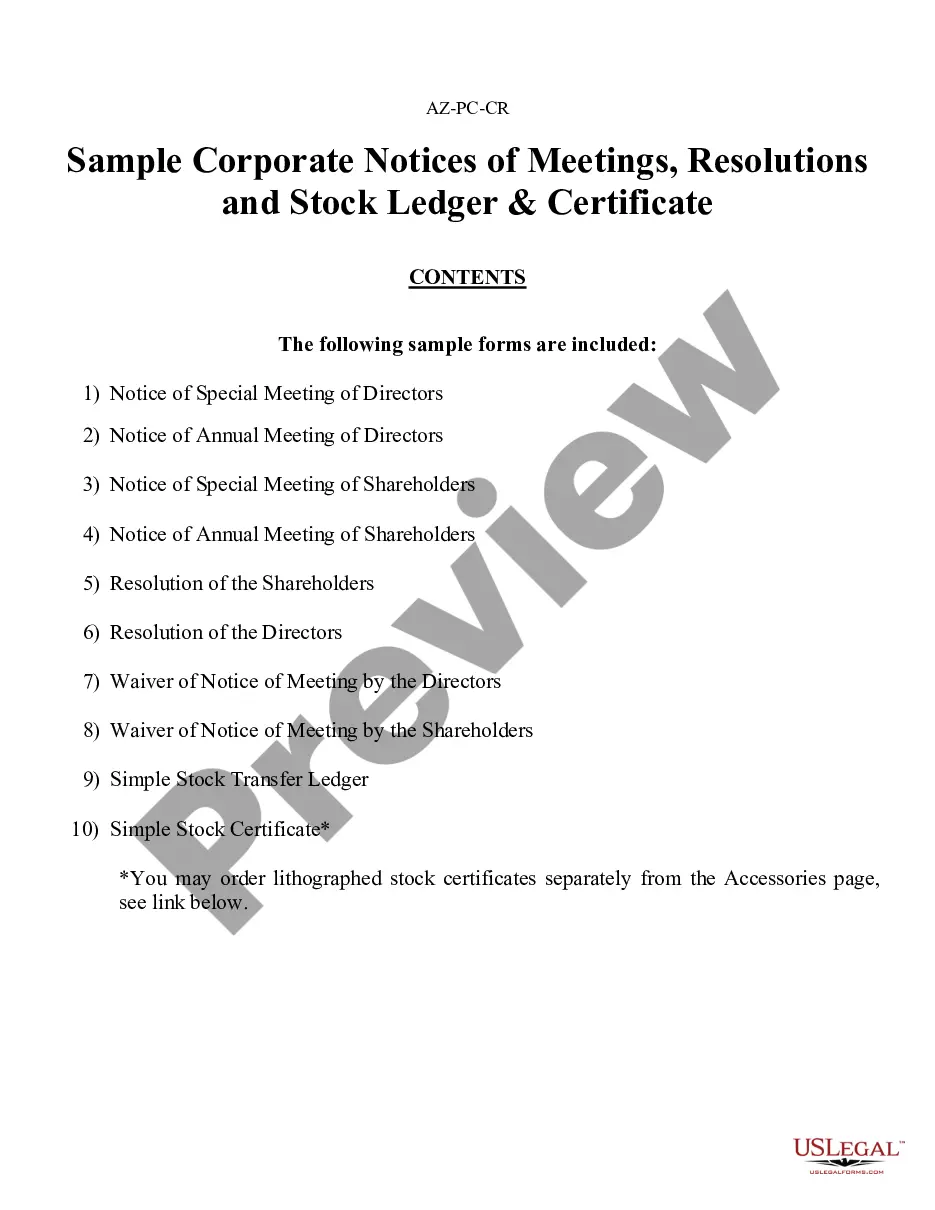

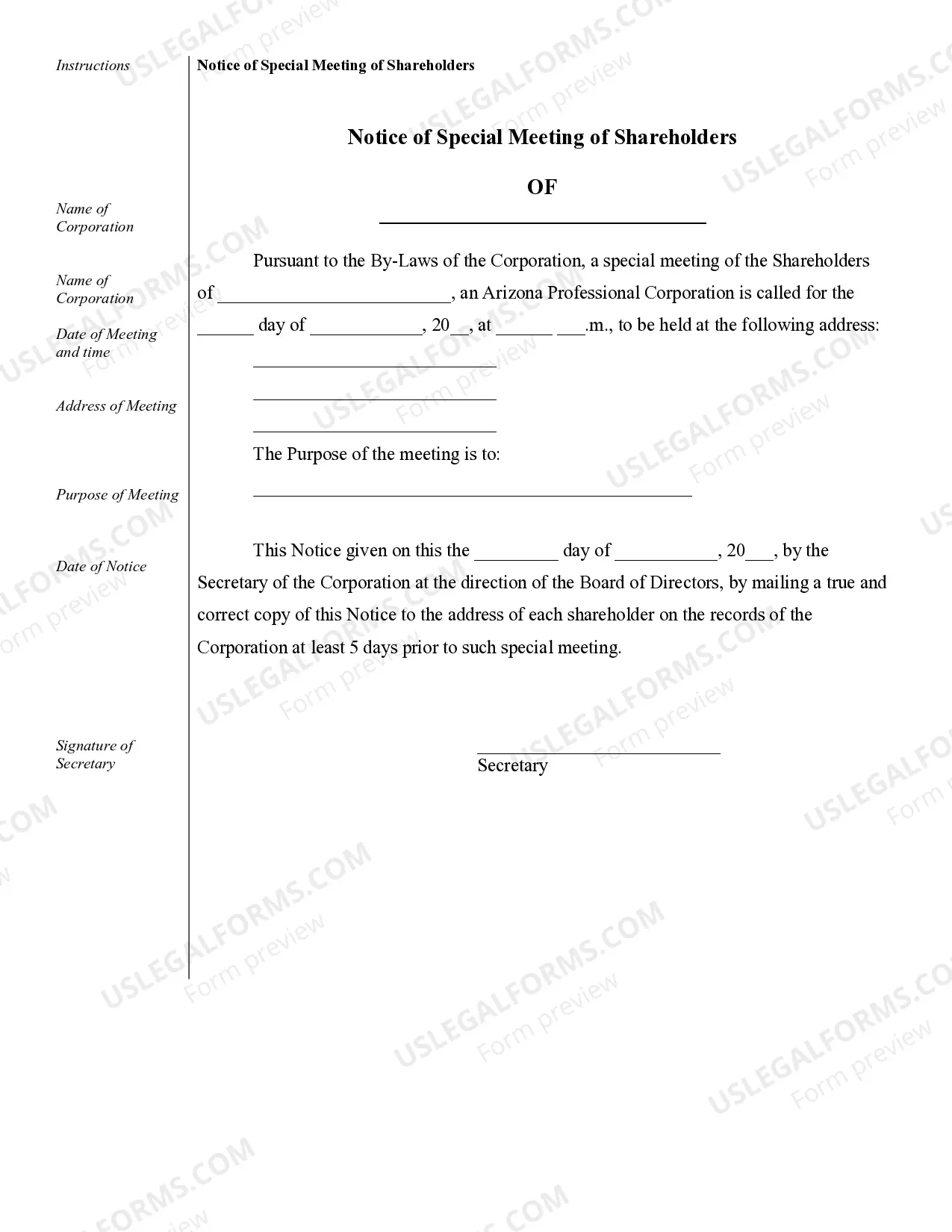

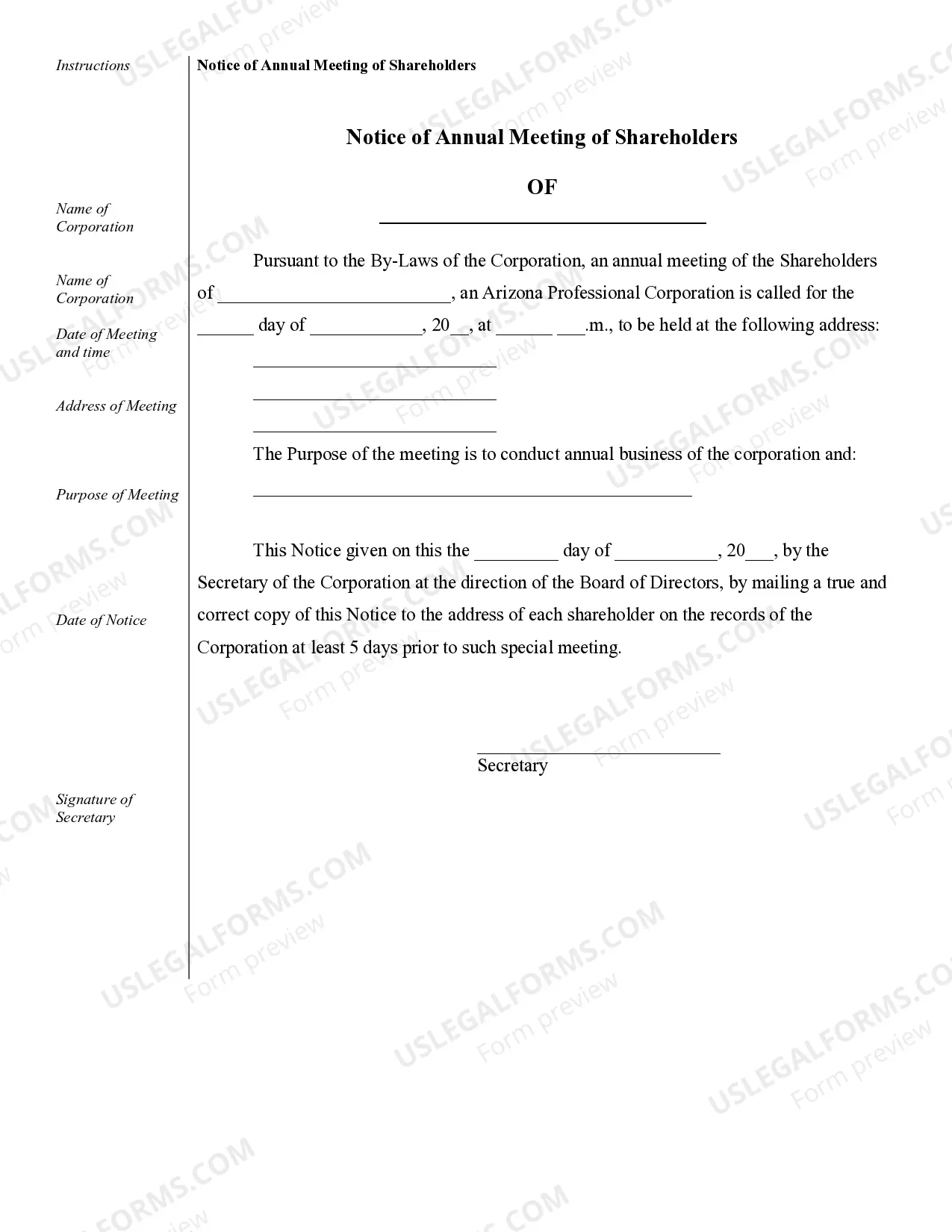

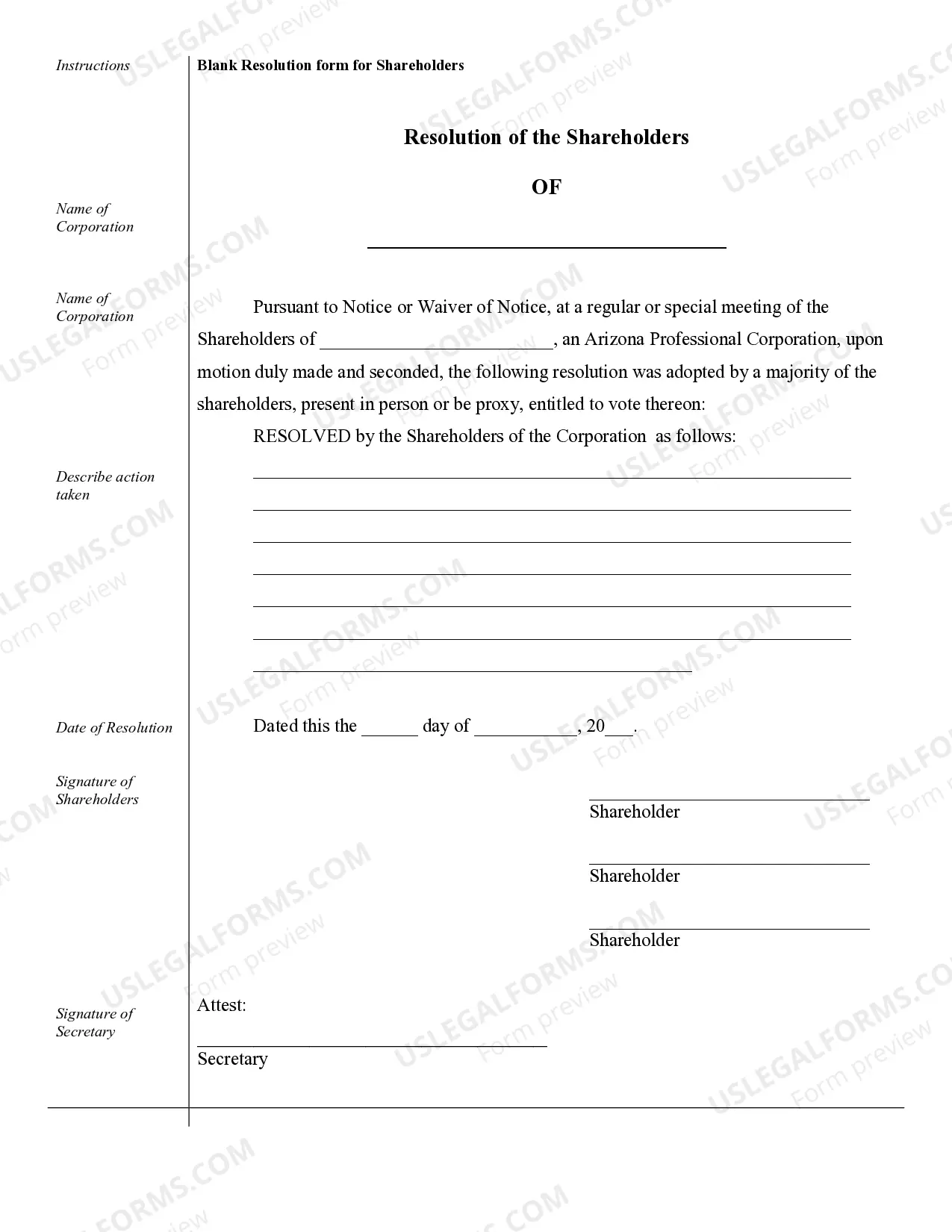

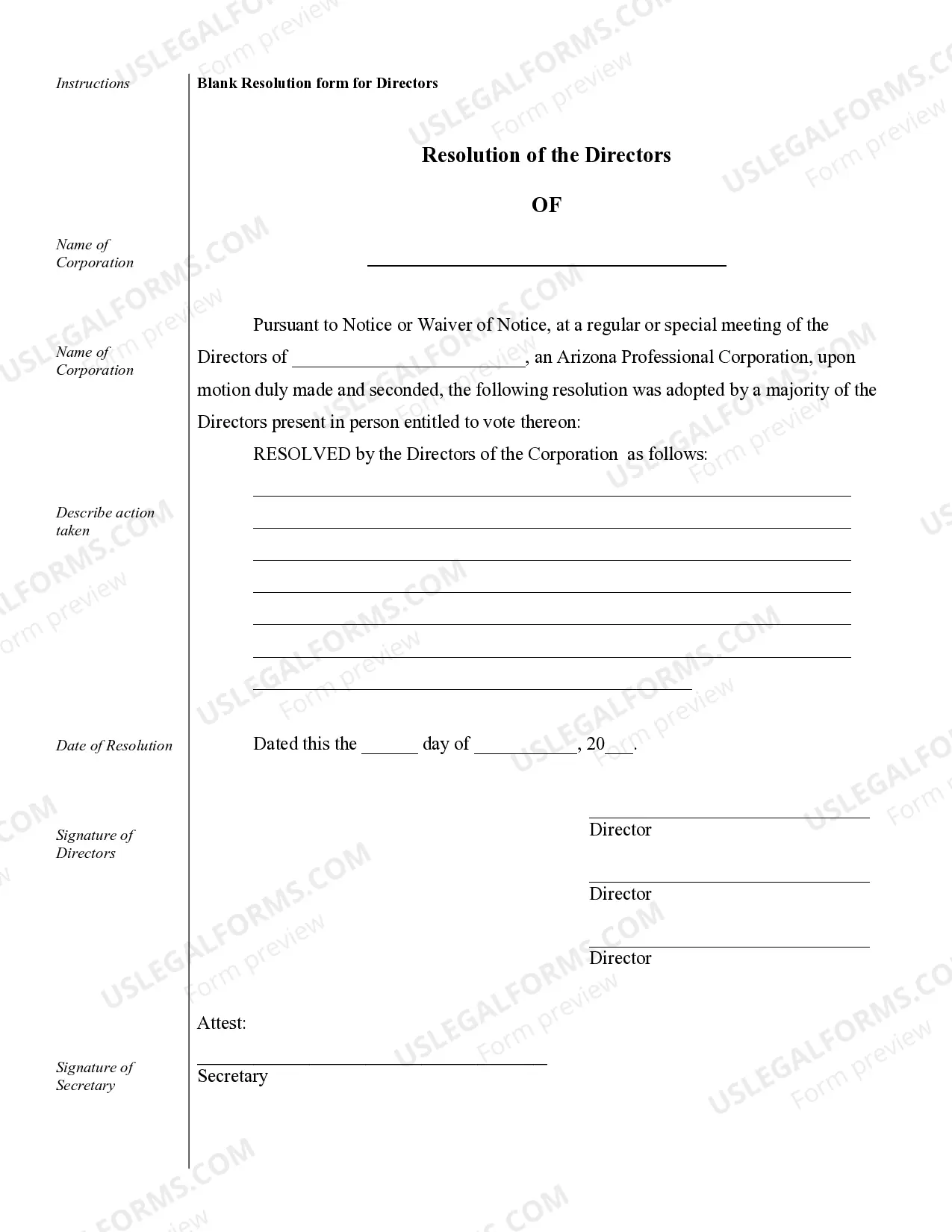

Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

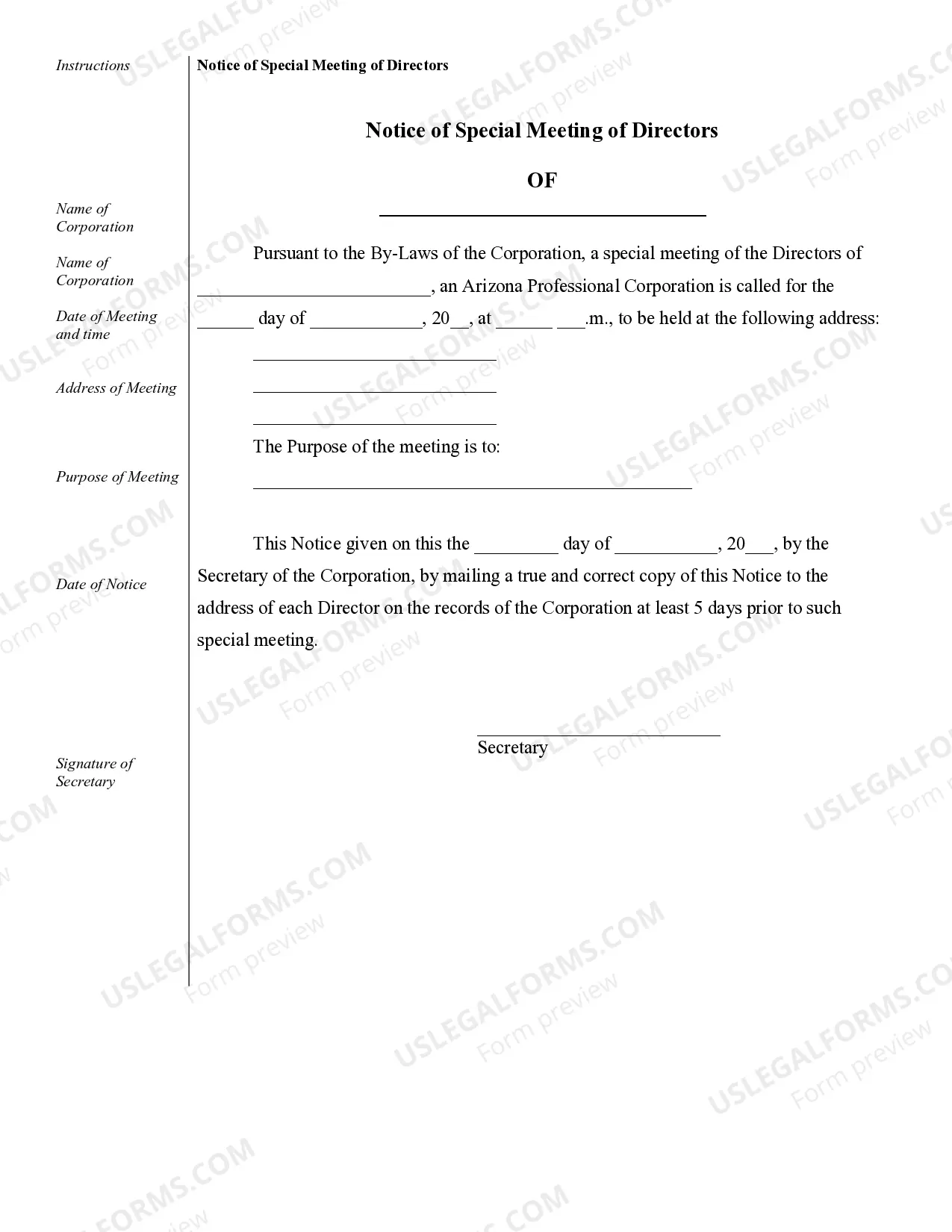

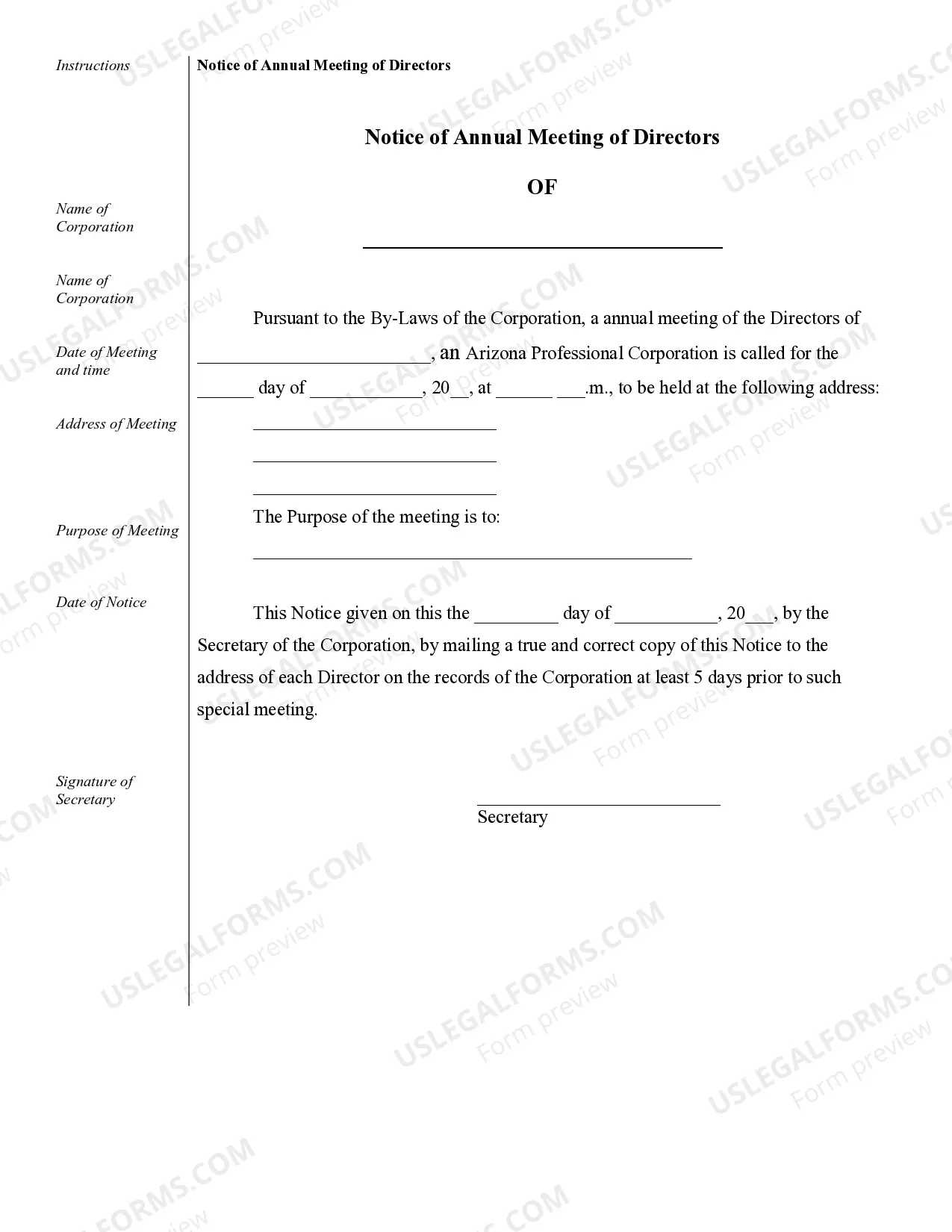

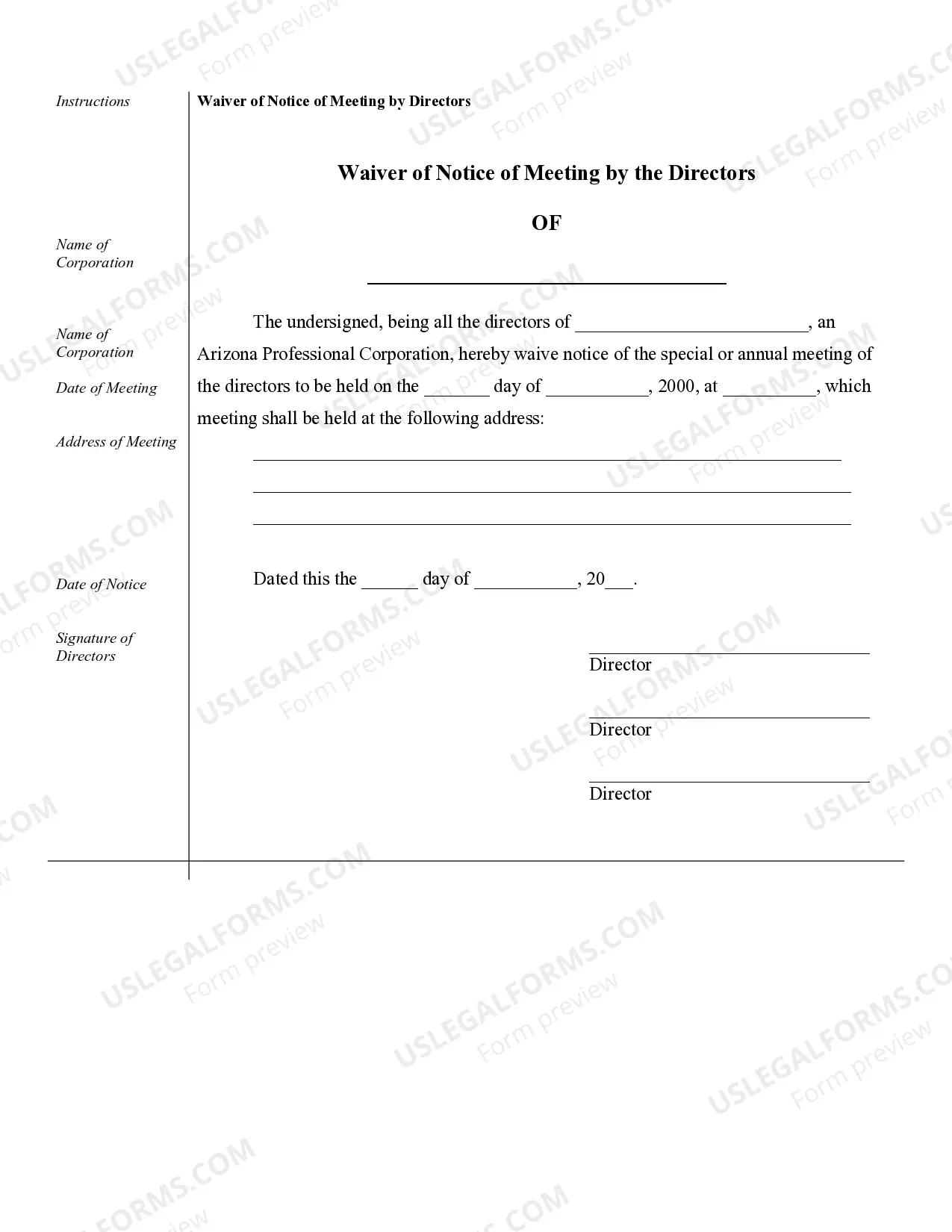

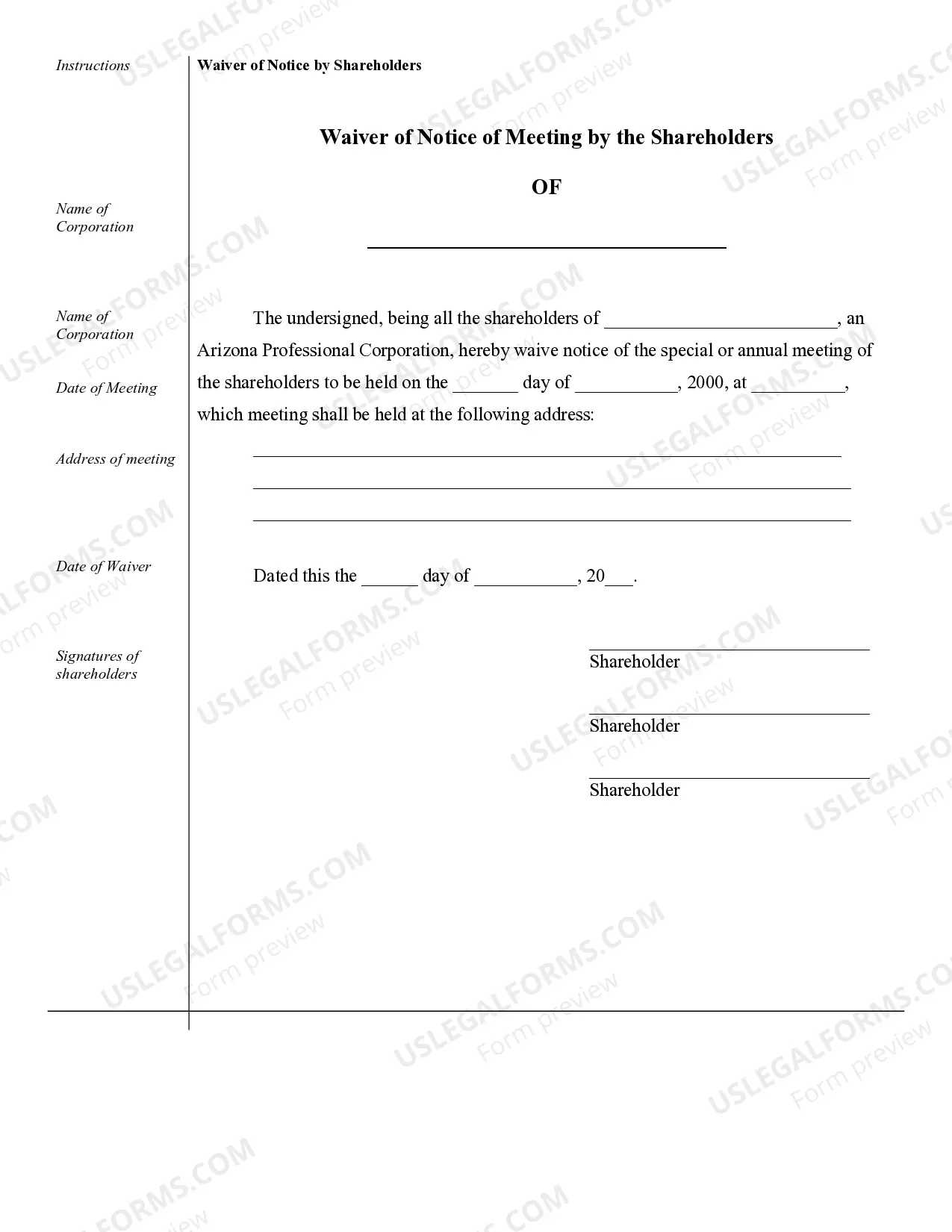

Surprise Sample Corporate Records for an Arizona Professional Corporation are essential documents that provide a comprehensive and thorough record of the company's operations, compliance, and overall organizational structure. These records serve as the foundation for legal and regulatory compliance, internal decision-making processes, and potential audits or investigations. Ensuring the accuracy and maintenance of corporate records is crucial to