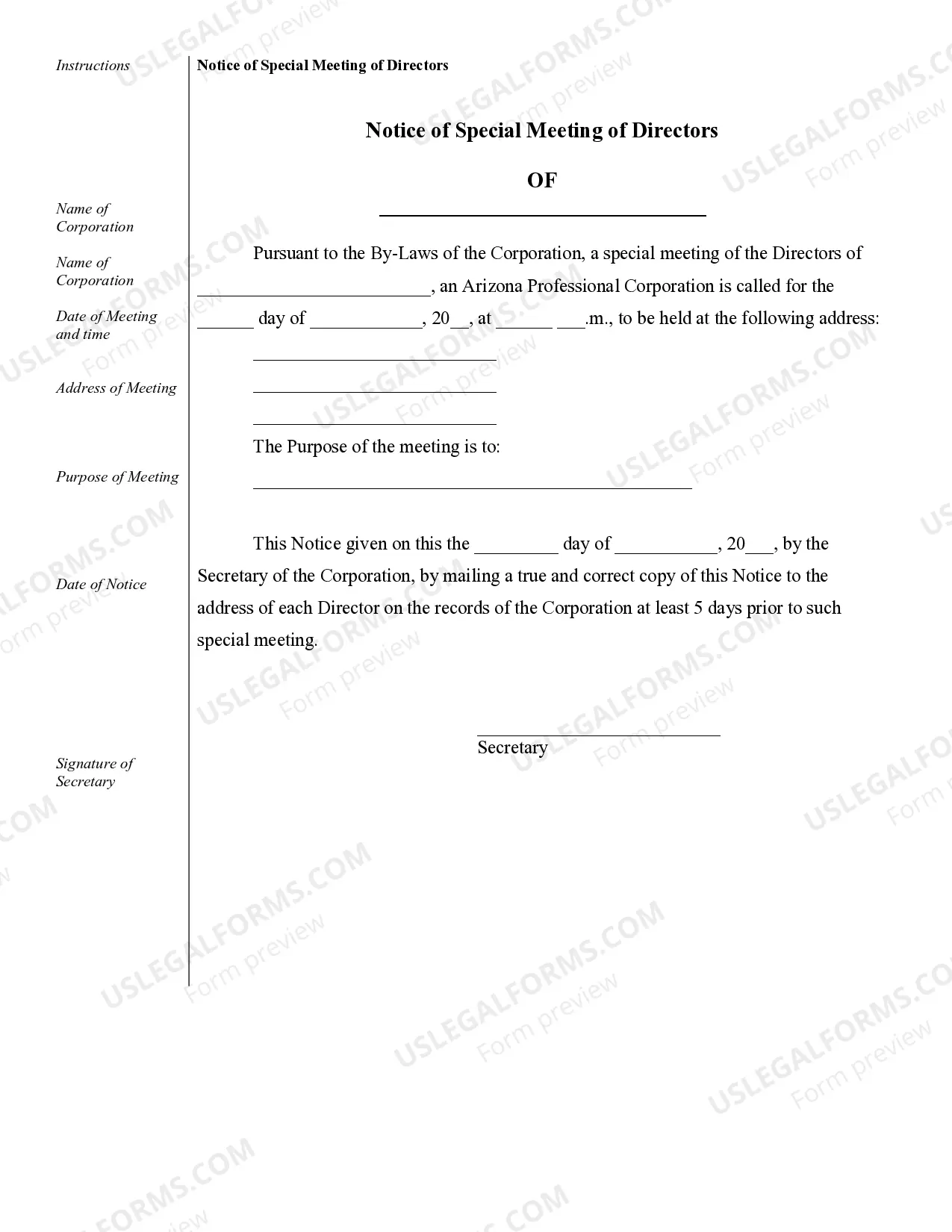

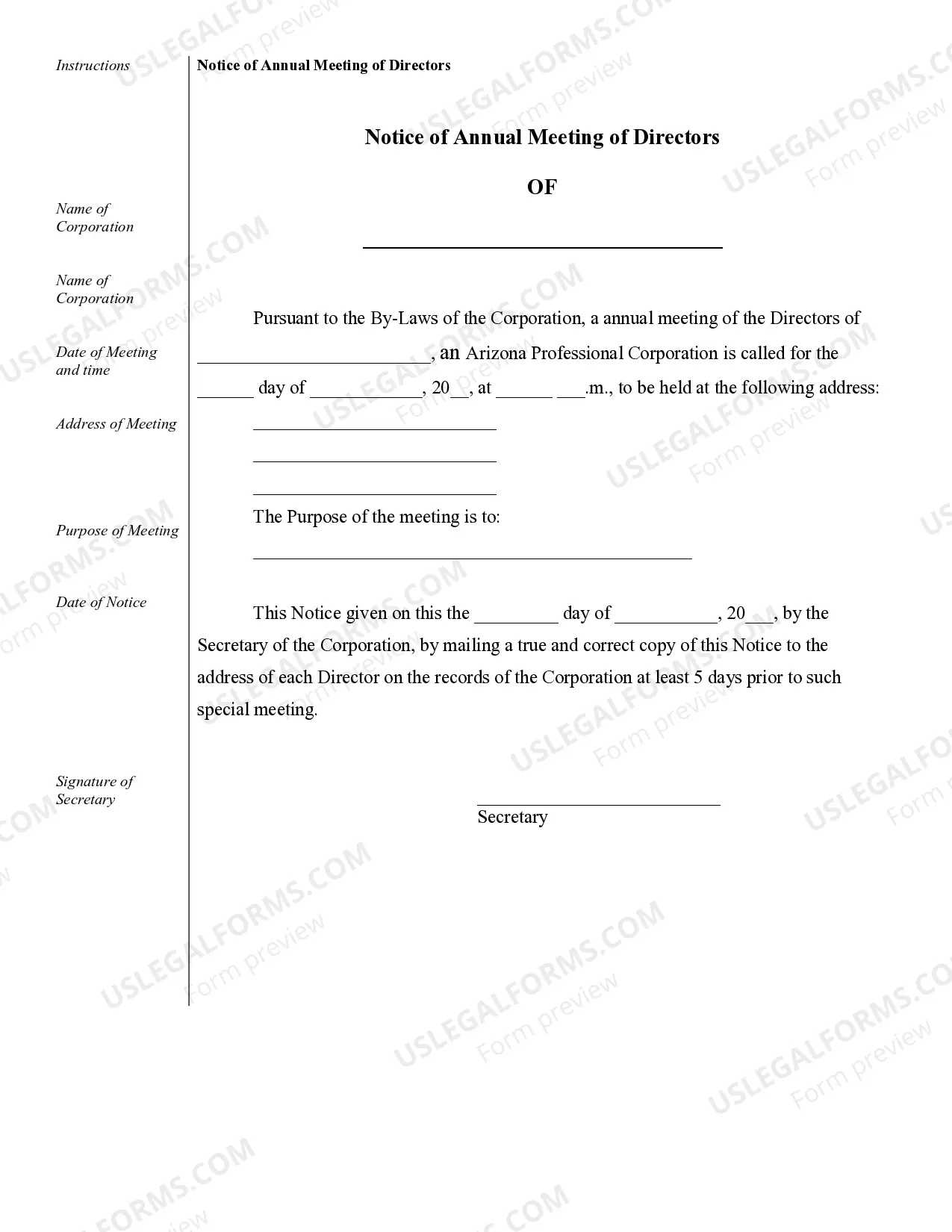

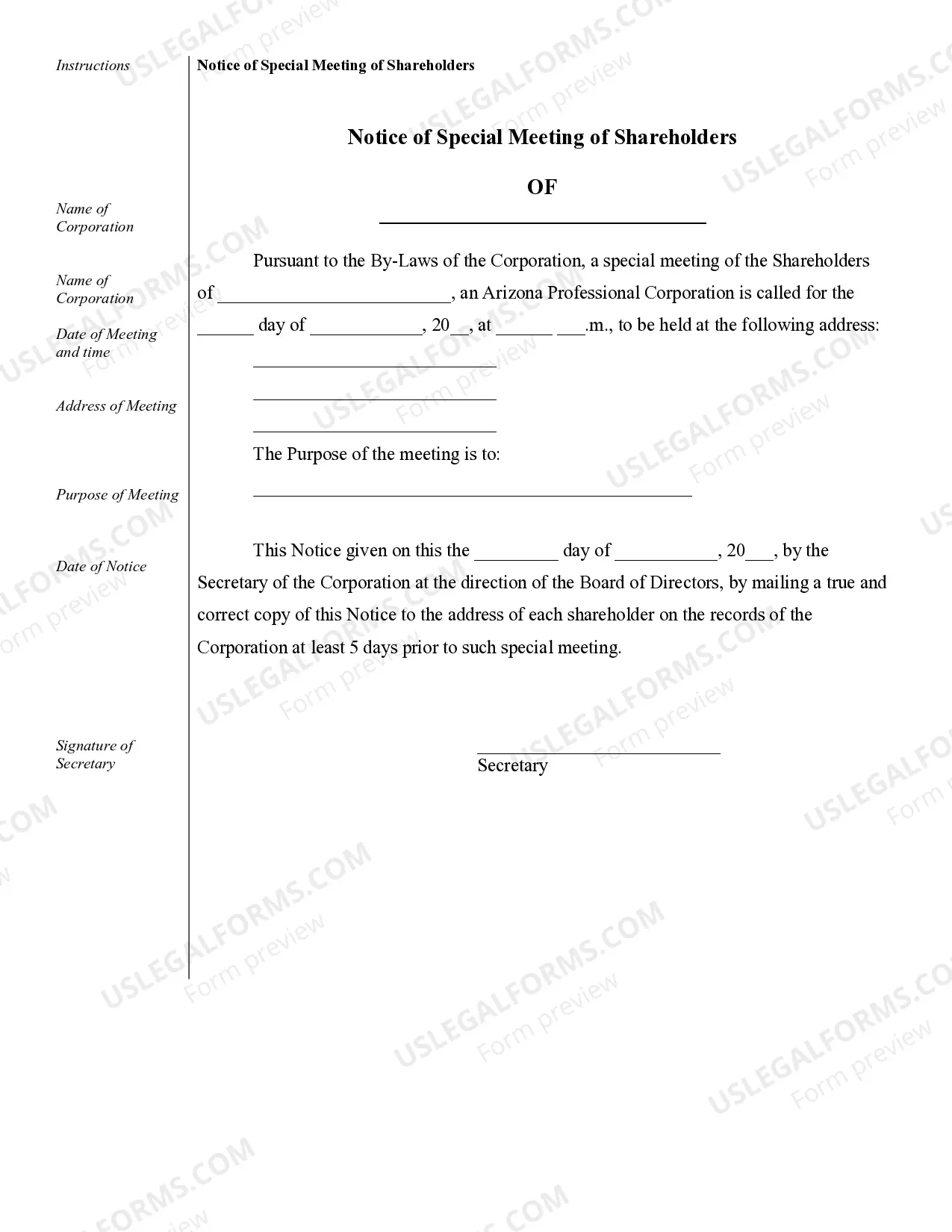

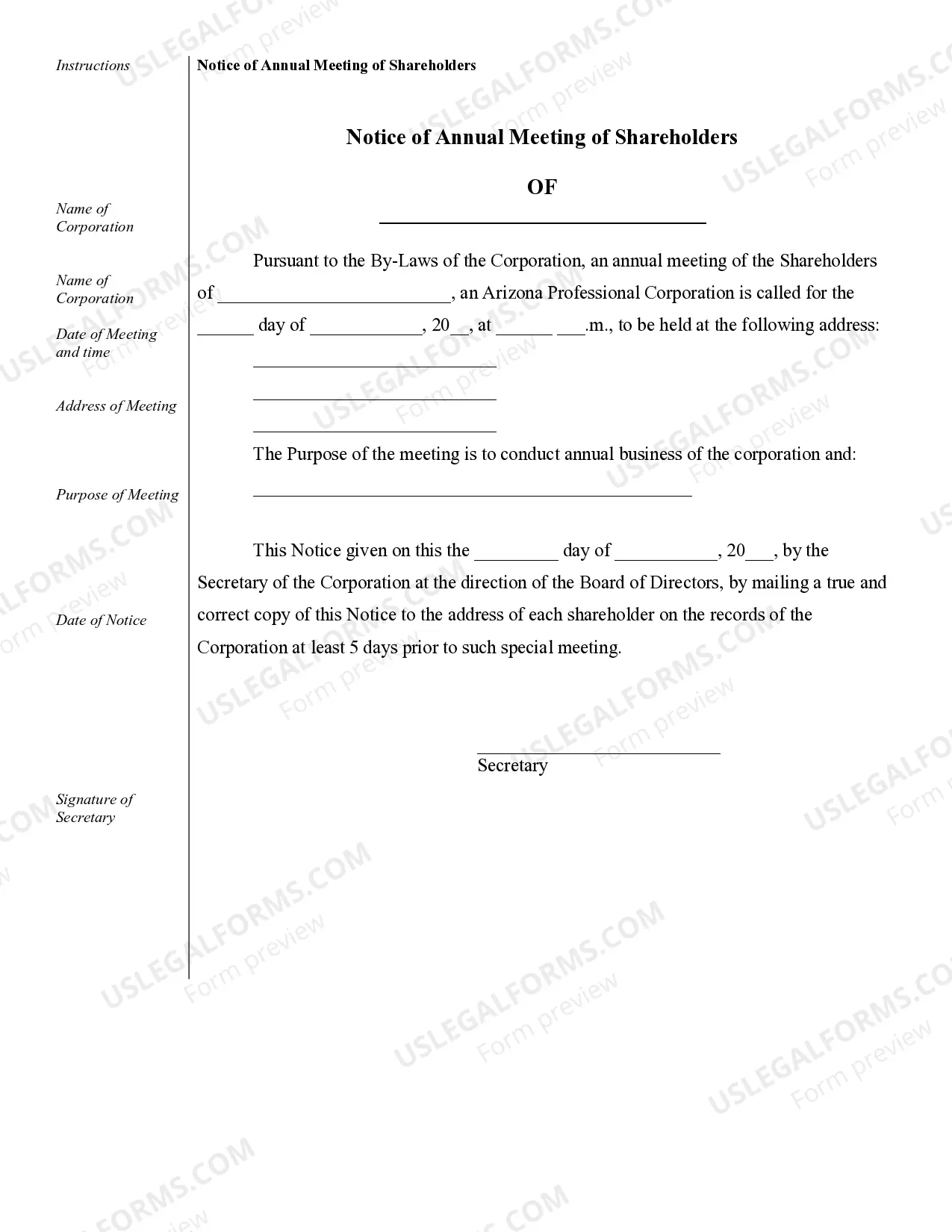

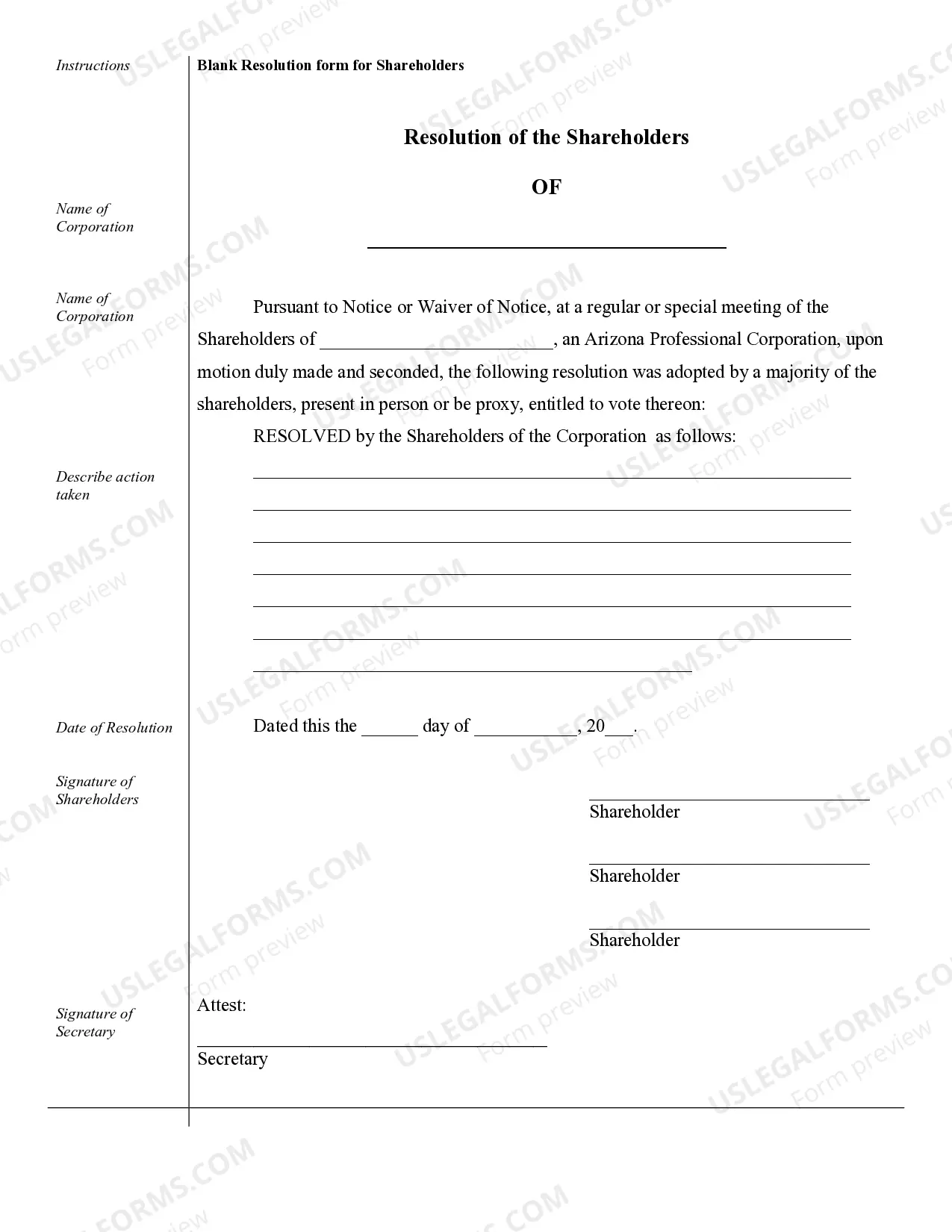

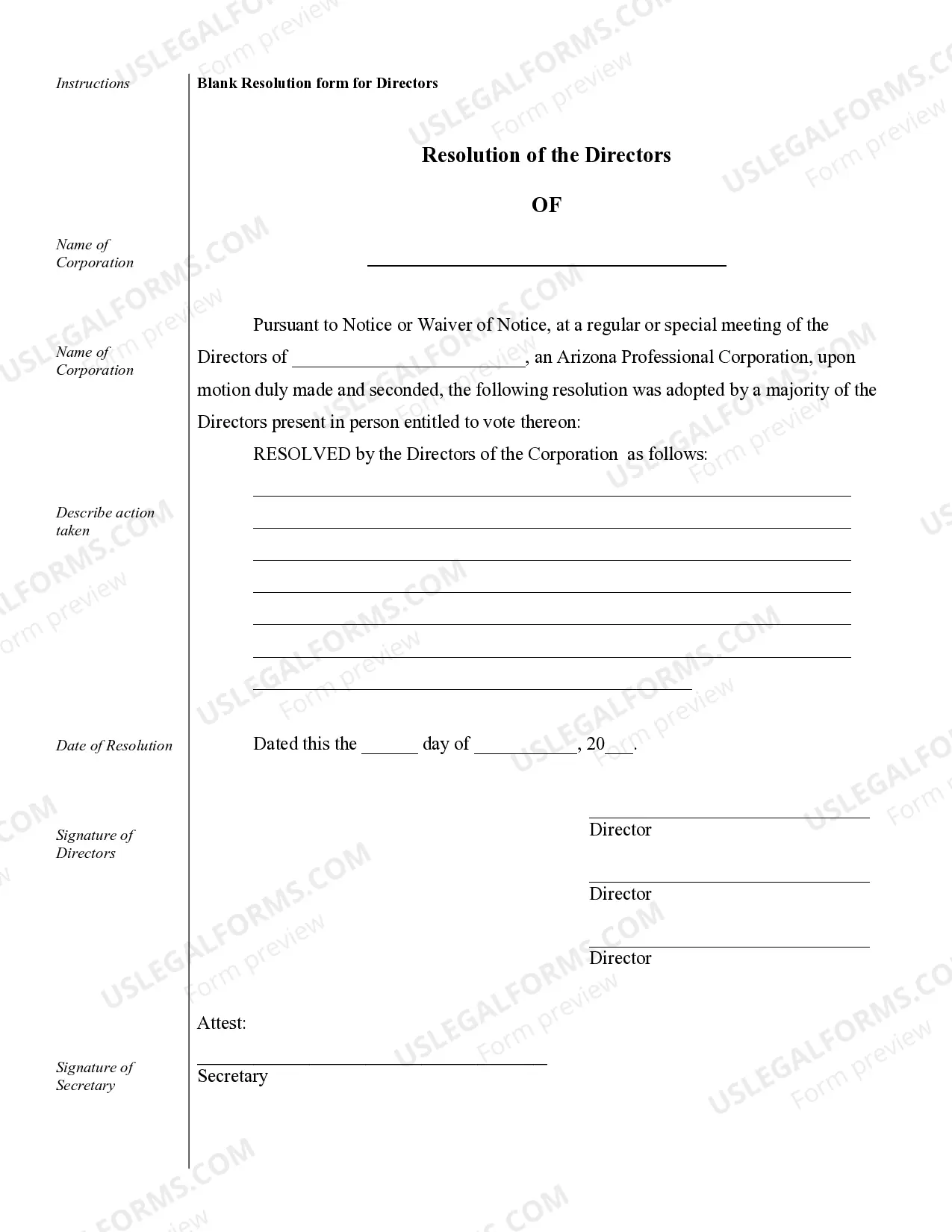

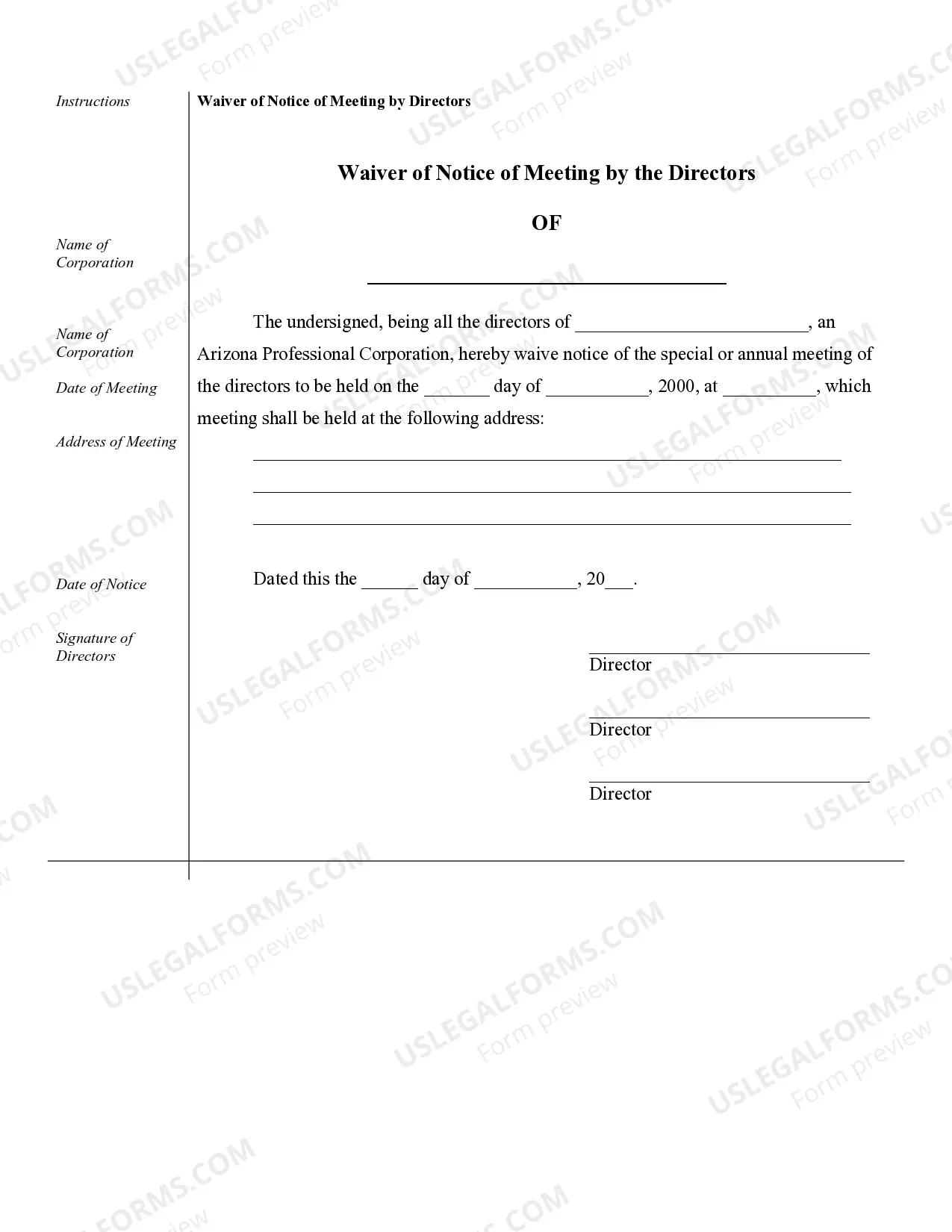

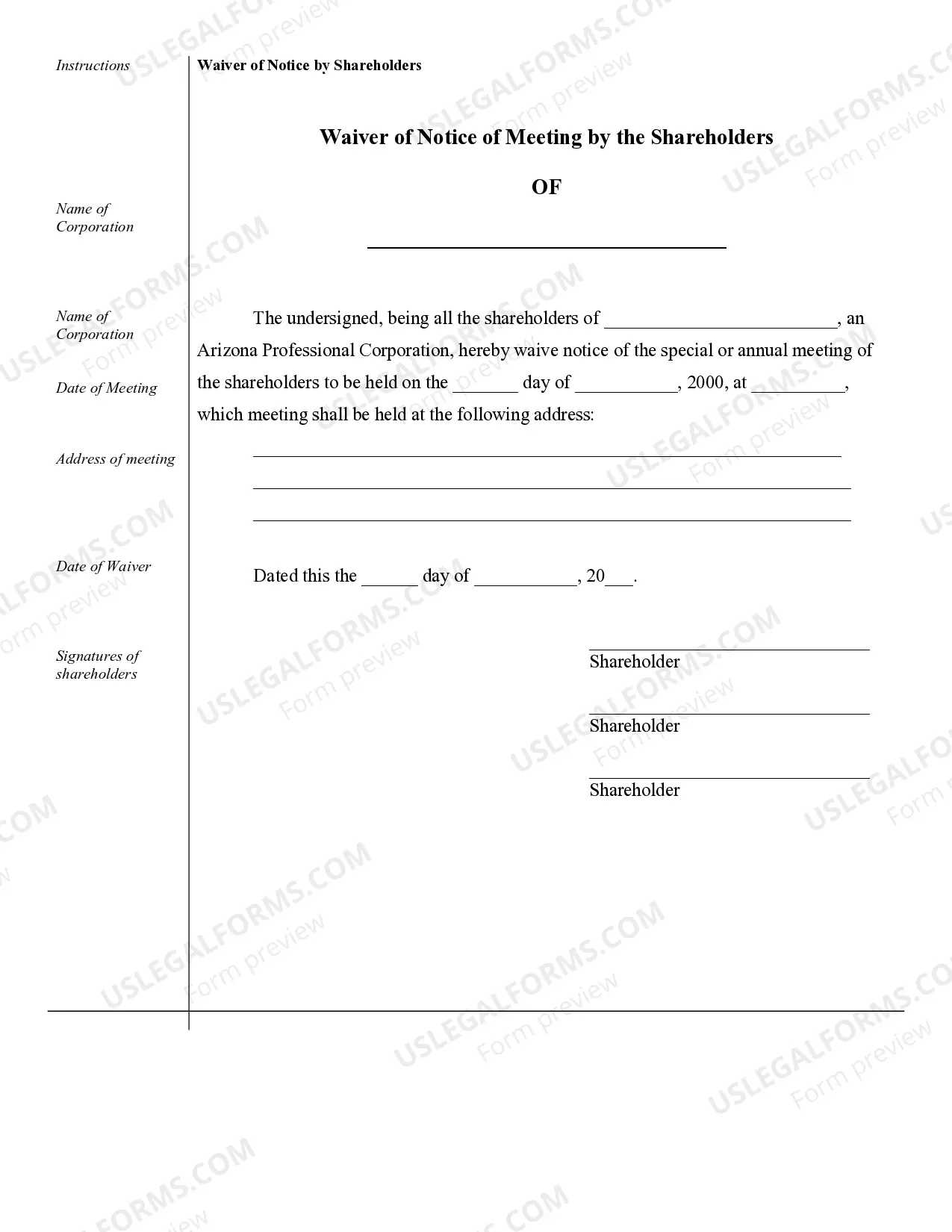

Gilbert Sample Corporate Records for an Arizona Professional Corporation refer to the official documentation and records maintained by a professional corporation in the town of Gilbert, Arizona. These records serve as a vital resource for maintaining a transparent and compliant business structure, ensuring legal obligations are met, and facilitating effective corporate governance. The following are the different types of Gilbert Sample Corporate Records for an Arizona Professional Corporation: 1. Articles of Incorporation: These are the foundational documents that establish the legal