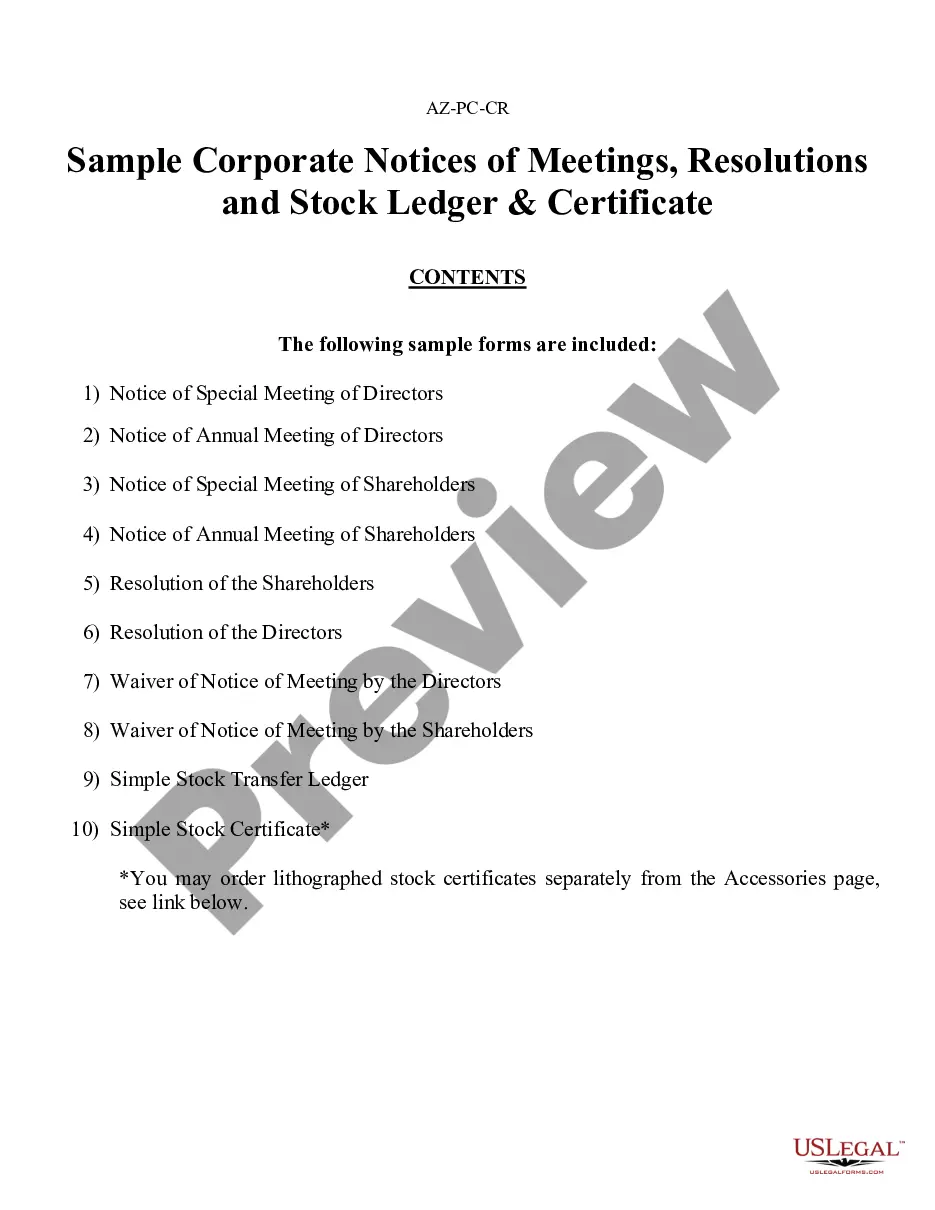

Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

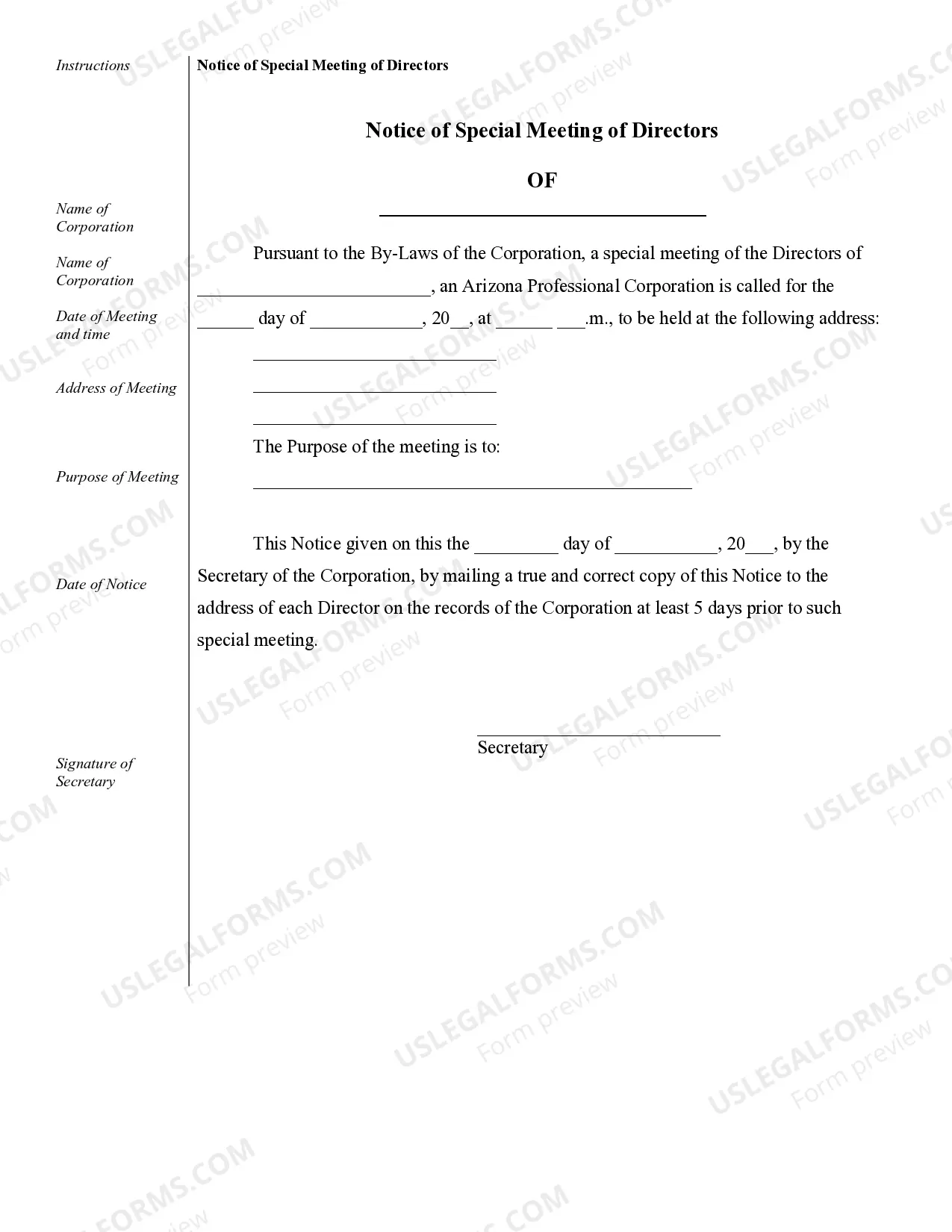

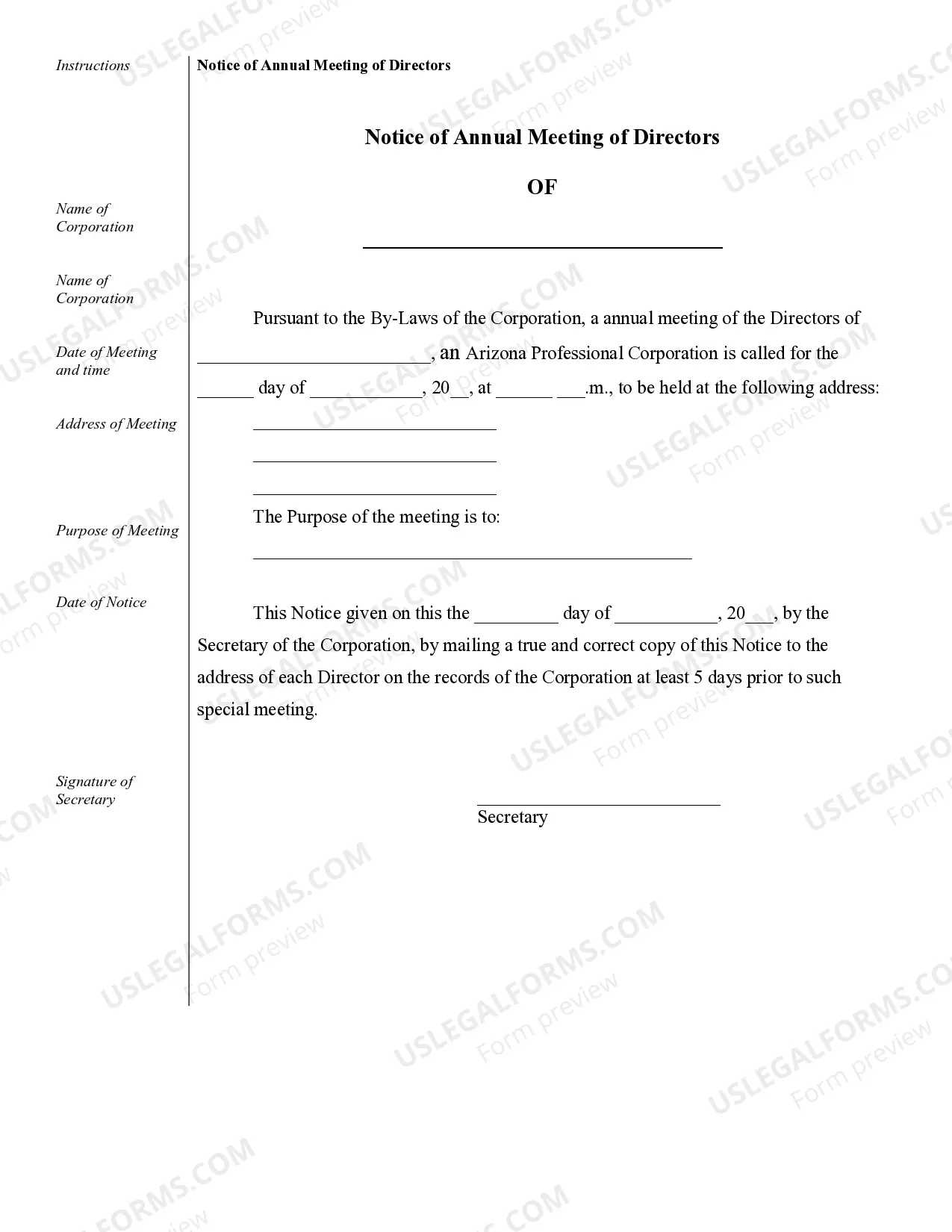

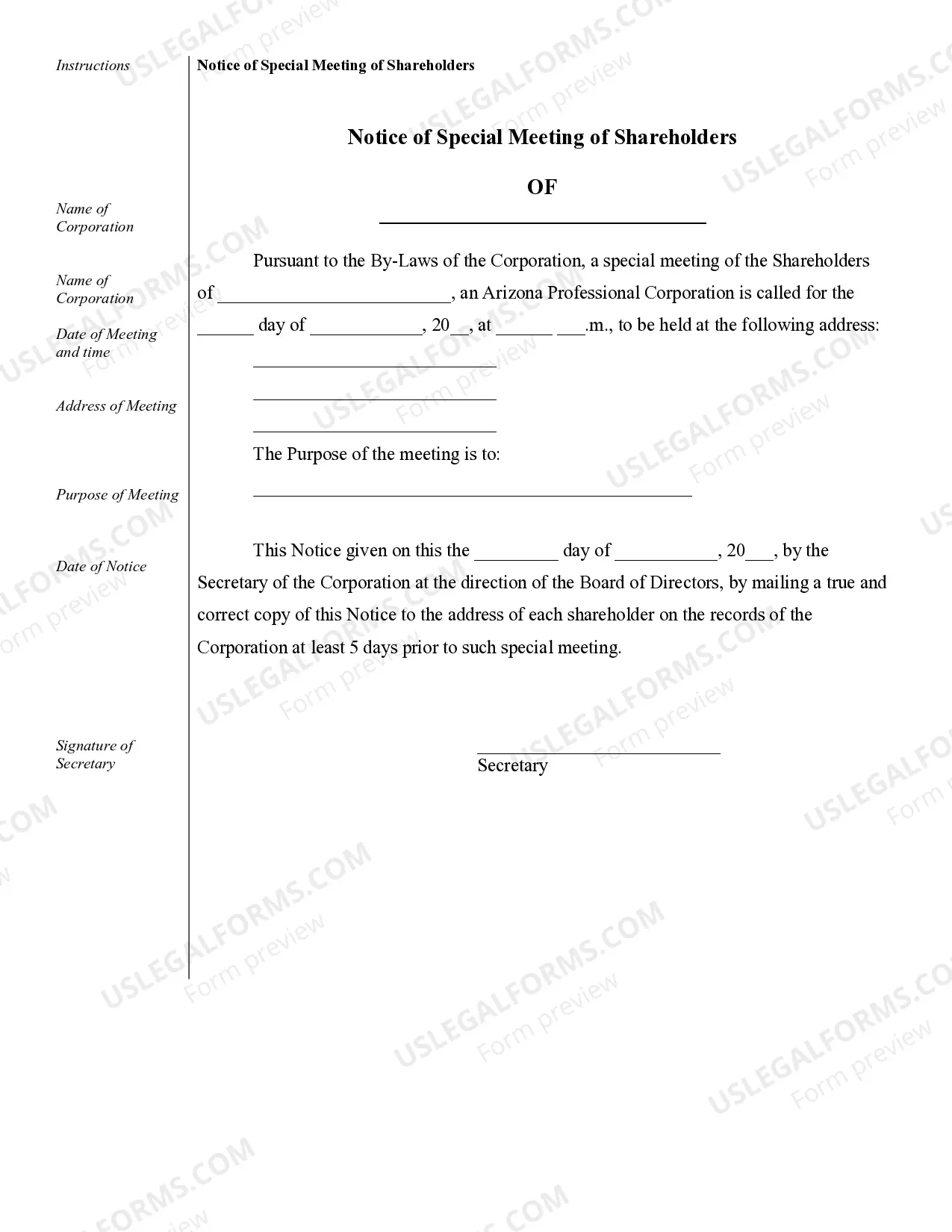

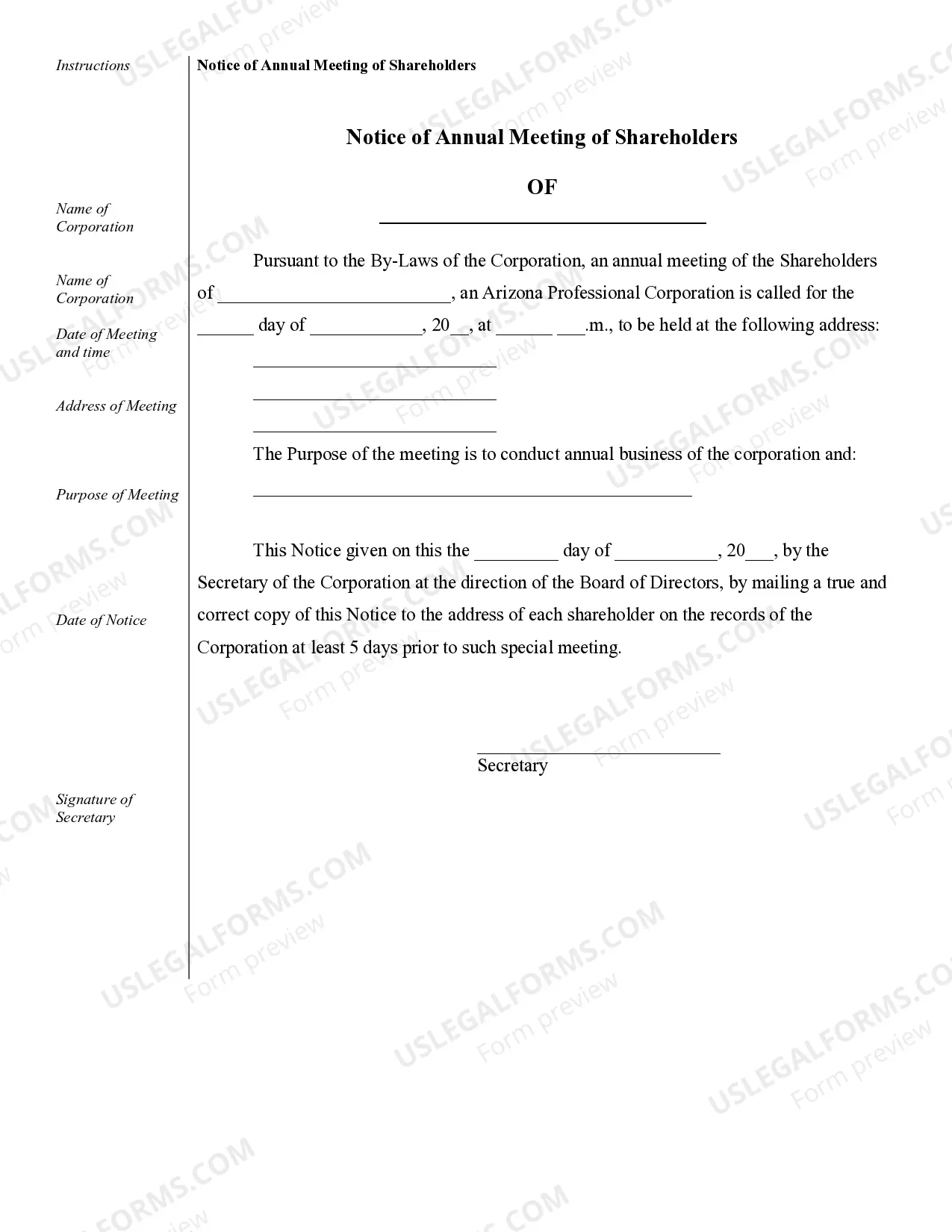

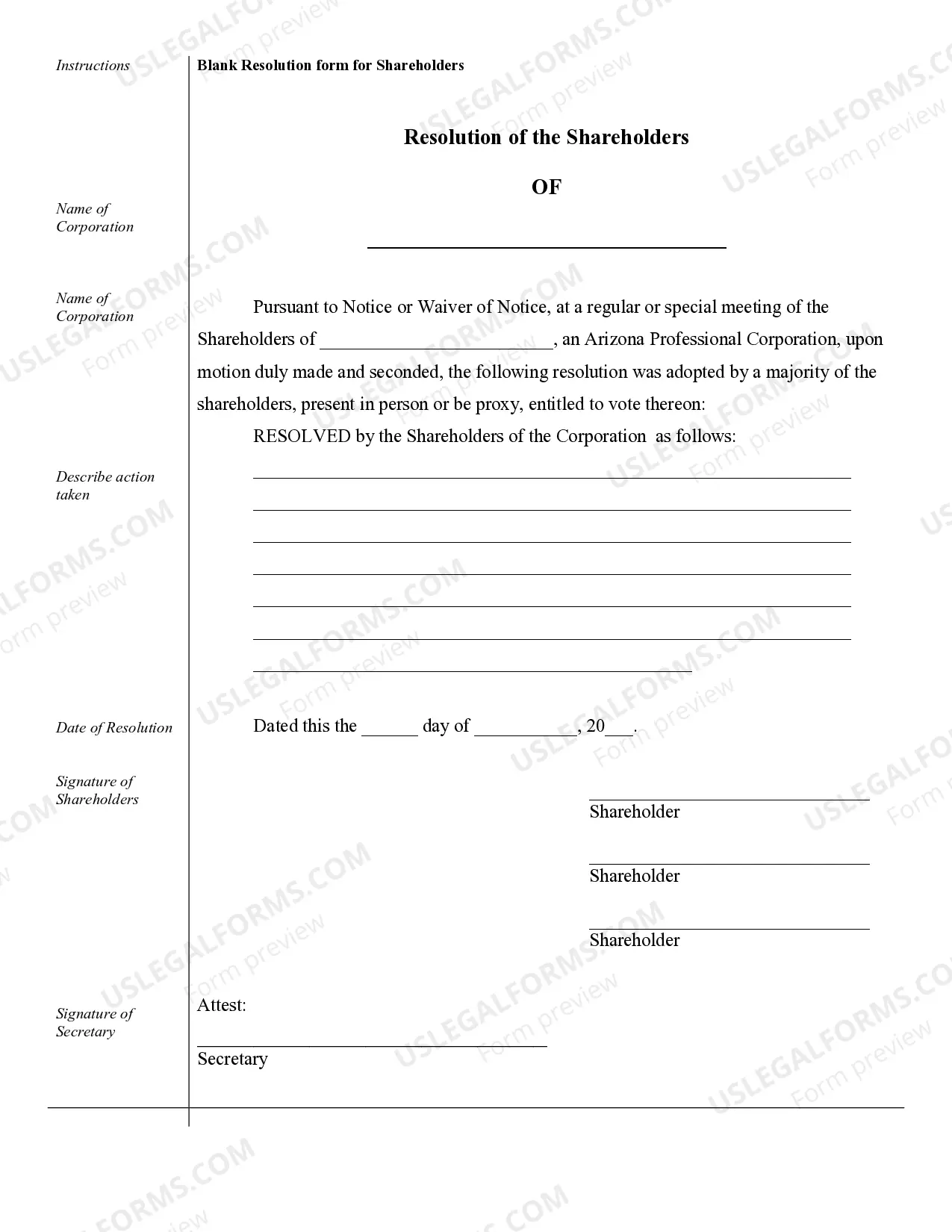

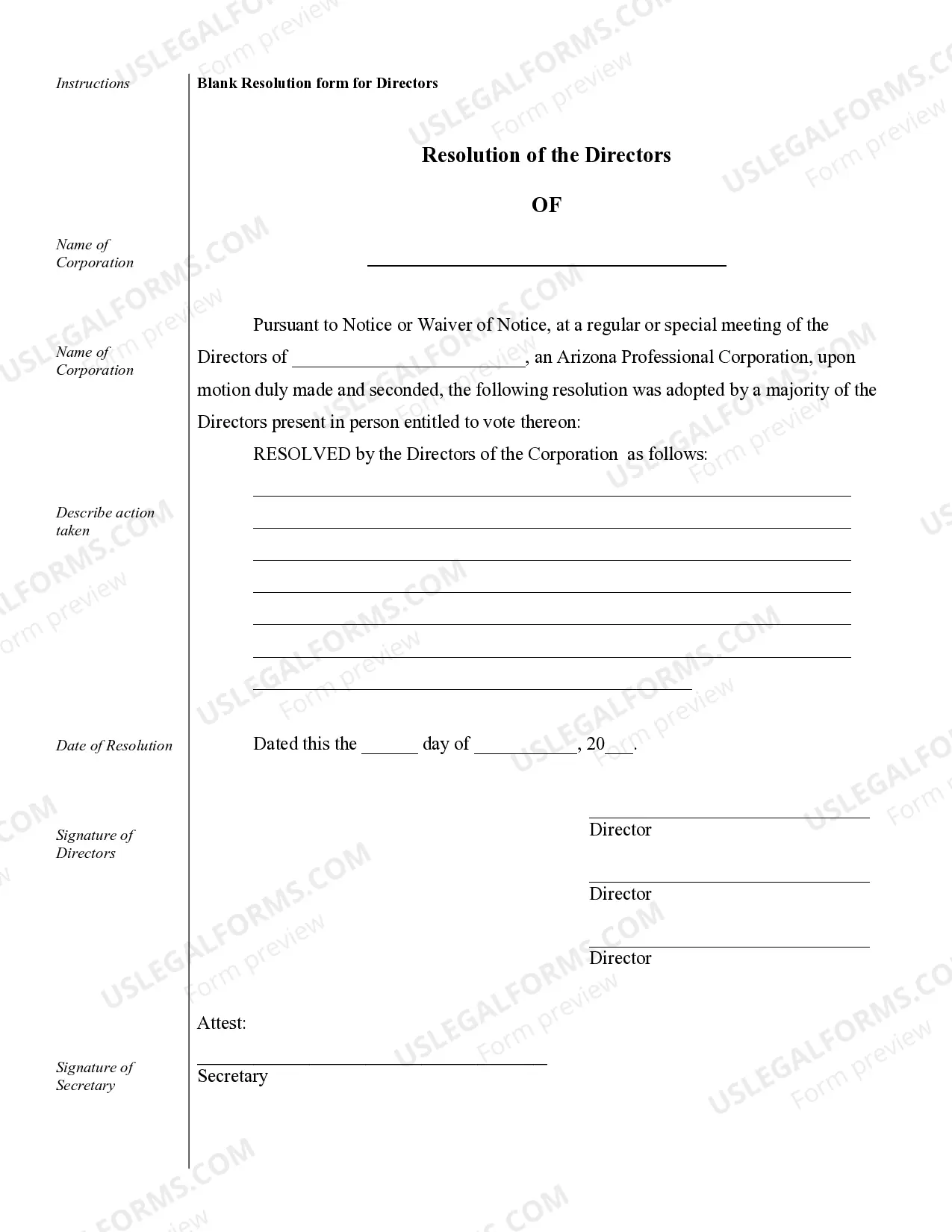

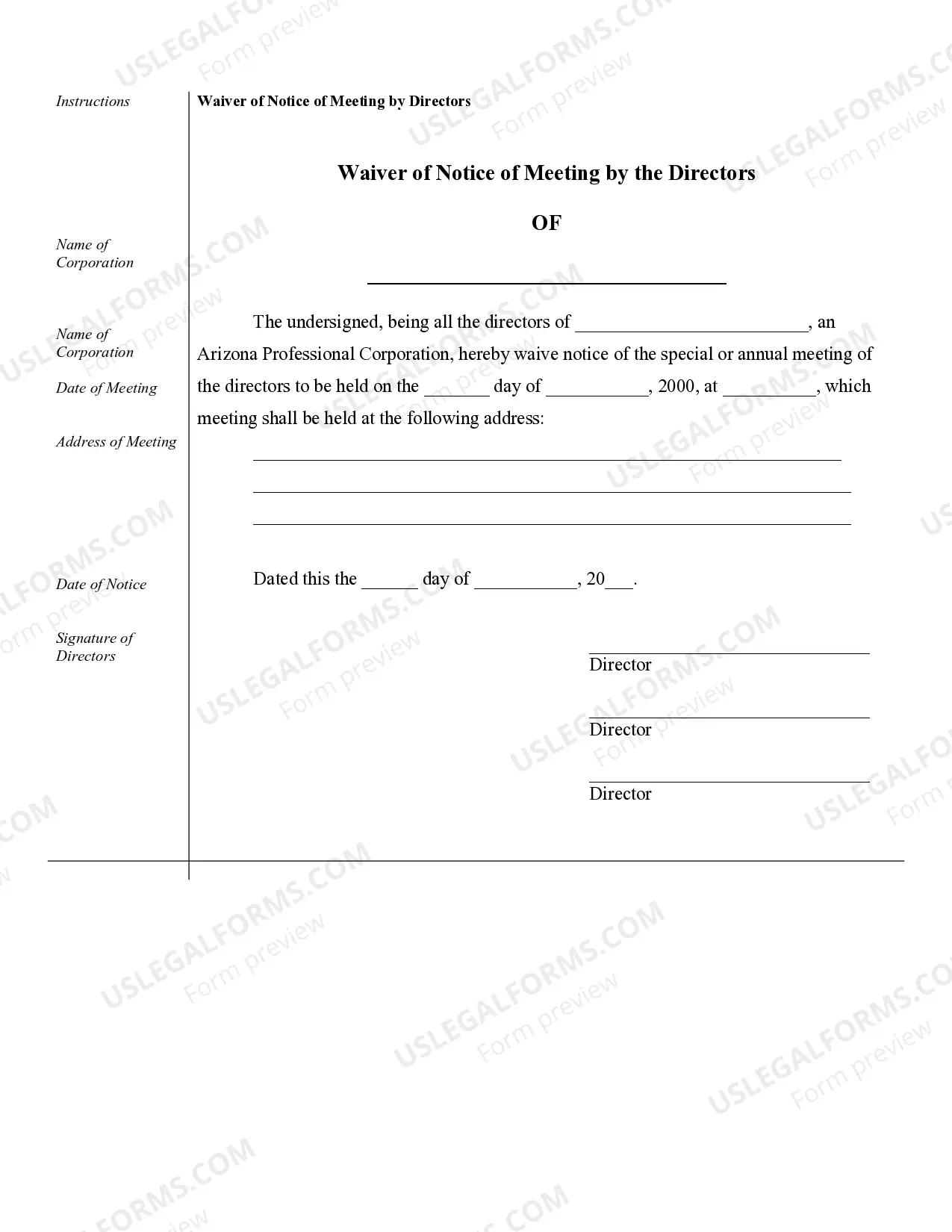

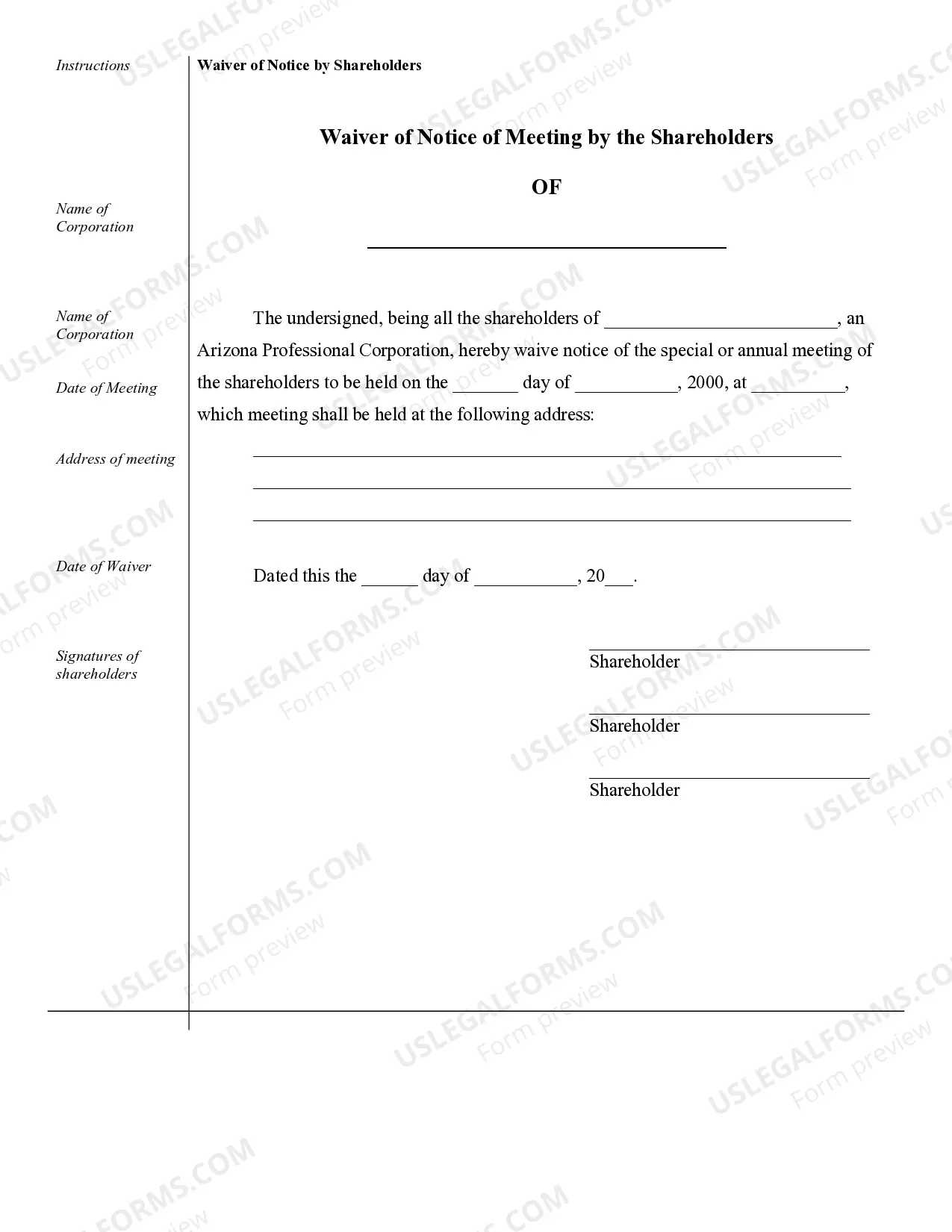

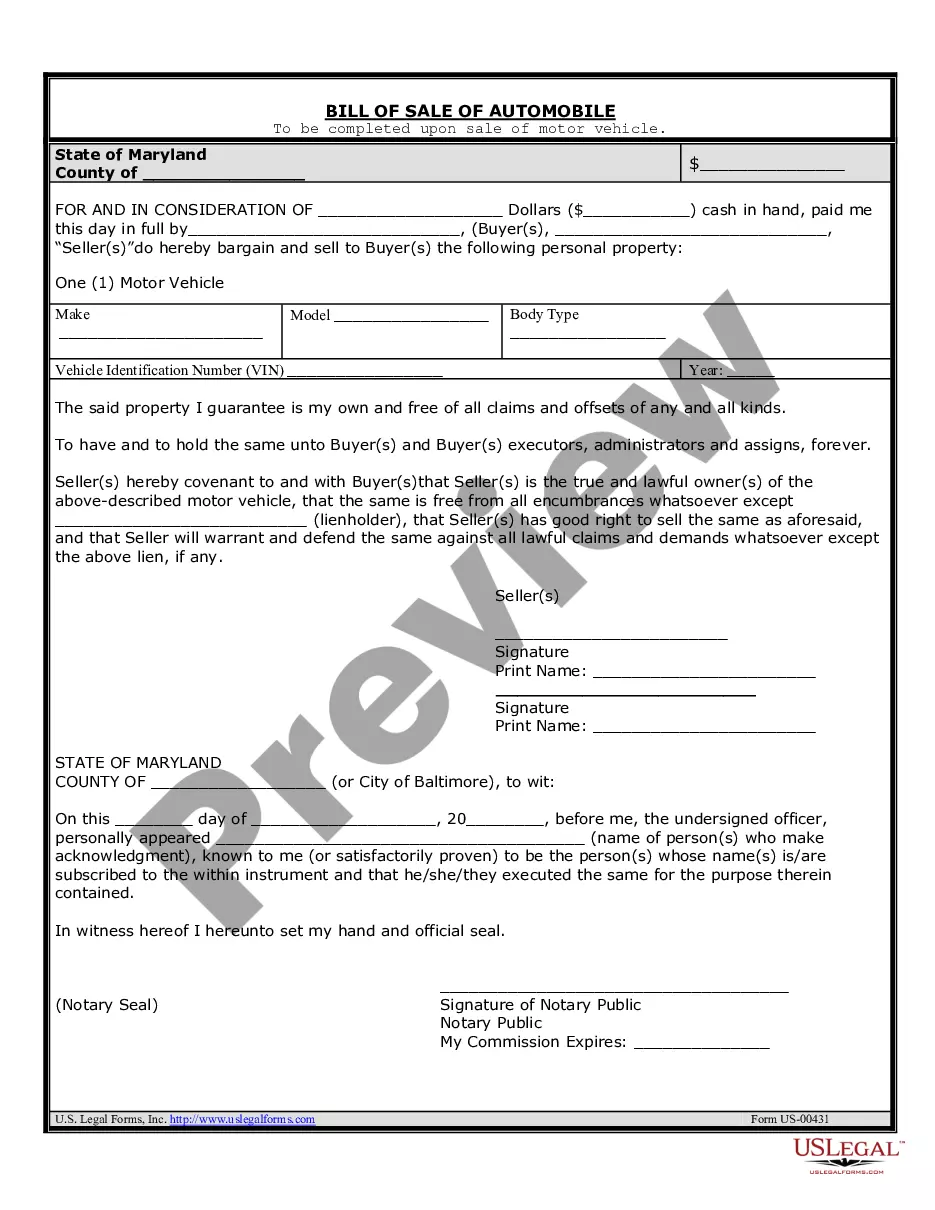

Glendale Sample Corporate Records for an Arizona Professional Corporation are comprehensive documents that serve as a record of important legal and administrative information pertaining to the corporation's formation, organization, and ongoing activities. These records are critical for complying with state laws and regulations, maintaining transparency, preserving corporate history, and securing the corporation's