establishing transparency, protecting the corporation's interests, and fostering trust among stakeholders. Listed below are some different types of Surprise Sample Corporate Records for an Arizona Professional Corporation: 1. Articles of Incorporation: These foundational documents establish the corporation as a legal entity in Arizona. They include details such as the corporation's name, purpose, registered agent, initial directors, and the number of authorized shares. 2. Bylaws: Bylaws outline the rules and procedures governing the corporation's internal affairs, including shareholder and director meetings, voting procedures, and the roles and responsibilities of officers and directors. 3. Stock Ledger: This record maintains an accurate account of the corporation's stockholders, their respective shareholdings, stock certificates issued, and any transfers or changes in ownership. 4. Meeting Minutes: Detailed notes or minutes of all board of directors and shareholder meetings should be recorded. These minutes reflect matters discussed, decisions made, and actions taken during these meetings. 5. Financial Statements: Comprehensive financial statements, including balance sheets, income statements, and cash flow statements, provide an overview of the corporation's financial position and performance. These records should adhere to generally accepted accounting principles (GAAP). 6. Annual Reports: An annual report summarizes the corporation's activities, financial performance, and future prospects. It typically includes a message from the CEO or President, financial statements, and other pertinent information required by the Arizona Corporation Commission. 7. Shareholder Agreements: These agreements outline the rights, obligations, and responsibilities of shareholders, addressing matters such as stock transfers, buy-sell provisions, shareholder voting, and dispute resolution mechanisms. 8. Employment Contracts: Employment contracts should be maintained for key executives and employees, outlining terms and conditions of employment, compensation details, benefits, and expectations. 9. Licenses, Permits, and Certifications: Copies of licenses, permits, and certifications obtained by the corporation to conduct its professional services should be kept to evidence compliance with applicable regulations. 10. Tax Records: All tax-related documents, including federal and state tax returns, tax payments, and correspondence with tax authorities, should be retained for compliance and audit purposes. Overall, Surprise Sample Corporate Records for an Arizona Professional Corporation encompass a wide range of documents that are