existence of the professional corporation. The articles include important information such as the corporation's name, purpose, registered agent, duration, and the number of shares authorized. 2. Bylaws: Bylaws outline the internal rules and procedures that govern the corporation's operations, including the responsibilities of shareholders, directors, and officers. These rules cover areas such as shareholder meetings, voting rights, board structure, and corporate decision-making processes. 3. Shareholder Records: These records document the ownership details of the corporation, including the names, addresses, and share allotments of each shareholder. They also keep track of any transfers or sales of shares that occur over time. 4. Director and Officer Information: These records contain information about the corporation's directors and officers, including their names, addresses, positions held, and dates of appointment or election. These documents help maintain an accurate record of the individuals responsible for the corporation's management and decision-making. 5. Minutes of Meetings: Minutes provide a summary of the discussions, decisions, and actions taken during shareholder meetings, board meetings, and committee meetings. They document key resolutions, votes, and other significant matters, ensuring transparency and serving as an important reference for future decision-making. 6. Financial Records: These records include financial statements, tax returns, and other financial reports that demonstrate the corporation's financial health and compliance. They allow stakeholders to assess the corporation's performance, track financial transactions, and ensure compliance with relevant laws and regulations. 7. Contracts and Agreements: These records comprise copies of contracts, agreements, leases, and other legal documents entered into by the corporation. Contracts may include employment agreements, client contracts, vendor agreements, shareholder agreements, and more. Retaining these records is essential for legal compliance, risk mitigation, and dispute resolution purposes. 8. Licenses, Permits, and Certifications: These records include any licenses, permits, or certifications obtained by the corporation to operate legally and in compliance with regulatory requirements. Examples may include professional licenses, industry-specific permits, health and safety certificates, and more. Maintaining accurate, up-to-date, and well-organized Gilbert Sample Corporate Records for an Arizona Professional Corporation is crucial for legal compliance, effective governance, transparency, and establishing credibility with stakeholders. These records provide a comprehensive overview of the corporation's structure, ownership, decision-making processes, financial