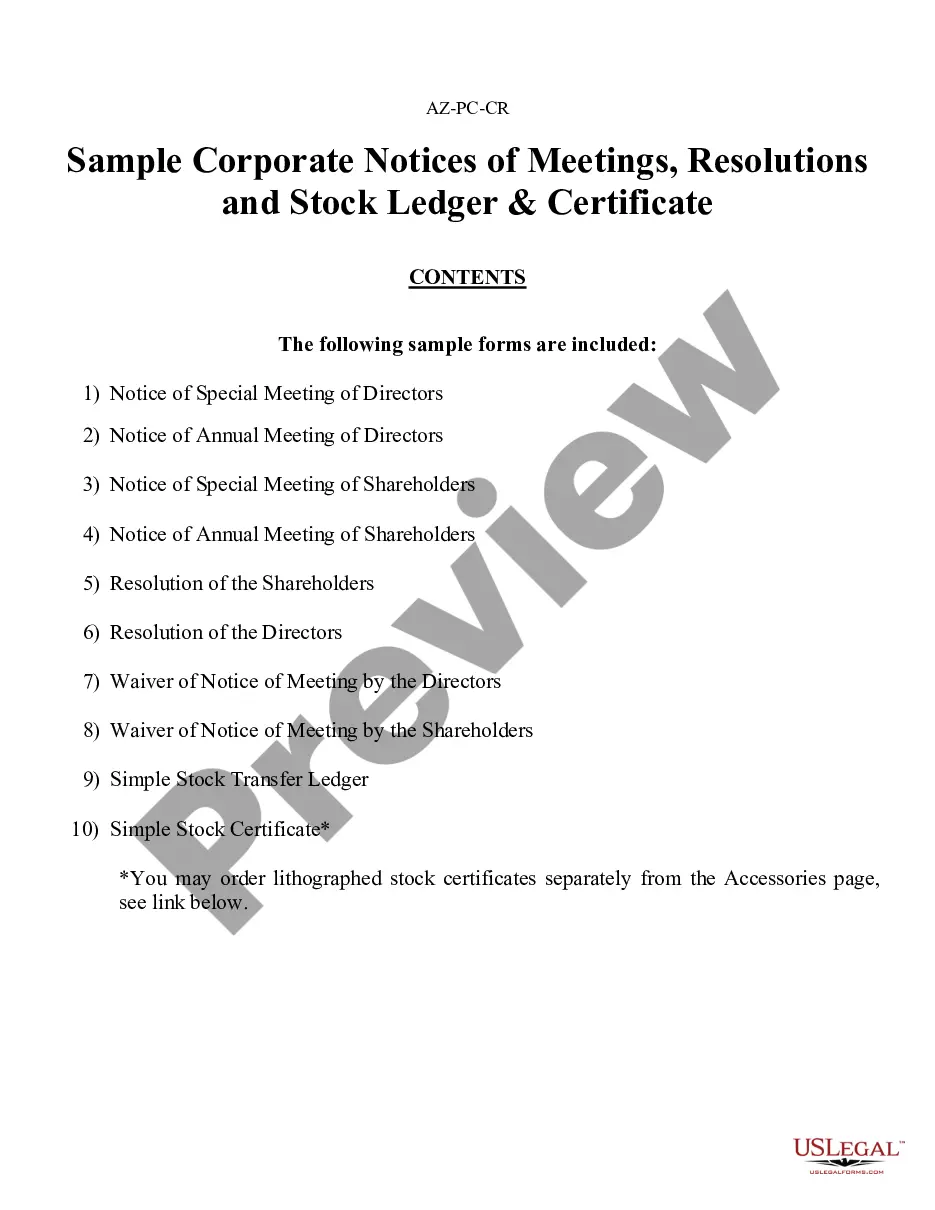

Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

Phoenix Sample Corporate Records for a Arizona Professional Corporation

Description

How to fill out Sample Corporate Records For A Arizona Professional Corporation?

Are you in search of a reliable and affordable legal forms provider to obtain the Phoenix Sample Corporate Records for an Arizona Professional Corporation? US Legal Forms is your ideal choice.

Whether you require a straightforward arrangement to establish guidelines for living together with your partner or a collection of documents to facilitate your separation or divorce through the court, we have you covered. Our platform offers more than 85,000 current legal document templates for personal and business purposes. All templates that we provide access to are tailored and structured in accordance with the regulations of specific states and regions.

To retrieve the document, you must Log In to your account, locate the desired template, and click the Download button adjacent to it. Please remember that you can download your previously acquired document templates at any time from the My documents tab.

Is this your first visit to our website? No problem. You can create an account with great ease, but before doing that, make sure to take the following steps.

Now you can register your account. Then select the subscription option and continue to payment. Once the payment is completed, download the Phoenix Sample Corporate Records for an Arizona Professional Corporation in any available format. You can revisit the website whenever needed and redownload the document at no additional cost.

Obtaining current legal documents has never been simpler. Try US Legal Forms today, and stop wasting your precious time searching for legal paperwork online.

- Verify if the Phoenix Sample Corporate Records for an Arizona Professional Corporation complies with the regulations of your state and locality.

- Examine the details of the form (if available) to understand who the document is meant for.

- Reinitiate the search if the template does not suit your legal needs.

