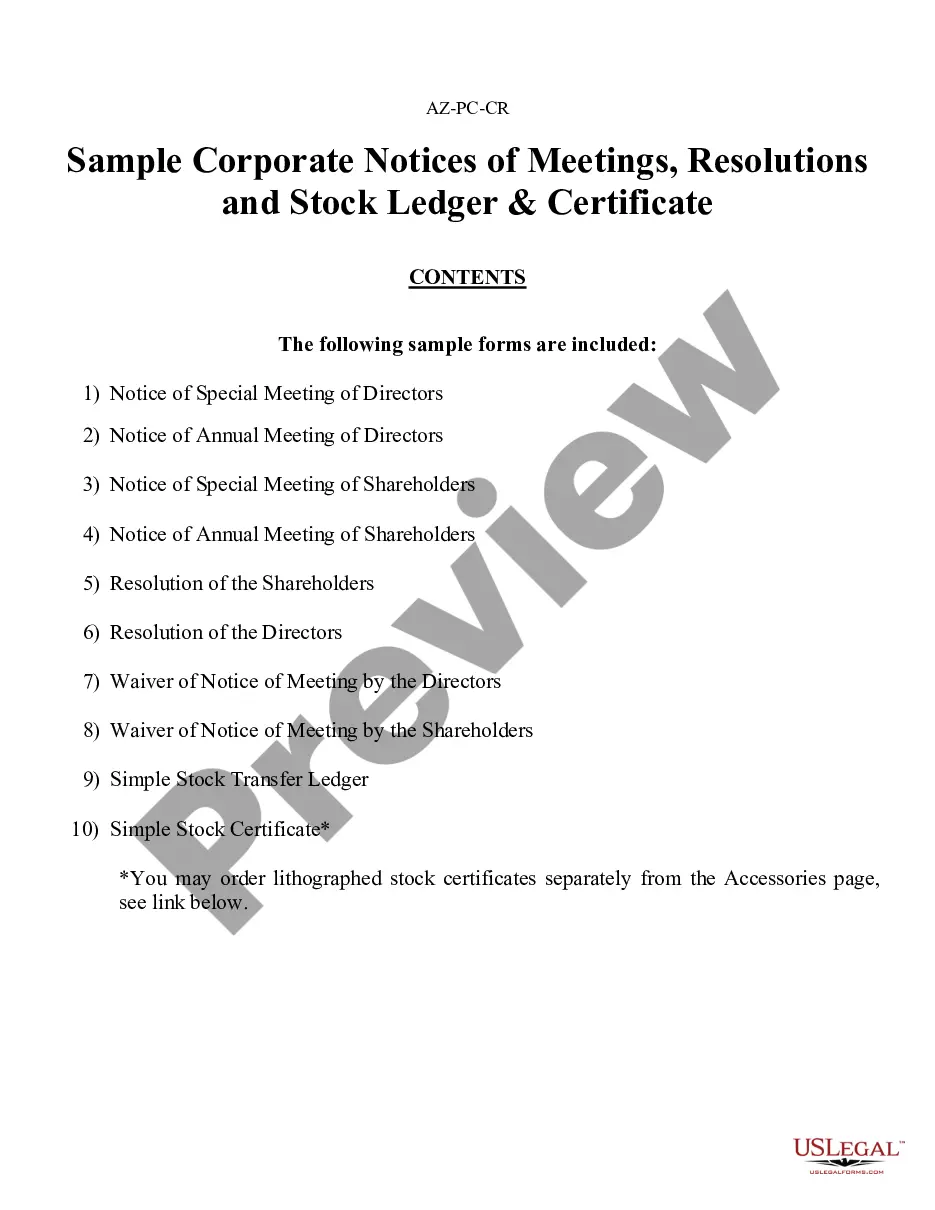

Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

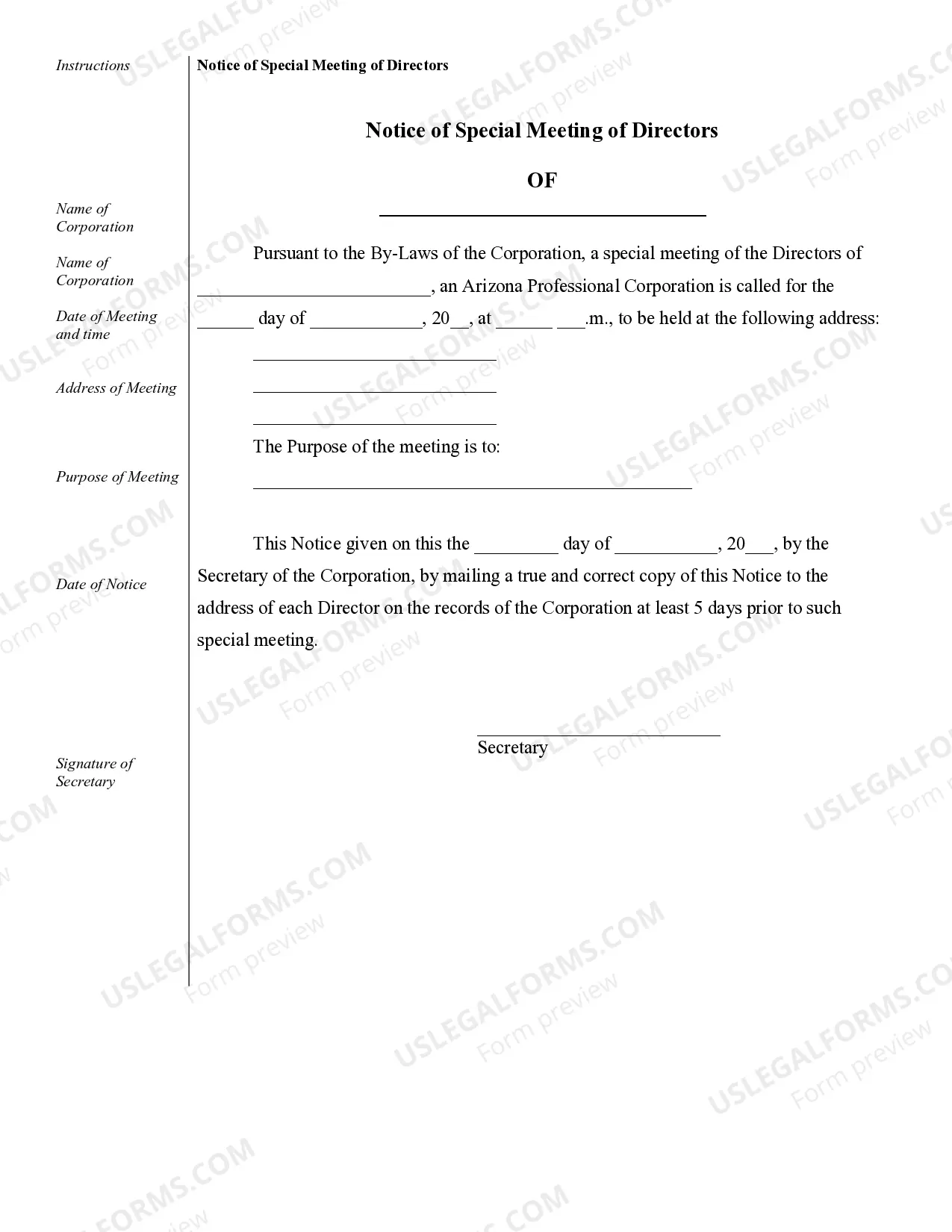

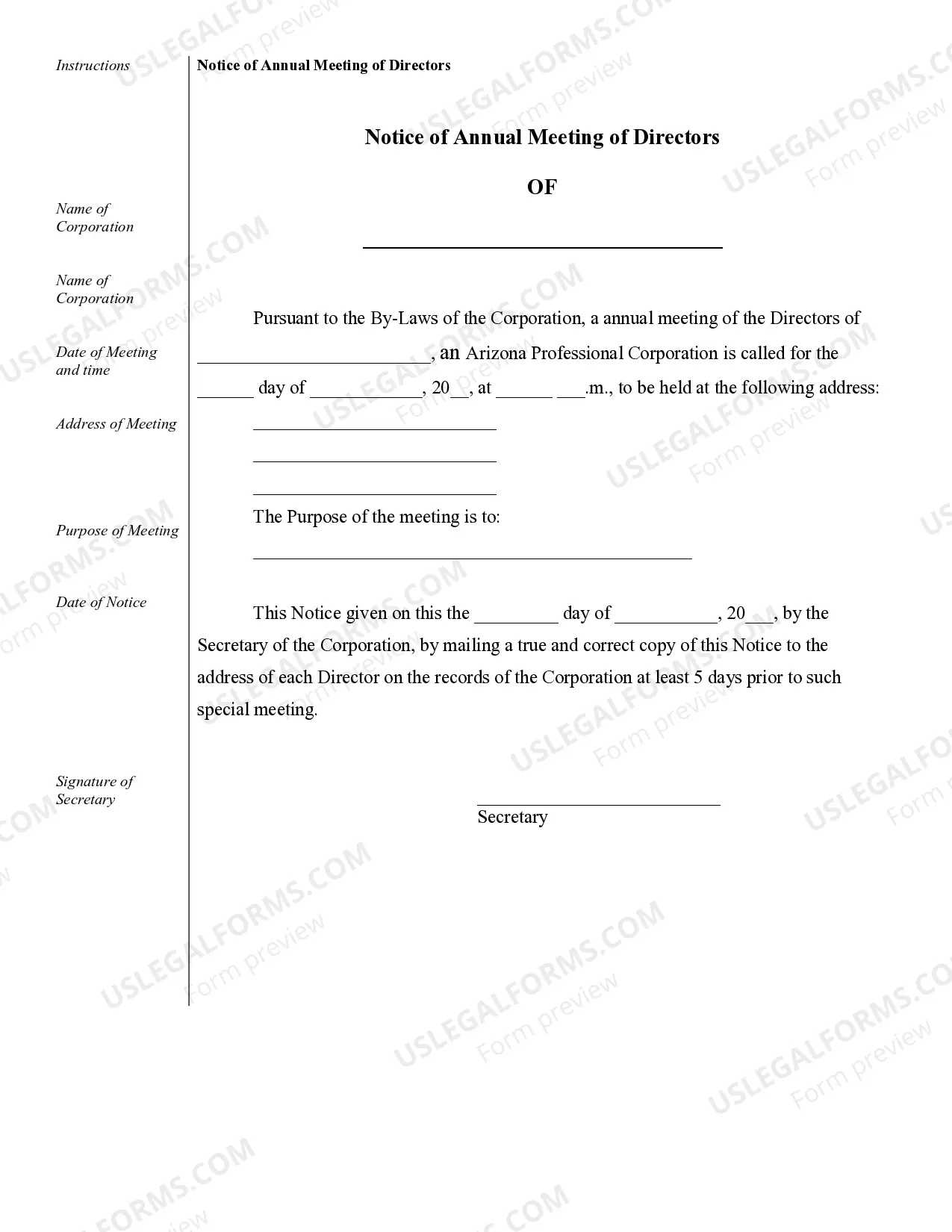

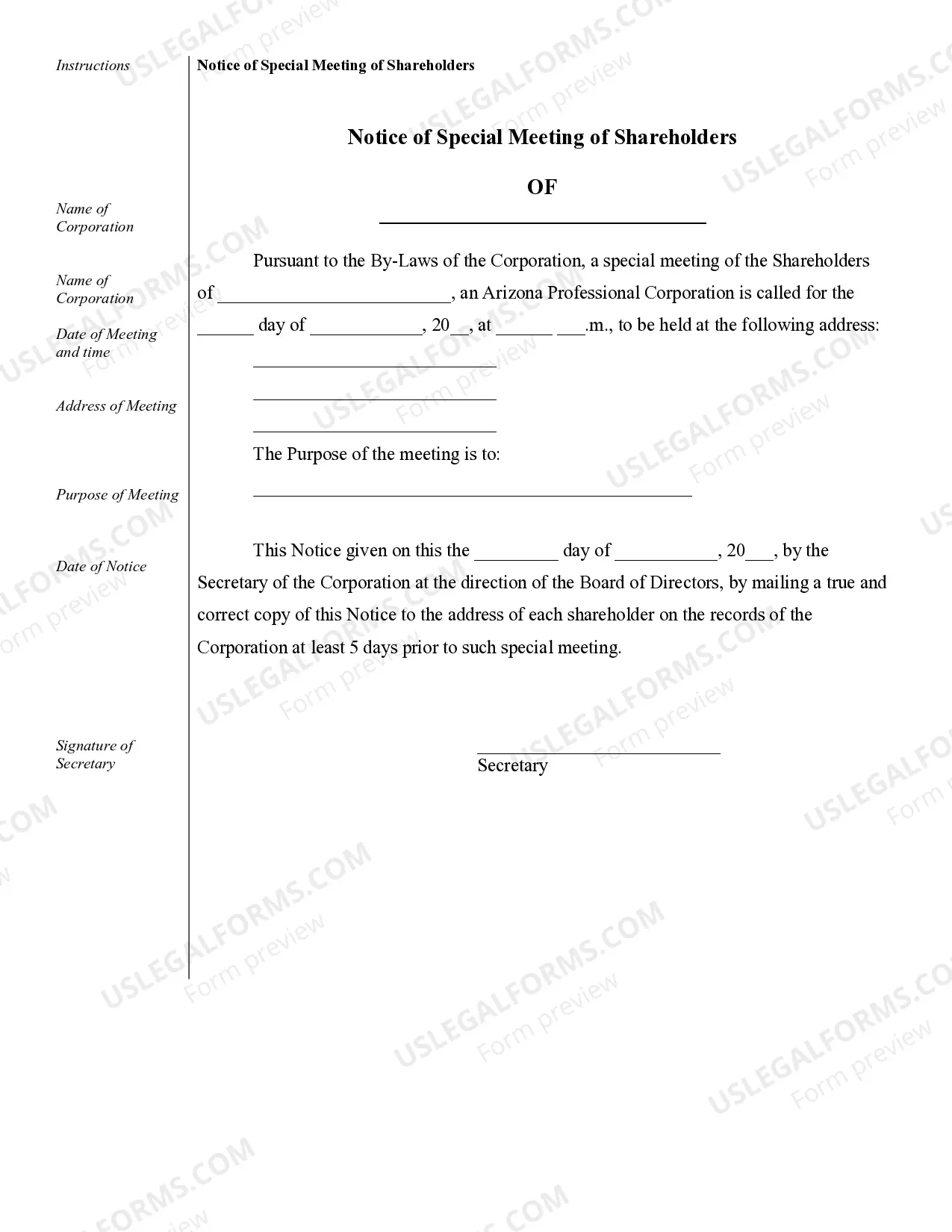

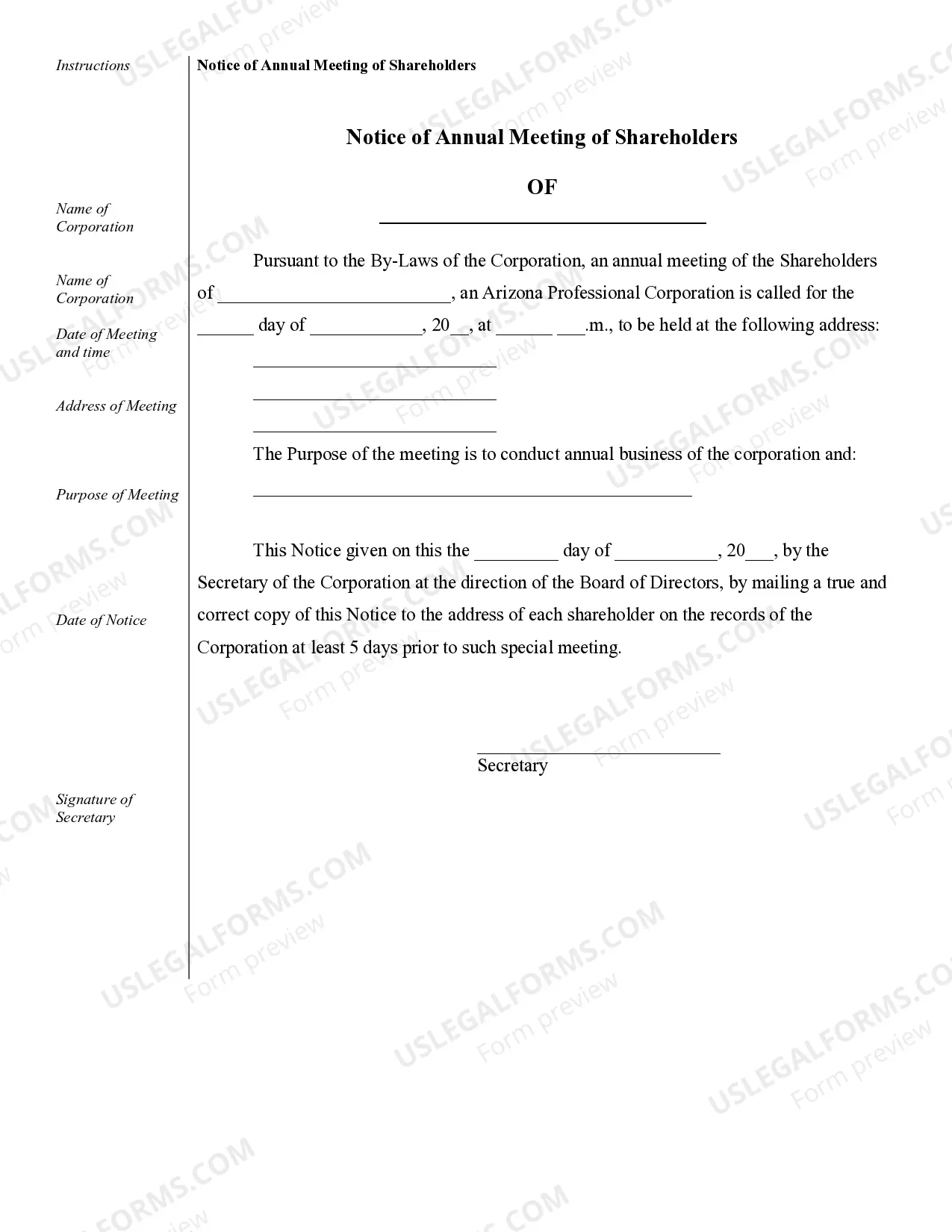

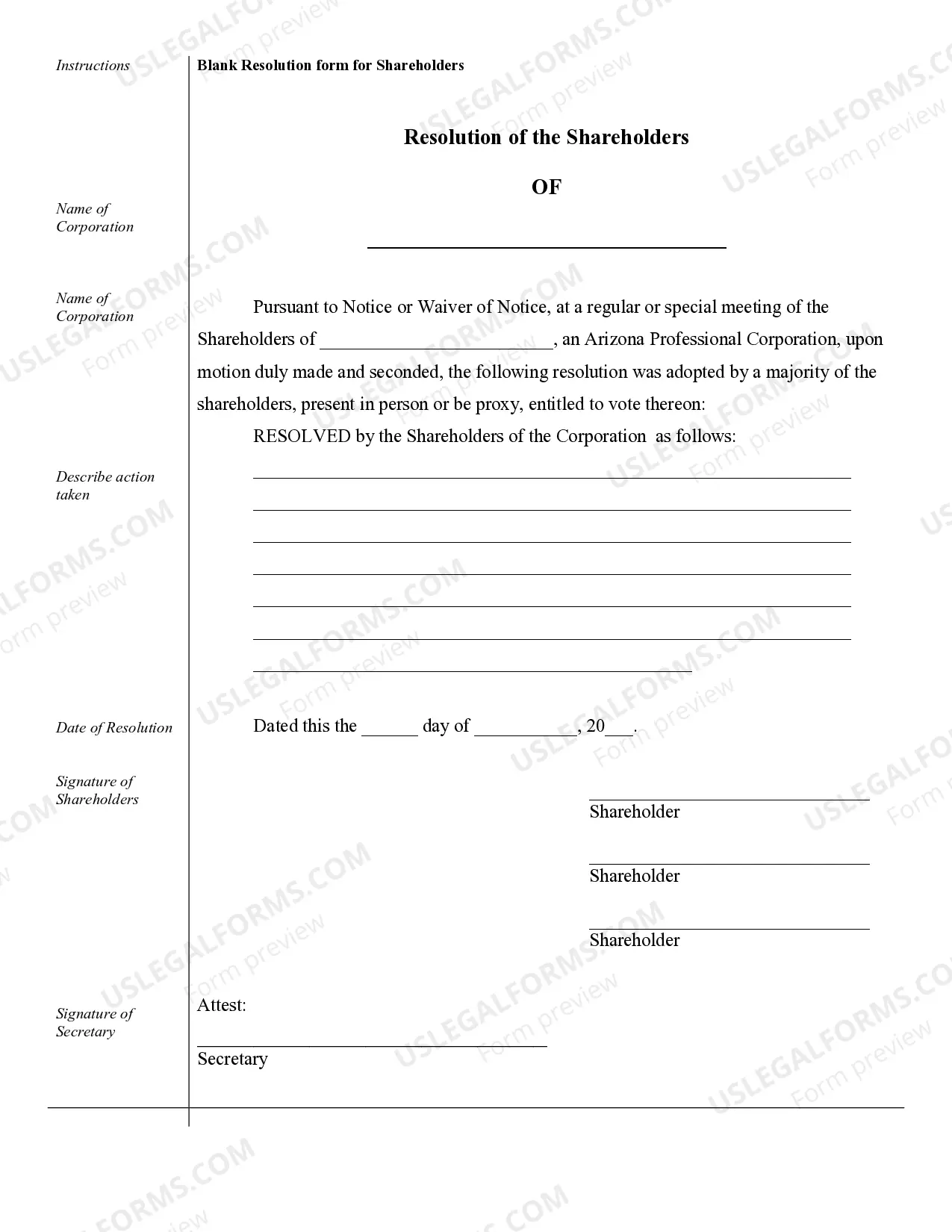

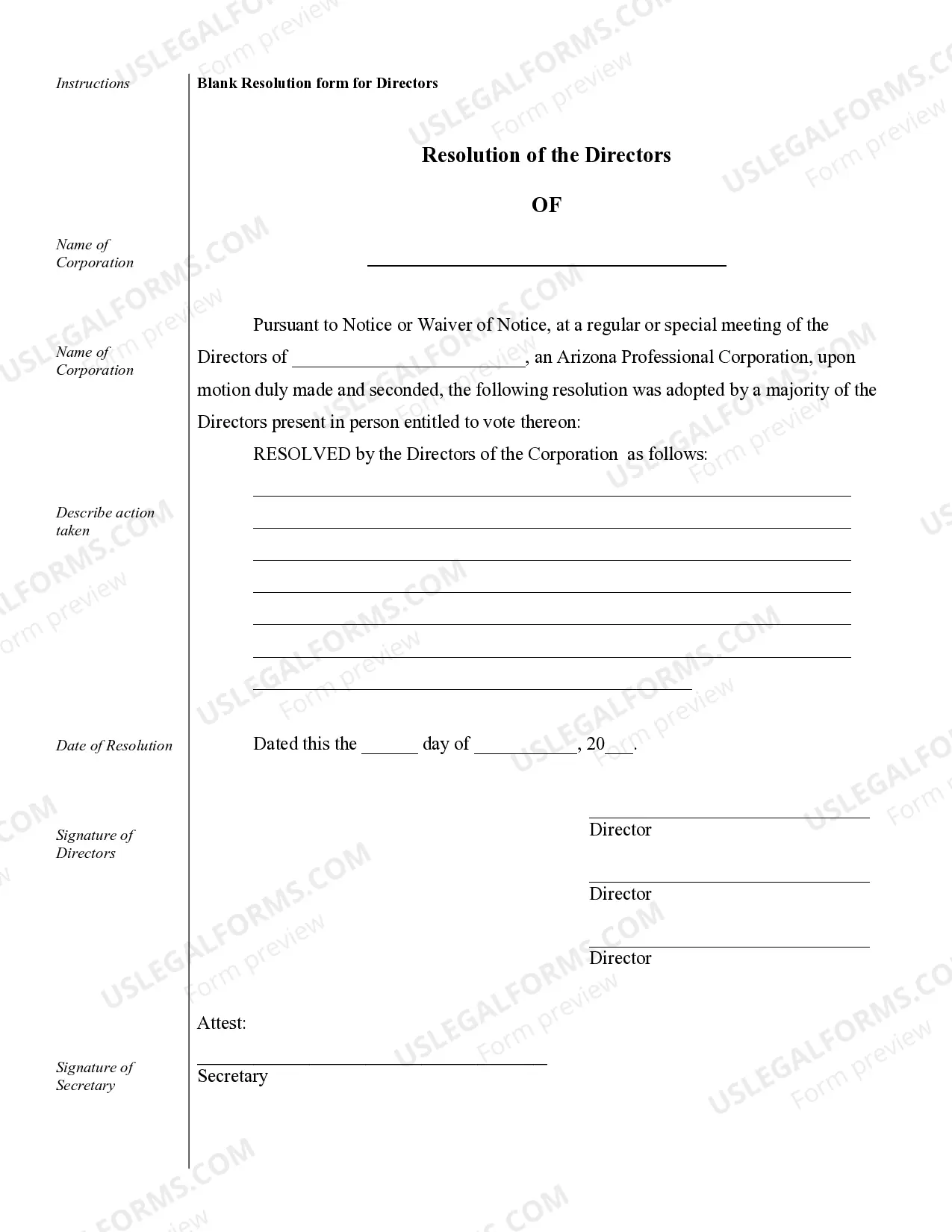

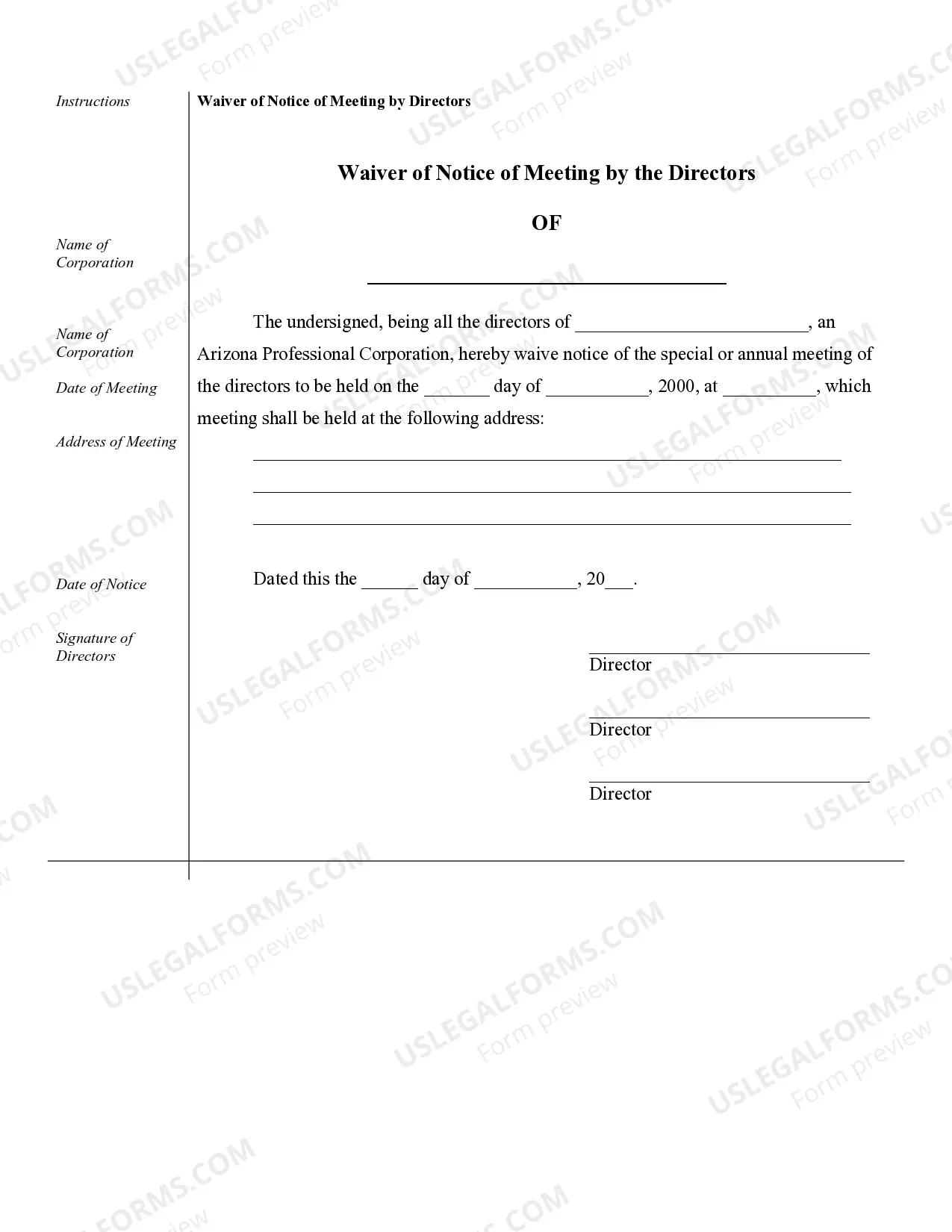

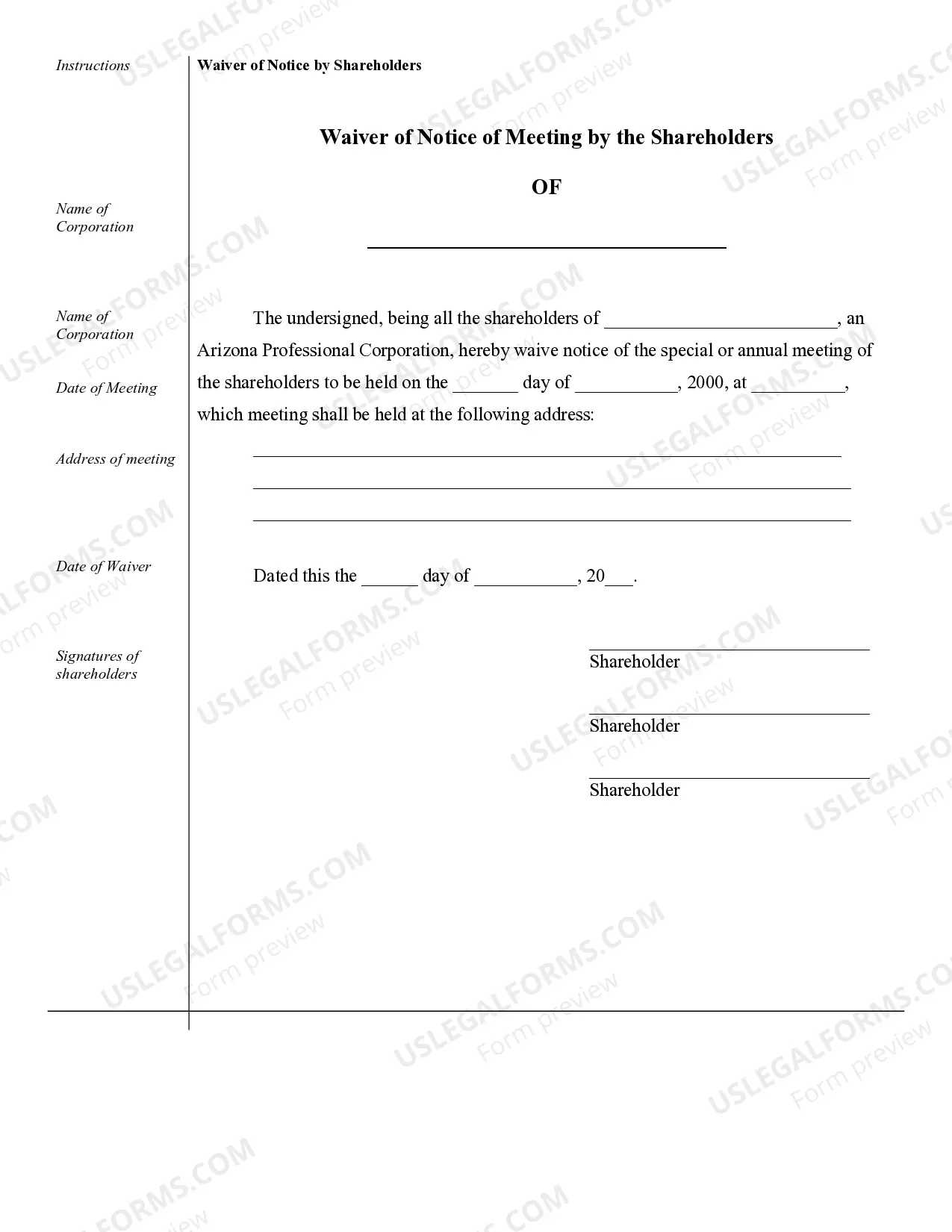

Scottsdale Sample Corporate Records for an Arizona Professional Corporation serve as important documents that outline and organize the essential information and activities of a company. These records are crucial for maintaining legal compliance, recording business transactions, and asserting transparency within the organization. A variety of corporate