health, and legal obligations. They are vital resources that support the smooth and legally compliant functioning of professional corporations in Gilbert, Arizona.Gilbert Sample Corporate Records for an Arizona Professional Corporation refer to the official documentation and records maintained by a professional corporation in the town of Gilbert, Arizona. These records serve as a vital resource for maintaining a transparent and compliant business structure, ensuring legal obligations are met, and facilitating effective corporate governance. The following are the different types of Gilbert Sample Corporate Records for an Arizona Professional Corporation: 1. Articles of Incorporation: These are the foundational documents that establish the legal existence of the professional corporation. The articles include important information such as the corporation's name, purpose, registered agent, duration, and the number of shares authorized. 2. Bylaws: Bylaws outline the internal rules and procedures that govern the corporation's operations, including the responsibilities of shareholders, directors, and officers. These rules cover areas such as shareholder meetings, voting rights, board structure, and corporate decision-making processes. 3. Shareholder Records: These records document the ownership details of the corporation, including the names, addresses, and share allotments of each shareholder. They also keep track of any transfers or sales of shares that occur over time. 4. Director and Officer Information: These records contain information about the corporation's directors and officers, including their names, addresses, positions held, and dates of appointment or election. These documents help maintain an accurate record of the individuals responsible for the corporation's management and decision-making. 