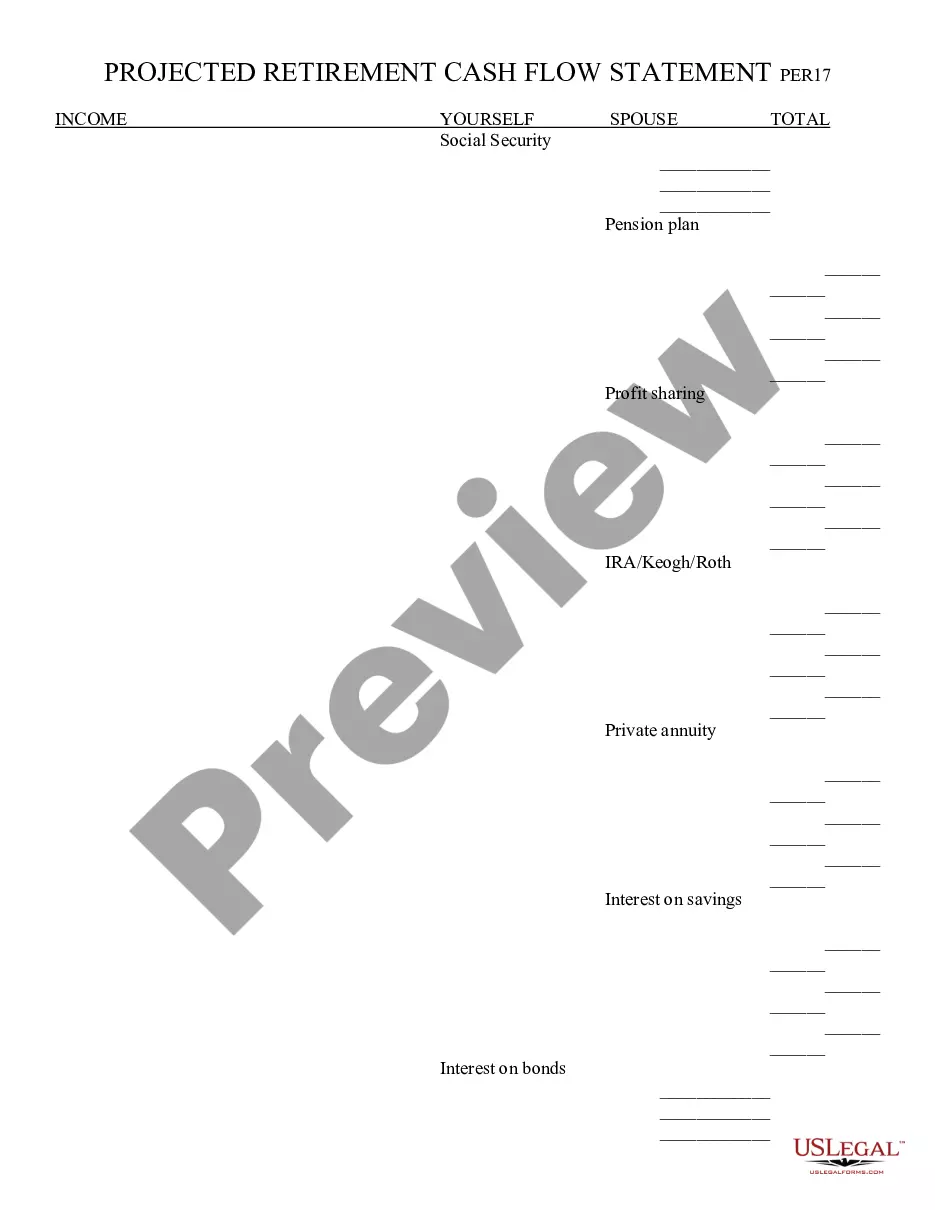

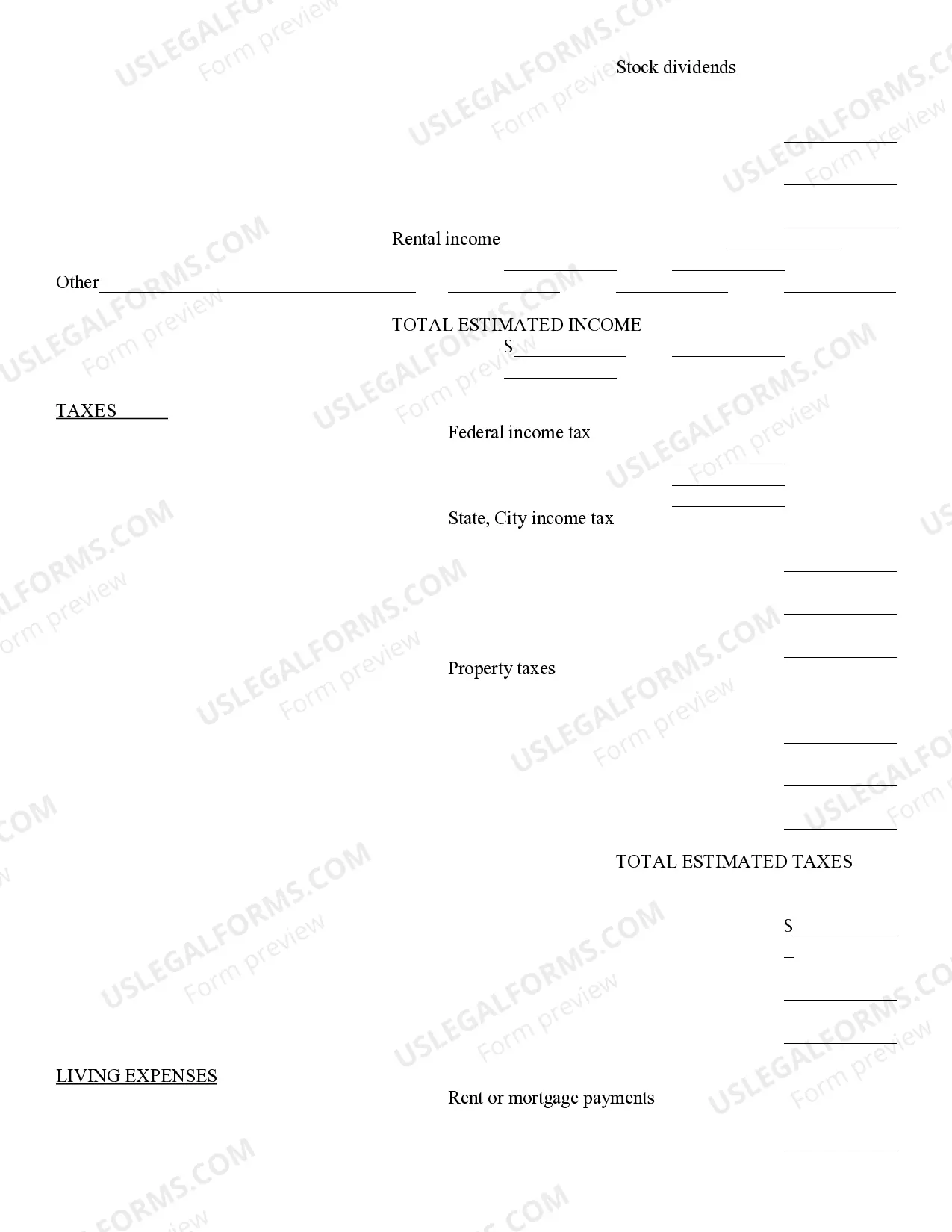