legal status. Some key types of Glendale Sample Corporate Records for an Arizona Professional Corporation include: 1. Articles of Incorporation: This is a foundational document that establishes the corporation's existence, identifying its name, registered agent, purpose, duration, and other essential details. It defines the corporation's legal structure and sets forth its initial shareholder information. 2. Bylaws: These are the set of rules and regulations governing the internal operations and management of the corporation. Bylaws outline procedures for meetings, decision-making processes, shareholder rights and responsibilities, officer duties, and more. 3. Meeting Minutes: These records summarize the discussions and actions taken during shareholder meetings, board of directors' meetings, and other important gatherings. Meeting minutes provide a chronological account of the corporation's decision-making processes, including resolutions, voting outcomes, and any changes to corporate policies. 4. Stock Certificates and Ledger: Stock certificates are issued to shareholders as evidence of their ownership in the corporation. The stock ledger maintains a record of all shares issued, shareholders' names, ownership percentages, and any transfers or changes in ownership. 5. Financial Statements: These reports include balance sheets, income statements, and cash flow statements, serving as a snapshot of the corporation's financial health. Financial statements are crucial for tax filings, investor communications, and compliance with accounting standards and regulations. 6. Shareholder Agreements: These contracts outline the rights, obligations, and responsibilities of shareholders among themselves and the corporation. They may cover matters such as