5. Minutes of Meetings: Minutes provide a summary of the discussions, decisions, and actions taken during shareholder meetings, board meetings, and committee meetings. They document key resolutions, votes, and other significant matters, ensuring transparency and serving as an important reference for future decision-making. 6. Financial Records: These records include financial statements, tax returns, and other financial reports that demonstrate the corporation's financial health and compliance. They allow stakeholders to assess the corporation's performance, track financial transactions, and ensure compliance with relevant laws and regulations. 7. Contracts and Agreements: These records comprise copies of contracts, agreements, leases, and other legal documents entered into by the corporation. Contracts may include employment agreements, client contracts, vendor agreements, shareholder agreements, and more. Retaining these records is essential for legal compliance, risk mitigation, and dispute resolution purposes. 8. Licenses, Permits, and Certifications: These records include any licenses, permits, or certifications obtained by the corporation to operate legally and in compliance with regulatory requirements. Examples may include professional licenses, industry-specific permits, health and safety certificates, and more. Maintaining accurate, up-to-date, and well-organized Gilbert Sample Corporate Records for an Arizona Professional Corporation is crucial for legal compliance, effective governance, transparency, and establishing credibility with stakeholders. These records provide a comprehensive overview of the corporation's structure, ownership, decision-making processes, financial health, and legal obligations. They are vital resources that support the smooth and legally compliant functioning of professional corporations in Gilbert, Arizona.