Form popularity

FAQ

Even if a company has all necessary business licenses, it still needs to file its annual reports. Annual report filing requirements continue even after forming your company. Just like tax returns and business licenses, formation and incorporation filings are different from annual report filings.

How do I get copies of corporation or LLC documents? Most documents filed with the A.C.C. are already publicly available on the eCorp website. However, if you need to obtain a certified copy or a record that is preserved on microfilm or microfiche, you may submit a Records Request Form.

Option 1: Create or log into your account with the Arizona Corporation Commission. Then, fill in the required fields and submit. Option 2: Download and mail in the Articles of Organization to the Arizona Corporation Commission or submit it in-person.

All corporations registered with the Arizona Corporation Commission, whether for-profit or nonprofit, domestic or foreign, must file an Annual Report and a Certificate of Disclosure with the Arizona Corporation Commission each year on or before the corporation's due date. See A.R.S. §§ 10-1622 and 10-11622.

A PLLC is an LLC organized under Chapter 4 of Title 29 of the Arizona Revised Statutes for the purpose of providing one or more categories of service that may be lawfully rendered only by a person licensed, or otherwise authorized by a licensing authority in Arizona to render the service.

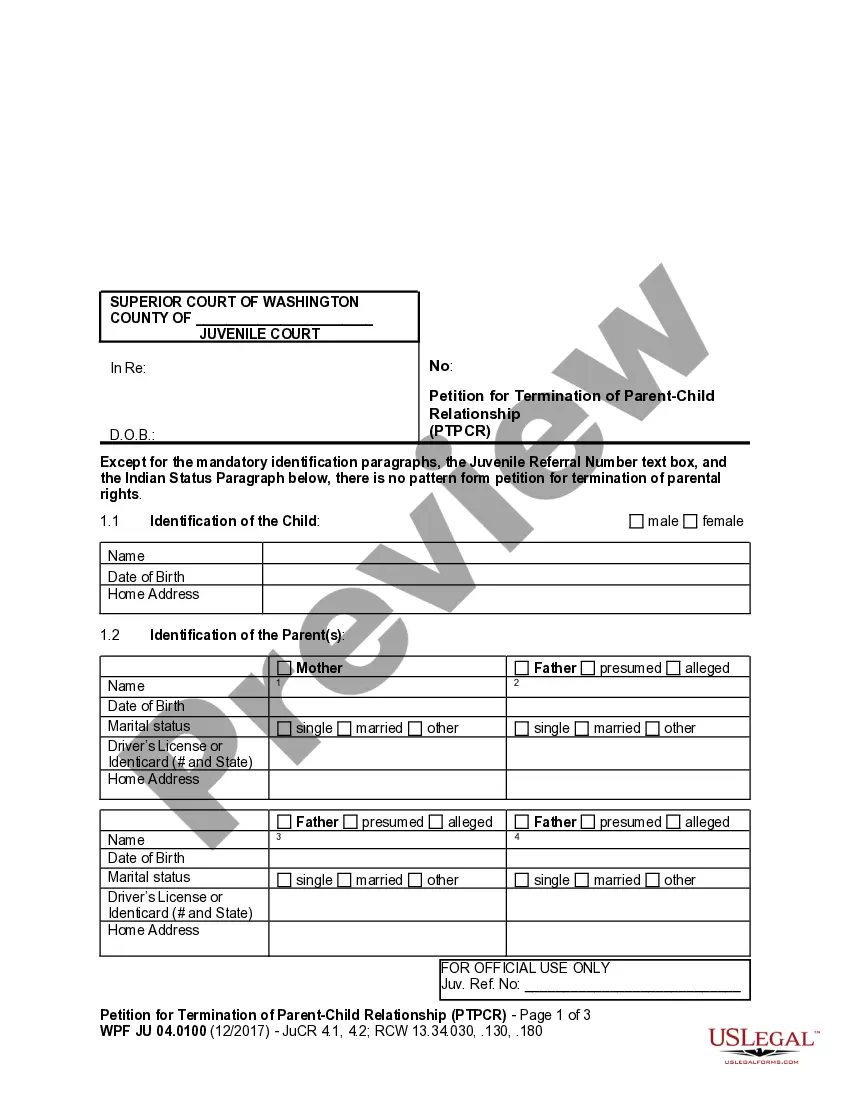

Professional corporations may exist as part of a larger, more complicated, legal entity; for example, a law firm or medical practice might be organized as a partnership of several or many professional corporations.

The difference between LLC and PC is straightforward. A limited liability company (LLC) combines the tax benefits of a partnership and the limited liability protection of a corporation. A professional corporation (PC) is organized according to the laws of the state where the professional is licensed to practice.

Pretty much anyone can form a regular corporation. Professional corporations, however, are more limited, as only certain professional groups can form one. Which professions qualify varies from one state to the next, but typical professions include doctors, attorneys, chiropractors, accountants, and similar trades.

Pursuant to Arizona law, only Corporations are required to file annual reports, on or before their prescribed due date.

How to Form a Corporation in Arizona Choose a Corporate Name.File Articles of Incorporation.Appoint a Registered Agent.Comply with Publishing Requirements.Prepare Corporate Bylaws.Appoint Initial Directors and Hold First Board Meeting.File Annual Reports.Obtain an EIN.