share transfer restrictions, buyout mechanisms, dispute resolution, and more. 7. Annual Reports: A requirement for Arizona corporations, annual reports provide an overview of the corporation's financial and operational performance during the preceding year. They include information on business activities, major transactions, changes in leadership, and financial data. 8. Licensing and Permit Documents: These records include licenses, permits, and registrations required for the corporation to operate legally within Arizona. Examples include professional licenses, trade permits, and tax registrations. 9. Contracts and Agreements: Any legally binding agreements entered into by the corporation, such as client contracts, partnership agreements, employment contracts, or leases, should be recorded and kept as part of the corporate records. By maintaining and organizing these Glendale Sample Corporate Records, an Arizona Professional Corporation ensures compliance with legal obligations, facilitates effective governance, provides a historical record of corporate activities, and enables seamless business operations.Glendale Sample Corporate Records for an Arizona Professional Corporation are comprehensive documents that serve as a record of important legal and administrative information pertaining to the corporation's formation, organization, and ongoing activities. These records are critical for complying with state laws and regulations, maintaining transparency, preserving corporate history, and securing the corporation's legal status. Some key types of Glendale Sample Corporate Records for an Arizona Professional Corporation include: 1. Articles of Incorporation: This is a foundational document that establishes the corporation's existence, identifying