records are necessary to ensure smooth operations and demonstrate accountability. One key type of corporate record is the Articles of Incorporation. These documents officially establish a professional corporation in Arizona and include vital information such as the corporation's name, purpose, registered agent, and authorized shares of stock. Articles of Incorporation essentially serve as the company's foundational document and are typically filed with the Arizona Corporation Commission. Another crucial type of record is the Bylaws. These are comprehensive internal rules and guidelines that lay out how the corporation will operate. Bylaws typically cover areas such as shareholder meetings, board of directors' structure, voting procedures, and corporate decision-making processes. They aim to ensure that all stakeholders understand their rights, responsibilities, and the corporation's overall governance structure. Minutes of Meetings are also vital records that provide a detailed account of meetings held by the company's directors and shareholders. These minutes record the topics discussed, decisions made, and any resolutions or actions agreed upon during each meeting. They help document the corporation's decision-making process and are often required for legal and compliance purposes. Stock and Shareholder Records are essential for tracking ownership of the corporation's stock. These records document the names, addresses, and shares owned by each shareholder. They can also include information regarding stock transfers, dividends, and other related transactions. Accurate stock and shareholder records are crucial for ensuring transparency and accountability within the organization. In addition to these key records, financial statements such as balance sheets, income statements, and cash flow statements are often prepared and maintained by professional corporations. These documents provide a snapshot of the company's financial health and performance, enabling stakeholders to assess its profitability, liquidity, and overall fiscal stability. Maintaining well-organized and up-to-date corporate records is imperative for any Arizona Professional Corporation operating in Scottsdale. These records not only demonstrate lawful operation but also play a critical role in enhancing the corporation's reputation and protecting its