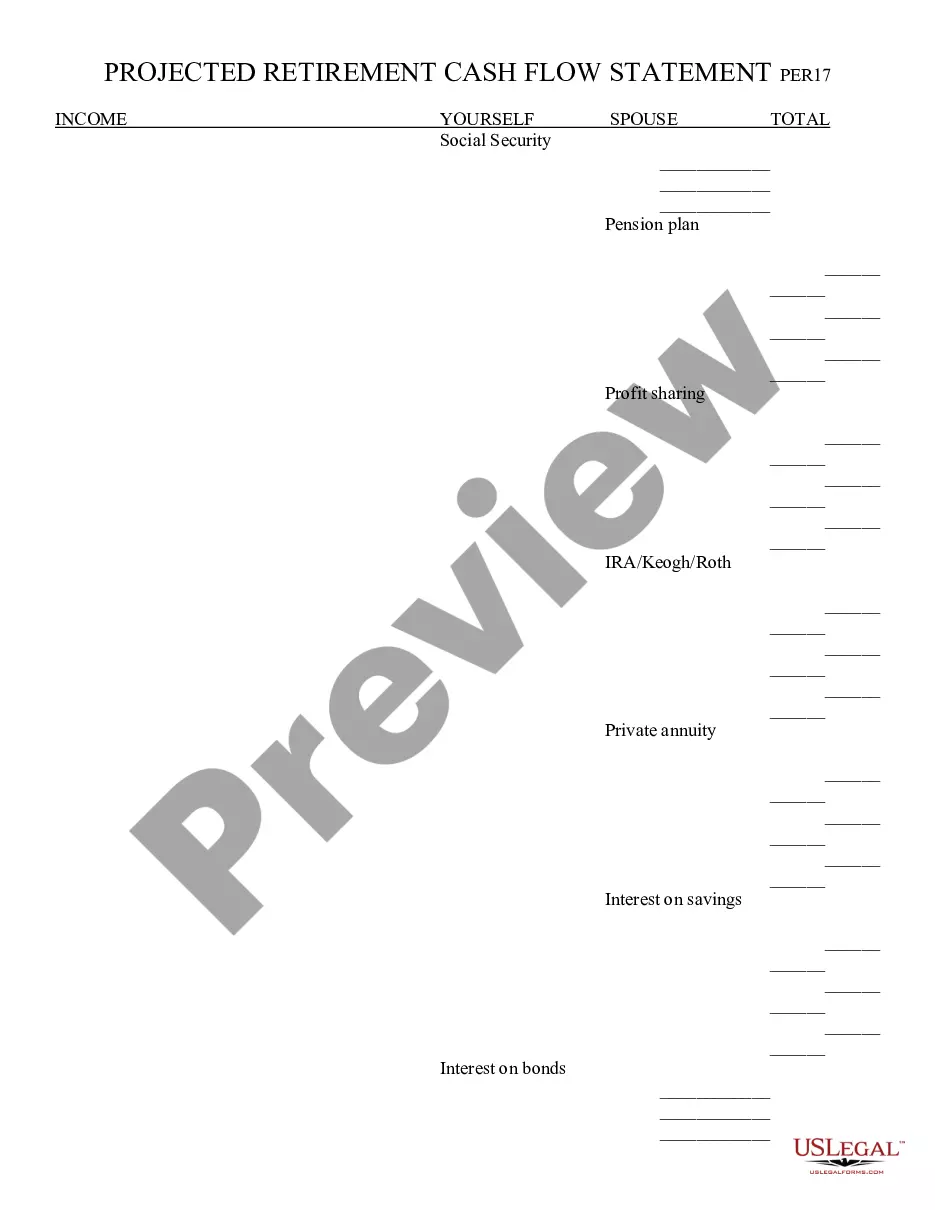

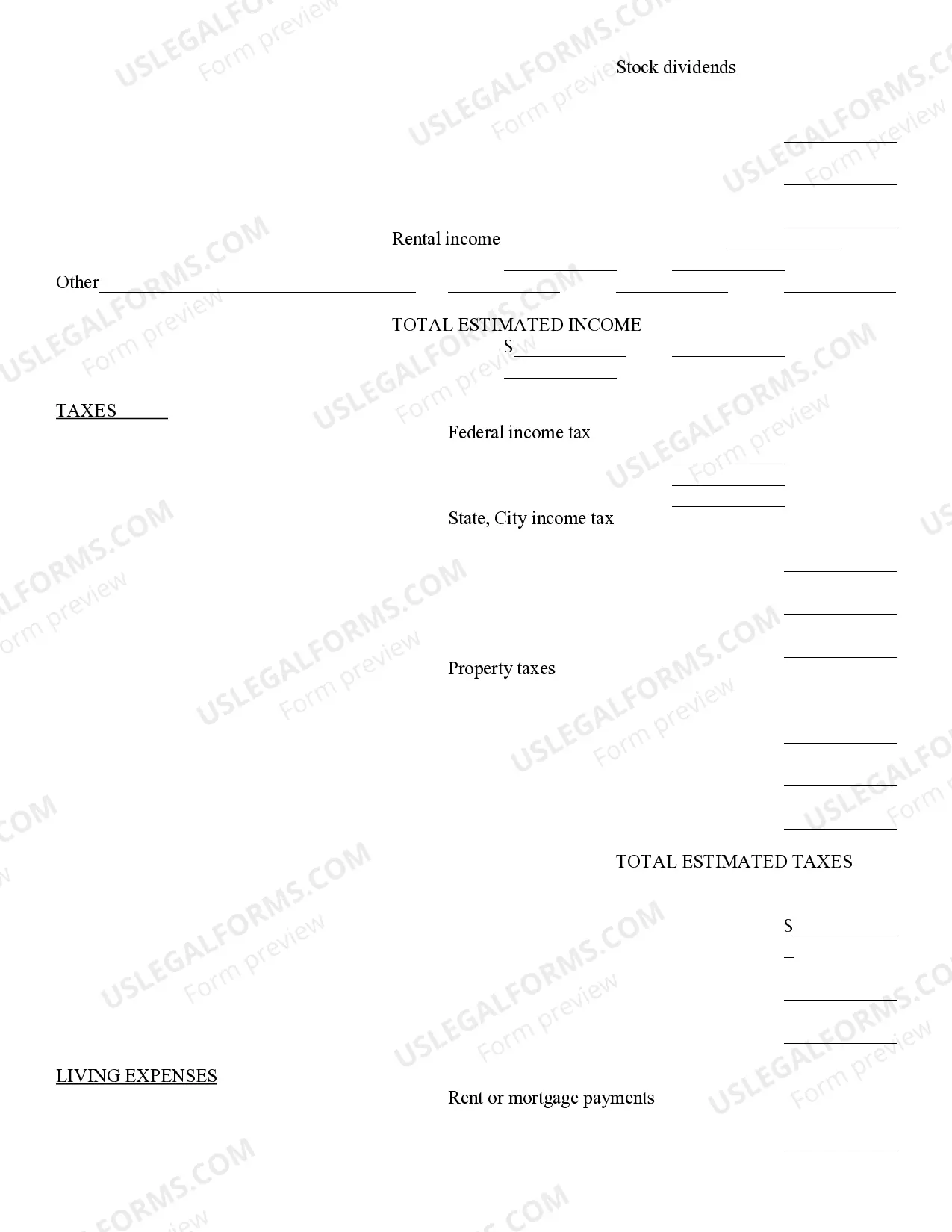

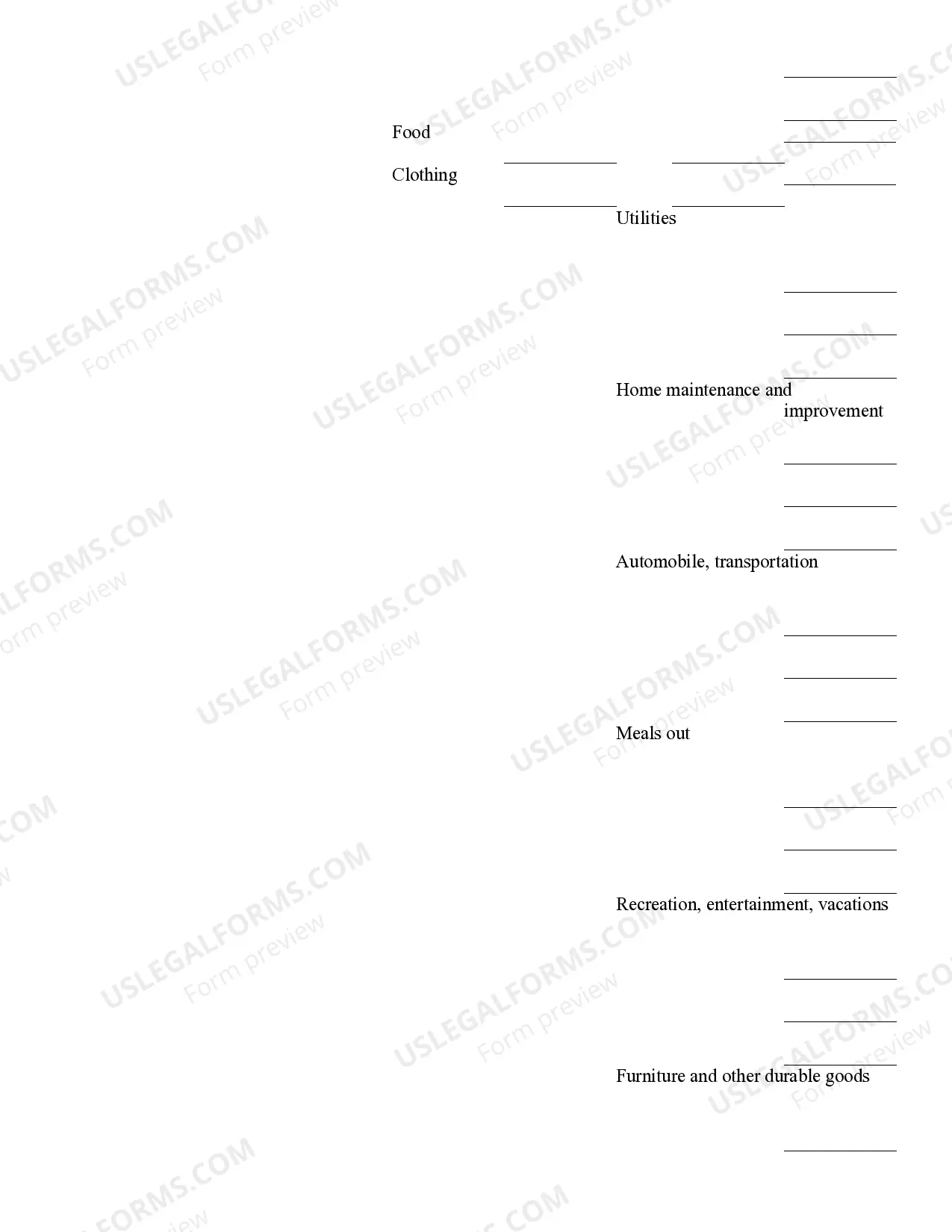

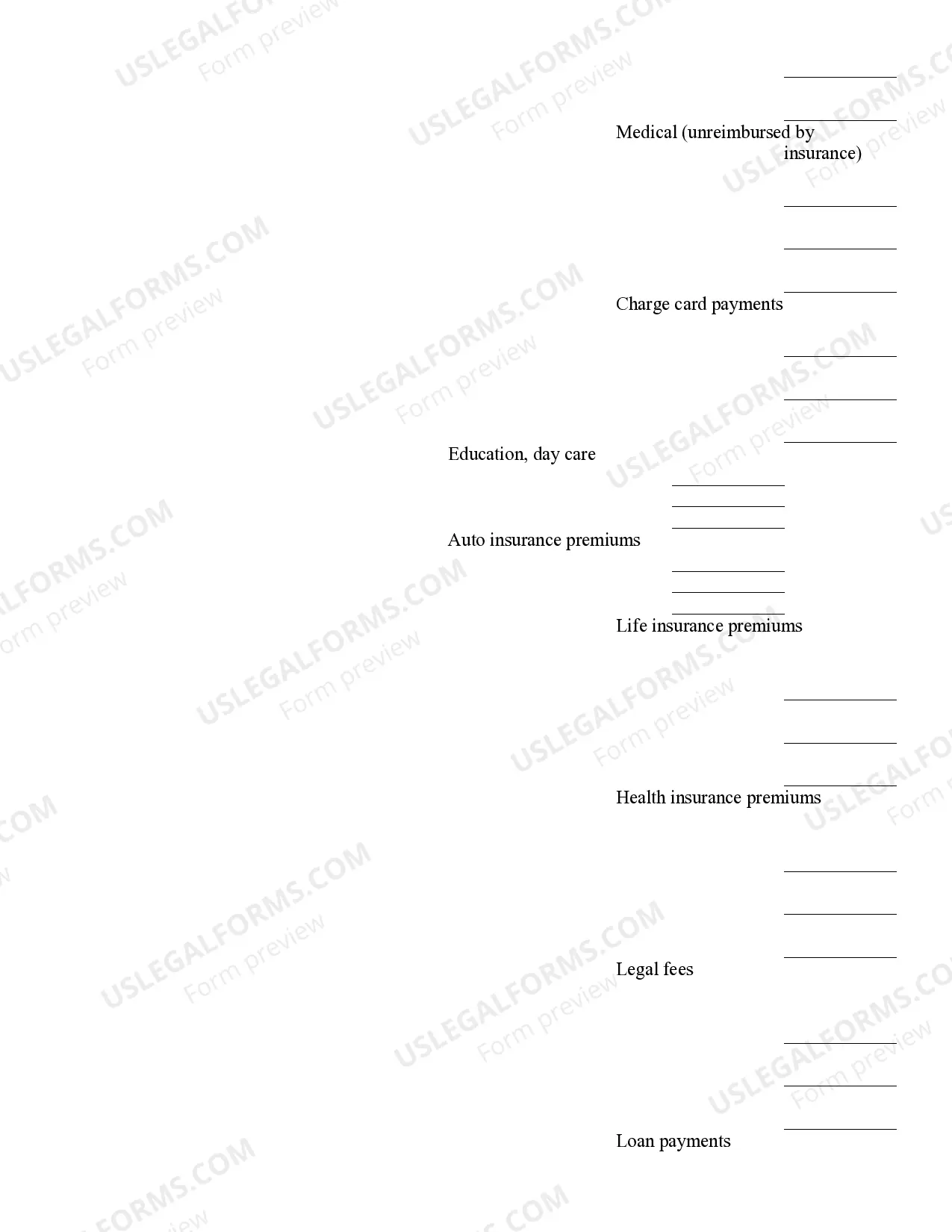

Retirement Cash Flow - Arizona: This is a standard statement which includes all the money coming in after retirement, including annuities, IRA's, pension, etc. It also includes a place for money going out each month, such as rent. It is available for download in both Word and Rich Text formats.