indispensable for demonstrating legal compliance, financial stability, and operational transparency. The particular records required may vary based on industry-specific regulations and the corporation's business structure.Surprise Sample Corporate Records for an Arizona Professional Corporation are essential documents that provide a comprehensive and thorough record of the company's operations, compliance, and overall organizational structure. These records serve as the foundation for legal and regulatory compliance, internal decision-making processes, and potential audits or investigations. Ensuring the accuracy and maintenance of corporate records is crucial to establishing transparency, protecting the corporation's interests, and fostering trust among stakeholders. Listed below are some different types of Surprise Sample Corporate Records for an Arizona Professional Corporation: 1. Articles of Incorporation: These foundational documents establish the corporation as a legal entity in Arizona. They include details such as the corporation's name, purpose, registered agent, initial directors, and the number of authorized shares. 2. Bylaws: Bylaws outline the rules and procedures governing the corporation's internal affairs, including shareholder and director meetings, voting procedures, and the roles and responsibilities of officers and directors. 3. Stock Ledger: This record maintains an accurate account of the corporation's stockholders, their respective shareholdings, stock certificates issued, and any transfers or changes in ownership. 4. Meeting Minutes: Detailed notes or minutes of all board of directors and shareholder meetings should be recorded. These minutes reflect matters discussed, decisions made, and actions taken during these meetings. 