its name, registered agent, purpose, duration, and other essential details. It defines the corporation's legal structure and sets forth its initial shareholder information. 2. Bylaws: These are the set of rules and regulations governing the internal operations and management of the corporation. Bylaws outline procedures for meetings, decision-making processes, shareholder rights and responsibilities, officer duties, and more. 3. Meeting Minutes: These records summarize the discussions and actions taken during shareholder meetings, board of directors' meetings, and other important gatherings. Meeting minutes provide a chronological account of the corporation's decision-making processes, including resolutions, voting outcomes, and any changes to corporate policies. 4. Stock Certificates and Ledger: Stock certificates are issued to shareholders as evidence of their ownership in the corporation. The stock ledger maintains a record of all shares issued, shareholders' names, ownership percentages, and any transfers or changes in ownership. 5. Financial Statements: These reports include balance sheets, income statements, and cash flow statements, serving as a snapshot of the corporation's financial health. Financial statements are crucial for tax filings, investor communications, and compliance with accounting standards and regulations. 6. Shareholder Agreements: These contracts outline the rights, obligations, and responsibilities of shareholders among themselves and the corporation. They may cover matters such as share transfer restrictions, buyout mechanisms, dispute resolution, and more. 7. Annual Reports: A requirement for Arizona corporations, annual reports provide an overview of the corporation's financial and operational performance during the preceding year. They include information on business activities, major transactions, changes in leadership, and financial data. 8. Licensing and Permit Documents: These records include licenses, permits, and registrations required for the corporation to operate legally within Arizona. Examples include professional licenses, trade permits, and tax registrations. 9. Contracts and Agreements: Any legally binding agreements entered into by the corporation, such as client contracts, partnership agreements, employment contracts, or leases, should be recorded and kept as part of the corporate records. By maintaining and organizing these Glendale Sample Corporate Records, an Arizona Professional Corporation ensures compliance with legal obligations, facilitates effective governance, provides a historical record of corporate activities, and enables seamless business operations.