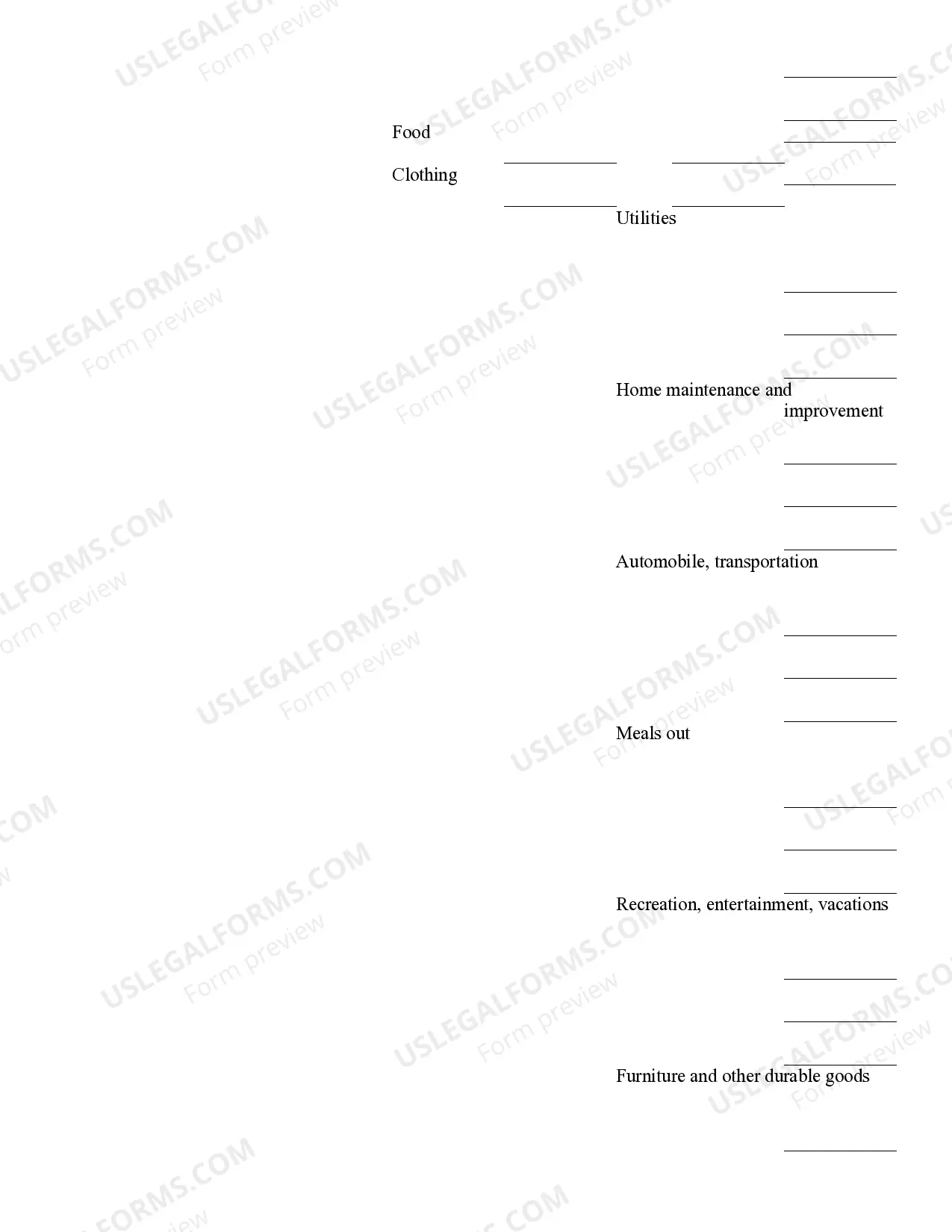

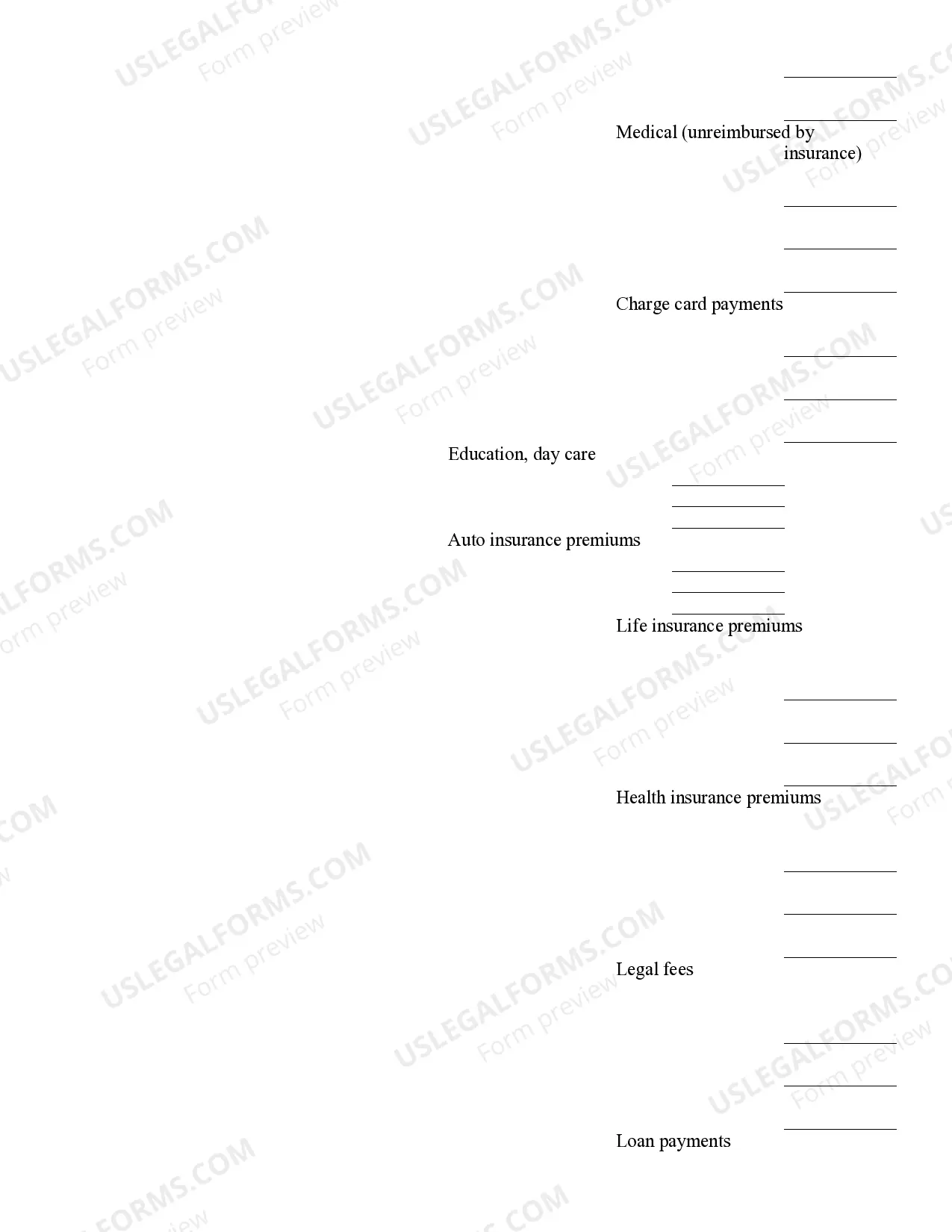

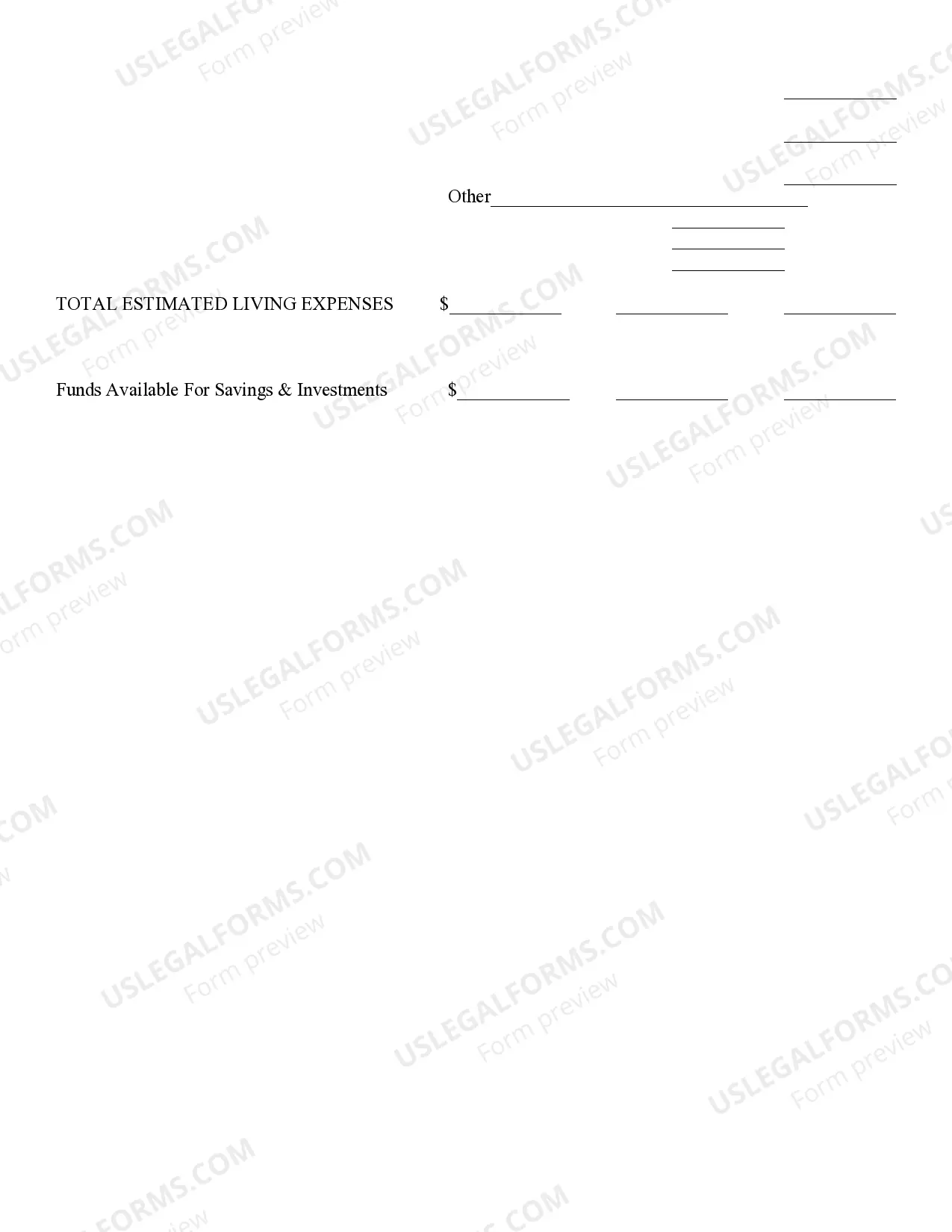

Retirement Cash Flow - Arizona: This is a standard statement which includes all the money coming in after retirement, including annuities, IRA's, pension, etc. It also includes a place for money going out each month, such as rent. It is available for download in both Word and Rich Text formats.