5. Financial Statements: Comprehensive financial statements, including balance sheets, income statements, and cash flow statements, provide an overview of the corporation's financial position and performance. These records should adhere to generally accepted accounting principles (GAAP). 6. Annual Reports: An annual report summarizes the corporation's activities, financial performance, and future prospects. It typically includes a message from the CEO or President, financial statements, and other pertinent information required by the Arizona Corporation Commission. 7. Shareholder Agreements: These agreements outline the rights, obligations, and responsibilities of shareholders, addressing matters such as stock transfers, buy-sell provisions, shareholder voting, and dispute resolution mechanisms. 8. Employment Contracts: Employment contracts should be maintained for key executives and employees, outlining terms and conditions of employment, compensation details, benefits, and expectations. 9. Licenses, Permits, and Certifications: Copies of licenses, permits, and certifications obtained by the corporation to conduct its professional services should be kept to evidence compliance with applicable regulations. 10. Tax Records: All tax-related documents, including federal and state tax returns, tax payments, and correspondence with tax authorities, should be retained for compliance and audit purposes. Overall, Surprise Sample Corporate Records for an Arizona Professional Corporation encompass a wide range of documents that are indispensable for demonstrating legal compliance, financial stability, and operational transparency. The particular records required may vary based on industry-specific regulations and the corporation's business structure.