shareholders' interests. By following Arizona's legal requirements and best practices, professional corporations can effectively manage their corporate records and foster a compliant and transparent business environment.Scottsdale Sample Corporate Records for an Arizona Professional Corporation serve as important documents that outline and organize the essential information and activities of a company. These records are crucial for maintaining legal compliance, recording business transactions, and asserting transparency within the organization. A variety of corporate records are necessary to ensure smooth operations and demonstrate accountability. One key type of corporate record is the Articles of Incorporation. These documents officially establish a professional corporation in Arizona and include vital information such as the corporation's name, purpose, registered agent, and authorized shares of stock. Articles of Incorporation essentially serve as the company's foundational document and are typically filed with the Arizona Corporation Commission. Another crucial type of record is the Bylaws. These are comprehensive internal rules and guidelines that lay out how the corporation will operate. Bylaws typically cover areas such as shareholder meetings, board of directors' structure, voting procedures, and corporate decision-making processes. They aim to ensure that all stakeholders understand their rights, responsibilities, and the corporation's overall governance structure. Minutes of Meetings are also vital records that provide a detailed account of meetings held by the company's directors and shareholders. These minutes record the topics discussed, decisions made, and any resolutions or actions agreed upon during each meeting. They help document the corporation's decision-making process and are often required for legal and compliance purposes. Stock and Shareholder Records are essential for tracking ownership of the corporation's stock. These records document the names, addresses, and shares owned by each shareholder. They can also include information regarding stock transfers, dividends, and other related transactions. Accurate stock and shareholder records are crucial for ensuring transparency and accountability within the organization. In addition to these key records, financial statements such as balance sheets, income statements, and cash flow statements are often prepared and maintained by professional corporations. These documents provide a snapshot of the company's financial health and performance, enabling stakeholders to assess its profitability, liquidity, and overall fiscal stability. Maintaining well-organized and up-to-date corporate records is imperative for any Arizona Professional Corporation operating in Scottsdale. These records not only demonstrate lawful operation but also play a critical role in enhancing the corporation's reputation and protecting its shareholders' interests. By following Arizona's legal requirements and best practices, professional corporations can effectively manage their corporate records and foster a compliant and transparent business environment.