Phoenix Arizona Retirement Cash Flow refers to the income and financial resources individuals or couples receive during their retirement years in Phoenix, Arizona. It is an essential consideration for retirees as it allows them to maintain their desired lifestyle, cover expenses, and meet their financial goals without relying solely on employment income. Retirement cash flow typically involves a combination of various income sources, including pensions, social security benefits, personal savings, investments, and any other form of recurring income generated during retirement. This cash flow can vary based on personal circumstances, financial planning, and investment choices. There are different types of retirement cash flows that individuals may have or plan for in Phoenix, Arizona. These include: 1. Pension Cash Flow: Some retirees may have access to employer-provided pensions, which guarantee a fixed sum of money for the rest of their lives. This consistent stream of income provides stability and contributes to retirement cash flow. 2. Social Security Cash Flow: Social Security benefits play a significant role in retirement planning for many individuals in Phoenix. These benefits are based on an individual's work history and can be claimed as early as age 62, although full retirement age is typically between 66 and 67. Social Security benefits add to the cash flow and provide a reliable income stream. 3. Personal Savings Cash Flow: Retirement savings accumulated over a person's working years also contribute to retirement cash flow. This includes contributions to retirement accounts such as 401(k)s, IRAs, and other investment vehicles. Individuals may choose to withdraw funds from these accounts based on their retirement needs, which can supplement other income streams. 4. Investment Cash Flow: Retirees often invest their savings in various assets such as stocks, bonds, real estate, or mutual funds. These investments can generate additional income through dividends, interest, rental income, or capital gains, which further contribute to retirement cash flow. 5. Annuity Cash Flow: Some retirees choose to purchase annuities, which provide regular payments over a predetermined period or for the rest of their lives. Annuities, whether immediate or deferred, add to the overall retirement cash flow and guarantee a steady income stream. 6. Part-Time Employment Cash Flow: Some retirees may opt to continue working part-time during their retirement years. Income from part-time jobs or consulting work adds to the cash flow and provides additional financial flexibility. It is crucial for individuals planning for retirement in Phoenix, Arizona, to carefully analyze their sources of retirement cash flow and effectively manage their expenses to ensure a comfortable and secure retirement. Seeking professional advice and engaging in comprehensive financial planning can help retirees optimize their retirement cash flow and achieve their financial goals.Phoenix Arizona Retirement Cash Flow refers to the income and financial resources individuals or couples receive during their retirement years in Phoenix, Arizona. It is an essential consideration for retirees as it allows them to maintain their desired lifestyle, cover expenses, and meet their financial goals without relying solely on employment income. Retirement cash flow typically involves a combination of various income sources, including pensions, social security benefits, personal savings, investments, and any other form of recurring income generated during retirement. This cash flow can vary based on personal circumstances, financial planning, and investment choices. There are different types of retirement cash flows that individuals may have or plan for in Phoenix, Arizona. These include: 1. Pension Cash Flow: Some retirees may have access to employer-provided pensions, which guarantee a fixed sum of money for the rest of their lives. This consistent stream of income provides stability and contributes to retirement cash flow. 2. Social Security Cash Flow: Social Security benefits play a significant role in retirement planning for many individuals in Phoenix. These benefits are based on an individual's work history and can be claimed as early as age 62, although full retirement age is typically between 66 and 67. Social Security benefits add to the cash flow and provide a reliable income stream. 3. Personal Savings Cash Flow: Retirement savings accumulated over a person's working years also contribute to retirement cash flow. This includes contributions to retirement accounts such as 401(k)s, IRAs, and other investment vehicles. Individuals may choose to withdraw funds from these accounts based on their retirement needs, which can supplement other income streams. 4. Investment Cash Flow: Retirees often invest their savings in various assets such as stocks, bonds, real estate, or mutual funds. These investments can generate additional income through dividends, interest, rental income, or capital gains, which further contribute to retirement cash flow. 5. Annuity Cash Flow: Some retirees choose to purchase annuities, which provide regular payments over a predetermined period or for the rest of their lives. Annuities, whether immediate or deferred, add to the overall retirement cash flow and guarantee a steady income stream. 6. Part-Time Employment Cash Flow: Some retirees may opt to continue working part-time during their retirement years. Income from part-time jobs or consulting work adds to the cash flow and provides additional financial flexibility. It is crucial for individuals planning for retirement in Phoenix, Arizona, to carefully analyze their sources of retirement cash flow and effectively manage their expenses to ensure a comfortable and secure retirement. Seeking professional advice and engaging in comprehensive financial planning can help retirees optimize their retirement cash flow and achieve their financial goals.