Lima Arizona Retirement Cash Flow is a financial tool designed to ensure a stable and consistent income during retirement for individuals residing in Lima, Arizona. It offers retirees with a reliable stream of income that allows them to maintain their quality of life and cover daily expenses without relying solely on savings or government benefits. This Cash Flow program specifically caters to the retirement needs of Lima residents, taking into account the unique lifestyle and expenses associated with the locality. There are various types of Lima Arizona Retirement Cash Flow, each tailored to cater to specific retirement goals and preferences. These types include: 1. Fixed Annuities: These cash flow options provide a fixed, guaranteed income over a predetermined period. Retirees can choose from immediate annuities, where income starts immediately after the initial investment, or deferred annuities, which begin payouts at a later predetermined date. 2. Social Security Optimization: This retirement cash flow strategy focuses on maximizing social security benefits to provide retirees with the highest possible income throughout their retirement years. 3. Retirement Savings Distribution: This approach involves creating a personalized plan for distributing retirement savings to ensure a consistent cash flow while preserving the principal amount. It takes into account factors such as inflation, investment returns, and life expectancy to determine the appropriate withdrawal rate. 4. Pension Income Strategies: Lima Arizona Retirement Cash Flow also encompasses strategies to optimize pension income, including assessing options such as lump sum payments, monthly payouts, or survivor benefits to create the most advantageous cash flow for retirees. 5. Investment Income Planning: This type of Lima Arizona Retirement Cash Flow focuses on effectively utilizing investment vehicles such as stocks, bonds, and mutual funds to generate income that supplements other retirement income sources. In summary, Lima Arizona Retirement Cash Flow offers tailored financial solutions to ensure retirees in Lima, Arizona can enjoy a worry-free retirement, knowing that a steady stream of income is available to cover their living expenses. Whether through fixed annuities, social security optimization, retirement savings distribution, pension income strategies, or investment income planning, retirees can choose the type of cash flow that best aligns with their financial goals and priorities.Lima Arizona Retirement Cash Flow is a financial tool designed to ensure a stable and consistent income during retirement for individuals residing in Lima, Arizona. It offers retirees with a reliable stream of income that allows them to maintain their quality of life and cover daily expenses without relying solely on savings or government benefits. This Cash Flow program specifically caters to the retirement needs of Lima residents, taking into account the unique lifestyle and expenses associated with the locality. There are various types of Lima Arizona Retirement Cash Flow, each tailored to cater to specific retirement goals and preferences. These types include: 1. Fixed Annuities: These cash flow options provide a fixed, guaranteed income over a predetermined period. Retirees can choose from immediate annuities, where income starts immediately after the initial investment, or deferred annuities, which begin payouts at a later predetermined date. 2. Social Security Optimization: This retirement cash flow strategy focuses on maximizing social security benefits to provide retirees with the highest possible income throughout their retirement years. 3. Retirement Savings Distribution: This approach involves creating a personalized plan for distributing retirement savings to ensure a consistent cash flow while preserving the principal amount. It takes into account factors such as inflation, investment returns, and life expectancy to determine the appropriate withdrawal rate. 4. Pension Income Strategies: Lima Arizona Retirement Cash Flow also encompasses strategies to optimize pension income, including assessing options such as lump sum payments, monthly payouts, or survivor benefits to create the most advantageous cash flow for retirees. 5. Investment Income Planning: This type of Lima Arizona Retirement Cash Flow focuses on effectively utilizing investment vehicles such as stocks, bonds, and mutual funds to generate income that supplements other retirement income sources. In summary, Lima Arizona Retirement Cash Flow offers tailored financial solutions to ensure retirees in Lima, Arizona can enjoy a worry-free retirement, knowing that a steady stream of income is available to cover their living expenses. Whether through fixed annuities, social security optimization, retirement savings distribution, pension income strategies, or investment income planning, retirees can choose the type of cash flow that best aligns with their financial goals and priorities.